The first question that comes in this is that the eligibility for the composition scheme is individual, the first of which we have to check 2 points to check its Scheme. Which is the most important. Whoever can become a competition dealer has to follow certain rules and regulations only then they can come in or else they are thrown out.

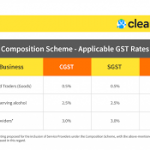

The first point is that whichever person can become a composition dealer, the first rule of their eligibility is that the registered person should be either a manufacturer or a trader or a supplier of restaurants.

The second point which is the turn over should be in the composition scheme. The person who does this scheme should have a 1 crore 50 lakh in the presiding year. Should be limited, if he is providing from the normal state, and if he is supplying from the special state, then it will be a new rule for him. In this case, whatever will be the financial turnover of the Proceeding Year should be limited to a maximum of 65000. Only then you can avail the benefits of this year’s scheme. These are the names of some special states that we count in the special state.

1 Sikkim

- Arunachal Pradesh

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Tripura

- Uttrakhand

How to opt for the composition scheme

We will open our portal and click on the service, then within that, we will get the option to register to opt for the composition scheme, with its help we can opt for this scheme.