This is Ravi Verma,

In this article, I will tell you how we can know our tax liability in the GST Portal and we will also know what is the process to pay this liability in an easy way if we have not paid any liability by mistake.

Please follow these steps so that you will be able to know about all your tax liability data month-wise or quarter-wise.

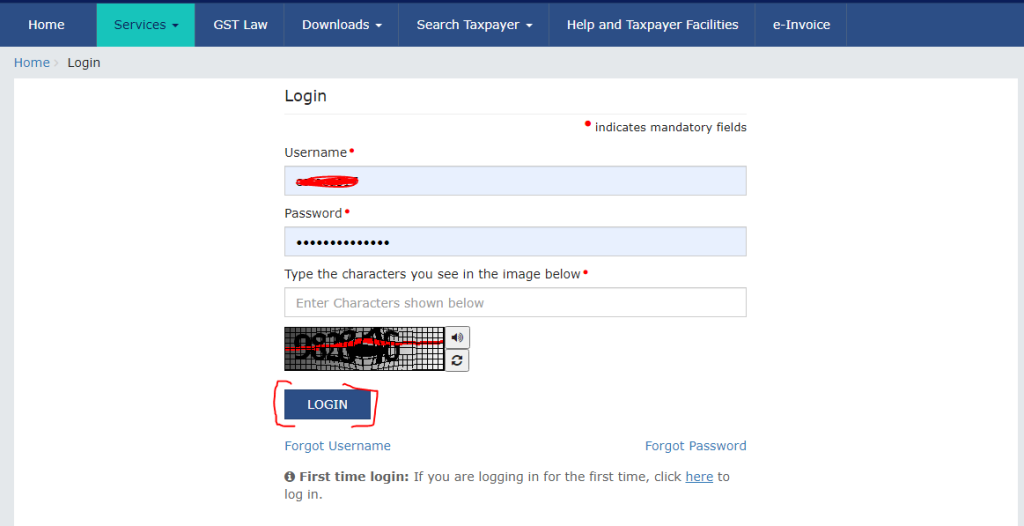

- Go to the GST Portal and login to it with your ID and Password

- Enter your login id and password and also enter captcha code this captcha code will appear in your login id dashboard and click on the login button.

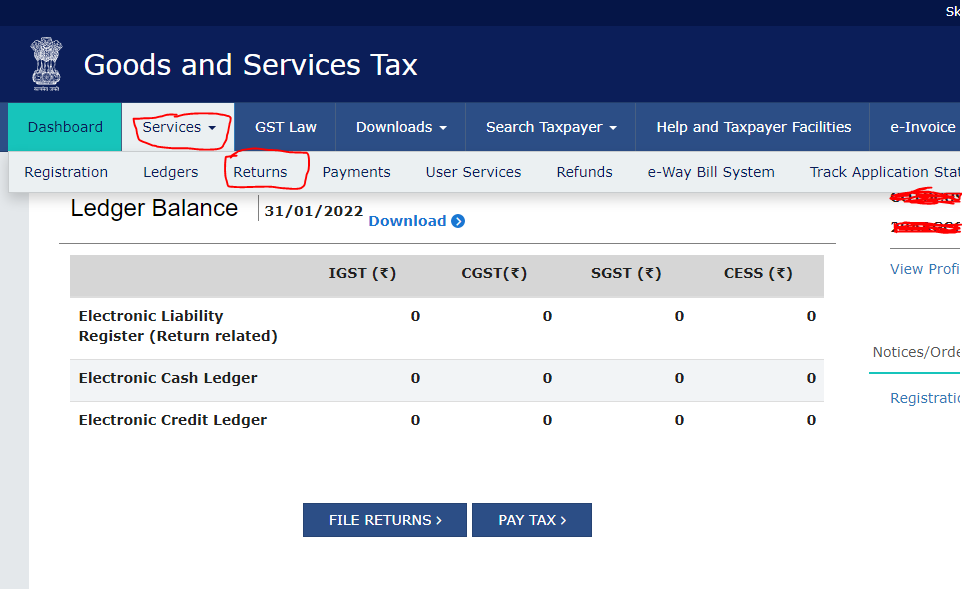

- After logging in to the GST Portal, please click on the service button, under this there is a return option, then click on it.

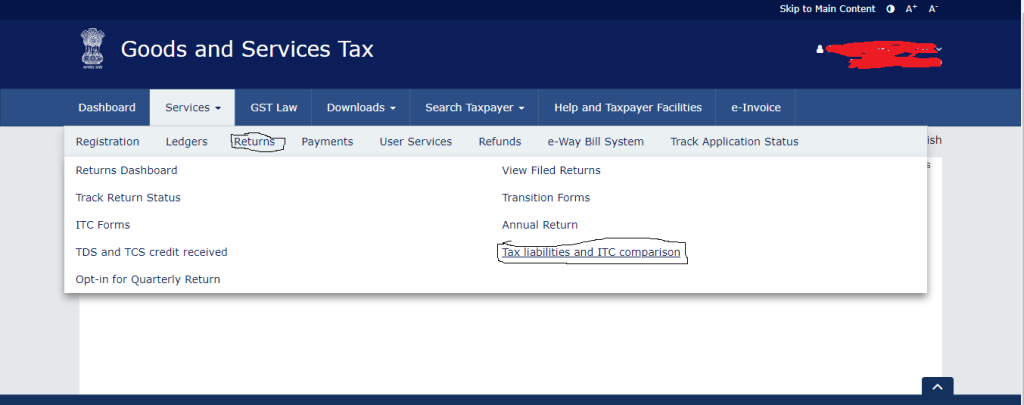

- Under this, Tax Liability and ITC comparison option will appear, so please click on it.

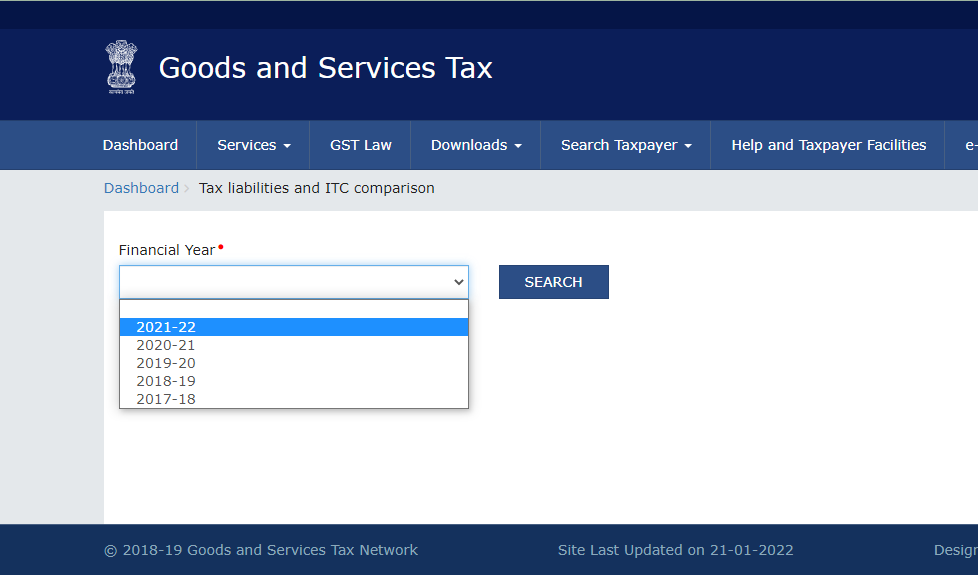

- This is the window of TAX LIABILITIES AND ITC COMPARISON Table, So in this table in whichever year you want to see your tax liabilities paid or unpaid, please select the financial year and click on the search button.

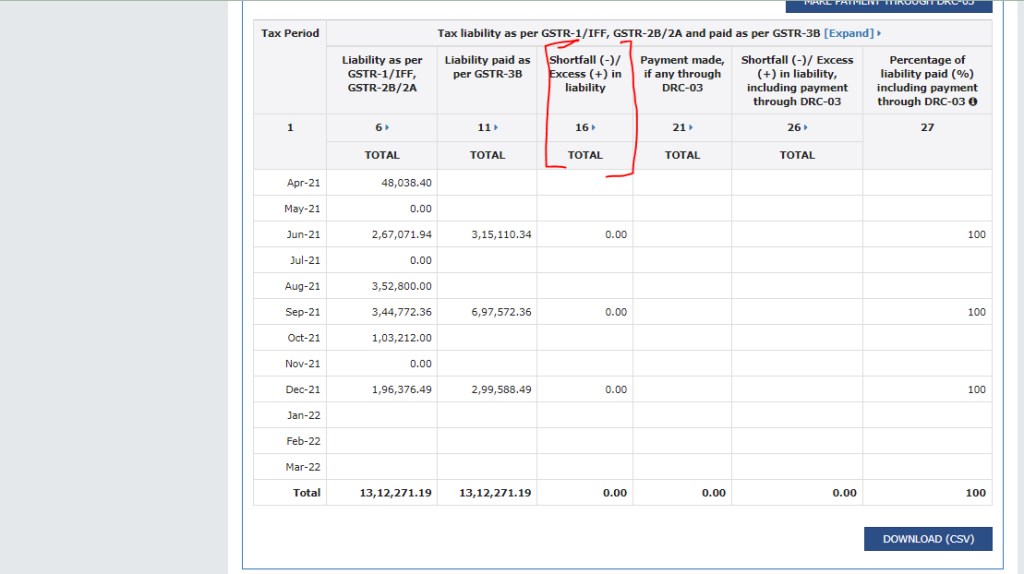

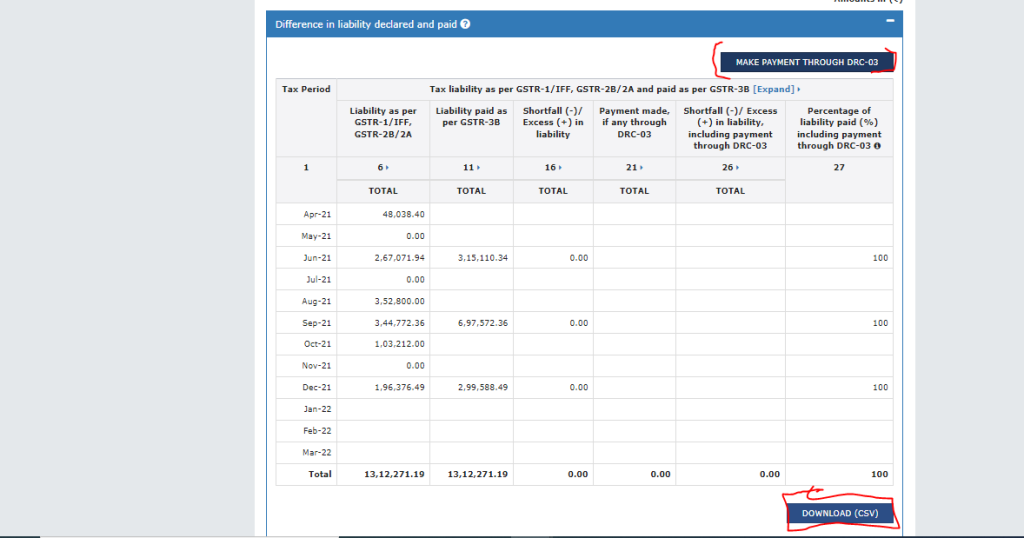

- After clicking on the search button, you will see your tax liability amount which is paid or unpaid {(If any tax liability you have not paid then this amount is shown in your dashboard under column number 16 and you have no tax liability then column number 16 shows the sign of Zero)}.

- Special Note:- If you have any tax liability for the year then you can easily pay it through DRC-03 Challan and this information is shown to you in column no.21.

- And the drop-down you have a option, you can easily download your report in a CSV file.

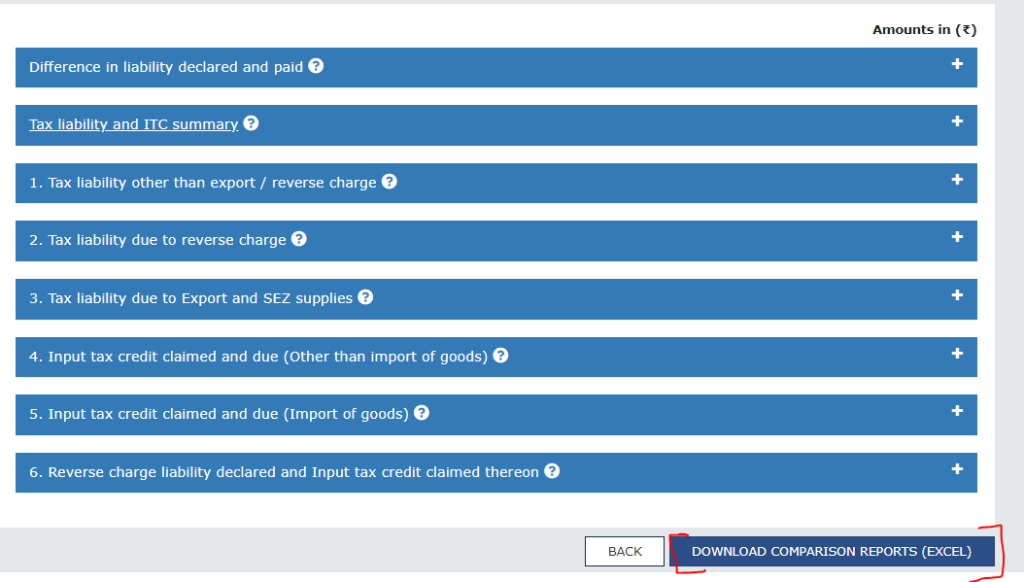

- And more data is available here You can view all your ITC or tax-related amount in this table, and all of these report you will easilly to download the Excel formate for using the DOWNLOAD COMPARISON TABLE(EXCEL)

- Tax Liabilities Benefits and ITC Compare Button:- Multiple benefits of using this option will be visible in your dashboard.

(1) You can easily download your every month tax payment reports

(2) You can easily know what amount is paid in the previous year

(3) From this table you can know any liability in any year.

(4) Difference in liability declared and paid

(5) Tax liability and ITC summary

(6) Tax liability other than export / reverse charge

(7) Tax liability due to reverse charge

(8) Tax liability due to Export and SEZ supplies

(9) Input tax credit claimed and due (Other than the import of goods)

(10) Input tax credit claimed and due (Import of goods)

(11) Reverse charge liability declared and Input tax credit claimed thereon

Thanks,