Hi everyone!

In my today’s session, I will let you know the TDS sections 194H

What is the TDS section 194H

Section 194H of the Income Tax Act is about deducting income tax when someone pays a commission or brokerage to a resident. It applies to individuals, Hindu Undivided Families (HUFs), and businesses that fall under Section 44AB.

Now, from the financial year 2020-21, even individuals and HUFs with a business turnover over Rs 1 crore or gross receipts from a profession over Rs 50 lakh need to deduct TDS. However, it’s essential to note that Section 194H doesn’t cover the insurance commission mentioned in Section 194D.

So, if you’re paying commission or brokerage to someone, especially in a business setting, you might need to deduct a portion for income tax, and these rules outline who and when it applies.

Section 194H of the Income Tax Act deals with Tax Deducted at Source (TDS) on income in the form of commission or brokerage. When any person, responsible for paying such commission or brokerage to a resident, makes the payment, they are required to deduct TDS before handing over the amount.

Individuals and Hindu Undivided Families (HUFs) who fall under Section 44AB are obligated to deduct TDS. Additionally, starting from the financial year 2020-21, individuals and HUFs with a turnover from business exceeding Rs 1 crore or gross receipts from a profession exceeding Rs 50 lakh are also required to deduct TDS under Section 194H.

It’s important to note that Section 194H doesn’t include the insurance commission referred to in Section 194D.

In simpler terms, if you’re paying someone a commission, and you fall under the mentioned categories, you need to take out a portion for taxes and send it to the government.

Who can Deduct TDS under Section 194H?

If you’re paying someone a commission or brokerage, and you are an individual, part of a family (HUF), or a business, you have to take out a part of that payment for taxes. This is called TDS (Tax Deducted at Source), and it’s your responsibility to deduct it before giving them the full amount.

For individuals and HUFs covered under Section 44AB, and from the financial year 2020-21 onwards, even those with a business turnover over Rs 1 crore or gross receipts from a profession over Rs 50 lakh, you need to deduct this TDS.

In simpler terms, if you’re the one making the payment, and you fit into these categories, you’re the person who needs to deduct TDS under Section 194H.

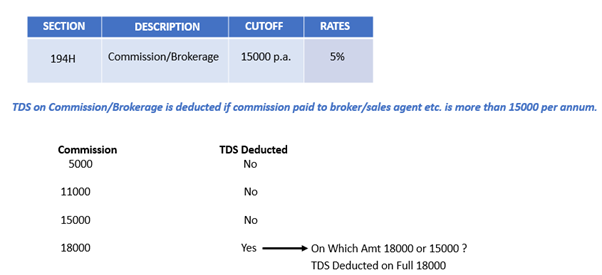

TDS Rate on Commission and Brokerage section 194H

TDS Rate for Section 194H:

- The standard TDS rate on brokerage and commission under Section 194H is 5%.

- However, if the person receiving the payment fails to provide their PAN (Permanent Account Number), the TDS rate is higher at 20%.

Additional Information:

- No additional surcharge or education cess is added to the actual TDS rate for Section 194H.

- The government fixes the TDS rate in the annual budget.

Important Note:

- Entities need to be aware of the due date for TDS deduction on commission and brokerage at all times.

- Staying informed about the current TDS limit under Section 194H is crucial for compliance.

In simpler terms, if you’re paying someone commission or brokerage, the usual TDS rate is 5%, but if they don’t provide their PAN, it goes up to 20%. No extra charges on top of these rates. Always keep an eye on the due dates for deduction!

Provisions for Nil Tax or Lower TDS under Section 194H

- Threshold Limit:

- If the total commission or brokerage payment is below a certain limit in a year, you don’t have to deduct any TDS.

- PAN Non-Availability:

- If the person getting paid doesn’t provide their PAN, the TDS rate becomes higher (20%). So, they must share their PAN.

- Lower TDS with Lower Income:

- If the person’s income is less than what gets taxed, they can ask for a lower TDS deduction by giving a declaration and the necessary documents.

- Form 15G/15H:

- People with income below the taxable limit can submit Form 15G (for those below 60 years) or Form 15H (for senior citizens) to avoid TDS deduction. It’s like saying, “I don’t need a TDS deduction because I earn less.”

There are ways to avoid or reduce TDS under Section 194H, but it’s important to follow the rules and provide the necessary information.

Exemption on TDS on Brokerage section 194H

- Normally, if you pay someone a commission or brokerage exceeding ₹15,000 in a year, you deduct 5% as TDS (Tax Deducted at Source) under Section 194H.

Exemptions to TDS:–

- Complete Exemption:

- Payment Threshold: If you pay less than ₹15,000 in commission or brokerage to a resident person in a year, no TDS is needed.

- Insurance and Loan Underwriting: Payments for commissions related to insurance policies or loan underwriting activities are fully exempt from TDS.

- Securities to Public: Payments to entities like stockbrokers for providing securities to the public are also fully exempt.

- Partial Exemption:

- Central Government/MTNL Payments: Commission or brokerage paid by entities like the Central Government or MTNL to their public call office franchisees is exempt from TDS.

Other Important Points:

- Individuals and Hindu Undivided Families (HUFs) usually don’t deduct TDS under Section 194H, except if they meet specific audit thresholds.

- If the person receiving the payment doesn’t provide a valid PAN card, the TDS rate becomes 20%, regardless of exemptions.

- Remember, these exemptions apply only to residents. Payments to non-residents have different rules under Section 195.

In simpler terms, if your payments fall under certain limits or specific categories, you might not need to deduct TDS, but always be aware of the rules.

Thanks!

[…] https://www.stocksmantra.in/what-is-the-tds-section-194h/ […]