Hi all,

In this tutorial, we will begin learning about debit notes and credit notes.

Let’s start

What is Credit note and debit note?

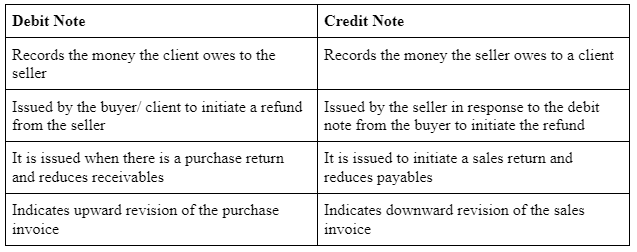

A credit note is issued by a seller to a buyer with the purpose of decreasing the amount owed by the buyer for purchased goods or services. It serves as a form of credit that can either offset future purchases or facilitate a refund to the buyer in cases such as product returns or non-delivery of goods.

On the other hand, a debit note is initiated by a buyer and directed to a seller. Its primary function is to increase the amount owed by the seller for goods or services that were previously purchased. Debit notes are typically employed to rectify invoice errors or request refunds, especially in cases of returned goods or undelivered items.

Credit notes and debit notes play vital roles in adjusting the financial records between buyers and sellers. However, they have distinct effects on the accounting entries of both parties. When a seller issues a credit note to a buyer, it reduces the seller’s accounts receivable and concurrently increases the seller’s sales returns account. Conversely, when a buyer issues a debit note to a seller, it increases the buyer’s accounts payable while reducing the buyer’s purchase returns account.

Let’s understand the concept of debit notes and credit notes.

We all understand the reasons for issuing credit notes or debit notes. We issue credit notes or debit notes when we need to make amendments to an invoice. However, we cannot issue credit notes or debit notes based on the original invoice if we need to reduce or increase the amount. In such situations, we will issue credit notes and debit notes.

Debit notes and credit notes essentially serve to amend invoices and rectify any errors within them.

Case1. Debit notes – Please see the point if you are issuing a debit note it means you would be debited to your party.

Case2. Credit notes – If you are issuing the credit notes that means you are credited to your party.

Case3. If you are a seller then,

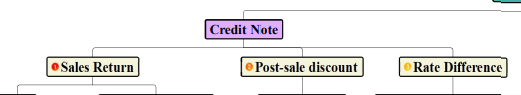

Credit notes – If you are a seller then you have to issue the credit note in such categories.

A. Sales return – it means you would be decreased to your party’s account.

B. Different rates – If you put the different rates in your party’s account and your party is not satisfied by your rates then in this case you would raise the credit notes to your party’s account.

A credit note against a sale means that either the quantity sold is reduced or the amount received is reduced.

- On account of sales returned by the buyer due to quality issues, service rejection, or damaged goods receipt.

- Give a post-sale discount to the buyer.

- Erroneously collected higher charges from the buyer or buyer paid amount is more than invoiced value. (Rate Difference)

- The quantity received by the customer is less than the one which is mentioned in the tax invoice.

- Cancelling any pending payments against invoices.

- Any other similar reasons.

Note point**** When we have to reduce the sales amount then we are issuing the credit notes to our purchaser.

Debit Note –

When we have to increase the sales amount to our purchaser then we are issuing the debit notes.

Thanks,