This is Ravi Verma,

In this article, I will tell you how to deposit TDS for salary through online mode.

- What is TDS on salary?

When the salary of any person crosses the threshold limit, then the government levies the tax on his salary, which we call TDS.

- Who Is Liable to Deduct TDS On Salary?

The employer is liable to deduct TDS on salary at the time of making the payment to the employee. When the employer pays the salary to his employee and if his salary structure exceeds 2.5 lakhs in 1 year, the employer deducts TDS on his salary and deposits it to the government because if the employer does not do so then the government will impose a penalty. And can also declare that company is a defaulter

- According to Section 192

When there is a relationship between the employer and the employee, the employer pays him the salary and if the salary of any of his employees is more than the threshold limit, then the employer has to deduct TDS from that salary and deposit it in the government portal.

In addition, the following employers are liable to make TDS on salary deduction:-

- Individuals

- Companies (Private or Public)

- HUF (Hindu Undivided Family)

- Trusts

- Partnership firms

- Co-operative societies

How to deposit TDS on salary in the government portal.

The steps to pay TDS through online mode on the government portal are as follows

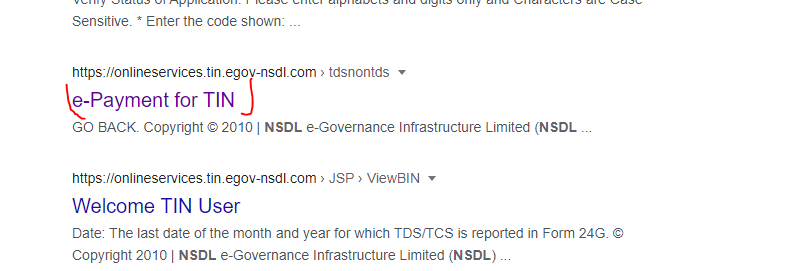

Step 01:- Go to the TIN NSDL.com website:- https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp and choose e-payment for the TIN option

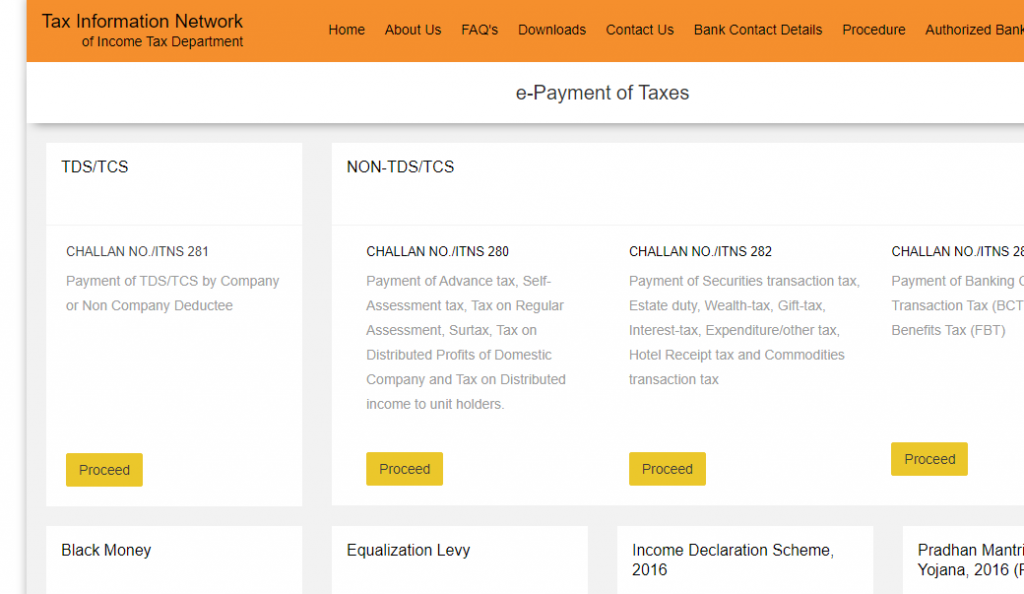

step 2:- After selecting it you will see an interface like this

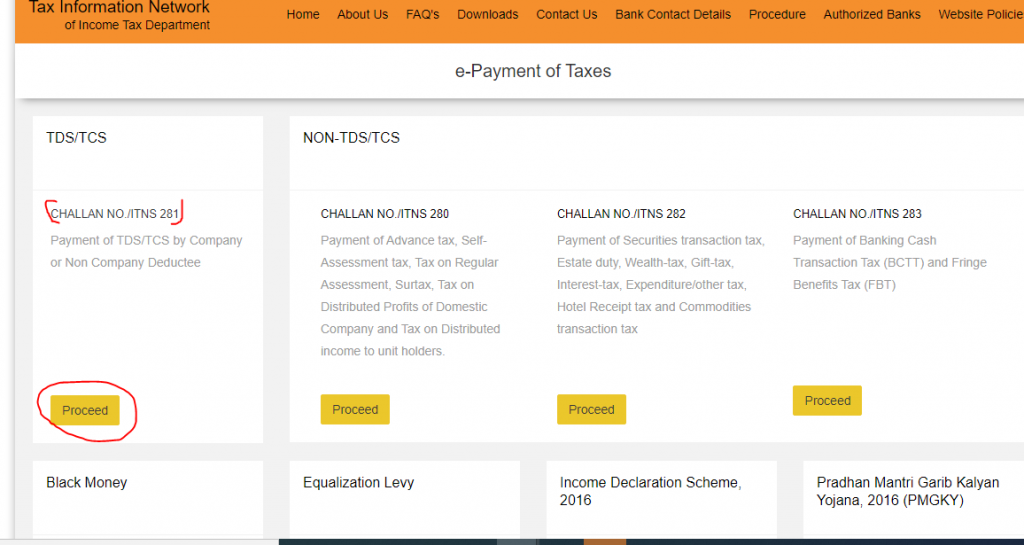

Step 3:- So you select Challan NO/ITNS 281 and click to process.

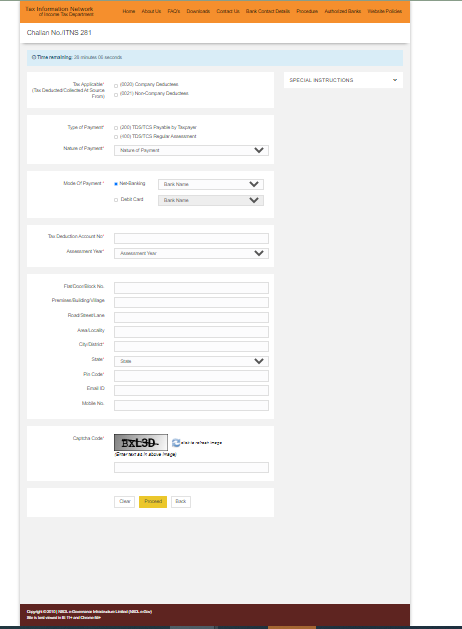

Step 4:- After clicking on it you will directly enter to TDS Monthly Payment Portal.

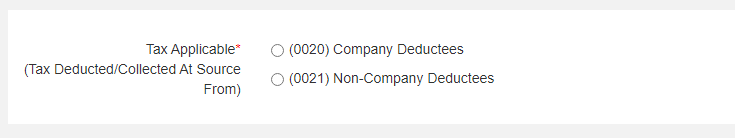

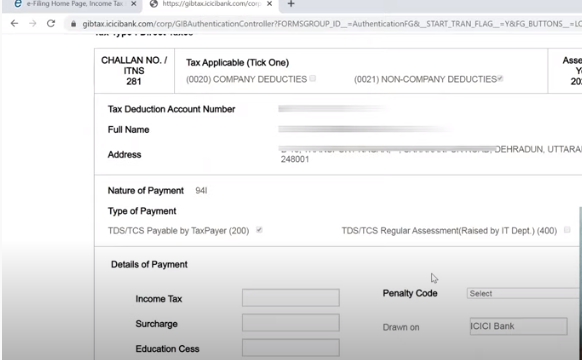

Step 5:- Under this head,{ (Tax Applicable

(Tax Deducted/Collected At Source From)} you have to see the two options

- (0020) Company Deductees:- That is, if you are deducting the TDS of any company and depositing it, then this option has to be selected.

- (0021) Non-Company Deductees:- That is, if you are deducting the TDS of an individual or non-company and depositing it, then this option has to be selected.

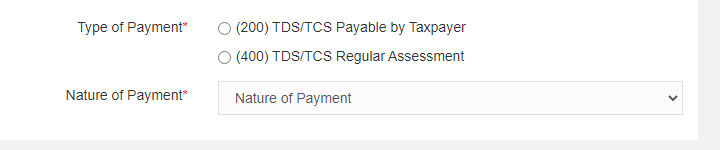

Step 6:- Select Type of Payment.

- (200) TDS/TCS Payable by Taxpayer:- Select this option if you are depositing TDS for the first time

- (400) TDS/TCS Regular Assessment:- And if you want to make any kind of correction in your TDS report then select this option.

Step 7:- Nature of Payment

Select the nature of payment section 192 (TDS on salary)

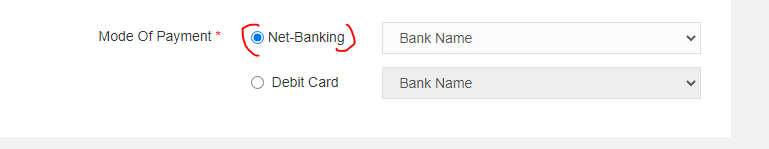

Step 8:- Mode Of Payment

- Net-Banking:- Select it if you want to make online payment through net banking

- Debit Card:- And if you want to make payment through offline mode then select it.

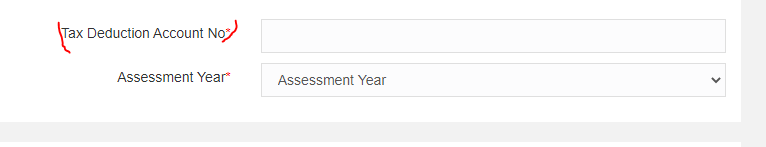

step 9:- Tax Deduction Account Number

Enter your company TAN number.

step 10:- Assessment Year

Choose your assessment year i.e. financial year is 2021-2022 then the assessment year will be 2022-2023.

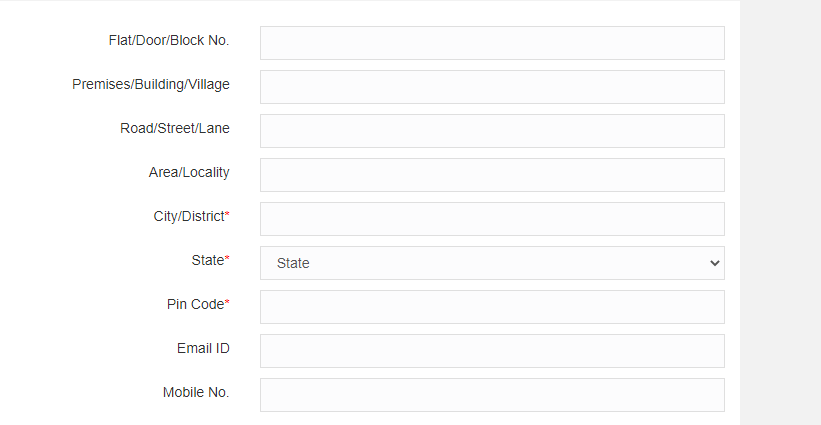

Step 11:- Address

It is mandatory to enter your complete address along with state, district, and pin code.

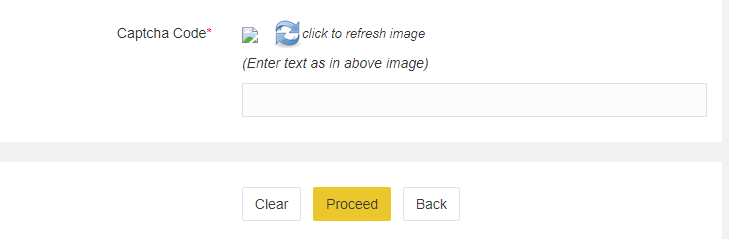

Step 12:- Captcha Code

You can process this form only after entering the captcha code

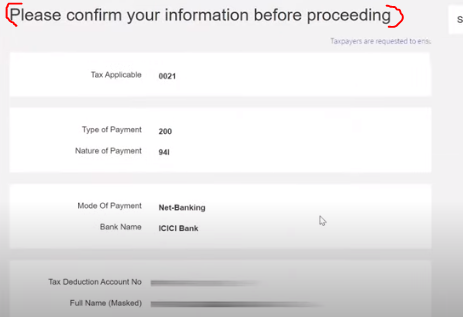

Step 13:- Now you will get an option to confirm whatever you have filled while filling out this form.

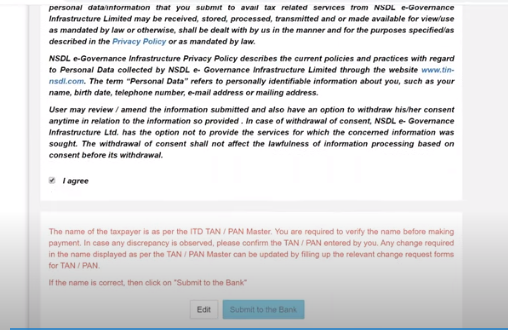

Do scroll down and click I agree & submit to the bank

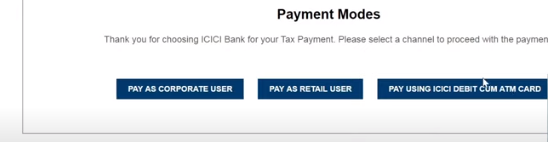

Step 14:- Now you have to choose your bank, the way you want to make the payment to the government.

Step 15:-Enter your user ID or password and proceed.

Step 16:- Now your bank’s gateway will open in front of you, in which you will have to enter the amount of tax, if there is any interest and penalty, then you will also have to enter it and after that, you will click on continue.

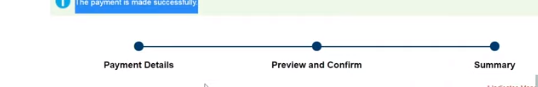

Last Step:- After this verification click on submit option and you will automatically move to the payment summary option And above you will get the message that your payment is made successful.

Note point*** Under section 206 AA If a payee does not furnish his PAN to the employer, the TDS rate shall be –

- Rate as per respective section

- Rate @20%

Whichever is higher

- Due Date for filing TDS returns

| Quarter | Filing Month 2021-2022 | End date for filing TDS returns | Starting date for Filing TDS returns | Relaxations |

| 01st | 1st April – 30th June 2021 | 31st July 2021 | 01st July 2021 | NA |

| 02nd | 1st July – 30th September 2021 | 31st October 2021 | 01st October 2021 | NA |

| 03rd | 1st October – 31st December 2021 | 31st January 2022 | 01st January 2022 | NA |

| 04th | 1st January – 31st march 2022 | 31st May 2022 | 01st April 2022 | NA |

Note point**** TDS monthly payment always has to be made before 7th of the next month and if want to pay in offline mode then always before 6th of the next month

How to calculate TDS on salary?

According to the new slab rate

| PARTICULAR | TAX |

| UP RS 2,50,000 | NIL |

| RS 2,50,001 TO RS 5,00,000 | 5% (TAX REBATE OF RS 12500 U/S 87A IS ALLOWED) |

| RS 5,00,001 TO RS 7,50,000 | 10% |

| RS 7,50,001 TO RS 10,00,000 | 15% |

| RS 10,00,001 TO RS 12,50,000 | 20% |

| RS 12,50,001 TO RS 15,00,000 | 25% |

| RS MORE THAN 15,00,000 | 30% |

According to the old slab rate.

| PARTICULAR | TAX |

| UP RS 2,50,000 | NIL |

| RS 2,50,001 TO RS 5,00,000 | 5% (TAX REBATE OF RS 12500 U/S 87A IS ALLOWED) |

| RS 5,00,001 TO RS 10,00,000 | 20% |

| MORE THEN RS 10,00,000 | 30% |

Example:- Ram’sannual salary is Rs 600000.

- Accourding to old slab rate

- up to 250000 – NIL

- Rs 250000 to 500000 – 5% (250000*5/100 = 12500) {(not allow tax rebate u/s 87A)}

- 500000 to 1000000 – 20%(100000*20/100 = 20000)

- More then 1000000 – NA

12500 + 20000 = 32500

32500/12 = 2708.333 P.M deposit

- According to new slab rate

- up to 250000 – NIL

- Rs 250001 to 500000 – 5% (250000*5/100 = 12500) {(not allow tax rebate u/s 87A)}

- RS 5,00,001 TO RS 7,50,000 – 10%(100000*10/100 = 10000)

12500 + 10000 = 32500

32500 / 12 = 2708.333 P.M deposit

Thanks,