Income tax is like a bill we all have to pay to the government if we earn a certain amount of money. It’s the government’s way of collecting money to pay for things like roads, schools, and hospitals. The rules about how much we have to pay and when can change sometimes. But it’s our job to tell the government how much we earn and pay our taxes on time. If we don’t do this, we might get into trouble and have to pay extra money as a fine.

What is Income Tax?

Income tax is a financial obligation you, as an individual or business, have to pay to the government based on your income. It’s one of the main sources of revenue for the government, used to fund various public services and infrastructure.

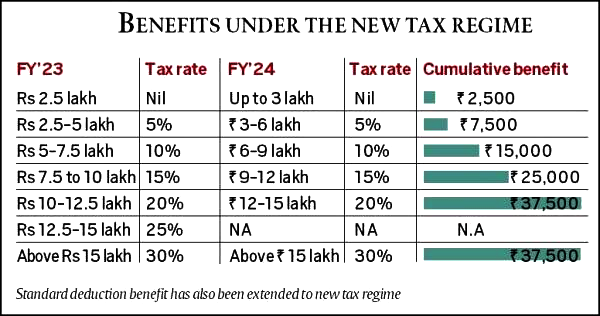

What is the new Tax regime For AY 2024-25

The new tax rules for Assessment Year (AY) 2024-25 have some changes in how we pay taxes. There are new tax rates and slabs, which are different from before. We can choose between the old tax rules and the new ones, depending on what works best for us.

Under the new rules for AY 2024-25, the tax rates and slabs might be different. We need to understand these changes to decide which rules are better for us. Also, some deductions and exemptions we used to get in the old rules may not be available in the new ones. So, we should think carefully about our taxes under both sets of rules before making a decision.

Here are some key features of the new tax regime for AY 2024-25

Lower Tax Rates: The new regime offers reduced tax rates compared to the old one, especially for people earning higher incomes. The highest tax rate is now 30%, which applies to incomes above Rs. 15 lakh.

Simplified Process: The new regime simplifies the tax filing process by reducing the number of deductions. This means less paperwork and easier filing for taxpayers.

Standard Deduction: Instead of claiming multiple individual deductions like HRA and LTA, the new regime provides a standard deduction of Rs. 50,000 for everyone.

Tax Rebate: Individuals with incomes up to Rs. 7 lakh can benefit from a tax rebate of up to Rs. 25,000 under the new regime. This helps lower the tax burden for lower-income earners.

Marginal Tax Relief: With marginal tax relief, the increase in your tax burden happens gradually as your income rises. This prevents sudden jumps in tax rates, making the tax system more fair and predictable.

These features aim to make the tax system more efficient and equitable for taxpayers, encouraging compliance and simplifying the overall tax process.

What are the benefits of opting for the New Tax Regime For AY 2024-25?

The New Tax Rules for AY 2024-25 come with some good things, but it’s important to see if they fit your situation. Here’s why they might be helpful.

Lower Taxes: You might pay less tax with the new rules, especially if you earn a medium or high income. For example, the highest tax rate is now 30%, but in the old rules, it was 42.74% for incomes over Rs. 5 crore.

Easier Process: There are fewer things to claim as deductions with the new rules, which makes filing taxes simpler and quicker. This is great for anyone who found the old rules confusing.

More Money in Your Pocket: If you switch to the new rules, you might end up with more money after taxes. This extra cash can be used for savings, investments, or paying off debts.

Standard Deduction: Instead of dealing with lots of different deductions, the new rules give everyone a standard deduction of Rs. 50,000. This saves time and hassle, especially if you don’t have many deductions under the old rules.

Tax Rebate (up to Rs. 25,000): If you earn up to Rs. 7 lakh, you might get a tax rebate under the new rules, which means you won’t have to pay any tax. This is good news for people with lower incomes.

So, if these benefits sound good to you, it might be worth considering switching to the new tax rules for AY 2024-25.

Tax Slab Rates of New Tax Regime For AY 2024-25

The tax slab rates of the new tax regime for Assessment Year (AY) 2024-25 are structured as follows.

| Income RangeTax Rate (%)Up to Rs. 2.5 lakh0Rs. 2.5 lakh – Rs. 5 lakh5Rs. 5 lakh – Rs. 7.5 lakh10Rs. 7.5 lakh – Rs. 10 lakh15Rs. 10 lakh – Rs. 12.5 lakh20Rs. 12.5 lakh – Rs. 15 lakh25Above Rs. 15 lakh30 |

|---|

These rates indicate the percentage of tax applicable to different income brackets. Taxpayers can use this table to determine their tax liability under the new tax regime for AY 2024-25.

How to opt out OLD Tax Regime to the New Tax Regime as a salaried Individual?

If you’re a salaried person and want to switch from the Old Tax Regime (OTR) to the New Tax Regime (NTR) for AY 2024-25, here’s how you can do it:

Before April 1st, 2024.

- Tell your employer: You need to inform your employer before April 1st, 2024, by submitting Form 11ET. This form tells them that you want your taxes calculated under the NTR, not the OTR. Make sure to do this before the deadline for filing income tax returns, usually July 31st.

After April 1st, 2024.

- Choose NTR when filing ITR: If you miss the deadline to inform your employer or decide to switch later, don’t worry. When you file your Income Tax Return (ITR) for AY 2024-25, simply choose the “New Tax Regime” option in the relevant section of the ITR form, like ITR-1 or ITR-2.

By following these steps, you can switch to the New Tax Regime and ensure that your taxes are calculated according to the new rules for the upcoming assessment year.

How to opt-out OLD Tax Regime to the New Tax Regime as a Business Individual.

If you’re a business person and want to switch from the Old Tax Regime (OTR) to the New Tax Regime (NTR) for AY 2024-25, here’s what you should do

Before July 31st, 2024

Fill out Form 10ET: Complete and send Form 10ET to the Income Tax department before July 31st, 2024. This form tells them you want to use the NTR and allows them to adjust your advance tax accordingly.

Pay any extra tax: After the department recalculates your advance tax based on the NTR, you might owe more tax. If so, make sure to pay it by the due date.

If you miss the deadline

Don’t worry! You can still pick the NTR when you file your Income Tax Return (ITR). But remember, your advance tax for the whole year will be calculated based on the OTR.

When filing your ITR

Pick NTR: Choose the “New Tax Regime” option when filling out your ITR for AY 2024-25, like on ITR-3 or ITR-4.

Some important things to remember

- You can only choose one regime each year.

- You can switch between OTR and NTR only once a year when you file your ITR.

- Before choosing NTR, think about your income, deductions, and taxes under both regimes. It’s smart to talk to a tax expert, especially if your business finances are complicated.

By following these steps and keeping these points in mind, you can switch from the Old Tax Regime to the New Tax Regime for AY 2024-25 as a business person.

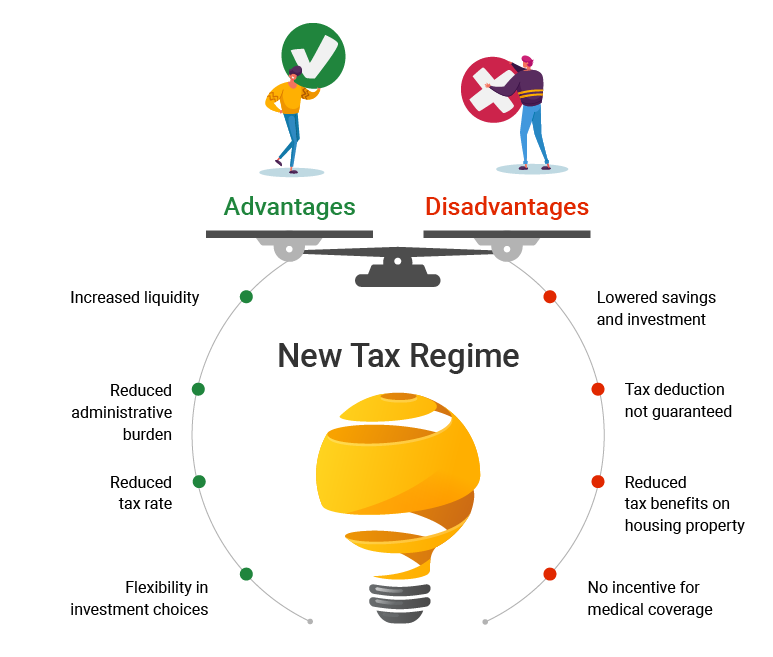

What are the advantages and disadvantages of the new income tax regime for the assessment year 2024-25

The New Tax Regime (AY 2024-25) refers to the updated set of tax rules and rates introduced by the government for the assessment year 2024-25. It offers lower tax rates, simplified tax filing processes, and various benefits such as increased take-home pay, tax rebates, and reduced surcharges for high-net-worth individuals. However, it also comes with limitations, including fewer deductions and complexities for certain taxpayers.

Advantages of the New Tax Regime (AY 2024-25)

| Advantages |

|---|

| Lower Tax Rates: The new regime offers lower tax rates compared to the old regime, especially for higher-income earners. The highest marginal tax rate is 30% compared to 42.74% (including surcharge) under the old regime above Rs. 5 crore. |

| Simplified Process: With fewer deductions and a flat standard deduction, the new regime simplifies tax filing and reduces paperwork. |

| Increased Take-Home Pay: Depending on your income and deductions, opting for the new regime could lead to more money in your pocket due to lower tax liability. This can be used for savings, investments, or debt repayment. |

| Tax Rebate: For individuals with income up to Rs. 7 lakh, there’s a tax rebate under the new regime, effectively reducing their tax liability to zero. |

| Reduced Surcharge for High-Net-Worth Individuals (HNWIs): The surcharge rate on income above ₹5 crores has been reduced from 37% to 25%, bringing down their effective tax rate from 42.74% to 39%. |

| Higher Leave Encashment Exemption: The exemption limit for non-government employees has been increased from ₹3 lakhs to ₹25 lakhs, offering tax relief on a larger portion of leave encashment. |

Disadvantages of the New Tax Regime:

| Disadvantages |

|---|

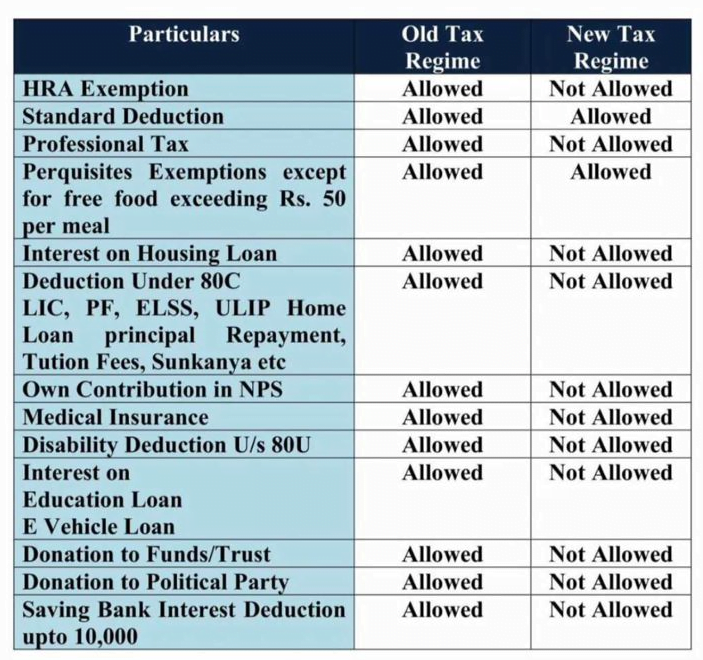

| Limited Deductions: The new regime offers significantly fewer deductions compared to the old one. This can be disadvantageous for individuals who rely heavily on deductions like HRA, LTA, medical insurance, education expenses, etc., as it can lead to a higher tax liability. |

| Limited Scope for Tax Planning: The reduced deductions limit your ability to strategically utilize investments and expenses to lower your tax burden. |

| Not Suitable for Everyone: The suitability of the new regime depends on your individual circumstances. If you have many deductions under the old regime, opting for the new one might not be beneficial. |

| Complexity for Business Individuals: While the regime is simplified, business individuals with complex income structures and deductions might find it challenging to navigate without professional guidance. |

Conclusion:

The New Tax Regime offers potential benefits, particularly for salaried individuals with lower income and fewer deductions. However, carefully compare both regimes, considering your income, expenses, and deductions, to determine which one is more advantageous for your specific situation. Consulting a qualified tax professional is highly recommended to make an informed decision.

Concept of standard deduction claim under the new tax regime.

The standard deduction in the New Tax Regime for AY 2024-25 makes tax filing easier by giving you a fixed deduction of Rs. 50,000. Here’s what you need to know.

What is it?

It’s a simple deduction of Rs. 50,000 in the New Tax Regime.

It replaces individual deductions like HRA, LTA, and medical expenses.

You don’t need to show any bills or receipts for these deductions anymore.

Who can get it?

Salaried workers and retirees who choose the New Tax Regime.

It’s not for business people in the New Tax Regime.

How does it help?

The Rs. 50,000 comes off your total salary or retirement pay automatically.

This lowers your taxable income, which decides how much tax you owe based on your income level.

Pros:

Makes taxes simpler: No need to fuss with lots of paperwork for different deductions.

Less paperwork: You don’t have to keep and show receipts for all your expenses.

Might lower your taxes: If you don’t have many deductions, the Rs. 50,000 deduction can save you money.

Cons:

Less flexibility: You can’t claim extra deductions beyond the Rs. 50,000, even if you have more expenses.

Might not be right for everyone: If you have a lot of individual deductions, sticking with the old tax rules might be better for you.

What is the difference between tax relief and marginal tax relief under the new tax regime for the assessment year 2024-25?

While both “tax relief” and “marginal tax relief” aim to reduce your tax burden under the new tax regime for AY 2024-25, they work differently and offer different benefits. Let’s break it down.

Tax Relief:

- Definition: Tax relief is a general term for anything that lowers your overall tax bill.

- Examples:

- Standard deduction: This is a flat Rs. 50,000 deductions that replace individual deductions like HRA and LTA. It makes tax filing easier and could lower your taxable income.

- Tax rebate (up to Rs. 25,000): If you earn up to Rs. 7 lakh, you can get a rebate that brings your tax bill down to zero.

- Deductions for specific expenses: You can still claim deductions for things like medical insurance and education expenses.

Marginal Tax Relief:

- Definition: This is a specific way to avoid sudden jumps in your tax rate as your income goes up.

- How it works: Under the new regime, tax rates increase in steps (5%, 20%, 30%). Marginal tax relief makes sure that if you’re close to moving into a higher tax bracket, you don’t suddenly face a big increase in tax.

- Example: Let’s say your income is Rs. 14.99 lakh. The tax rate for this income is 30%. Marginal tax relief calculates how much extra tax you’d owe if you crossed the Rs. 10 lakh threshold and makes sure it doesn’t go way up.

Key Differences:

| Feature | Tax Relief | Marginal Tax Relief |

|---|---|---|

| Application | Specific methods to smooth out tax increases | Specific method to smooth out tax increases |

| Effect | Lowers your overall tax bill | Makes tax increases gentler as income rises |

| Examples | Standard deduction, tax rebate, specific deductions | It’s a method, not a specific deduction |

Summary

Tax relief gives you different ways to cut down your tax bill under the new regime, while marginal tax relief makes sure that any tax increases happen gradually as your income goes up. Both help make the new tax rules more efficient for some people.

Types of Deductions under the New Tax Regime For AY 2024-25.

In the New Tax Regime for AY 2024-25, there are fewer deductions available compared to the Old Tax Regime, but they still offer some tax relief. Here’s a simple explanation of the available deductions.

Standard Deduction

This is a fixed deduction of Rs. 50,000. It replaces individual deductions like HRA and LTA.

Deductions for Specific Expenses

Health Insurance Premiums – You can deduct premiums paid for health insurance covering yourself, your spouse, dependent parents, and dependent children.

Donations

Donations to certain charitable institutions qualify for deductions within specified limits.

Medical Expenses

You can deduct medical expenses for yourself, your spouse, dependent parents, and dependent children.

Education Loan Interest Interest paid on education loans for higher studies, taken for yourself or your dependent children, is deductible.

Senior Citizen Savings Scheme Interest Interest earned from the Senior Citizen Savings Scheme, up to Rs. 50,000, is tax-free.

House Rent Allowance (HRA) Though HRA is not a separate deduction, it’s considered when calculating the standard deduction for self-employed individuals.

Leave Encashment Non-government employees can get a tax exemption on a part of their leave encashment amount, up to Rs. 25 lakh.

Tax rebate of up to Rs. 25,000 is available for individuals with income up to Rs. 7 lakh, effectively reducing their tax liability to zero.

These deductions help lower your taxable income, reducing your tax bill under the New Tax Regime.

Thanks!