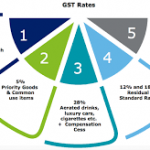

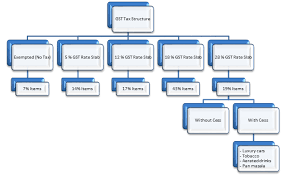

GST means goods and services tax .there are 7 types of tax slab rate

- 0 %

- 0.25%

- 3%

- 5%

- 12%

- 18%

- 28%

- In India there are 7 tax slabs, so how will this tax slab rate be charged, how much will be charged, and which will not be taxed on which goods, it is important for us to know because it is running the whole system on the basis of this

In 0% tax slab we count the products of our regular use which we are purchase in our daily use such as wheat, chicken .egg, newspaper, collegiate, soap, we count it in 0% tax slab. - second 0.25% tax slab :- rough diamond is under 0.25% tax slab .it means Those who are like Diamond, it is not clear whether they are in diamond or not. Which are currently kept for testing.

- The third was 3%:- 3% tax will be paid on gold pay tax. Because earlier it was taxed more, then after the arrival of GST, its tax rate has been fixed by GST 3% tax rate 1.5%SGST+ 1.5% CGST = 3% IGST

- fourth was is 5%:- The 5% tax rate is the same tax rate when we purchase a product under 1000, then we have to pay 5% tax. And these frozen are placed on the vegetables. , Package food items are levied, cheese, coffee, tea, masala (spices) pizza, transport (railway and air transport) small restaurant, all these are paid tax of 5%.

- The fifth is 12%:- A product whose rate will be more than 1000 will be taxed at 12%. It includes frozen meat, electronic items, phone, Non AC hotel, dry fruit, ayurvedic medicine, all these come under the 12% tax slab.

- sixth is 18%:- Any footwear item that is more than 500 will be taxed at 18%. And all types of biscuits, whichever company or test belongs to, will also be paid 18% tax. Cake, pasta, mineral water, camera, monitor, IT service, a hotel, all these will be paid tax of 18%

- seventh is 28%:- this tax belongs to luxury items. Within this, we can use alcohol, cigarettes, beer, hair shampoo, sun cream, ATM, washing machines, motorcycles, personal aircraft, Sanima, race batting clubs,