Hi guy’s

This is Ravi Varma, in this article I will tell you about Communication between taxpayers.

Let’s start,

- What is the meaning of Communication between taxpayers?

The GST portal has brought a new feature of the government which we will know as communication between taxpayers. With the help of this, we can mail any of our clients in a professional manner so that when our client sees this mail, he will immediately respond to the mail sent by us.

This option is used to claim our Input Tax Credit, we can say in simple language that if we did not get our Input Tax Credit from our client then at that time we can use this new facility. that we can inform our customers that we have not received our input tax credit.

Its most important function is to reach the message, if we want to send any message to our client without calling, then by using this feature we can send our message to any client directly on their GST portal.

- How can we use this new feature?

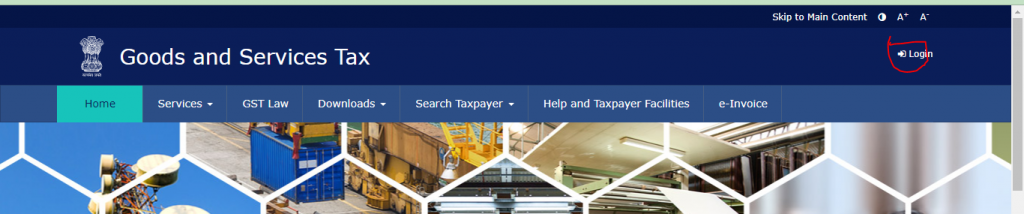

- Log in to your GST Portal

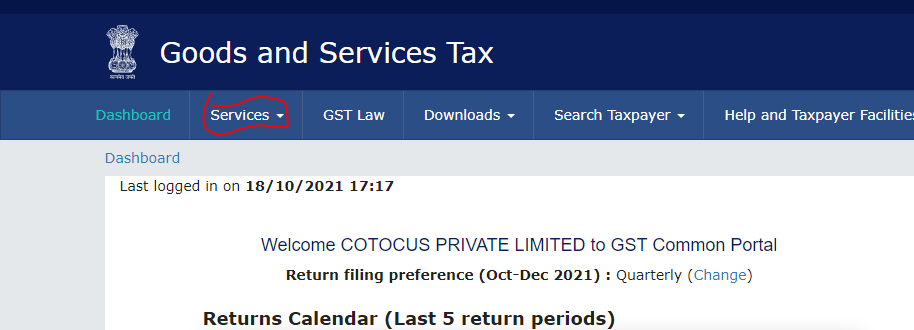

2. Go to the services option

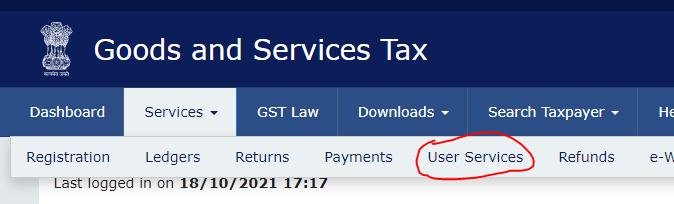

3. Click on the User Services Option

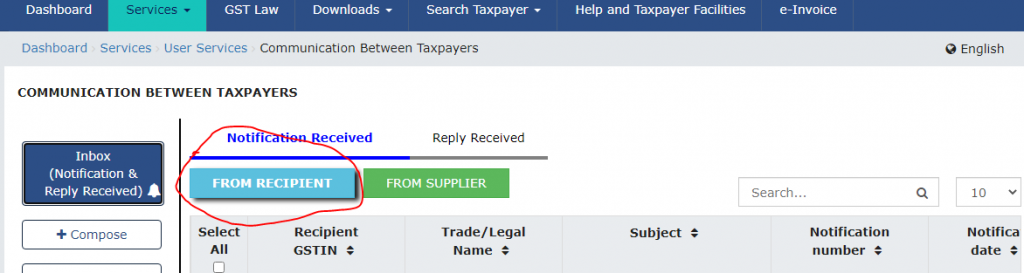

4. Under this you have to see communication between taxpayers option

5. After clicking on it, you can use these new feature options

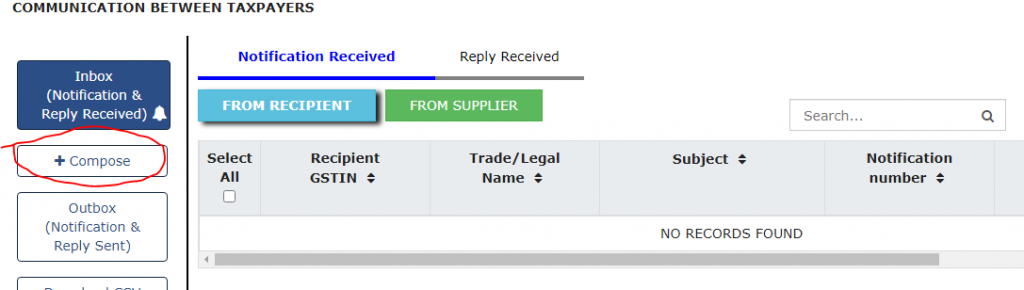

6. In this option, if you will get any message from your recipient, then after clicking on it, we will start showing his message.

7. In this option, if you will get any message from your Supplier, then after clicking on it, we will start showing his message.

8. If you need to send any message to your client for any reason, then after clicking on this option, you can send the message to him.

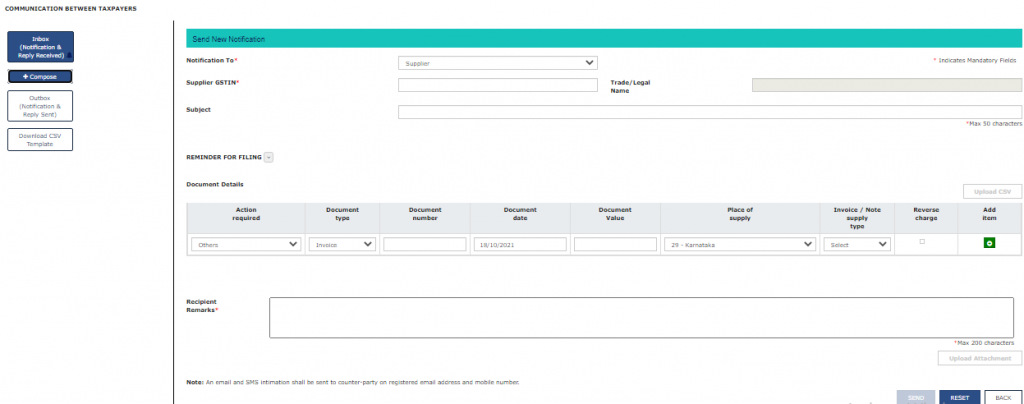

9. When you click on it, a lot of columns will appear in front of you, with the help of which you can send your message to your client.

10. When you fill all these columns and click on send button, that your message reaches your client.

Thanks,