Hi everyone!

In my today’s blog, I will let you know the TDS section of 194R.

What is TDS section 194R?

Section 194R of the Income Tax Act, 1961, introduced in the 2022 Union Budget, mandates the deduction of tax at source (TDS) on benefits or perquisites (perks) provided to residents in India.

Businesses often offer various benefits to their distributors, partners, agents, or dealers to encourage and motivate them to help the business grow. Examples of these benefits include travel packages, gift cards or vouchers, products as part of incentive schemes, or the use of business assets.

What is the Purpose of Section 194R?

Section 194R of the Income Tax Act has a main goal to make sure that the tax system is fair and that people don’t hide income by not reporting the benefits or perks they get from businesses or professions. Here are the key points about why this section exists:

- Stopping Under-reporting of Income: In the past, businesses gave gifts and perks to their partners or employees without reporting them properly. This could lead to those receiving the perks not declaring them, causing a problem. Section 194R ensures that tax is taken out before the person gets the perk, making it harder to avoid paying taxes.

- More Tax Money: By making sure that perks are properly taxed, the government can collect more tax money. This extra money can be used for public services and building better infrastructure.

- Fair Rules for Everyone: Section 194R ensures that all businesses abide by the same tax rules. This makes the business environment fair, discouraging unfair advantages gained through untaxed benefits.

- Easy Tax Compliance: For those who receive perks, Section 194R makes it simpler to follow tax rules. Taxes are taken out before they get the perk, so they don’t have to keep track of every perk they receive when filing their tax return.

- Promoting Openness: The rule to deduct and deposit tax at source encourages businesses to keep proper records of the perks they give. This promotes openness and reduces the chances of tax evasion.

Section 194R is there to make the tax system fairer and more effective by tackling under-reporting and making sure taxes are collected on perks related to businesses.

What is the Scope of Section 194R?

Section 194R of the Income Tax Act covers a bunch of benefits and perks given in business or work situations, but there are some limits too. Let’s simplify it:

What’s Covered

- Benefits or Perks: This includes things like gifts, allowances (for travel, meals, entertainment), reimbursements (for personal expenses), club memberships, free samples (for doctors), and discounts.

Who Applies to it?

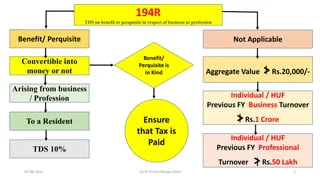

- Resident Recipients: This rule applies only if the person getting the benefit or perk lives in India.

- Threshold Limit: TDS (that’s tax) needs to be taken out only if all the perks given in a year add up to more than Rs. 20,000. If one perk is below Rs. 20,000, it’s okay even if the total is more.

Who Takes Out the Tax

- People or businesses giving the perk are the ones who take out the tax.

Limits or Things it Doesn’t Cover

- Not for Employees: If you get a salary, this rule doesn’t apply because your tax is already taken out from your salary.

- Some are Exempt: Some people or families with low earnings are not included (like those with less than Rs. 1 crore turnover for business or Rs. 50 lakh for a profession).

- Tricky Definition: The exact meaning of “benefit or perk” can be a bit unclear, causing issues in some cases.

Section 194R wants to keep an eye on lots of benefits and perks in business or work situations. But it doesn’t bother employees, has specific money limits, and lets some people off the hook based on their earnings.

Section 194R Collusion with business or profession.

If a person is giving some kind of benefit or perk to another person who lives in the same place, whether it can be turned into money or not, and it’s connected to their business or profession, they have to make sure that they take out the tax before giving that benefit or perk.

So, in easy words, according to Section 194R, if you live in the same place as the person giving you something extra (like a gift or advantage), and it’s related to their work or business, they need to make sure the tax is taken out before giving it to you. It could be something you can use or even cash, and it might be linked to promoting their business.

Applicability of Section 194R

Understanding Section 194R might seem complicated, so let’s break it down into simple points:

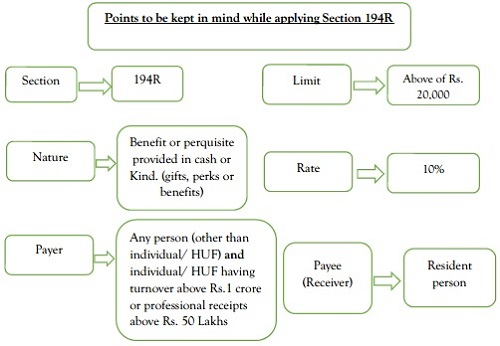

Who Does It Affect?

- It applies to anyone giving benefits or perks, whether individuals, businesses, or professionals.

- Only to residents: The person getting the perks must live in India for more than 182 days in a year.

What Perks Are Included?

- Both money and non-money perks are linked to business or professional activities.

- Examples: gifts, allowances, travel expenses, club memberships, discounts, free samples (for medical professionals).

When Does It Apply?

- Only when the total value of perks given to one person is more than Rs. 20,000 in a year. Perks under Rs. 20,000 individually are okay, even if the total is more.

Who Takes Out the Tax (TDS)?

- The one giving the perk needs to deduct 10% TDS before giving the benefit.

Any Exemptions?

- Yes, for salaried employees (they already have TDS deducted under another section) and individuals or families with low business turnover.

Important Points to Remember:

- It aims to make sure taxes are paid on perks and prevent tax evasion.

- It only applies to perks linked to business or profession, not personal gifts.

- The provider needs to show a connection with their business or profession.

- For specific situations, it’s best to consult a tax professional.

Additional Info:

- The meaning of “benefit or perk” can vary, causing potential issues in understanding.

- Recent government updates might change certain aspects of how it applies.

Who should deduct TDS under Section 194R?

Under Section 194R of the Income Tax Act, if you’re a person, business, or someone doing a job, you have to take out Tax Deducted at Source (TDS) in these situations:

- Giving Benefits or Perks:

- Both money and non-money benefits from your business or job.

- Examples: gifts, allowances, travel expenses, club memberships, free samples (for doctors), discounts, and more.

- Giving to a Resident:

- The person getting the perk must live in India for more than 182 days in a year.

- Crossing the Limit:

- TDS is needed only if the total value of perks given to one person is more than Rs. 20,000 in a year. If one perk is less than Rs. 20,000, it’s okay even if the total is more.

So, if you fall into these three categories, no matter your own tax situation, you must take out TDS under Section 194R. But remember, some people are exempt, like those who get a salary (they already have TDS deducted) or those with low earnings.

Here are a few examples of when you’d need to take out TDS under Section 194R:

- A company giving travel vouchers to distributors who exceeded sales targets.

- A doctor providing free medicine samples to other doctors at a conference.

- A real estate agent gifting a watch to a client after a deal (if it goes over Rs. 20,000).

Non-applicability of TDS under Section 194R

Section 194R of the Income Tax Act says you have to deduct TDS (that’s like a bit of tax) on benefits or perks over Rs. 20,000 given to residents in a year. But there are situations where this rule doesn’t apply:

1. For People Getting the Perks

- If you’re already getting a salary, your employer takes care of TDS (Section 192), so 194R doesn’t bother you.

- If you live outside India (you’re a non-resident), a different section (195) handles your TDS.

2. For People Giving the Perks

- If you’re a regular person or family with not a lot of business (less than Rs. 1 crore) or professional work (less than Rs. 50 lakh), you don’t have to worry about 194R.

- If you’re a government group not doing business or work, 194R doesn’t bother you.

- Some perks like educational scholarships, meal allowances, and medical expense reimbursements are also exempt.

3. When the Perk Value is Low

- If all the perks given to one person in a year don’t add up to Rs. 20,000, no need for TDS even if the other rules apply.

4. If the Benefit is Not Connected to Business or Work

- If the perk isn’t linked to business or work, like a personal gift from a friend, 194R doesn’t apply.

5. Other Exemptions

- The government can make new rules or clarify things (like in circulars) that might change who 194R applies. Keeping up with these updates is important.

So, if you or the person giving you perks falls into these categories, you might not have to worry about TDS under Section 194R.

How to deduct TDS under Section 194R?

If a company, business, or professional is giving you extra benefits or perks, they have to take out a bit of tax (TDS) from those benefits before handing them over to you.

TDS certificate

The person taking out the tax (deductor) will give you a TDS certificate every quarterly, and it’s called Form 16A. They can get this form from their TRACES account, and you can check it in your 26AS. If someone needs to take out tax under Section 194R, they also have to file reports every quarterly, and that’s in Form 26Q.

Thanks!