Source – Finshots Markets

The Story

In the mid-2000s, Ratan Tata had an audacious dream. He wanted to make the world’s cheapest car. So he called a meeting of 4 engineers from the Tata stable.

But guess what?

Only 1 engineer arrived from Tata Motors. The other 3? They came from Tata Technologies.

Now that seems like quite an odd skew. You’re making a car and yet you’re calling folks from a ‘tech’ company. What’s up with that?

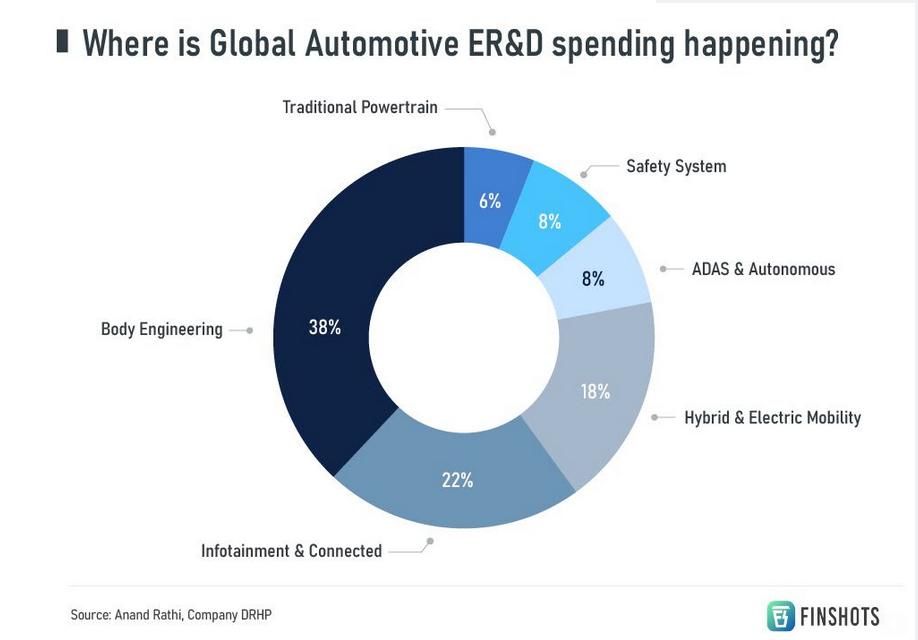

Well, it’s probably because Tata Technologies had a niche skill. It specialised in something called ER&D. Or Engineering, Research and Development. Its job is to help other car companies design the concept vehicle. It’ll help create the vehicle architecture and engineer the body. It’ll help set up the electrical systems. It’ll help digitise production processes to improve efficiency. And even iron out kinks in customer experience. The whole shebang.

And since the Tata Nano was the first of its kind, maybe the design and engineering skills needed for this were quite different to what a typical automobile expert was used to. Maybe the good folks at Tata Motors couldn’t do it all. And they needed help if they were going to get the product to market quickly. So Tata Technologies stepped in for the Nano back in the 2000s. Heck, 15 Tata Tech engineers even applied for patents for things they developed for the Nano. And the project was so pivotal for the company that in the words of its CEO , it “really honed our frugal engineering capabilities.”

But cars of today are very different from the cars of the 2000s. Today, they’ve become software on 4 wheels. And Tata Technologies developed its engineering capabilities to participate in the massive megatrend playing out in the industry — it’s called ACE .

Firstly, it involves C onnected vehicles that are linked to the internet. It’s what keeps your infotainment system running smoothly. And helps you download software updates for it over the air. And as per McKinsey, 95% of new vehicles sold in 2030 will be connected to the internet.

Secondly, there are A utonomous cars — the kind that can automatically help you avoid a head-on collision or alert you when it senses you’re drowsy. You can imagine that these things require complex lines of code and software to run without a hitch.

Thirdly, there’s a paradigm shift towards E lectric vehicles — either due to a personal preference or as in the case of the EU, because of a ban on fossil-fuel-dependent cars by 2035. Now legacy carmakers are embracing this new normal quickly and they need to develop robust battery management systems for EVs and improve charging technology. All through software.

And let’s just say that Carmakers aren’t exactly what you’d call tech experts. They just want to make mechanically and aesthetically pleasing cars that can take us safely from point A to point B. Sure, they could hire a large team, pay them the big bucks, and get them to work on the tech stuff. But heck, carmakers routinely buy even the basic components — horns, brake pads, gears from auto ancillary companies. So why should they break their head over all this complex tech, right? It’s best to leave the tech to the pros.

Tech pros like Tata Technologies. It’s riding this ACE wave of outsourcing as companies try to innovate and launch products quicker.

I mean, just look at the electrification programme for Tata Motors’ small sedan Tigor. Now Tata could’ve built the EV from scratch. But that would’ve taken a lot of time and money. Maybe it would’ve needed a new factory too. So it took the help of Tata Technologies. And simply decided to electrify the existing production line. It simply used its existing unused floor space to hand-fit batteries into the bodies of regular fuel vehicles. And guess what? Tata managed to price it below the fabled ₹10 lakh barrier. Even with all the bells and whistles of the infotainment system. They launched it in quick time too.

It was a massive success story.

Now if you’ve read this far, you might be thinking that Tata Technologies exists just to service the whims and fancies of Tata Motors. So let’s clear this up. Sure, the company began life as an in-house ER&D provider to the Tata Group. But Tata quickly spun it off into a separate entity. And today, only 35% of its revenues come from the services it offers to the Tata Group. It has struck deals with the biggest carmakers in the world. And it now serves 7 of the top 10 automotive ER&D spenders in the world. Also, just to get closer to the headquarters of these global carmakers, Tata Technologies also has 19 delivery centres across the world — including the US and Europe.

But wait, isn’t there another company from the house of Tata that does something similar?

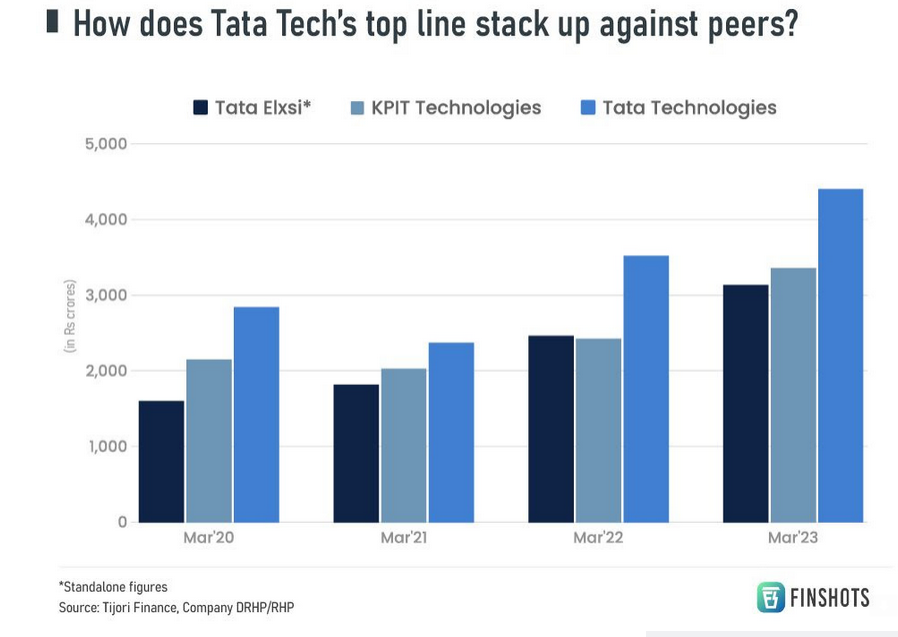

Well, the weird thing is that there is. There’s Tata Elxsi and it’s a listed stock too. The only real difference between the two is that Tata Technologies earns 75% of its revenues from the automotive industry. That has been its focus. On the other hand, Tata Elxsi is more diversified — only 45% of its revenues come from the transport sector and the rest of it is split between broadcasting media and healthcare.

So yeah, you could say that if you want to bet on the rapid changes in the car industry, maybe Tata Technologies is where you should be. Now granted, it’s not a 100% auto-play like another rival KPIT Technologies either — Tata Technologies provides services to aerospace companies and other transport and heavy machinery companies too. But it’s still just a small piece of the business and we’re just comparing the two ‘Tata’ companies in this space now.

So, the question is — what’s the risk in Tata Technologies?

Well, for starters, you’ll see a lot of reports highlighting that the company is heavily dependent on its parent brands — Tata Motors and Jaguar Land Rover. That 40% of its automotive revenue comes from these anchor clients.

But you could also argue that’s not necessarily a bad thing. After all, the relationship with the parent just means that Tata Technologies is assured of a certain business coming their way.

Also, one connected argument is that if the automotive sector slows down, and if car sales fall flat, it’s going to be a problem for Tata Technologies. But let’s just use its rival KPIT Tech to make a point here. See, between 2010 and 2018 , the sales of the top 20 carmakers around the world only grew by 6% annually. But, KPIT’s revenues soared by 22% (in US dollars). So even if cars weren’t selling like hotcakes, the manufacturers weren’t hesitating to outsource development and keep up with the tech curve. You could say that Tata Technologies could end up in a similar position too. Provided they can bag projects, of course.

Another niggling worry is that most of the ER&D spending comes from the top 20 automakers in the world. They’re the ones trying to innovate. So you could wonder if the pool of potential customers for Tata Technologies is limited in this way. And its many rivals are competing for projects from this same pool as well.

But on the flip side, you could argue that the EV space is just about to explode and there’s going to be plenty of business for everyone. At least that’s how Tata Technologies’ CEO sees it.

So yeah, there are these risks and the counterarguments too depending on the lens through which you want to view the company.

Rather, investors might be a little more unhappy with the fact that the company actually isn’t getting fresh money. The ₹3,000 crores it is ‘raising’ is simply a way for existing investors to get an exit. And that’s not something that’ll make investors too happy. You typically want companies to use an IPO event to build up the war chest to expand — build new capacity, advertise to drive new business. And you want existing investors to remain as a mark of the growth potential they still see in the company.

But at the end of the day, that’s just a minor quibble. After all, it’s an IPO emerging from the house of Tata after 20-long years. And you can bet that’s enough for a lot of people to hit the “Apply” button. Especially given how their other automotive-linked stocks — Tata Motors and Tata Elxsi — have been racing ahead of late.

Oh, there’s one more thing. You know how we always complain about IPOs these days being exorbitantly priced? That their valuations are out of whack with reality? Well, we can’t even say that for Tata Technologies. Let’s look at the Price-to-earnings (PE) ratio — which is just how much investors are willing to pay for each rupee of earnings — based on FY23 earnings. Tata Technologies is priced at just 32x while its rival Tata Elxsi is trading at over 60x and KPIT Technologies is also at 80x. Now that sounds quite enticing, no?

Starting: 1st of Every Month

Starting: 1st of Every Month  +91 8409492687

+91 8409492687  Contact@DevOpsSchool.com

Contact@DevOpsSchool.com