Introduction of MSMEs (Manufacturing enterprises) The full name of MSMEs is Micro, small & medium Enterprises, It is like the strongest channel in India with 60% of people from all over India investing. Under this, more than 5000 products are made, and through these products, our entire work is done […]

Continue readingTag: GST

Limited Time Offer!

For Less Than the Cost of a Starbucks Coffee, Access All DevOpsSchool Videos on YouTube Unlimitedly.

Master DevOps, SRE, DevSecOps Skills!

What is The Amnesty Scheme Under GST and Its benefits?

What is Amnesty Scheme? When a registered company does not file its GST return, it incurs a late fee and if that registered company does not file its GST in the same way, it incurs a lot of late fees, which causes that company a lot of trouble. How to […]

Continue readingHow to see it after filling GST PMT-09?

When we go back to the electronic cash ledger after filing GST PMT-09 in our portal, we have the option to view the GST PMT-09 file in it. After clicking on it, it gives us two options, from which we can see our PMT09 challan. 1st is SEARCH BY ARN […]

Continue readingFull Process To Filed GST-PMT09

What is GST-PMT09 Form? When the balance in our cache ledger accidentally moves to different columns, we use GST PMT-09 to bring it into the correct column. If the tax amount has gone to the wrong column, with the help of GST-PMT09 we can bring it to the right column, […]

Continue readingHow To Furnish our B2B Invoices in Offline Method under IFF Facility?

IFF (Invoice Furnishing facility):- Under this method, we submit all our (B2B) invoices by the 13th of every month. This is optional for each taxpayer. Because when a taxpayer finishes his invoices with the help of (IFF), it is easy for his supplier to get an income tax credit. IFF […]

Continue readingGST New Updates in 2021

There have been changes in the Summary since 1 April 2021. Within this, if the turnover of a business is up to 5 crores, then they have to enter the 4 digit HSN code and if the turnover of a company is more than 5 crores, then they have to […]

Continue readingGST FAQ’S

What is GSTIN ? When a person registers his company within the Goods and Services Tax, he is given a Goods and Services Tax Identification Number. What are the type of GST? There are Three Types of GST. (a) CGST (Central Goods & Service tax):- It means that if we […]

Continue readingFormat of an Invoice Under GST

What information is required to create any GST INVOICES Under Service Provider Company? (a) First of all, the service provider should have the registered address of the company with the PIN code of its region (b) Must have a PAN number (c) He should have the company’s register number, which […]

Continue readingUSEFUL ACCOUNTING RESOURCES FOR MONTHLY AND YEARLY COMPLIANCES

TDS (Tax Deducted At Source) These are the rules made by the government, in which the government is monitored by any of your income and as soon as you get any profit which falls under the rule of tax deducted At source, then the government is first paid tax. The […]

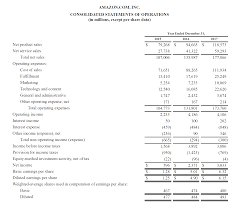

Continue readingSTATEMENT OF PROFIT AND LOSS ACCOUNT FOR PRIVATE LIMITED COMPANY

What is Profit And Loss Account? To know about the profit of the business, we have to look at the profit and loss account of that company, then it tells us that my company has earned profit or loss in that financial year. So for this, we have to create […]

Continue readingGST Update – How to file returns in QRMP scheme?

What is QRMP scheme? QRMP’s full form is “Quarterly Returns with Monthly Payment”. As this name is indicating it’s a scheme newly introduced under GST filing, where taxpayers can file their GSTR 1 and GSTR 3B both returns quarterly instead of monthly. Who can opt for QRMP scheme? All taxpayers […]

Continue readingStarting in GSTR-3B

When we open (3B), a report opens in front of us, in which we file all the details of that, only then we can file our returns, in which we are asked about our turnover, which we can tick by the entire column. After that, our Return Dashboard opens. *First […]

Continue readingWhat is an input tax credit?

The input tax credit is the first input which means that when we bring any raw material in our business, then it is called our input of business. The input of three types of any business is 1 Raw Material 2 Service 3 Capital Goods, these are what we call […]

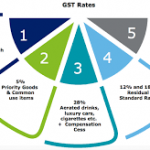

Continue readingWhat are GST rate slabs?

GST means goods and services tax .there are 7 types of tax slab rate 0 % 0.25% 3% 5% 12% 18% 28% In India there are 7 tax slabs, so how will this tax slab rate be charged, how much will be charged, and which will not be taxed on […]

Continue readingHow would you differentiate between CGST, SGST, and IGST?

Meanning SGST:- State goods and service tax When we sell goods in our own state, it is called SGSTCGST:- In this, when we supply the goods at one place like we are in Delhi, we are selling the goods inside it, then whatever tax will be there will be tax […]

Continue readingWhat are CGST, SGST, and IGST?

The full name of GST is Goods and Service Tax, in this, GST has been dived into 3 parts. CGST-Central Goods & Service Tax SGST-State Goods & Service Tax IGST-Integrated Goods & Service Tax First of all, we know about SGST – the full form of SGST is State Goods […]

Continue readingWhat are the benefits of GST?

There are 8 benefits of GST 0% tax on the essential commodity:- Within this, we have to pay 0% tax, which means that whatever our regular products are like (Fresh Vegetables, Books, Honey, News Paper, and Wheat Toothpaste, Soap),there are a lot of groceries. We have to pay 0% tax […]

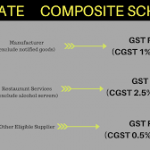

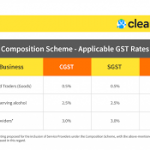

Continue readingRate of tax under the composition scheme?

These are the most points of composition scheme because any company accepts this scheme. Because the rates of tax in this are levied at a special rate pay tax. Whatever rates are inside it are special rates. The rate of tax at the favorable rate is the percentage of turnover, […]

Continue readingWho is eligible for the composition scheme?

The first question that comes in this is that the eligibility for the composition scheme is individual, the first of which we have to check 2 points to check its Scheme. Which is the most important. Whoever can become a competition dealer has to follow certain rules and regulations only […]

Continue readingWhat is GST Composition Scheme?

The purpose of this GST scheme in IndiaThose small companies used to get a lot of problems in running their company.His most important problem was that to run his business, he had to take a lot of complexes, due to which he used to come to problems in running his […]

Continue reading