Hi guy’s This is Ravi Varma, in this article I will tell you about the IFF filling process in an online way Let’s start, Full meaning of IFF:- The invoice furnishing facility method is the Full name of IFF. Please follow these steps to file IFF online Step01:- Log in […]

Continue readingTag: GST

Limited Time Offer!

For Less Than the Cost of a Starbucks Coffee, Access All DevOpsSchool Videos on YouTube Unlimitedly.

Master DevOps, SRE, DevSecOps Skills!

GSTR-1 New changes in all columns in 2021

Hi guy’s This is Ravi Varma, in this article I will tell you about the New changes in GSTR-1 columns Let’s start, The government has just changed all the columns of GSTR-1 as not many taxpayers use some of the columns of GSTR-1. So for this, the GST department thought […]

Continue readingAadhar Authentication facility is available. would you like to authenticate Aadhar of partner/Promoter and Primary Authorized Signatory?

Hi guy’s This is Ravi Varma, in this article I will tell you about Aadhar Authentication in the GST portal Let’s start, The government has made Aadhaar authentication mandatory for all GST holders, anyone who wants to get registered in GST will have to do their Aadhaar authentication so that […]

Continue readingThe new feature of GST (Communication between taxpayers) in 2021

Hi guy’s This is Ravi Varma, in this article I will tell you about Communication between taxpayers. Let’s start, What is the meaning of Communication between taxpayers? The GST portal has brought a new feature of the government which we will know as communication between taxpayers. With the help of […]

Continue readingWhich are the 29 states and 7 union territories in India in 2021?

Hi guy’s This is Ravi Varma, in this article I will tell you about India’s state & union territories. Let’s start, These are the names of the 09 Union Territories states in India. Andaman and Nicobar Chandigarh Daman and Diu Dadar and Nagar Haveli Delhi Ladakh Lakshadweep Jammu and Kashmir […]

Continue readingHow to pay Monthly Tax with the help of PMT-06 Challan under QRMP Scheme

Hi guy’s This is Ravi Varma, in this article I will tell you about PMT-06 Challan. Let’s start, For any company whose annual turnover is less than 5 crores, the government has put together a good option for all of them, which we call QRMP scheme, according to which we […]

Continue readingNew update in GST from 1st September (Implementation of Rule-59(6) on GST portal)

Hi guy’s This is Ravi Varma, in this article I will tell you a new update (Implementation of Rule-59(6) on the GST portal). Let’s start, A new update has come in GST, under which all registered tax filers have been told that if they have not filed their GSTR-3B, then […]

Continue readingTDS/TCS online return filing Due date for the financial year 2021-2022, and the assessment year 2022-2023

Hi guy’s This is Ravi Verma, in this article I will let you know about the due date for filing TDS/TCS online returns. Due Date for filing TDS returns Quarter Filing Month 2021-2022 End date for filing TDS returns Starting date for Filing TDS returns Relaxations 01st 1st April – […]

Continue readingWhat do you understand by reverse charge mechanism, understand the whole concept of reverse charge mechanism and goods transport agency(GTA)?

Hi guy’s This is Ravi Verma, in this article we will know about the reverse charge mechanism under the GST ACT. Let’s Start What is RCM (reverse charge mechanism)? If we take service from someone who collects tax from us but that person does not deposit that tax to the […]

Continue readingHistory of the GST in India.

Hi guy’s This is Ravi Verma, today I am writing about the history/basics of GST. let’s start What is GST? Different indirect taxes were being levied all over India, due to which many small businesses and companies used to waste all their time due to tax, due to which they […]

Continue readingWhat is meant by Proforma Invoice?

Hi guy’s This Ravi Verma, in this blog we will discuss Proforma Invoice. Let’s start, What is a Proforma Invoice? When any two companies import any goods/services between themselves, that company demands to issue Proforma Invoice because if the quality of service is not good then it can be revised […]

Continue readingHow to file a Non-GST invoice in the GSTR-1 ( 8A, 8B, 8C, 8D – Nil Rated Supplies )

Hello Guy’s, This is Ravi Verma, and I want to say, how to file Non-GST invoices In the GST portal in the case of GSTR-1 What is a Non-GST invoice? The invoice in which our supplier has not paid the amount of GST or we have supplied goods/services to our […]

Continue readingHow to activate the canceled GSTIN number?

Hi guy’s This Ravi Verma, in this blog I am writing on how to activate our canceled GSTIN number What is the GSTIN number? The full name of GSTIN is the goods and service tax identification number. All India GST number is total of 15 digits which consists of alphanumeric […]

Continue readingSection 149Q (TDS on purchase of Goods)

Introduction of Section 149Q The government of India has given notice to all to deduct TDS on the purchase of goods from 1st July 2021. If a resident person buys goods in excess of the Threshold limit, then TDS will be levied on the purchase of goods by the seller […]

Continue readingWhat will be the penalty are applicable in GSTR-1 if The HSN code is not entered

If the turnover of a company remains up to 5 crores then it is mandatory to write HSN code in the B2B invoice. And in the case of B2C, it is not necessary to write HSN code in the invoice. If the Turnover of a company is more then 5 […]

Continue readingFull detail of GSTR-1 Column no.12- HSN-wise Summary of outward Supplies

Any company whose turnover is more than 5 crores and has opted for monthly mode to submit its invoice, then it becomes necessary to enter the HSN/SAS code information of the goods or services in the invoice in column number 12 of GSTR-1 All information about HSN CODE columns (a) […]

Continue readingProtected: How to pay monthly TDS on salary from online method

There is no excerpt because this is a protected post.

Continue readingProtected: TDS Forms Details (24Q,26Q,27Q,27EQ) with section

There is no excerpt because this is a protected post.

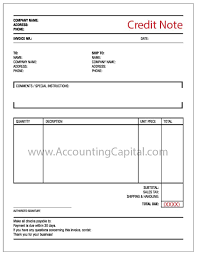

Continue readingWhat is a credit note and how is a credit note issued?

What is credit note? When a company accidentally increases the amount when issuing its invoice, at that time we issue a credit note to rectify that invoice. When we issue a credit note to our supplier, due to the release of that amount of the credit note, we amassed the […]

Continue readingNew update for the amnesty scheme

India’s Finance Minister “Nirmala Sita Raman Ji” introduced a new scheme to reduce the late fees levied on all taxpayers under which the amnesty scheme was introduced to reduce the tax liabilities of all taxpayers so that the minimum for all taxpayers The amount can be levied under which all […]

Continue reading