Hi Guys

This is Ravi Verma

In this article, I will tell you about how to pay tax after saving PMT-06 challan

Please follow these steps

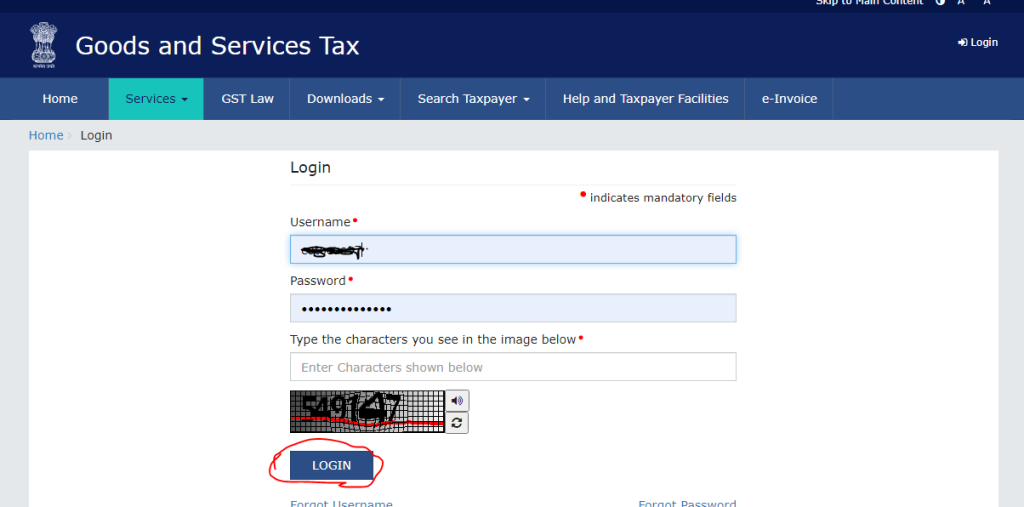

- Goto the GST portal and click to the login button.

- After clicking on it please enter your login id and password as well as captcha code and last click on the login option

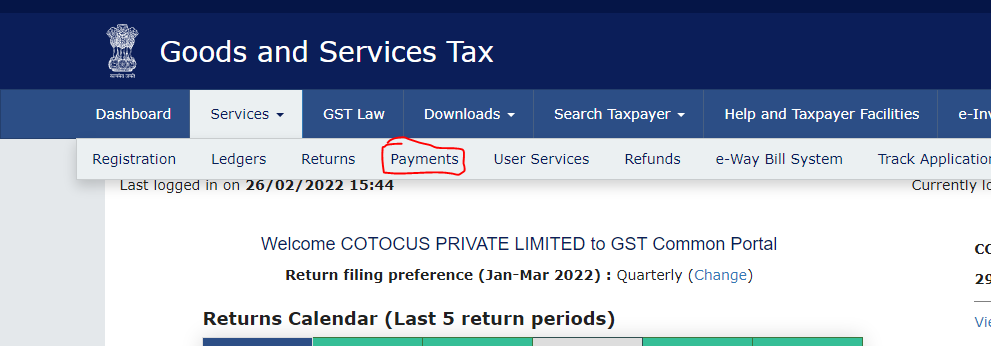

- Click on the service button, an option will appear in front of you, that is a payment option, please click on this option

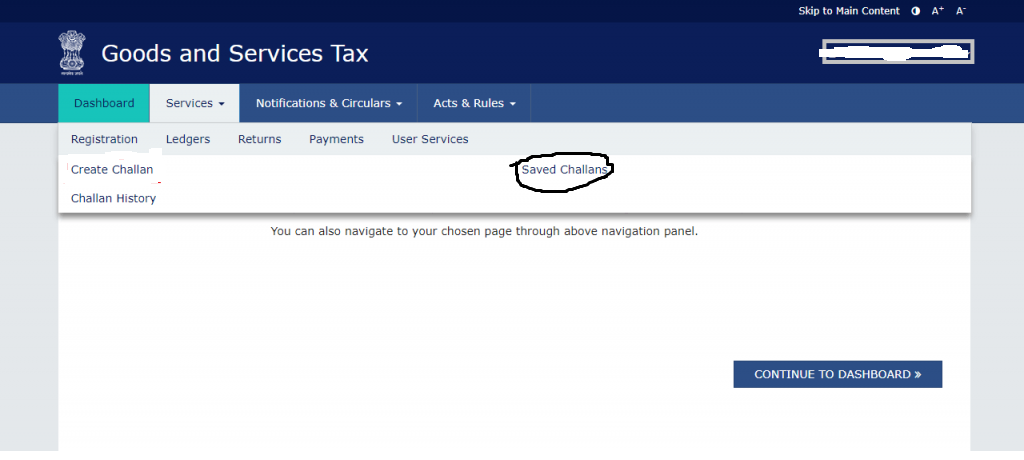

- After clicking on the payment option, the option of Tax Payment Challan comes in front of you which is (1) Save Challan (2) Create Challan (3) Challan History, you have to click on the Save Challan option.

- In this you will see Save Challan, this challan you have saved for payment of tax then click on the edit option.

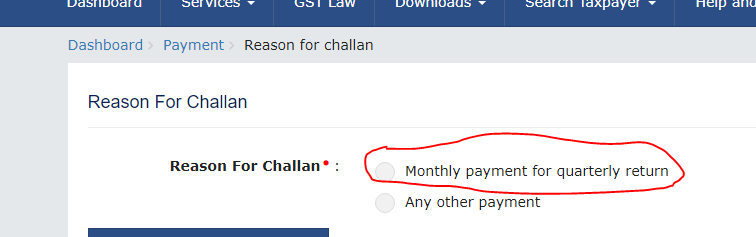

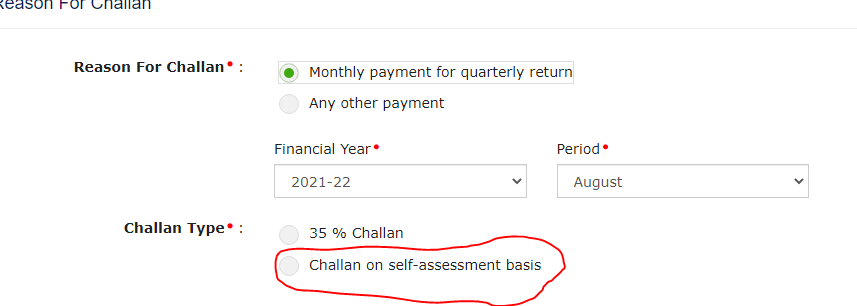

- After doing this step the next step is to click on the quarterly return monthly payment option

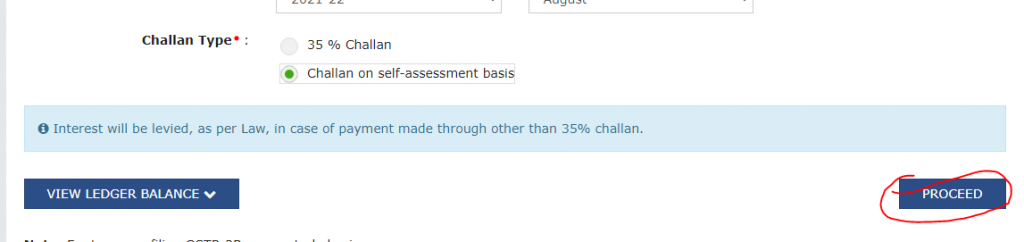

- After doing this choose your financial year and period, select your challan types

- Click to the proceed option

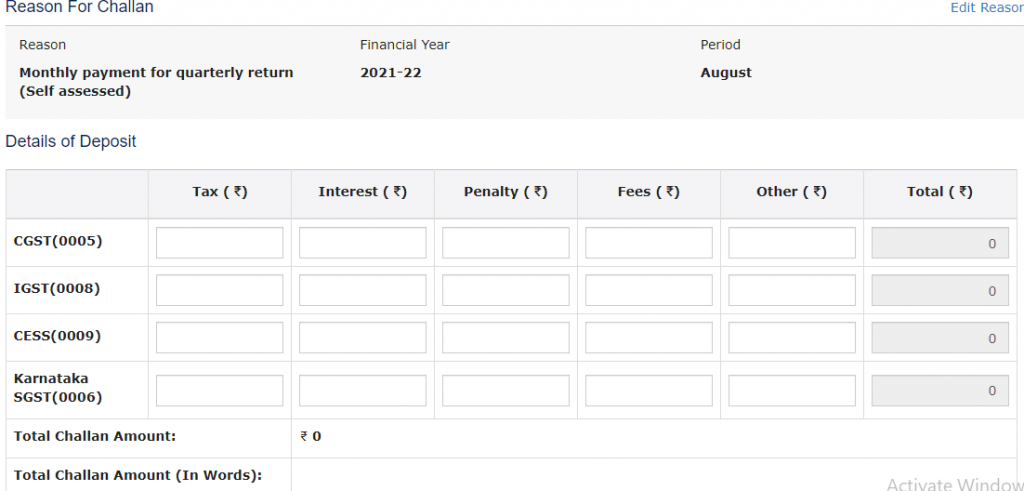

- Enter your taxable amount as per the given head of GST in the given column

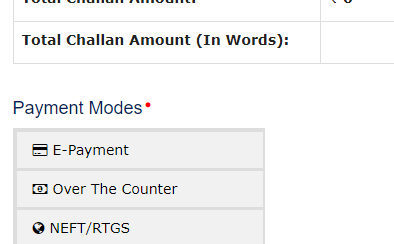

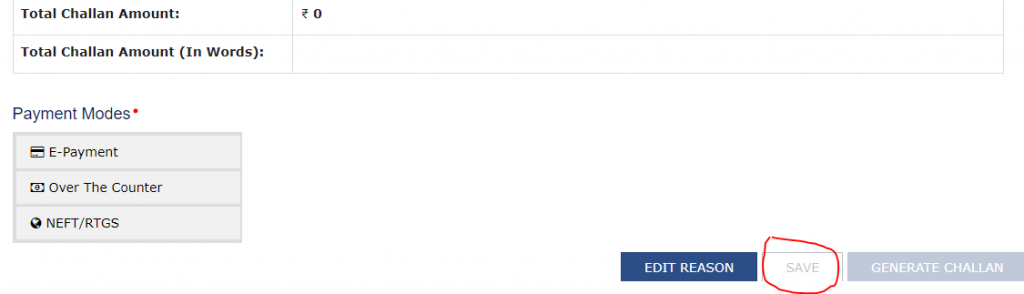

- Select your payment mode

- After selecting your payment options click on the Save button which is given at the bottom right side

- Then Click on Generate Challan Option

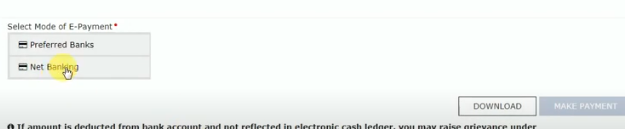

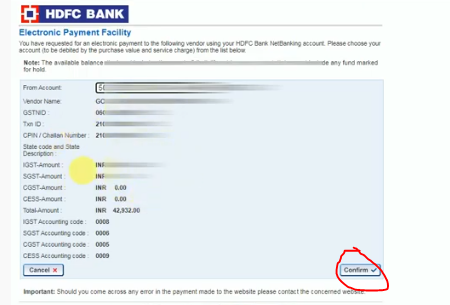

- After clicking on it, you will go to your payment banking option and you will have to make payment by selecting the mode in which you want to make the payment.

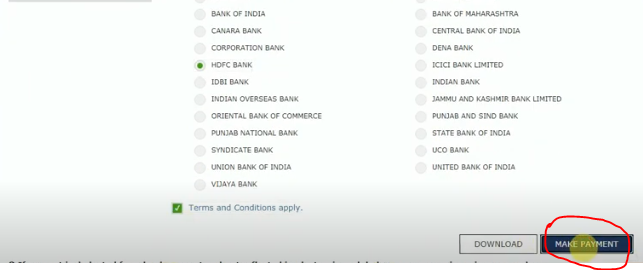

- So after selecting your bank option please click on make payment

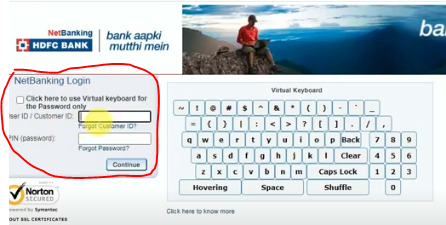

- Enter your Bank’s Gateway Login ID and Password and click on the Continue option

- And the last process is to click on the confirm option

Thanks,