Dear Friends,

This is Ravi Kumar and in this article, I am gonna teach you the new slab rate of Income Tax for an individual person.

Let’s Begin,

There are two types of Income Tax slab rates in India the Old slab rate and the New slab rate. The finance minister Nirmala Sitharaman announced the Union Budget for 2023 on 1 February.

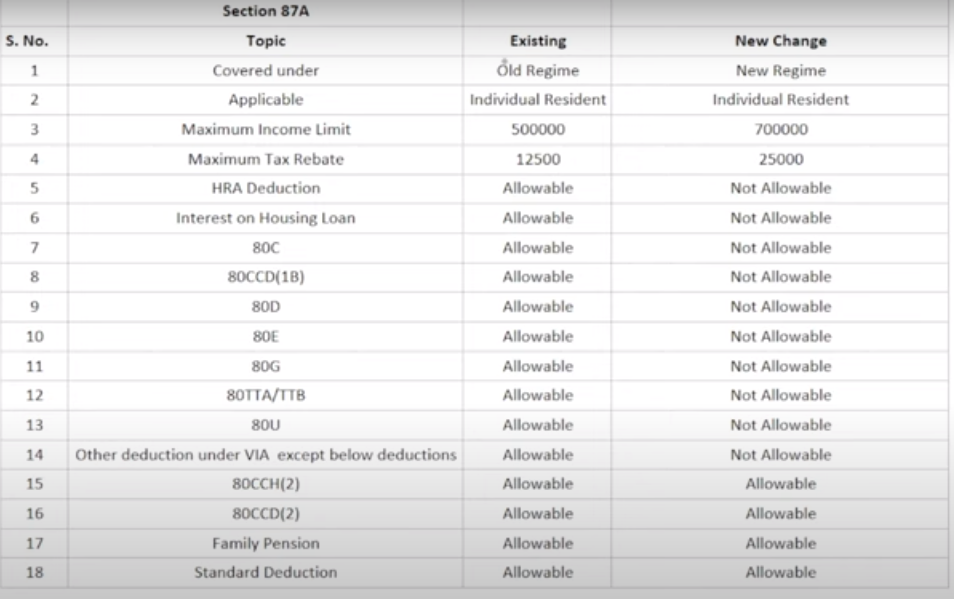

The finance minister Nirmala Sitharaman announced that under the new tax regime, the 87A rebate for income tax has been increased to Rs.07 lakh from the earlier limit of up to Rs.5 lakh.

What is the income tax slab?

According to the Indian rule of Income Tax, all the people will need to be paid their taxes on the income tax slab rates.

On the basis of the Income tax slab rate, we can identify our taxes whatever we have to pay the tax to the Indian government, and we can easily calculate our tax amount with the help of the slab rate.

Old Tax Slab Rate For the FY. 2023 – 2024

Individuals (Upto the age of 60 Years)

| S.No | YEAR | INCOME | RATE% |

| 1 | 2023 – 2024 | Upto 2.5 Lakh | NIL |

| 2 | 2023 – 2024 | 2.5Lakh – 05 Lakh | 5% (tax rebate u/s 87A is available) |

| 3 | 2023 – 2024 | 05 Lakh – 10 Lakh | 20% |

| 4 | 2023 – 2024 | More Than 10 Lakh | 30% |

Up to the age of 60 to 80 Years

| S.NO | YEAR | INCOME | RATE% |

| 1 | 2023 – 2024 | Upto 03 Lakh | NIL |

| 2 | 2023 – 2024 | 03 Lakh to 05 Lakh | 5% (tax rebate u/s 87A is available) |

| 3 | 2023 – 2024 | 05 Lakh to 10 Lakh | 20% |

| 4 | 2023 – 2024 | More Than 10 Lakh | 30% |

More Than 80 years old

| S.NO | YEAR | INCOME | RATE% |

| 1 | 2023 – 2024 | Upto 05 Lakh | NIL |

| 2 | 2023 – 2024 | 05 Lakh to 10 Lakh | 20% |

| 3 | 2023 – 2024 | More Than 10 Lakh | 30% |

New Tax Slab Rate For the FY. 2023 – 2024

Individuals (Upto the age of 60 Years)

| S.NO | YEAR | INCOME | RATE% |

| 1 | 2023 – 2024 | Upto 03 Lakh | NIL |

| 2 | 2023 – 2024 | 03 Lakh to 06 Lakh | 5% (tax rebate u/s 87A is available) |

| 3 | 2023 – 2024 | 06 Lakh to 09 Lakh | 10% |

| 4 | 2023 – 2024 | 09 Lakh to 15 Lakh | 15% |

| 5 | 2023 – 2024 | More Than 15 Lakh | 30% |

Up to the age of 60 to 80 Years

| S.NO | YEAR | INCOME | RATE% |

| 1 | 2023 – 2024 | Upto 03 Lakh | NIL |

| 2 | 2023 – 2024 | 03 Lakh to 05 Lakh | 5% ( (tax rebate u/s 87A is available) |

| 3 | 2023 – 2024 | 05 Lakh to 7.5 lakh | 10% |

| 4 | 2023 – 2024 | 7.5 lakh to 10 Lakh | 15% |

| 5 | 2023 – 2024 | 10 Lakh to 12.5 Lakh | 20% |

| 6 | 2023 – 2024 | 12.5 Lakh to 15 Lakh | 25% |

| 7 | 2023 – 2024 | More Than 15 Lakh | 30% |

More than 80 Years old

| S.NO | YEAR | INCOME | RATE% |

| 1 | 2023 – 2024 | Upto 2.5 Lakh | NIL |

| 2 | 2023 – 2024 | 2.5 Lakh to 05 Lakh | 5% |

| 3 | 2023 – 2024 | 05 Lakh to 7.5 Lakh | 10% |

| 4 | 2023 – 2024 | 7.5 Lakh to 10 Lakh | 15% |

| 5 | 2023 – 2024 | 10 Lakh to 12.5 Lakh | 20% |

| 6 | 2023 – 2024 | 12.5 Lakh to 15 Lakh | 25% |

| 7 | 2023 – 2024 | More Than 15 Lakh | 30% |

****-Super senior citizens (those above 80 years of age) are not eligible to avail income tax deductions under section 87A.

Here is the Deduction about old tax rebate and new tax rebate.

Thanks,