Hey all,

Welcome to my blog! Here, I’ll guide you on the process of GTA services opt-out way Stay tuned for step-by-step instructions and helpful tips!

What is GTA?

A Goods Transport Agency (GTA) is a company that transports goods using trucks and provides a note with details about the goods, where they’re from, and where they’re going.

A Goods Transport Agency (GTA) is a company that moves stuff using trucks. In India’s tax system (GST), a GTA gives a note with details about the goods and where they’re going. With GTA services, the company getting the service often pays the tax instead of the one providing the service. This is called the Reverse Charge Mechanism (RCM). The company paying tax for GTA services can usually get some money back by using the Input Tax Credit. Some people or businesses don’t have to pay tax for GTA services.

According to a notice from June 28, 2017, a “goods transport agency” or GTA is a person who gives services for moving goods by road and gives a note (like a receipt) with details about the goods. So, even though some others may rent out vehicles for moving goods, only those who give this special note are called a GTA. This note is crucial to be recognized as a GTA.

Charges in GTA?

Goods Transport Agencies (GTAs) in India have two options for paying GST:

- 5% Rate without ITC (Input Tax Credit): GTAs can choose to pay GST at a 5% rate but cannot claim Input Tax Credit. This option is simpler, but it means GTAs cannot use the tax they paid on their purchases to reduce their own GST liability.

- 12% Rate with ITC: GTAs also have the option to pay GST at a 12% rate and claim Input Tax Credit. This allows GTAs to use the tax they paid on their purchases to lower their own GST liability. However, handling this option is a bit more complex.

As for who pays the GST, generally, the recipient of the GTA service (consignee) is responsible for paying the GST under the reverse charge mechanism (RCM). This means that the consignee pays the GST directly to the government, not to the GTA. The reverse charge mechanism is a system where the liability to pay tax shifts from the service provider (GTA, in this case) to the service recipient (consignee).

What is Forward Charge Mechanism and Reverse Charge Mechanism?

In the world of taxes, there are two main ways to handle the responsibility of paying the Goods and Services Tax (GST): Forward Charge Mechanism and Reverse Charge Mechanism. Let’s break them down in simple terms:

Forward Charge Mechanism

Imagine you run a bakery and sell delicious cakes. As the supplier of the cakes, you’re responsible for collecting the GST from the customer and then depositing it to the government. It’s like being the “forwarder” of the tax. This is the most common way GST works. The supplier adds the GST amount to the price of the goods or services, and the customer pays the total amount, including the tax.

Reverse Charge Mechanism

Now, imagine you’re a construction company hired to build a bridge. Instead of you, the supplier, collecting the GST, the responsibility actually falls on the other end – the government in this case, who acts as the recipient of the service. This “reverse” scenario happens when the government, or specific types of businesses, purchase certain goods or services. Here, the recipient is responsible for calculating, collecting, and depositing the GST to the government.

Here’s a table summarizing the key differences:

| Feature | Forward Charge Mechanism | Reverse Charge Mechanism |

|---|---|---|

| Who pays the GST? | Supplier | Recipient |

| Example | Bakery selling cakes to customer | Government hires a construction company |

| Common? | Yes | No, used in specific cases |

| Responsibility | Supplier adds GST to price | The government hires a construction company |

What is a consignment note?

A consignment note is like a special paper or receipt that comes with stuff when it’s moved from one place to another using a truck. It’s a bit like a ticket for the journey of those things. This paper has important info like who sent the stuff, who’s getting it, what the stuff is, and where it’s starting from and going.

For a company to be officially called a Goods Transport Agency (GTA) under GST (which is like a tax system), they need to give this special paper, the consignment note. It’s like proof that they’re really moving things, and it helps in dealing with taxes the right way. So, the consignment note is a key document that says, “Hey, we’re moving these things, and here are all the important details about it.

What is Annexure V in GTA?

Annexure V is a form that Goods Transport Agencies (GTAs) can use if they want to take charge of paying the Goods and Services Tax (GST) directly, instead of the usual way where the person receiving the GTA service pays the GST.

Why Choose Forward Charge?

There are some benefits to using forward charge with Annexure V:

- Simpler compliance: GTAs find it easier to manage their own GST payments rather than depending on others who might be late or miss payments.

- Claiming input tax credit: GTAs can use the taxes they paid on their purchases (like fuel or vehicle maintenance) to lower their own GST amount.

When Can You File Annexure V?

GTAs need to submit Annexure V before the start of each financial year, which is April 1st. So, you’d need to send it in by March 31st for the upcoming year.

Is It Mandatory?

No, filing Annexure V is optional for GTAs. If you choose not to use it, the person getting your services will still be responsible for paying the GST.

Things to Remember:

- Once you choose Annexure V, you’re committed to paying GST this way for the entire financial year.

- You’ll need to include the GST on your invoices to the people getting your services.

How to get registration in GTA Annexure V?

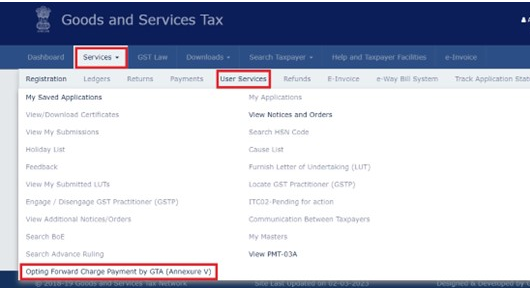

a. After logging in, go to Services, then User Services, and choose the option for Opting Forward Charge Payment by GTA (Annexure V).

b. Please note that starting from the financial year 2023-24, if you provide GTA services and want to choose to pay taxes under the Forward Charge, you need to submit a declaration in Annexure V Form on the portal by March 31.

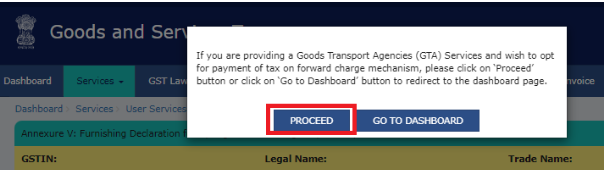

Once you click on Opting Forward Charge Payment by GTA (Annexure V), a message will pop up. Click Proceed to file Annexure V.

c. On the Annexure V filing page, the “PROCEED TO FILE” button will only work after you’ve selected the checkboxes.

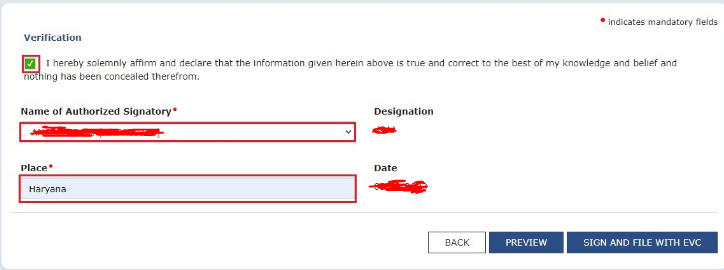

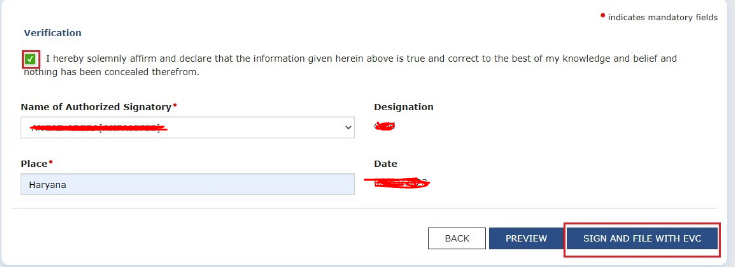

d. Next, a verification page will appear. Choose the Verification checkbox, select the Name of Authorized Signatory, and enter the Place.

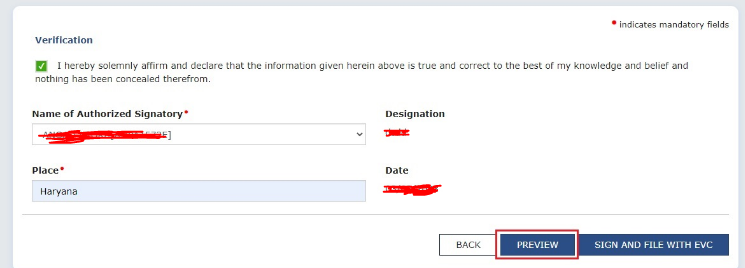

e. Please note that the “PREVIEW & SIGN AND FILE WITH EVC” button will only work after you’ve selected the Verification box, Name of Authorized Signatory, and Place field. You can preview the draft Annexure V Form by clicking the PREVIEW button.

f. After previewing, click on “SIGN AND FILE WITH EVC.”

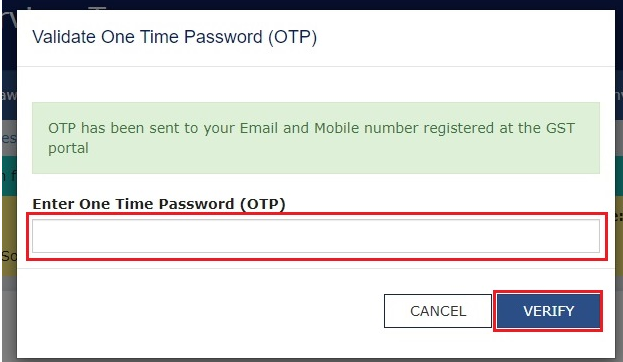

g. Enter the OTP sent to the email and mobile number of the Authorized Signatory, and click on VERIFY.

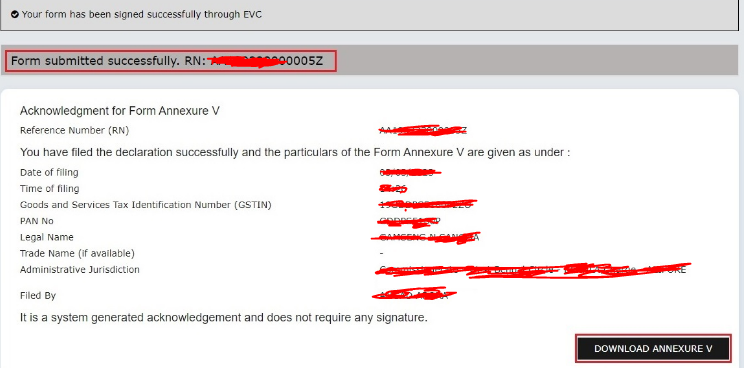

h. After successful validation, a success message with an RN (reference number) will be displayed. Click on DOWNLOAD ANNEXURE V to download the filed Annexure V Form.

i. You will receive a system-generated email and SMS notification after successfully filing the Annexure V Form.

j. If you want to download the Annexure V Form for the previous Financial Year, select the financial year from the drop-down menu and click on the GO button. Click on DOWNLOAD ANNEXURE V to download the Filed Annexure V Form PDF document.

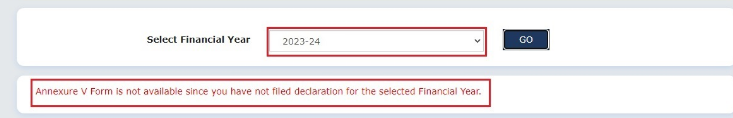

k. If the Annexure V Form is not filed for the selected financial year, a message will be displayed.

Goods Transport Agency (GTA) VI

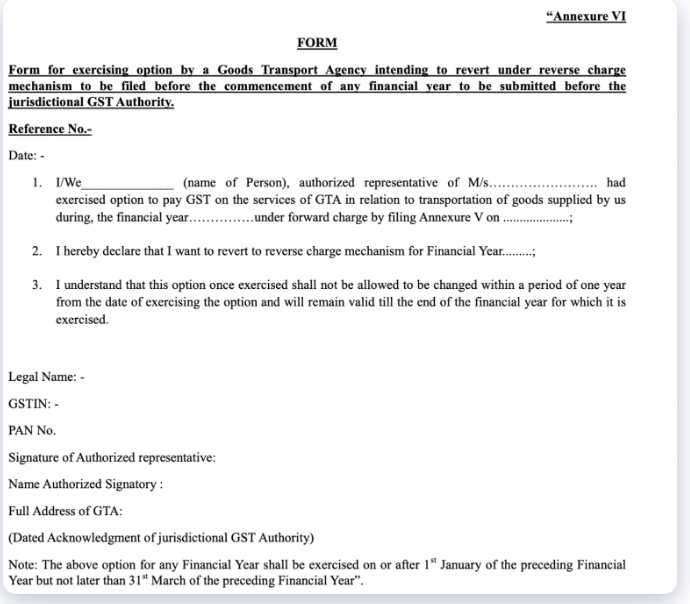

If a Goods Transport Agency (GTA) chooses to pay tax under the Forward Charge Mechanism (FCM) and files Annexure V, they don’t need to fill out Annexure V every year. Once they’ve made this choice, it continues until they decide otherwise.

However, if the GTA decides to opt out of the Forward Charge Mechanism (FCM) and chooses to pay tax under the Reverse Charge Mechanism (RCM), they need to file Annexure VI. This form is used when they want to switch from being responsible for paying the tax to making the recipient of their services responsible for it. So, Annexure VI comes into play when there’s a change in how the tax is handled.

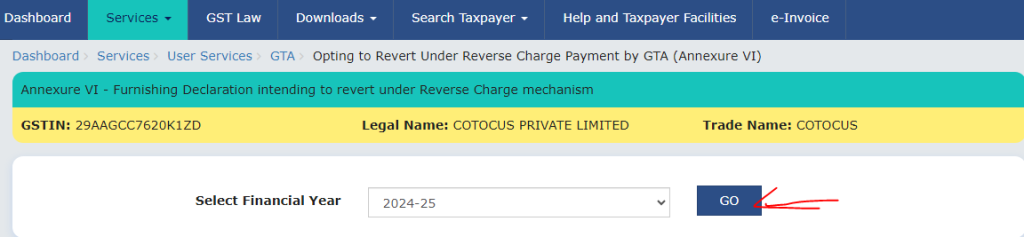

a. Go back to the services section and click on the GTA services & select Annexure VI after filling in the FY please click on the Go button.

b. After clicking the go button please acknowledge the form and do the further process.

Thanks,