Hi Dear,

I am Ravi Kumar working in Cotocus Pvt Ltd as an accountant and I am providing you with all the new info related to GST on my stocksmantra.in.

What is 2 Factor Authentication?

In the Goods and Services Tax, a new protection layer is enabled by the government for security reasons. This is an additional security measure implemented to safeguard sensitive taxpayer data and transactions within the GST.

It adds an extra layer of protection at the time of login, in the previous time we just entered the user ID, and password and filled in the captcha, and after that, our GST portal would be login but from 1st December 2023 we have to enter a 2-factor authentication OTP for the login and this 2-factor authentication code will be received in your registered mobile number and your registered email ID.

How to enter the 2-factor OTP in the GST Portal?

Let me know how to enter the OTP and where you will receive this OTP.

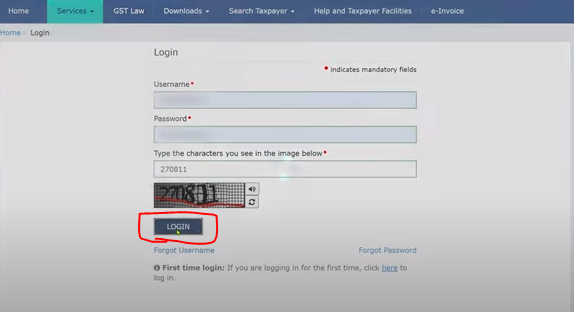

Please visit the GST portal dashboard.

Click on the Login button.

After clicking on the login button, please enter your User ID, and password and enter the captcha Code. After that, please click on the login button.

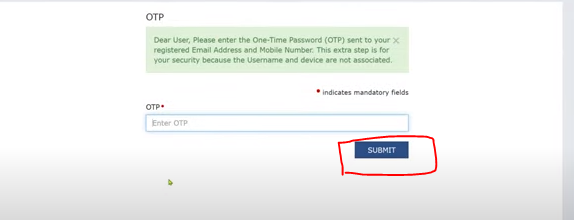

After clicking on the login button you will receive an OTP in your registered email ID and the Registered mobile number. So you would have to enter this OTP in the GST portal and click on the submit button.

After following these steps you will be able to log into your GST portal without any confusion.

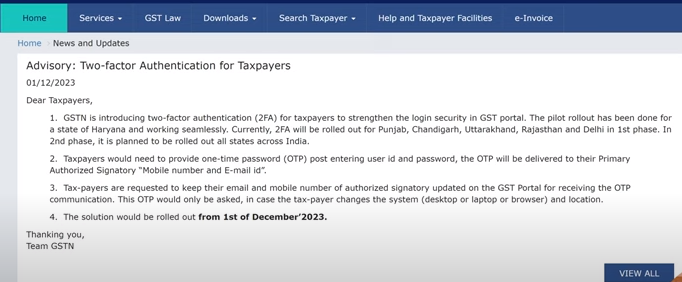

Which States are mandatory to log in to their GST portal by the OTP?

There are a few states that are listed in the GST portal for the 2-factor authentication login process in the 1st phase. 1. Delhi, 2. Rajasthan, 3. Punjab, 4. Chandigarh, and 5. Uttrakhand. The government is planning for the launching in the second phase of states.

What are the benefits of the 2-factor authentication in the GST?

There are large benefits to implementing 2-factor authentication in the GST.

- Security – Double layer security protection of the DATA in the GST.

- Reduces fraud risk – If a person knows your GST registered ID and Password and they will try to log into your GST portal then they are not able to log in because only you can have the login OTP in your mobile or Gmail.

- Increased trust and transparency – You will be able to trust the GST because your all GST data will be safe from fraud people that’s why.

An attachment of the GST for the 2-factor authentication

Thanks,