Startup India Registration is a flagship initiative by the Indian Government aimed at fostering innovation and promoting a robust startup ecosystem in India. Here’s a detailed look at how to register for Startup India and the steps involved in the registration process:

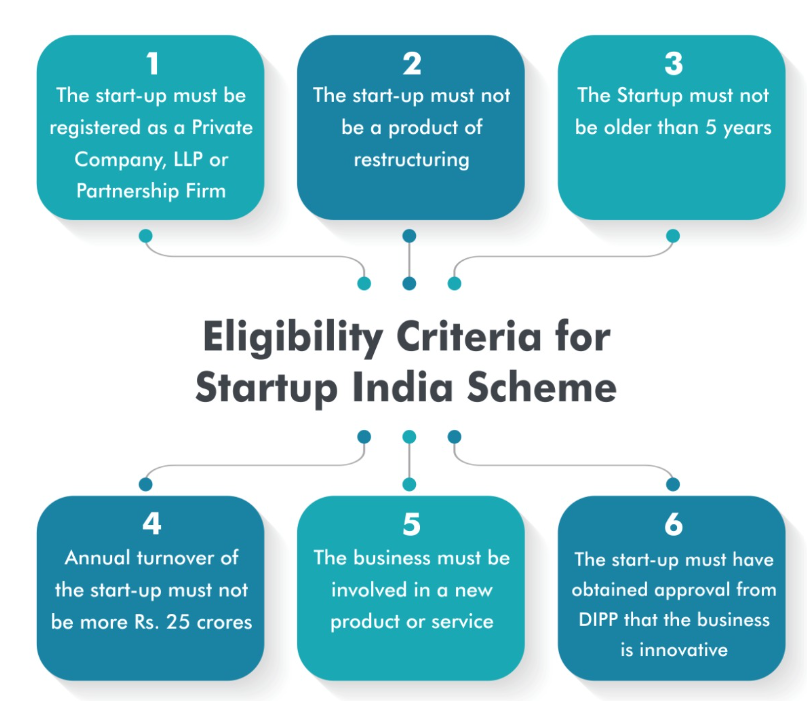

Eligibility Criteria:

To register under the Startup India initiative, an entity must:

- Be incorporated as a private limited company, registered partnership firm, or a limited liability partnership.

- Have an annual turnover not exceeding INR 100 crores for any of the financial years since its incorporation.

- Be working towards innovation, development, or improvement of products, services, or processes and have the potential to generate employment or wealth creation.

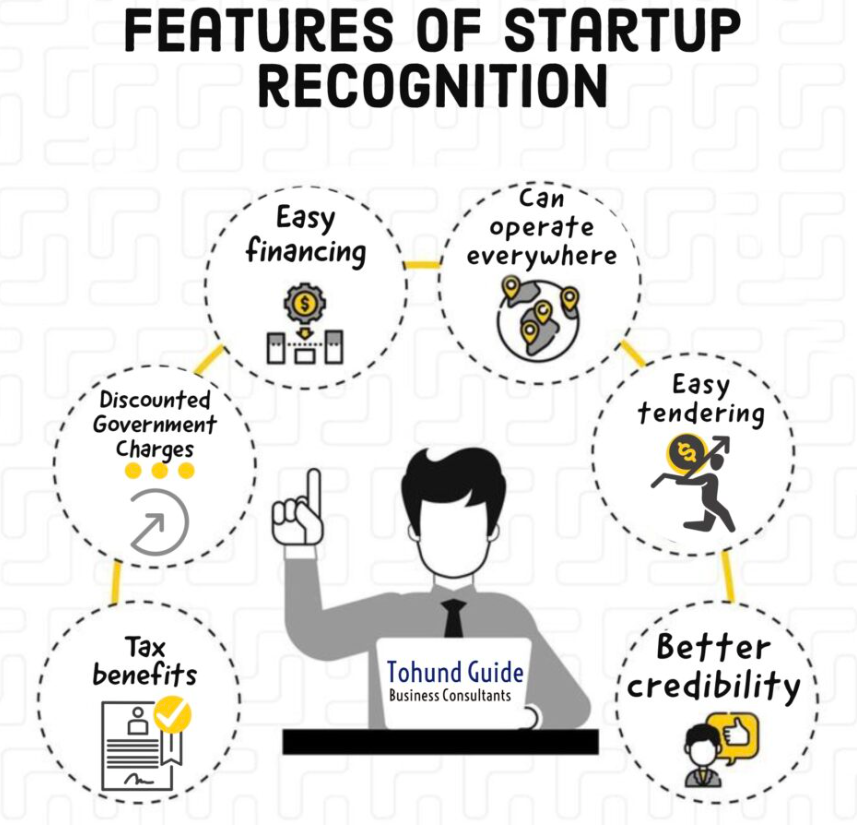

Benefits of Registration:

- Tax exemptions on income for three years and on capital gains.

- Opportunities to participate in government tenders.

- Simplified procedures and documentation.

- Access to Intellectual Property Rights services including fast-tracking patent applications at reduced costs.

- Eligibility for government funding, incentives, and challenges.

Steps for Registration:

- Incorporate Your Business: First, ensure that your business is registered as one of the eligible business structures (Private Limited, Partnership, or LLP).

- Register on the Startup India Portal:

- Go to the Startup India website and create your profile by filling out the necessary details about your business and the founders.

- DPIIT Recognition:

- After registering, you need to apply for DPIIT recognition. This is crucial as it officially recognizes you as a startup under the Startup India scheme and makes you eligible for various benefits.

- Fill out the recognition form which requires details such as a brief about the business, the products/services, and any intellectual property that you might have registered.

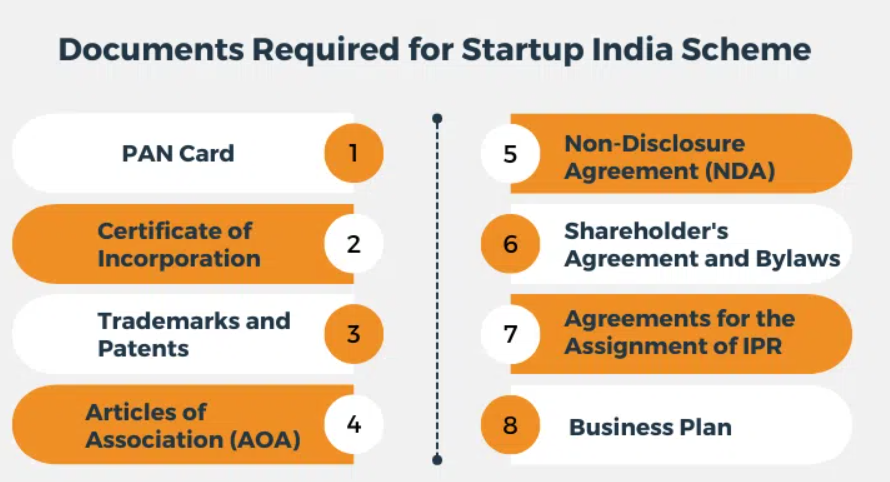

- Upload Documents:

- Depending on the nature of the business, different documents such as a letter of recommendation, proof of concept, patent filed and published in the Journal by the India Patent Office, and details about the uniqueness of your product/service may be required.

- Tax Benefits:

- Post getting DPIIT recognition, startups can apply for tax benefits under Section 80 IAC and Section 56 of the Income Tax Act, which pertains to tax exemptions on investments above fair market value.

- Final Review and Recognition:

- Once your application is submitted along with necessary documents, it is reviewed by the appropriate authorities. If all criteria meet the standards set by the Startup India initiative, your startup will be recognized, and you will receive a recognition number.

- Continued Compliance:

- Startups must ensure ongoing compliance with the criteria set by the Startup India initiative, including annual turnover and continuing to work on innovative products or services.

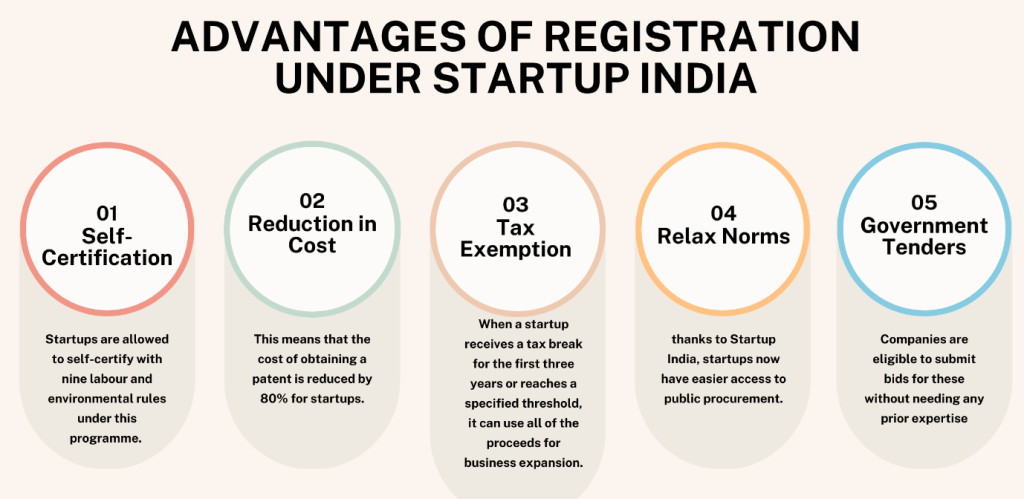

Benefits for registering company under Startup India Registration

Registering your company under the Startup India initiative offers several benefits designed to support and encourage emerging businesses:

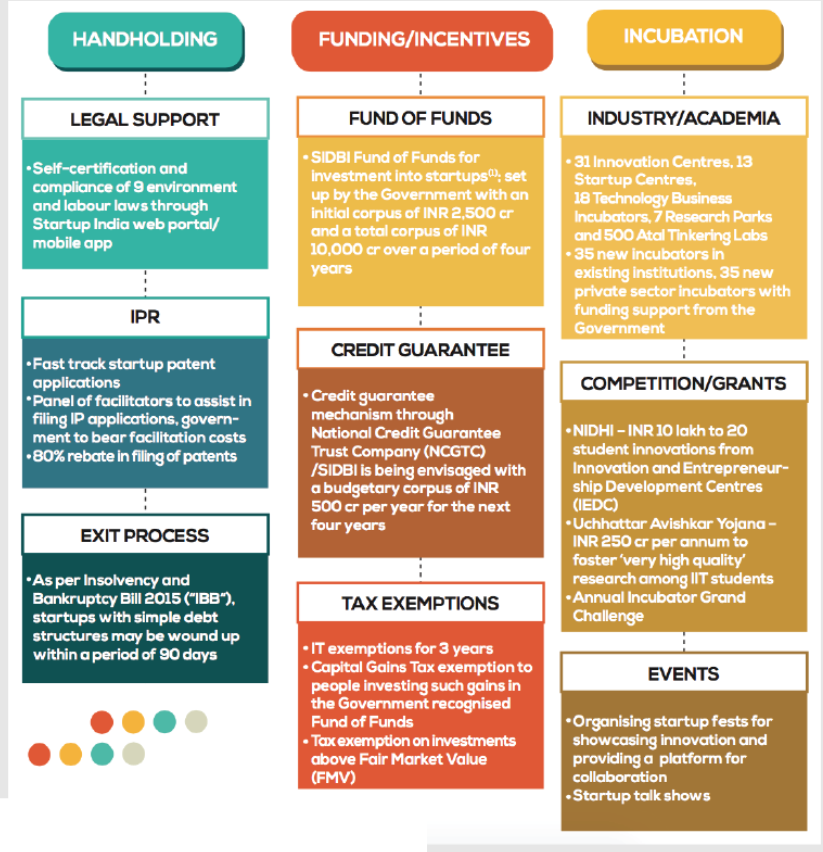

- Self-Certification: Startups can self-certify compliance with specific labor and environmental laws, reducing the regulatory burden during the initial years of operation.

- Tax Exemptions: Registered startups benefit from income tax exemption for three consecutive years and are also eligible for exemptions under other sections like the Angel Tax (Section 56 of the Income Tax Act).

- Intellectual Property Benefits: There are significant incentives like an 80% rebate on patent costs and a 50% rebate on trademarks to encourage the protection of intellectual property.

- Fast-Track Patent Examination: Applications for patents by startups are fast-tracked to reduce the waiting period.

- Easy Winding-Up of Company: The initiative allows for an easier process to wind up the company within 90 days under certain conditions, facilitating a smoother exit strategy.

- Funding Opportunities: Startups can access government funds as part of the Fund of Funds scheme and are also eligible for seed funding support.

- Easier Public Procurement Norms: Startups can participate in government tenders without prior experience and turnover requirements and are exempt from submitting Earnest Money Deposits.

- Networking Opportunities: Opportunities to meet with various stakeholders through events and fests, promoting networking and collaboration.

- Mentorship and Incubation Support: Access to a network of incubators and professional mentors who can provide guidance and support to nurture business growth.

- Training and Learning: Startups have access to specially designed workshops, training, and learning modules that cover various aspects of business management and entrepreneurship.

These benefits collectively aim to create a conducive environment for startups to innovate, grow, and contribute effectively to the economy.