(A)GST IN INDIA AN INTRODUCTION

*background of taxes:-if you take any country it is actually the responsibility of the government to fulfill the increasing devolvement needs of its people and how the government can fulfill them by getting all public expenditure.

If you take in India:-India is still a developing economy are striving to fulfill the obligations of the welfare state. but it has very limited resources and from that India gets its resources

what is a primary source of revenue:-for India.its basically through taxes. collecting tax:- government will be able to provide public services.so this collection of tax is not really seen as a tool for providing public services but it is also acting as an instrument of fiscal policy because at this time leading economic growth so that taxes collected will enable the government to fulfill its social-economic objectives.

*WHAT IS TAX:-taxes basically do not the burden that the individuals are the property owners or businesses in dady is will support the government by paying an amount.so what is Daggs-its a big punitive burden on the individuals or property owners or businesses in day days where they are asked to pay a certain amount to the government to support the government and this almost payable Scarlett stag’s and this payment is actually exacted by legislative authority.

it means it is legalized they are supposed to pay.they have no choice to escape from that.

Taxus is not all in repayment.

It is not a donation.

It is rather an end for the contribution They are demanded

They asked to pay.they don’t have any choice. because it is exacted by the legislative authority to put it in simple words tax system money where people are paid to the government so that government can provide public services.

Taxes can be divided into two dyadic direct tax and indirect tax

*Direct tax is a case that taxes imposed directly on the taxpayer and the taxpayer will pay it directly lead to the government .so the taxpayer can be bosal not bosuns individual or business entities but it is paid directly by them to the government.it means this tax obligation cannot be shifted.

EXAMPLE IS INCOME TAX.

That the direct tax in that indirect tax is something that backspacer is going to be gone do it in every stage.it mean tax incidence will be passed on stage by stage and it finally reaches the consumer it means under indirect tax.this tax incidence can be shifted if it’s passed on. the tax incidence is born by the consumer who is going to ultimately consume the product or services. such state it will get shiftwork.it means here that immediately bill did pay the tax to the government will fall upon another person and not the person who is consuming because a person who is consuming the product will pay the price for the product and backs dogs that are to manufacture.it means the obligation to pay that tax to the government fall upon another person he may be a manufacturer or he may be a provider of services or a seller of goods but a legitimate consumer is not going to pay.immeditely liability to be the tax fall apart on other bills and under indirect tax

The consumption of banks is actually regressive in nature. It means that taxes are not based on the principle of ability to pay if you have money if you don’t have money it’s not an issue if you are consuming the product or service then you are expected to pay so the ability to pay is not checked here because it is regressive in nature.it means all the customers whether they are economically challenged or rich they are going to bear the brunt and it is levied on the weariest act to deal with these items.it can be levied on consumption expenditure privilege. right, but it cannot be levied on income or property because we have income tax on it.

*Number of indirect tax in India we had them using the systems we had a number of indirect taxes in India like X is dudi customs duty. of course, this still continues.so we Staggs central sales tax value-added tax increase tax purchase tax entertainment tax on lottery, betting gambling then luxury tax daks on an advertisement, and so on. we have a number of taxes but on July 1 2017 India has shifted to unified in the attic backs Reggie

It means instead of having a large number of taxes now we are going to have central and state indirect taxes amalgamated into a single tax called goods and services tax.

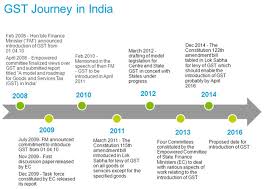

In short, the GST and this is seen as a significant step in indirect tax reforms and we will be understanding about all this in every detail in the following sessions.

*what are the major of direct and indirect tax:-the major indirect tax is number one the GST what had come and seen on Julietta dozen on them and the other one is customs duty.

*what are the major of direct tax:-one is income tax where the taxes levied on your income.the another one is something known as interest tax expenditure tax which is not our focus and the scores

let what we are understood direct tax is something where the person paying the tax to the government bodies the incidence of the tax it means it cannot be shifted this that it taxes progress in nature.it means if we use all consumers equally it means all the consumers will equally bear the burden irrespective of ability to be