Dixon Technologies (India) Limited (DTIL) is a fully integrated end-to-end product and solution suite provider to Original Equipment Manufacturers (OEMs). Their offerings to OEMs range from Global Sourcing, Manufacturing, Quality Testing and Packaging to Logistics. They are also a leading Original Design Manufacturer (ODM) of lighting products, LED TVs and semi-automatic washing machines in India. Apart from this, DTIL also provides solutions in Reverse Logistics, i.e. repair and refurbishment services of set top boxes, mobile phones and LED TV panels. We expect its revenues to grow at a CAGR of 20.6% from Rs. 2,456.8 crore to Rs. 4,306.9 crore by FY20. Over the same period, EBITDA and PAT are expected to grow at a CAGR of 26.7% and 33.1% to Rs. 187.5 crore and Rs. 118.8 crore, respectively. ROCE and ROE are also expected to remain stable at 32.2% and 23%, respectively.

We are extremely enthused by the fact that the company has minimal debt, majority of which will be repaid from the issue proceeds. Further, we do not expect significant capex at least over the forecast period, given the fact that it is an asset-light model.

We initiate with a BUY for a price target of Rs. 2,623 (25x FY20 target PE) representing an upside of 48.5% (from the upper band price of Rs. 1,766) over the next 21 months.

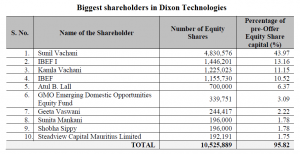

On offer are 3,39,751 shares being issued as fresh equity and 2,601,329 shares being offloaded by Motilal Oswal Private Equity Investment Advisors Pvt Ltd as part of the FPO offer.