Hi all,

Today, we will discuss the new tax regime in Income tax.

What Is an Income Tax Slab?

In India, Income Tax is levied on individuals using a slab system, where varying tax rates are assigned to different income ranges. As an individual’s income rises, the tax rates also increase. This approach to taxation fosters a fair and progressive tax system in the country. The income tax slabs undergo periodic revisions, usually aligned with each budget cycle. These slab rates vary among different groups of taxpayers. Let’s now examine all the applicable slab rates for FY 2022-23 (AY 2023-24) and FY 2023-24 (AY 2024-25).

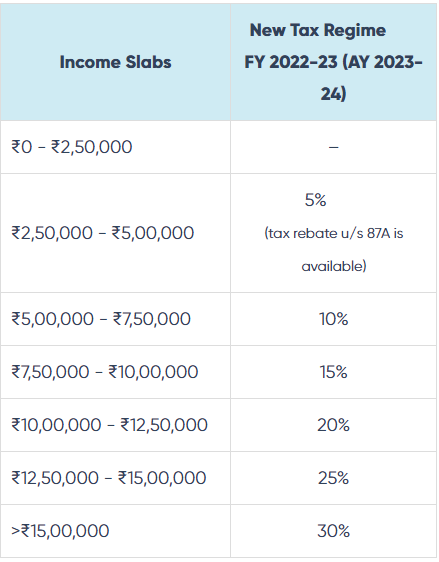

Income Tax Slab Rates For FY 2022-23 (AY 2023-24)

A. New tax regime.

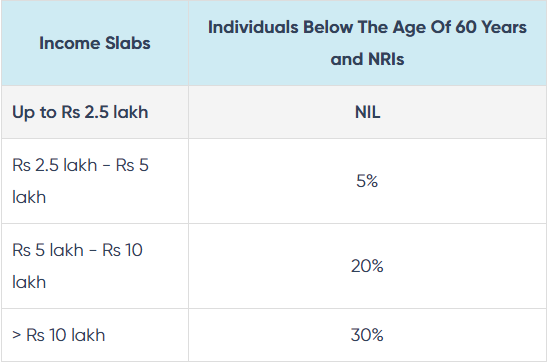

B. OLD Tax regime.

Income tax slabs for individuals aged below 60 years & HUF

Note point**

- The income tax exemption limit is up to Rs 2,50,000 for Individuals, HUF below 60 years of age, and NRIs.

- Surcharge and cess will be applicable as discussed above

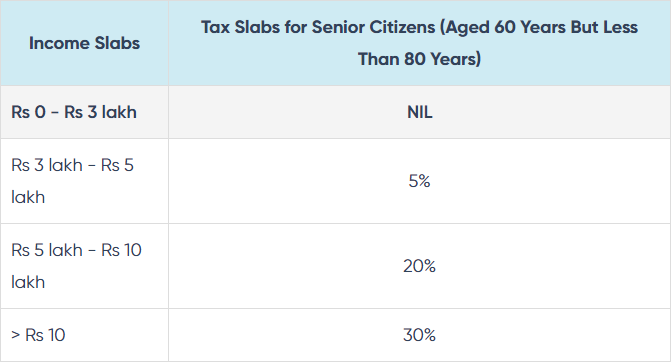

Income tax slab for individuals aged above 60 years to 80 years.

Note point**

- The Income tax exemption limit is up to Rs.3 lakh for senior citizens aged above 60 years but less than 80 years.

- Surcharge and cess will be applicable as discussed above

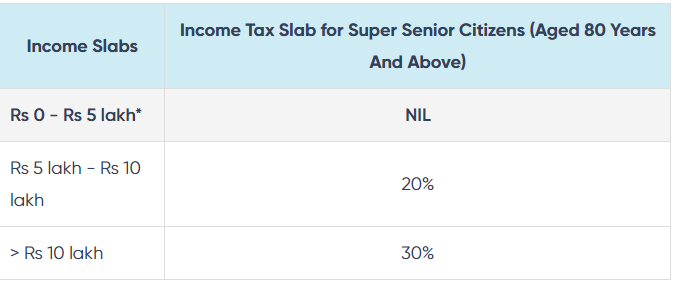

Income tax slab for Individuals aged more than 80 years

Note Point***

- The income tax exemption limit is up to Rs 5 lakh for super senior citizens aged above 80 years.

- Surcharge and cess will be applicable as discussed above

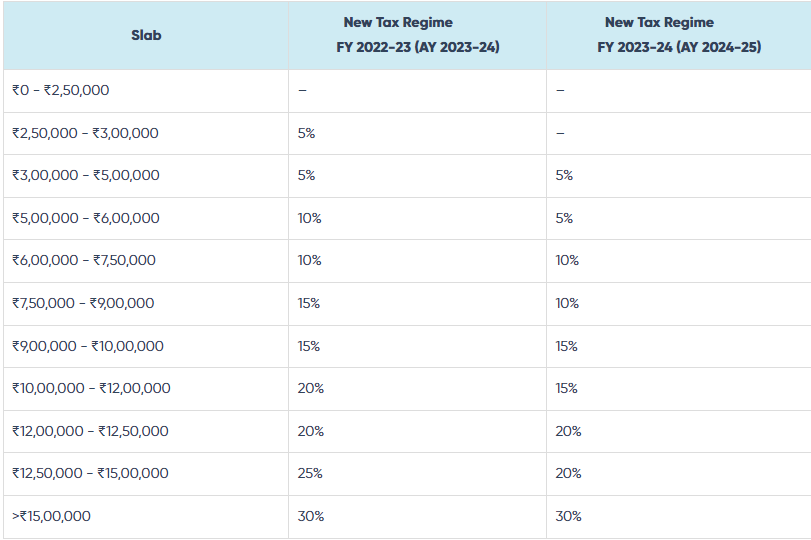

Comparison of tax rates under the New tax regime & the Old tax regime for FY 2022-23 (AY 2023-24)

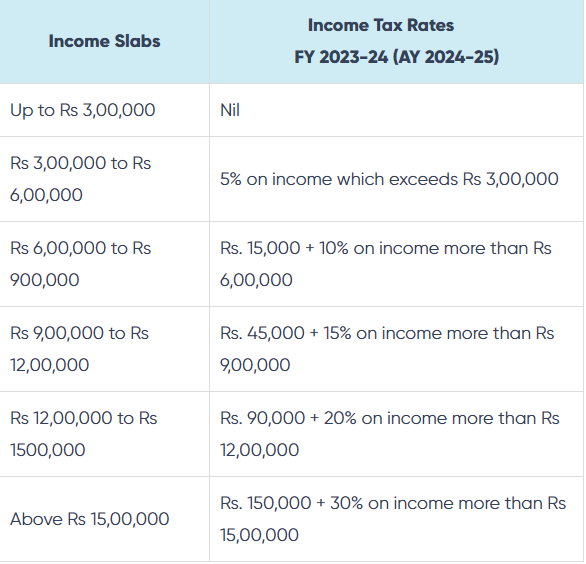

Revised Income Tax Slab Rate FY 2023-24 (AY 2024-25) – For New Regime.

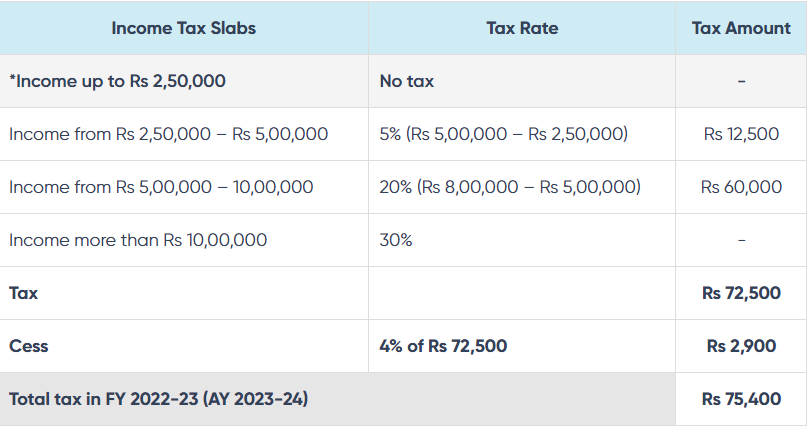

How to Calculate Income Tax from Income Tax Slabs?

Ravi has a total taxable income of Rs 8,00,000. This income has been calculated by including income from all sources such as salary, rental income, and interest income. Deductions under section 80 have also been reduced. Rohit wants to know his tax dues for FY 2022-23 (AY 2023-2024).

Please note that Ravi is an individual taxpayer assesses having an income tax exemption of Rs 2,50,000. For other taxpayer assesses, namely senior citizens and super senior citizens, the income tax limit for availing the exemption would be Rs 3,00,000 and Rs 5,00,000, respectively.

Conditions for opting new tax regime

In India, the Income Tax system operates using a slab-based structure, where distinct tax rates are assigned to varying income brackets. As an individual’s income increases, the associated tax rates also increase. This method of taxation fosters an equitable and progressive tax system within the country. Income tax slabs undergo regular revisions, typically coinciding with each annual budget. These slab rates exhibit variations across diverse taxpayer categories. Below, we examine the applicable slab rates for FY 2022-23 (AY 2023-24) and FY 2023-24 (AY 2024-25).

| Particulars | Old Tax Regime | New Tax regime (until 31st March 2023) | New Tax Regime (From 1st April 2023) |

| Income level for rebate eligibility | 05 lakhs | 05 lakhs | 07 lakhs |

| Standard Deduction | 50,000 | NA | 50,000 |

| Effective Tax-Free Salary income | 5.5 lakhs | 05 lakhs | 7.5 lakhs |

| Rebate u/s 87A | 12500 | 12500 | 25000 |

| HRA Exemption | Yes | NA | NA |

| Leave Travel Allowance (LTA) | Yes | NA | NA |

| Other allowances include food allowance of Rs 50/meal subject to 2 meals a day | Yes | NA | NA |

| Standard Deduction (Rs 50,000) | Yes | NA | Yes |

| Entertainment Allowance Deduction and Professional Tax | Yes | NA | NA |

| Perquisites for official purposes | Yes | Yes | Yes |

| Interest on Home Loan u/s 24b on slef-occupied or vacant property | Yes | NA | NA |

| Interest on Home Loan u/s 24b on let-out property | Yes | Yes | Yes |

| Deduction u/s 80C (EPF|LIC|ELSS|PPF|FD|Children’s tuition fee etc) | Yes | NA | NA |

| Employee’s (own) contribution to NPS | Yes | NA | NA |

| Employer’s contribution to NPS | Yes | Yes | Yes |

| Medical insurance premium – 80D | Yes | NA | NA |

| Disabled Individual – 80U | Yes | NA | NA |

| Interest on education loan – 80E | Yes | NA | NA |

| Interest on Electric vehicle loan – 80EEB | Yes | NA | NA |

| Donation to Political party/trust etc – 80G | Yes | NA | NA |

| Savings Bank Interest u/s 80TTA and 80TTB | Yes | NA | NA |

| Other Chapter VI-A deductions | Yes | NA | NA |

| All contributions to Agniveer Corpus Fund – 80CCH | Yes | NA | NA |

| Deduction on Family Pension Income | Yes | Yes | Yes |

| Gifts up to Rs 50,000 | Yes | Yes | Yes |

| Exemption on voluntary retirement 10(10C) | Yes | Yes | Yes |

| Exemption on gratuity u/s 10(10) | Yes | Yes | Yes |

| Exemption on Leave encashment u/s 10(10AA) | Yes | Yes | Yes |

| Daily Allowance | Yes | Yes | Yes |

| Transport Allowance for a specially-abled person | Yes | Yes | Yes |

| Conveyance Allowance | Yes | Yes | Yes |

Comparison of Income Tax Slabs under New Regime before and after budget

Only the Income tax slabs under the new regimes were revised in the recent Union Budget 2023.

Thanks,

Thanks to clear tax – https://cleartax.in/s/income-tax-slabs

[…] Income Tax Slabs for FY 2023-24 & AY 2024-25 (New & Old Regime Tax Rates) […]