Slab Rate Financial Year 2020-21

Direct tax to be paid on the income of any person is called income tax. In India, the tax levied on all persons is levied according to age, in which all are category wise divided.

- Individual (Resident or Resident but not Ordinarily Resident or non-resident), who is of the age of less than 60 years on the last day of the relevant previous year & for HUF

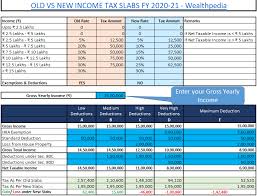

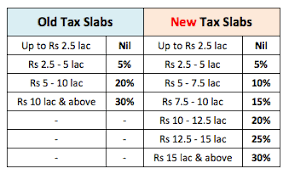

| INCOME TAX RATE SLAB | TAX RATE OLD | TAX RATE NEW |

| UP TO 250000 | NIL | NIL |

| 250000-500000 | 5% | 5% |

| 500000-750000 | 20% | 10% |

| 750000-1000000 | 20% | 15% |

| 1000000-1250000 | 30% | 20% |

| 1250000-1500000 | 30% | 25% |

| ABOVE 1500000 | 30% | 30% |

- The person who lives in India and his age is more than 60 years and less than 80 years

| INCOME TAX RATE SLAB | TAX RATE OLD | TAX RATE NEW |

| UP TO 250000 | NIL | NIL |

| 250000-300000 | NIL | 5% |

| 300000-500000 | 5% | 5% |

| 500000-750000 | 20% | 10% |

| 750000-1000000 | 20% | 15% |

| 1000000-1250000 | 30% | 20% |

| 1250000-1500000 | 30% | 25% |

| ABOVE 1500000 | 30% | 30% |

- Super Senior citizens (age 80 year and above)

| INCOME TAX RATE SLAB | TAX RATE OLD | TAX RATE NEW |

| UP TO 250000 | NIL | NIL |

| 250000-500000 | NIL | 5% |

| 500000-750000 | 20% | 10% |

| 750000-1000000 | 20% | 15% |

| 1000000-1250000 | 30% | 20% |

| 1250000-1500000 | 30% | 25% |

| ABOVE 1500000 | 30% | 30% |

Looking at all these, we can tell how much personal tax any individual person belongs to India will have to pay. And in which category they fall according to their age.