Hey everyone! I’ve got some exciting news for all you taxpayers out there. Guess what? The government has come up with a plan to make some of your outstanding income tax bills vanish into thin air, starting from February 2024. Yup, you heard it right – you might not have to pay some of those taxes you owe anymore!

Who Can Get This Tax Break?

This special deal applies to taxes under the Income Tax Act, Wealth Tax Act, and Gift Tax Act.

To qualify, your tax bill must have been hanging around unpaid as of January 31, 2024.

There are some limits on how much can be forgiven

For taxes owed before the 2010-11 fiscal year, you could get up to ₹25,000 waived.

For taxes from 2010-11 to 2014-15, it’s up to ₹10,000.

And there’s a maximum limit of ₹1 lakh per taxpayer for all the bills that can be forgiven.

Do I Need to Do Anything?

Nope, nothing at all! Sit back, relax, and let the magic happen. The tax folks will handle everything behind the scenes. You might even get a little message confirming it’s all sorted out.

Important Stuff to Remember

This only covers the main amount you owe, not any extra charges like interest or penalties.

If you owe more than ₹1 lakh in total, only ₹1 lakh will be forgiven.

You can still choose to pay the remaining amount, even if it’s eligible for forgiveness.

So, there you have it! Keep an eye out for updates from the tax office and enjoy the relief from those annoying tax bills. Remember, it’s always good to know about changes in tax rules, so spread the word and share the good news with your friends!

How do you check the waived status?

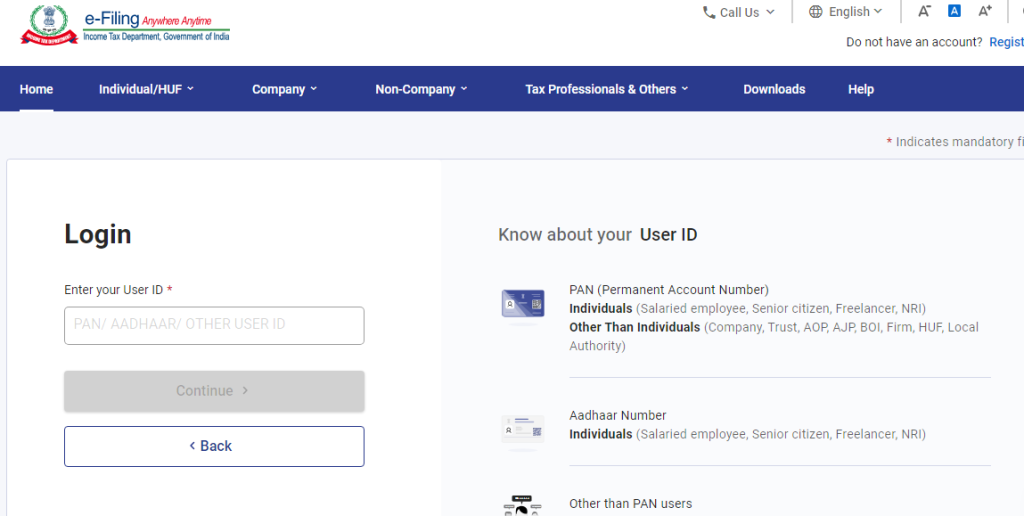

a. Login to the Income tax portal.

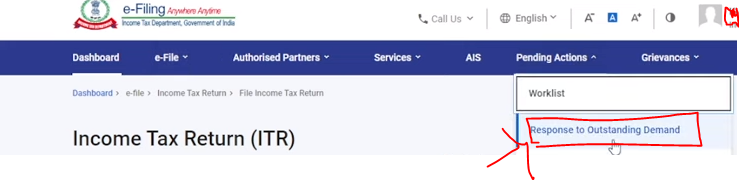

b. Go to the Pending action Button.

c. Under the pending action button click on the Response to Outstanding Demand button

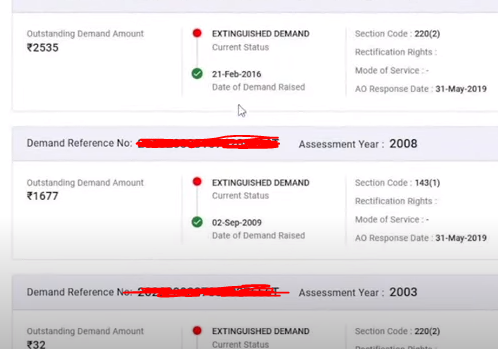

d. After clicking on it you can see the messages. And if you can see the “EXTINGUSHED DEMAND” that means your outstanding demand is waived.

Note point***

You don’t need to do anything, The department will automatically do every step and If they ask for some supporting document then you would have to attach it.

Thanks!

[…] https://www.stocksmantra.in/income-tax-outstanding-demands-waived-effective-february-2024/ […]