Hey all,

Today, I will inform you about the new GST changes, which make it mandatory to include the HSN/SAC code starting from October 1, 2023.

What is the HSN/SAC Code?

The HSN (Harmonized System of Nomenclature) and SAC (Services Accounting Code) codes are systems used in India for the categorization of goods and services under the Goods and Services Tax (GST) regime.

- HSN Code (Harmonized System of Nomenclature): This system is employed to classify goods based on their inherent characteristics and properties. Comprising a series of numbers, the HSN code is universally recognized for product classification. Its primary function is to determine the applicable GST rate for a specific item, contributing to the standardization of product classification for taxation and trade purposes.

- SAC Code (Services Accounting Code): SAC codes, on the other hand, are used to classify services for GST taxation purposes. Analogous to HSN codes for goods, SAC codes provide a structured method for the categorization of various services. They play a crucial role in identifying the GST rate applicable to particular services.

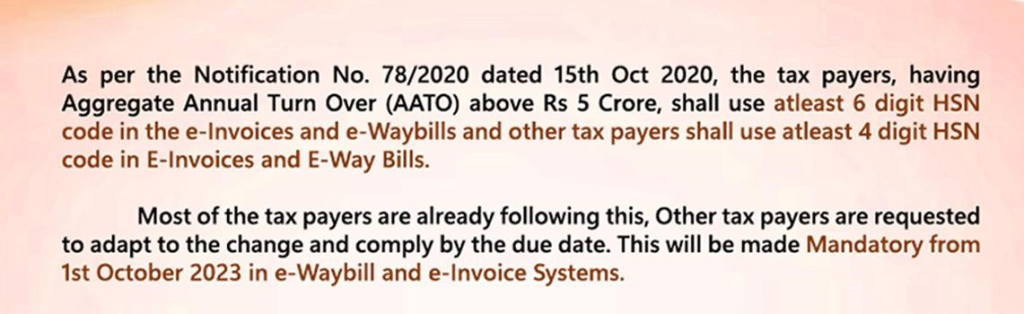

As per Notification No. 78/2020, dated October 15, 2020, the following requirements apply to taxpayers:

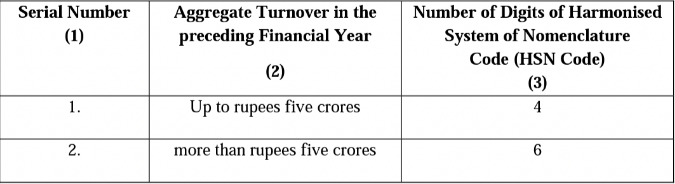

- Taxpayers with an Aggregate Annual Turnover (AATO) exceeding Rs 5 Crore are required to include a minimum of 6-digit HSN codes in their e-Invoices and e-Waybills.

- Other taxpayers should include a minimum of 4-digit HSN codes in their e-invoices and E-Way Bills.

While most taxpayers are already adhering to these guidelines, we kindly request that other taxpayers make the necessary adjustments and ensure compliance by the specified due date.

Please note that this requirement will become mandatory from October 1, 2023, for both e-Waybills and e-Invoice systems.

Taxpayers whose Aggregate Annual Turnover (AATO) was up to 5 crores in the previous financial year are not required to enter the HSN/SAC in their invoices for supplies made to unregistered persons. However, if you are supplying to a registered person, please ensure that you enter the 4-digit HSN/SAC code in your invoice.

Note point****

From 1st October 2023, the department will not give you permission to make the e-invoice without entering the HSN/SAC code.

How to search the HSN/SAC code?

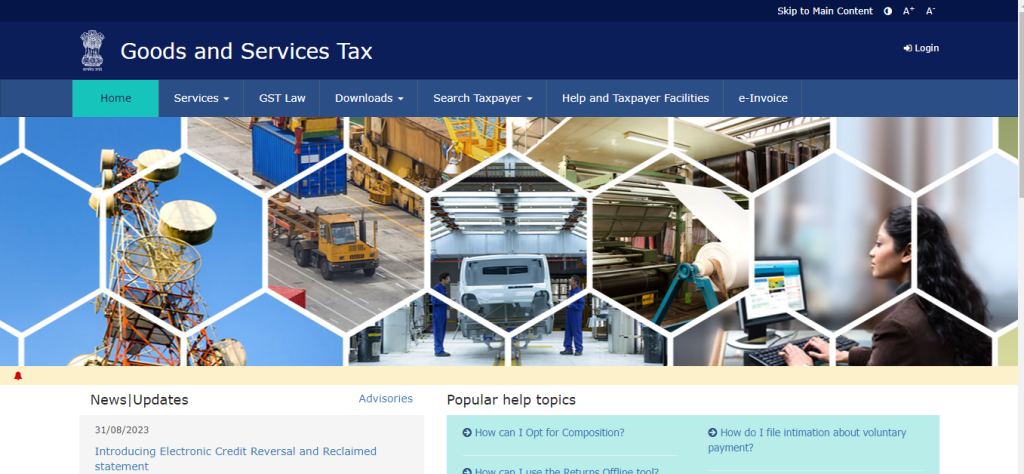

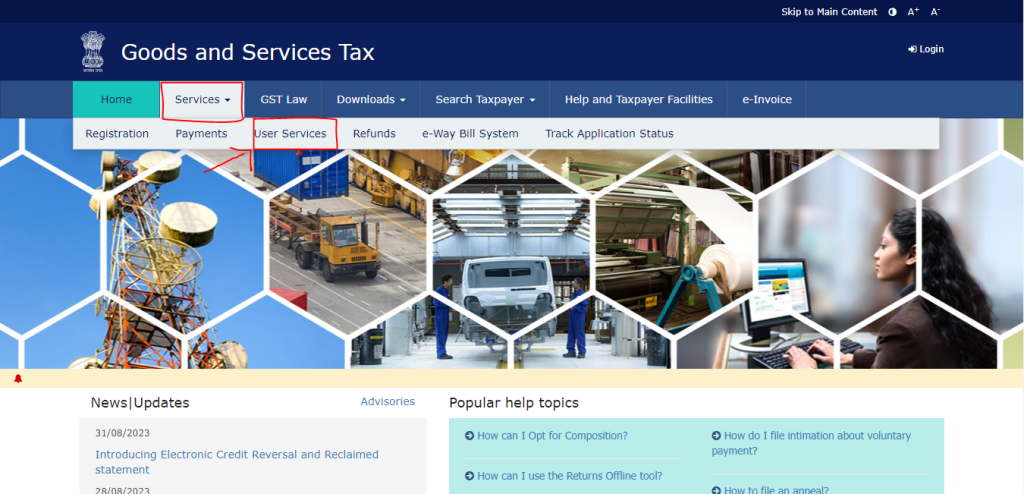

if you have no idea about the HSN/SAC code then please go to the GST portal.

Click on the ‘Services‘ button. Under this option, you can find the ‘User Services‘ option. Please click on it.

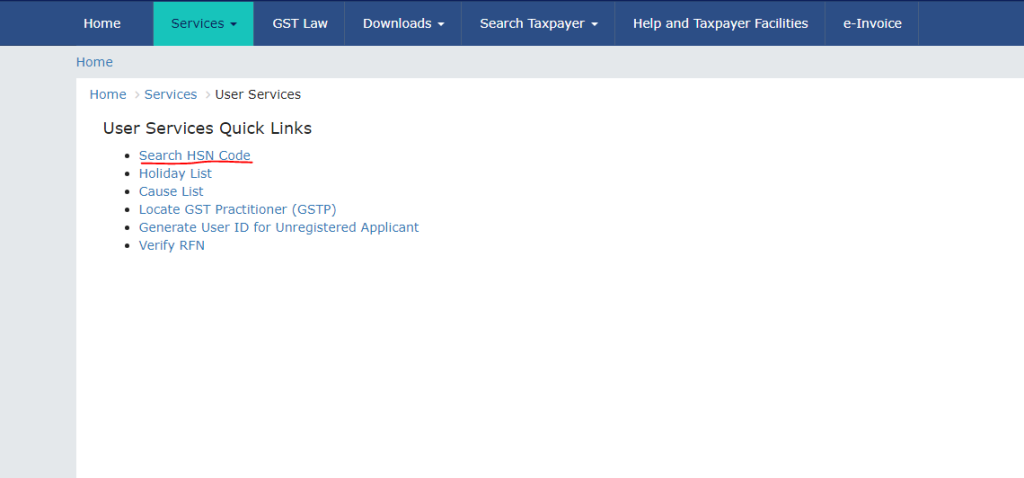

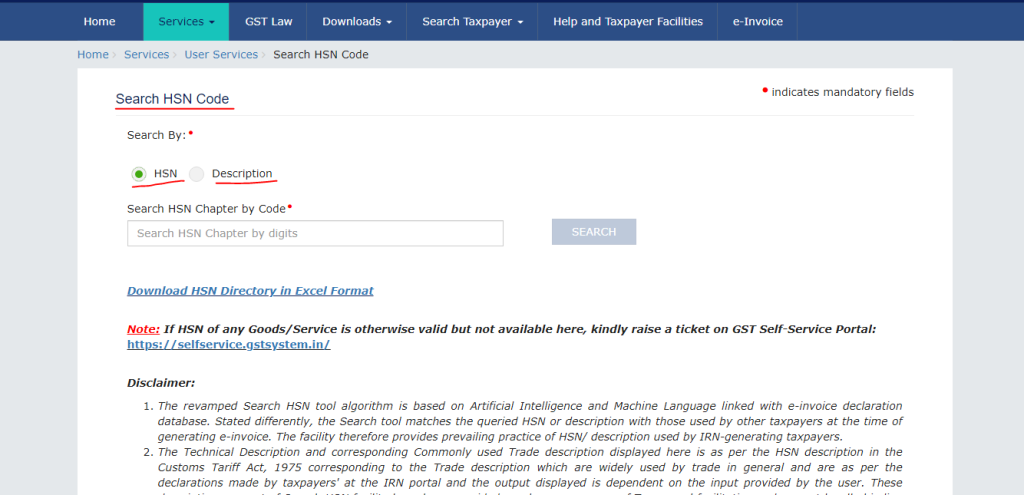

Under the ‘User Services‘ button, you will find the ‘Search HSN Code‘ option. Click on it to find your HSN/SAC code by using either the description or code criteria.

Get your result by entering the HSN code or Description in the given column.

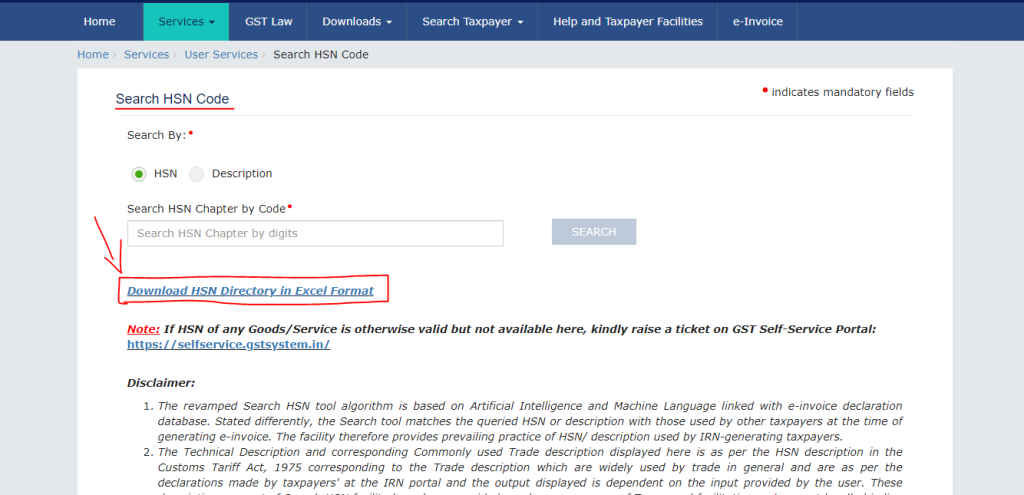

If you want to download the Excel file of the HSN/SAC code please click on the Download HSN Directory in Excel Format option.

Thanks,