What is Professional Tax?

Professional tax is a kind of tax which is levied by state government to all kinds of professions, trades, and employment who are functioning in their states. This tax amount levied monthly or yearly based on the income of such profession, trade and employment.

Professional tax determined or set by respective State Governments based on the income slab but the maximum levied can not exceed INR 2500 per year.

Applicability of Professional TAX

- Salaried employee

- Professional practitioner like CA’s, Lawyers, Doctors etc

- Employer (corporates, partnership firms, sole proprietorship etc) also being a person carrying on trade/profession is also required to pay professional tax on his trade/profession.

In India currently 15 states are collecting Professional taxes in their state

- Andhra Pradesh

- Chhattisgarh

- Karnataka

- Maharashtra

- Tamil Nadu

- Assam

- Gujrat

- Kerala

- Meghalaya

- Tripura

- Bihar

- Jharkhand

- Madhya Pradesh

- Odisha

- West Bengal

The companies or businesses owners have the responsibilities to enroll for PT (professional tax) for doing business in Karnataka state and shall pay certain annual tax before 30th April of every year.

PENALTIES FOR LATE PAYMENT OF PROFESSIONAL TAX

In case of late payment of Professional Tax in Karnataka

= Interest @1.25% pm would be levied.

= Maximum penalty of 50% of the total amount due.

How to file or submit professional tax?

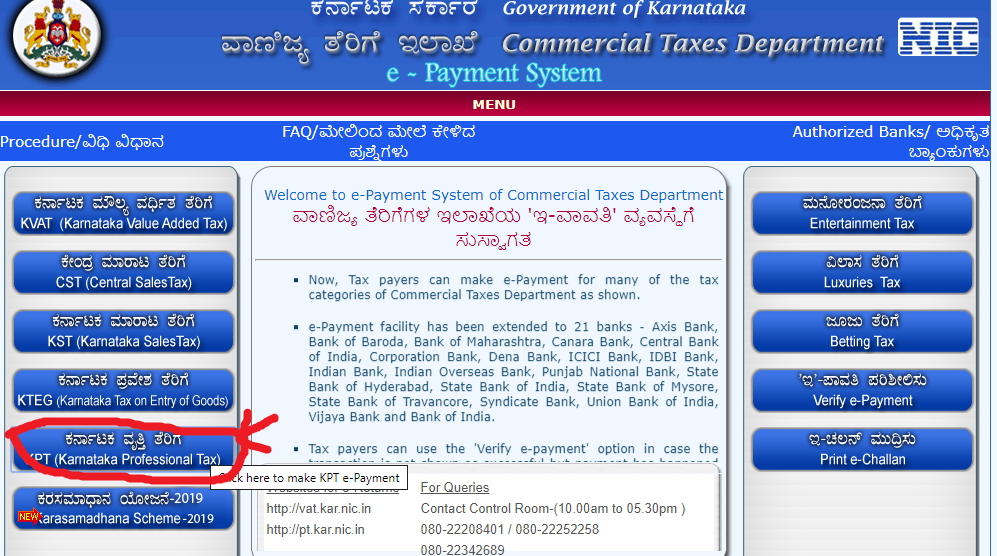

As this tax is levied by state government that’s why there is no uniform website or pattern to submit it. Every state collect this tax by different-different mode either online through their dedicated websites online or through offline by visiting their office.In the state of Karnataka you can pay your Professional tax either by visiting the office or through through their websites mentioned below:

https://vat.kar.nic.in/epay/

Step 1

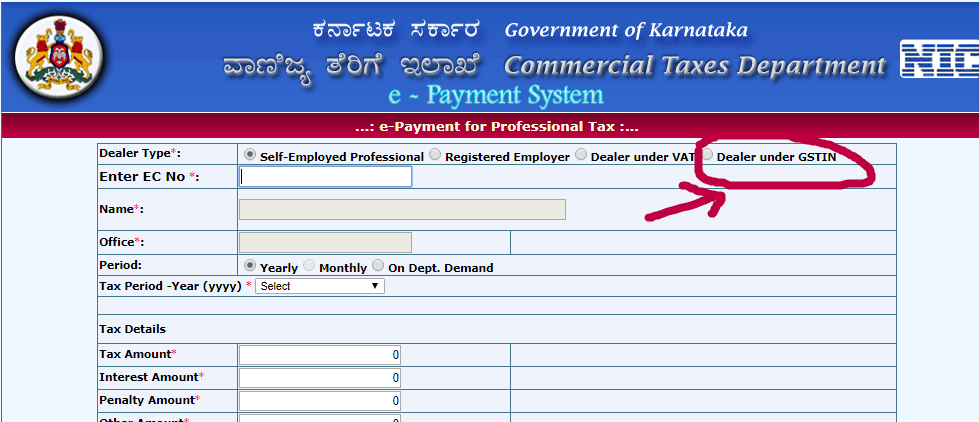

Step 2

After that fill up all the boxes with details and make the payment at the end.

http://pt.kar.nic.in/(S(fsogcmwsllxer3r11rb54pdj))/Main.aspx

For Queries you can contact to these official numbers:

Timings:- 10.00am to 05.30pm

Phone numbers:- 080-22208401 | 080-22252258 | 080-22342689