Hi Guy’s

This is Ravi Verma, In this article I will tell you about e-invoicing portle.

Let’s start,

What is e-Invoice?

When a registration person’s turnover in a financial year exceeds twenty crores or more, then the rule of e-invoicing becomes applicable to that person and he is required to register on the portal of e-Invoicing.

If a person does not do so, his invoice becomes invalid and his supplier cannot get input credit.

How to register on e-invoice portal.

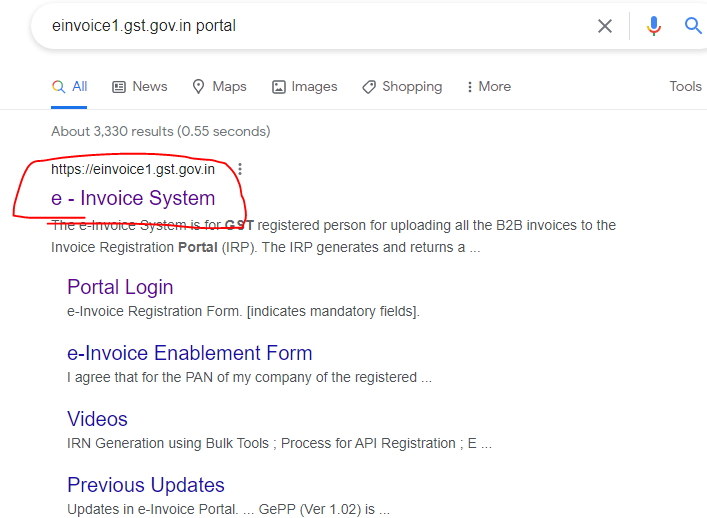

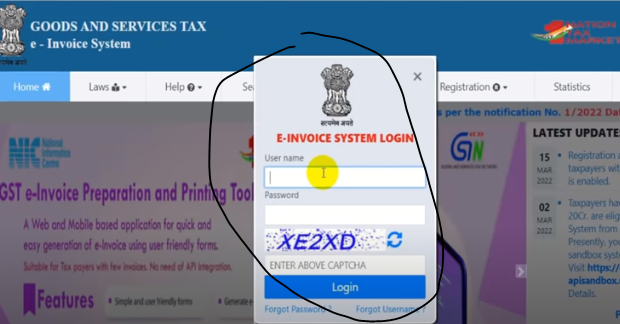

- Open your Browser and click the einvoice1.gst.gov.in portal.

2. Click on the einvoicing system.

3. After that click on the registration option, under this you will see the option of portal login.

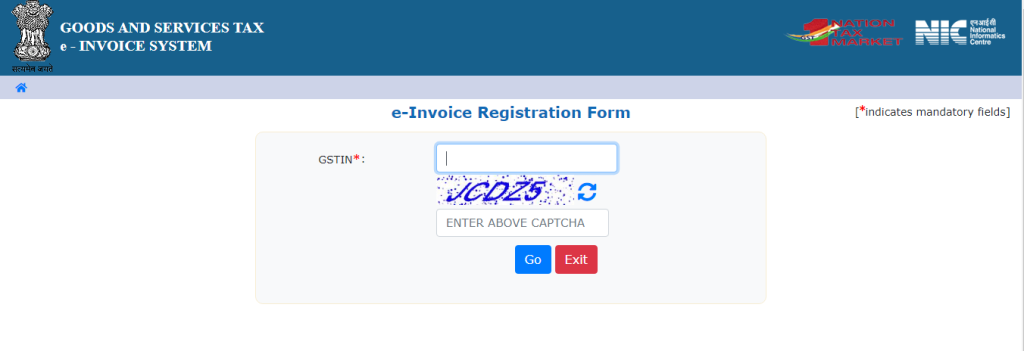

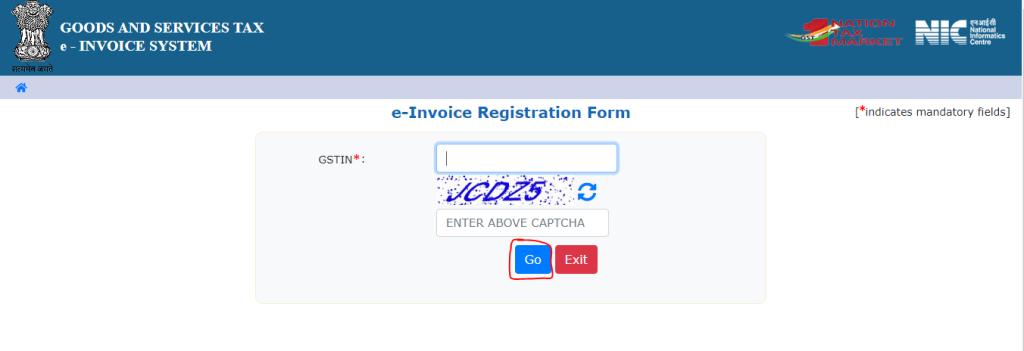

4. After clicking on the portal login option you will see the registration dashboard.

5. Enter the GSTIN number of your firm as well as fill the captcha code and click on Go option.

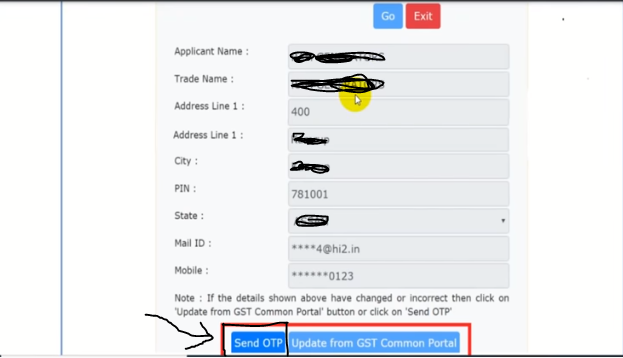

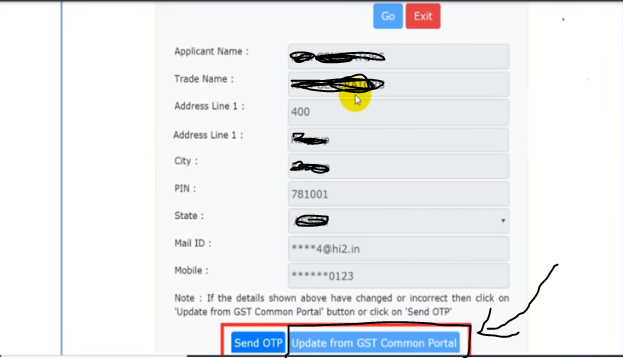

6. Your data gets autofetched from your GST portal as soon as you click on the Go button and click on the send OTP button

7. And your autofetch data is nt correct then please you click on the update from GST common portal and fill your correct data properlly.

8. Enter your OTP and click verify OTP button.

9. In the last step you have to create the User ID and Password, after doing all this you have successfully registered the e-invoice portal.

- IMPORTANT POINTS:- If you have already registered under e-way bill portal then you directly enter same credentials in your e-invoicing portal, you do not need to do registration process on e-invoice portal, you can directly enter your e-way bill crediential on e-invoicing poral by clicking on the login button.