Hi guy’s

This is Ravi Varma, in this article I will tell you about PMT-06 Challan.

Let’s start,

- For any company whose annual turnover is less than 5 crores, the government has put together a good option for all of them, which we call QRMP scheme, according to which we have to pay our tax in monthly mode with the help of PMT-06 challan, and in this scheme, our GSTR-3B is filed in quarterly mode.

- The full form of the QRMP scheme is Quarterly Return Monthly Payment.

- Here are the steps to pay our taxes

Step 1:- Login to the GST portal with the help of your Id & password.

Step 2:- After logging in, click on the services option.

Step 3:- After that please click on the payment option.

Step 4:- After clicking on the payment option you are entered in the challan page.

Step 5:- Please click Create Challan option.

*****And if you have already created and saved the Challan, click on the save Challan option.

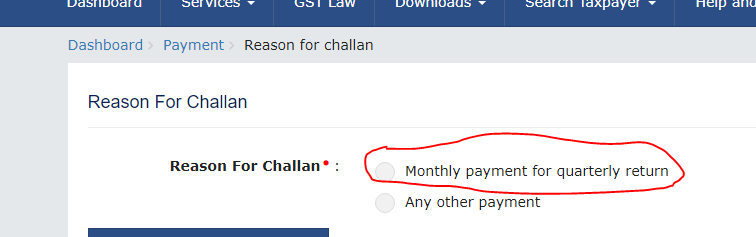

Step 6:- Click on the monthly payment for quarterly return.

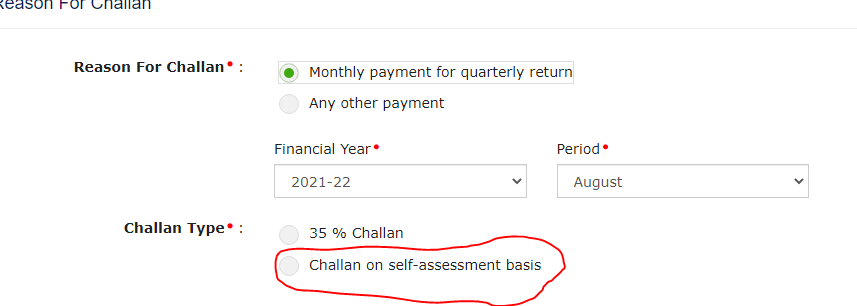

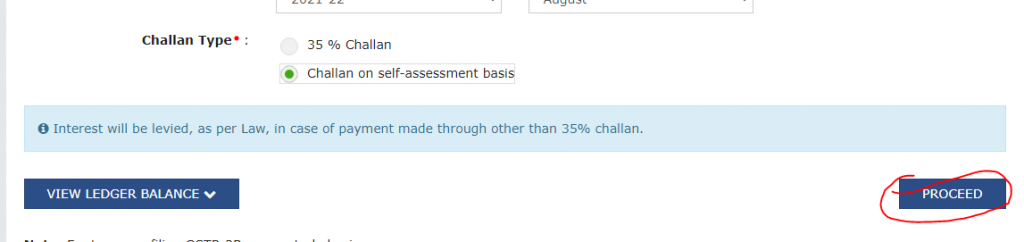

Step 7:- After doing this choose your financial year and period, select your challan types

Step 8:- Click to the proceed option

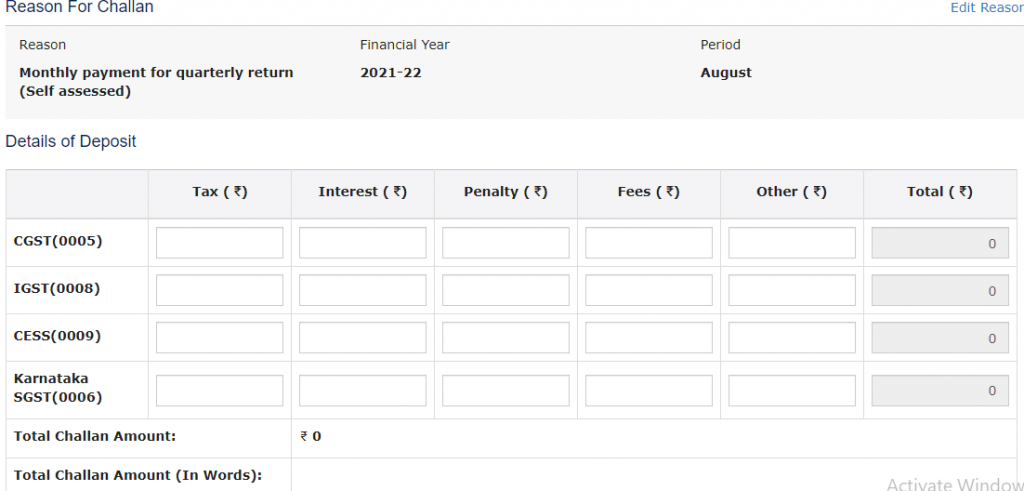

Step 9:- Enter your taxable amount as per the given head of GST in the given column

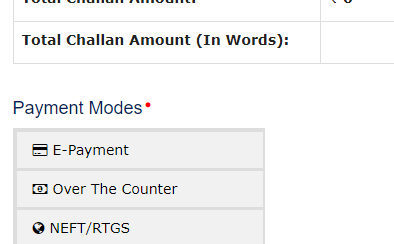

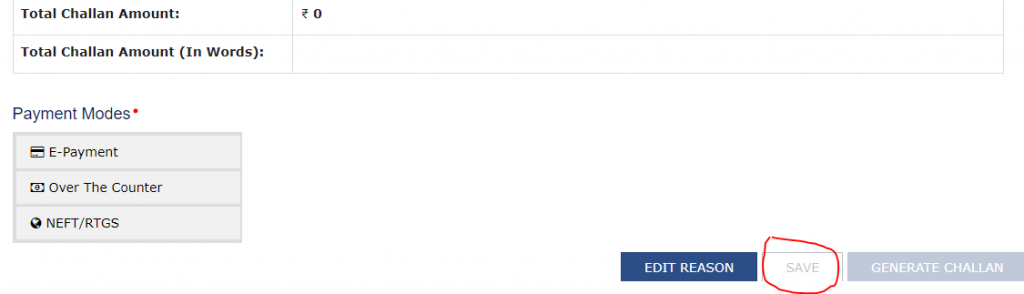

Step 10:- Select your payment mode

Step 11:- After selecting your payment options click on the Save button which is given at the bottom right side

Step 12:- Then Click on Generate Challan Option

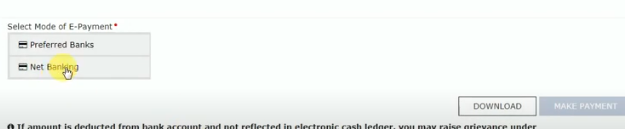

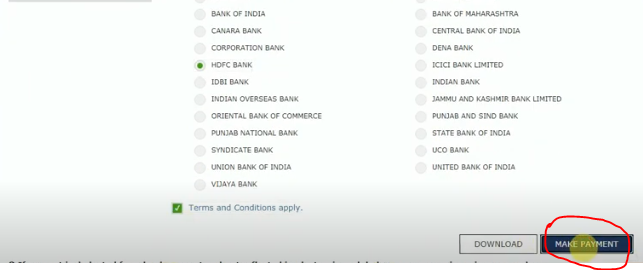

Step 13:- After clicking on it, you will go to your payment banking option and you will have to make payment by selecting the mode in which you want to make the payment.

Step 14:- So after selecting your bank option please click on make payment

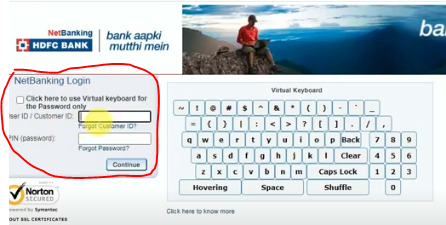

Step 15:- Enter your Bank’s Gateway Login ID and Password and click on the Continue option

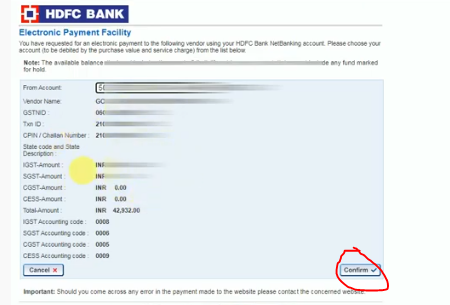

Step 16:- And the last process is to click on the confirm option

Thanks,