This Ravi Verma

In this article, I will tell you how we can know who is the default supplier in GST

Who is the defaulter in GST?

- A supplier who has not paid the GST amount to the government and has not filed his GSTR-3B, such supplier is a defaulter under the GST Act.

Please follow these steps so that you can easily know who is your default supplier.

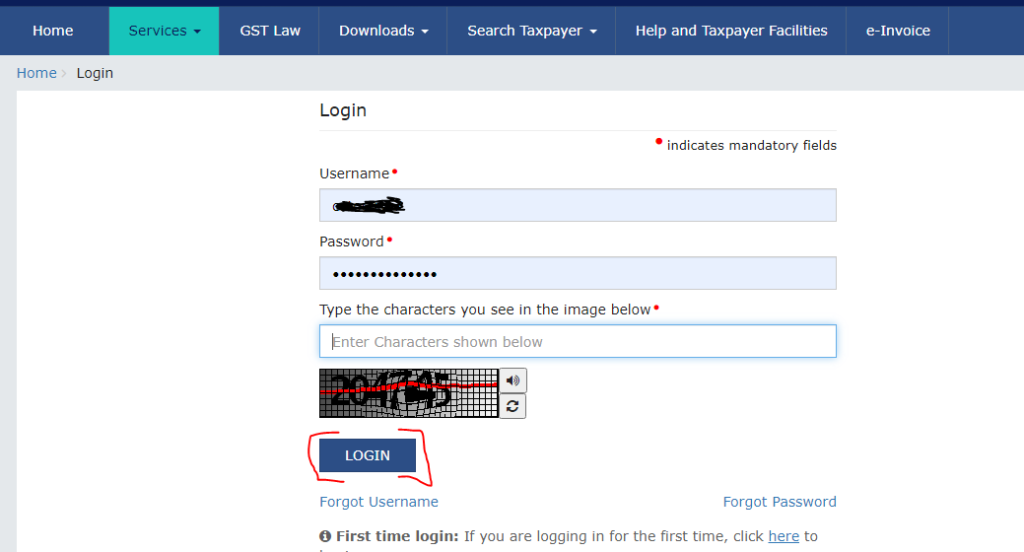

Step 1. Please visit the Government GST Portal. ( https://www.gst.gov.in )

Step 2. First of all kindly login into your GST portal with your login ID and password and also fill out the Captcha code.

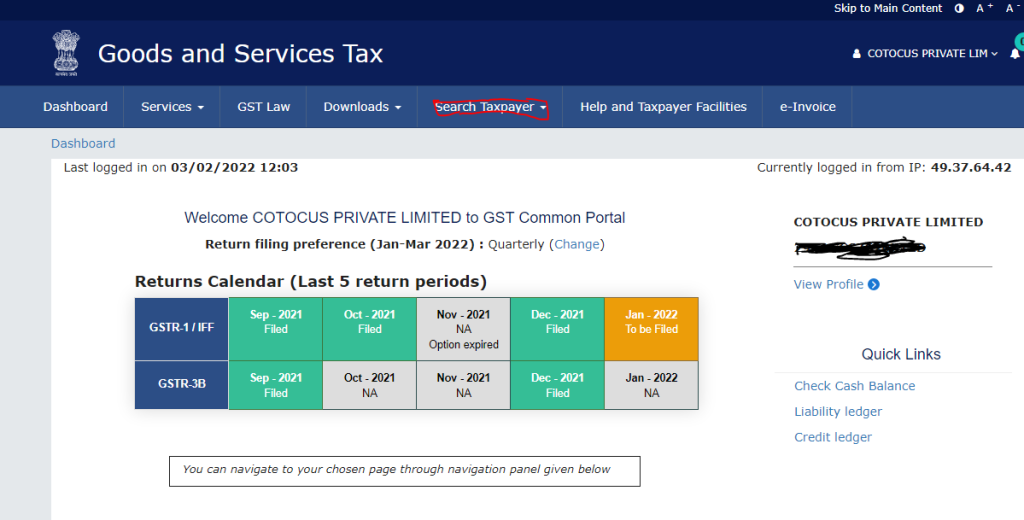

Step3. Click on the search Taxpayer button.

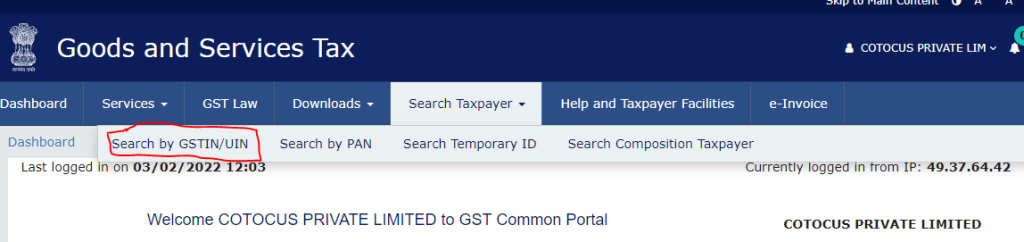

Step 4. As soon as you click on the Search Taxpayer button, under this you will have to see the option of Search by GSTIN / UIN Please click on it.

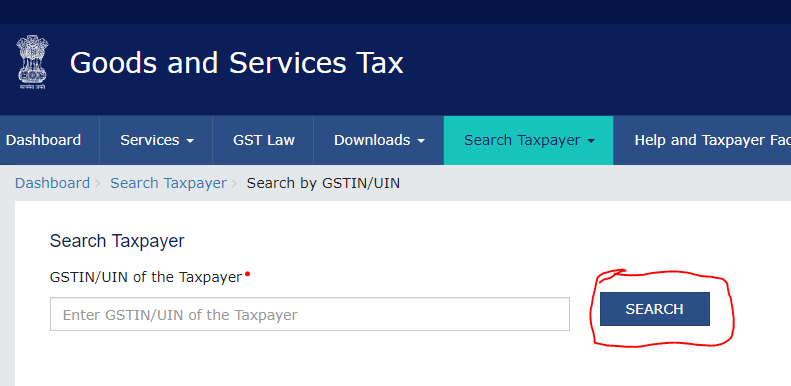

Step 5. After clicking on it, enter the GSTIN number of your supplier and click on the search button.

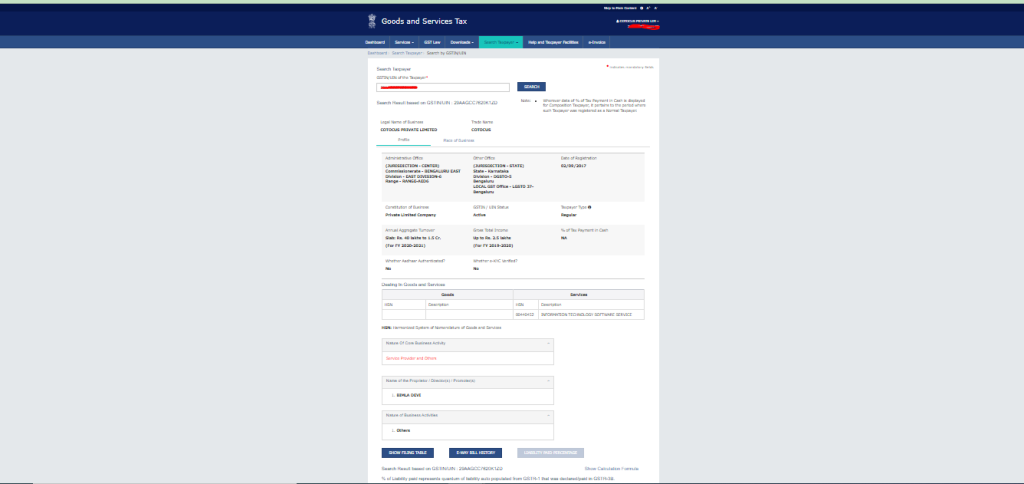

Step 6. Do this work Now you will have your supplier’s business profile in front of you.

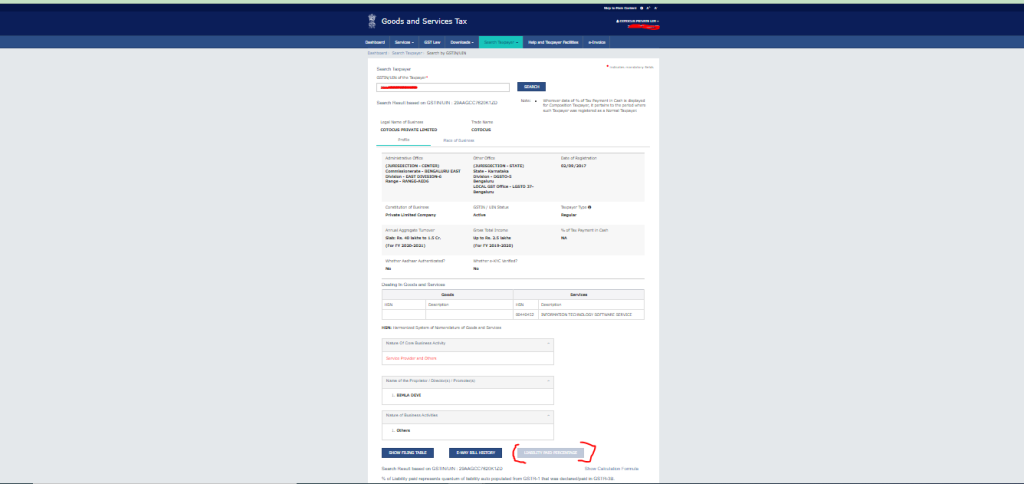

Step 7. Please scroll down and click on Liability Payment Percentage After doing this you can see the activities of your supplier in your GST Portal and also you will see the percentage of tax paid by your supplier.

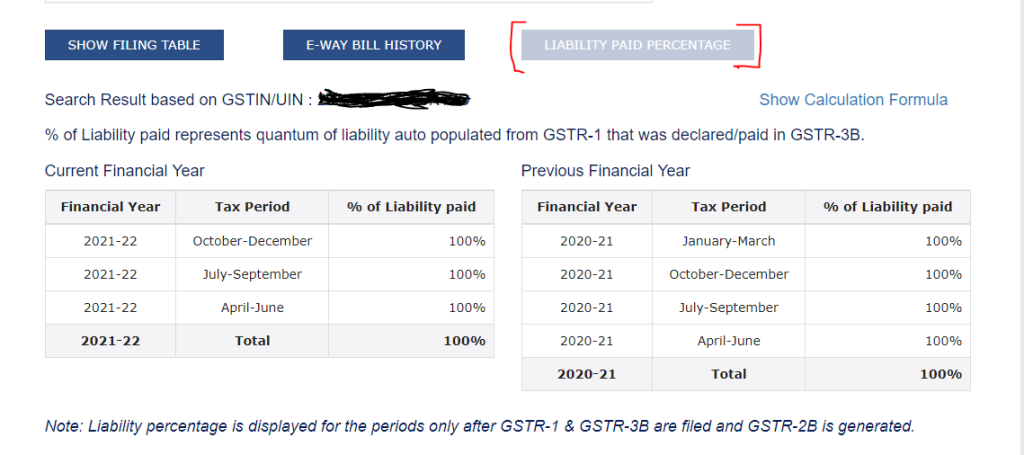

Step 7. Now the tax payment details of your supplier will also appear in front of you that what percentage of tax he has paid.

Note*** Liability percentage is displayed for the periods only after GSTR-1 & GSTR-3B are filed and GSTR-2B is generated.

This type of supplier is good if your supplier’s tax payment percentage is filled 100% of the tax paid, but if your supplier’s tax payment percentage is not filled 100%, then this type of supplier is called default supplier.

Thanks