Hi guy’s

This is Ravi Varma, in this article I will tell you about how to download form 16A on the traces portal.

Let’s start,

When we deduct the TDS of a person who is not related to salary, then in this case we have to issue him Form 16A, in which all the details of TDS deducted from him are written in Form 16A.

And that person should also be a resident of India.

Follow these steps properly

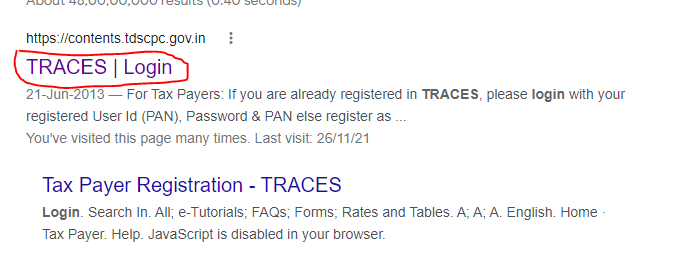

Step 1:- Go to the traces portal. tdscpc.gov.in

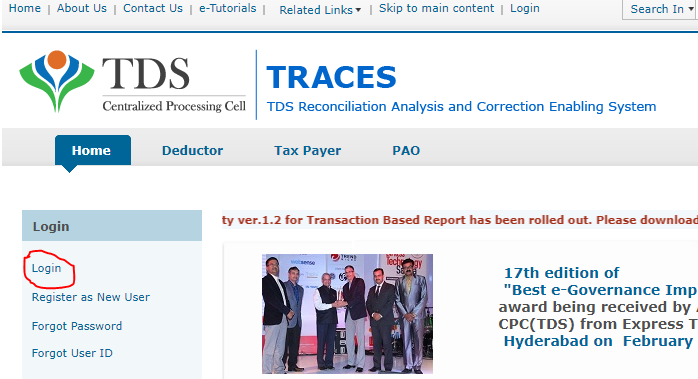

Step 2:- Click to the login option

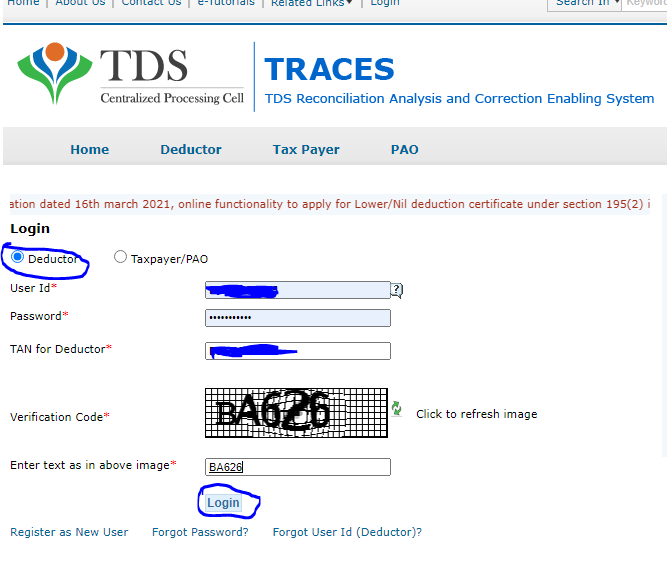

Step 3:- You have to enter your login id & password, the TAN number of the deductor, and also enter the verification code after completing these steps click on the login button.

** And you have to select the deductor option only because you are the deductor.

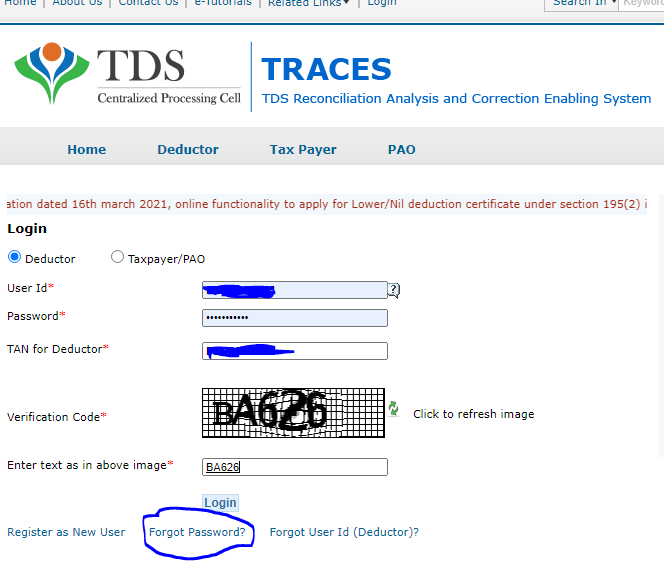

****If you have lost your password then click on the forgot password option. in this option you have a chance to set a new password in your traces portal, here you have to enter 2 OTPs 1st OTP is received to your email address and the second is received to your registered phone number.

***If you have lost your user-id then follow the same procedure to create a new user.

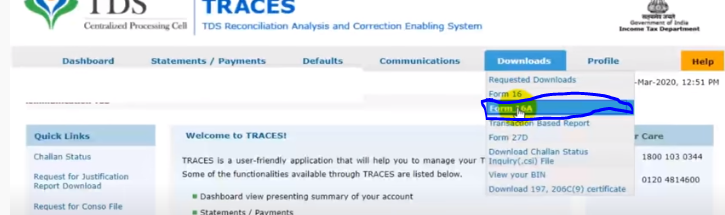

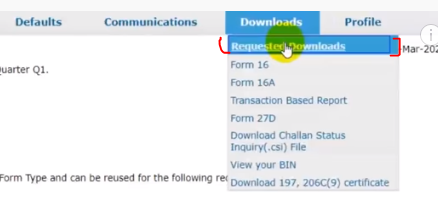

Step4:- Click the download button

Step5:- Under the download option, you will see the Form 16A popup, then click on the form 16A option.

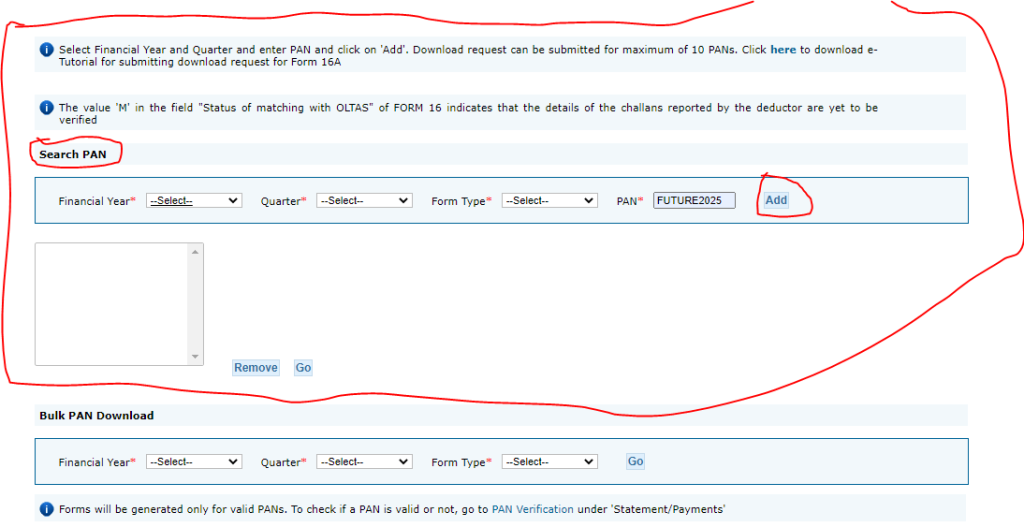

Step6:- You will see the form 16A page, under this page you have to enter your financial year and other detail after doing this process you will see the new enter face.

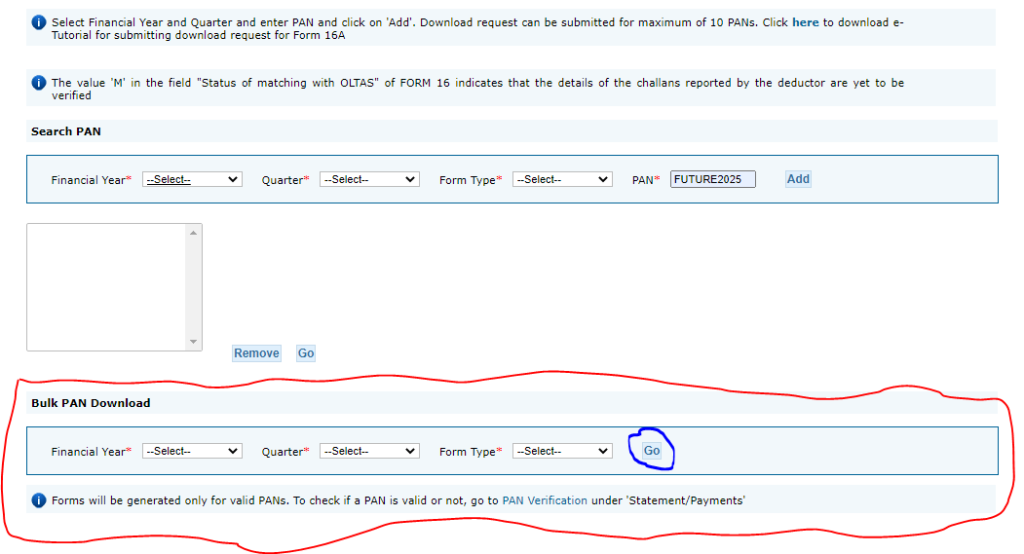

Here are the 2 options is available to download your form 16A

Case01:- If you will download only 5 or 6 forms then choose the first option (Search PAN) in this option you can download only 5 to 6 forms.

Case02:- If you will download more than 10 forms then choose the second option (bulk PAN) in this option you can download more than 10 forms.

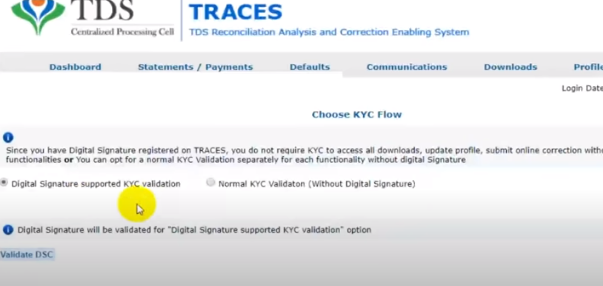

Step07:- the next step is to select only one option.

(a) DSC

(B) Normal KYC

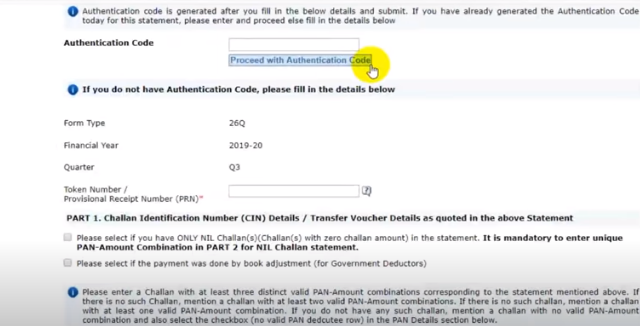

we are going to the normal KYC option

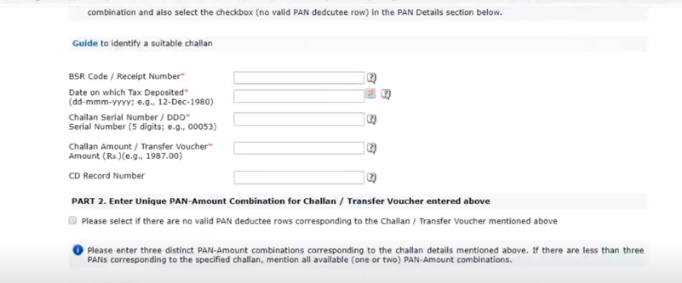

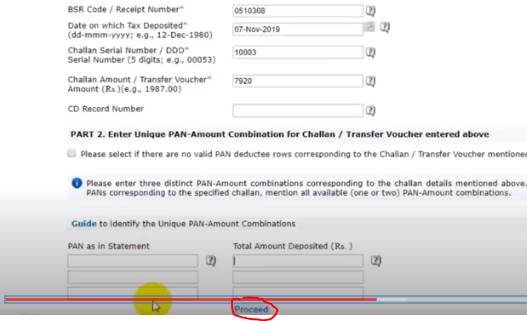

Step8:- In this step, you have to enter your deductee PAN number and its tax deducted AMT.

**Note Enter the details of the same challan in which you have paid the challan for at least more than 3 deductee

*** Token number is your RRR number

After filling all these columns please click on the proceed option.

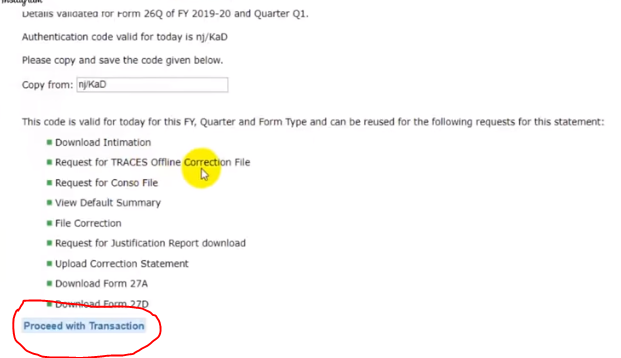

Step09:- As soon as you click on the Proceed option, you will see a new popup in which you will be told about filling many forms, and also you will be provided with a code the help which you can use anytime in the future.

Then click to proceed with the transaction

Step10:- Go to the download section and click on the requested downloads

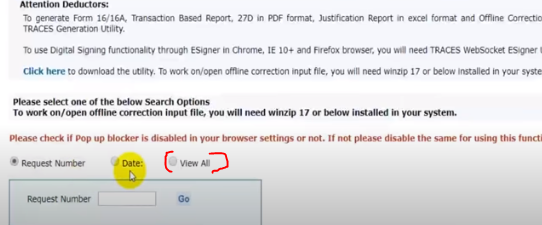

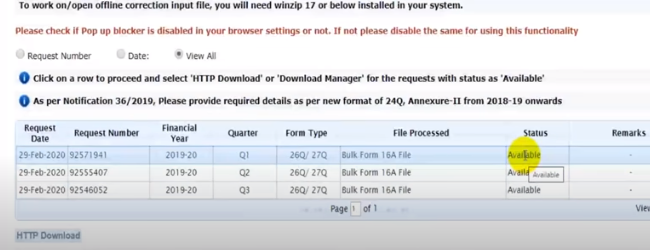

Step11:- after clicking the requested downloads option please click on the view all option

Step12:- If your status is showing in Available then after that see below you will see the HTTP Download button and click on it.

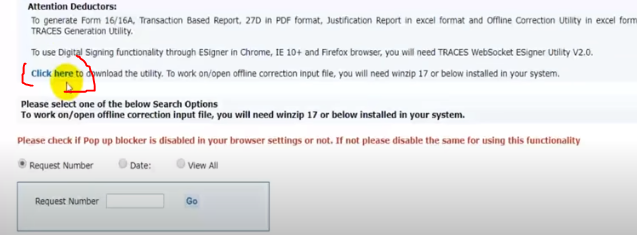

Step13:- The next step is to go back to the download option and click on the requested downloads option and under this, you click on the DOWNLOAD THE UTILITY option.

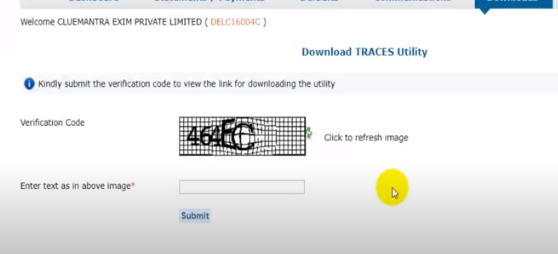

Step14:- After clicking this you are entering the new page under this please enter the verification code.

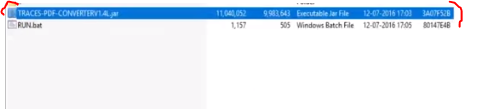

Step15:- Now you will get a zip file in this option to download Form 16A, by clicking on it you have to download this utility

***The use of this utility will be needed to extract the PDF from Form 16A when we download it.

Step16:- As soon as you download this utility, then you have to extract it and then click on Traces PDF converter.

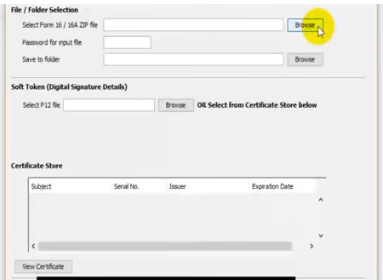

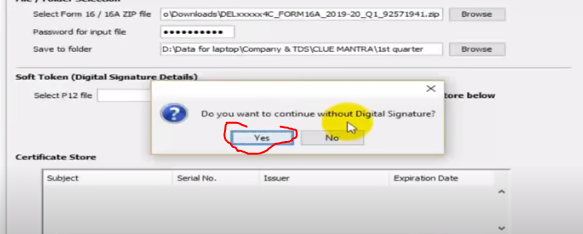

Step17:- When you will open this file, you will now have to browse the zip file containing Form 16A in it, after that, you will have to enter the password, keep in mind that your TAN number is your password, then in the last place where you have to save this file. That location has to be set and in the last click on the Proceed button.

Step18:- If you are processing without a digital signature then you will see a popup then you have to click on the yes button

****The most important thing to note is that you need to have Java installed in your system to generate Form 16A

Thanks,