- IFF (Invoice Furnishing facility):- Under this method, we submit all our (B2B) invoices by the 13th of every month. This is optional for each taxpayer. Because when a taxpayer finishes his invoices with the help of (IFF), it is easy for his supplier to get an income tax credit.

- IFF Furnished Offline utility Step By Step?

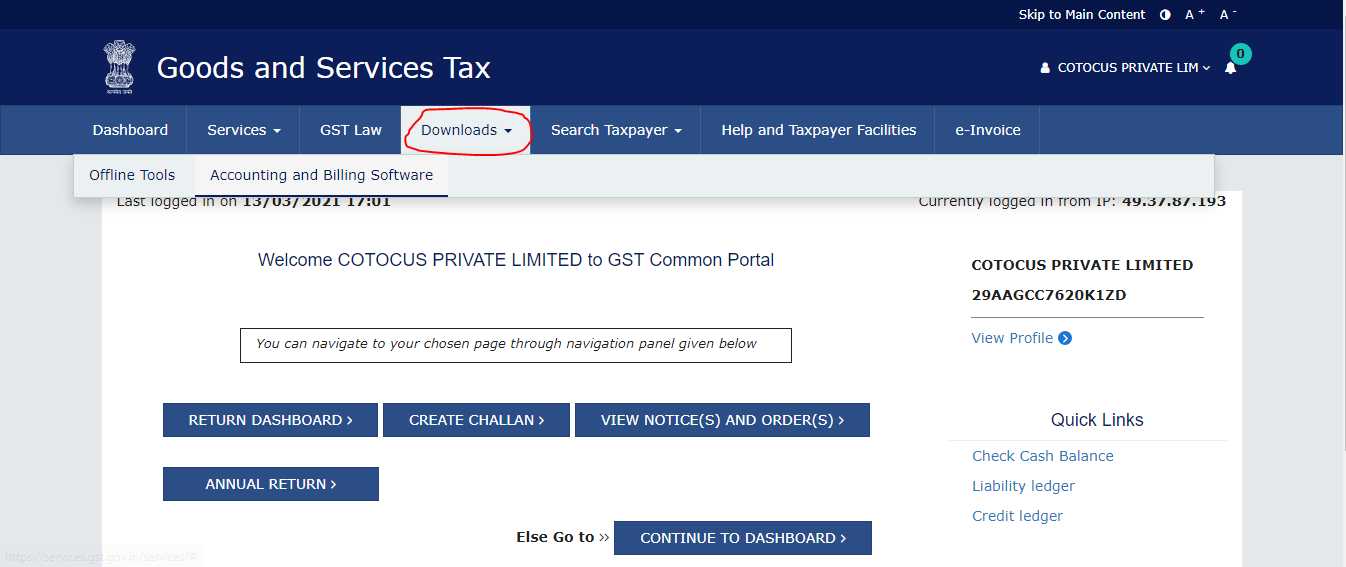

Step1:- open our GST portal >>>> And click download Option

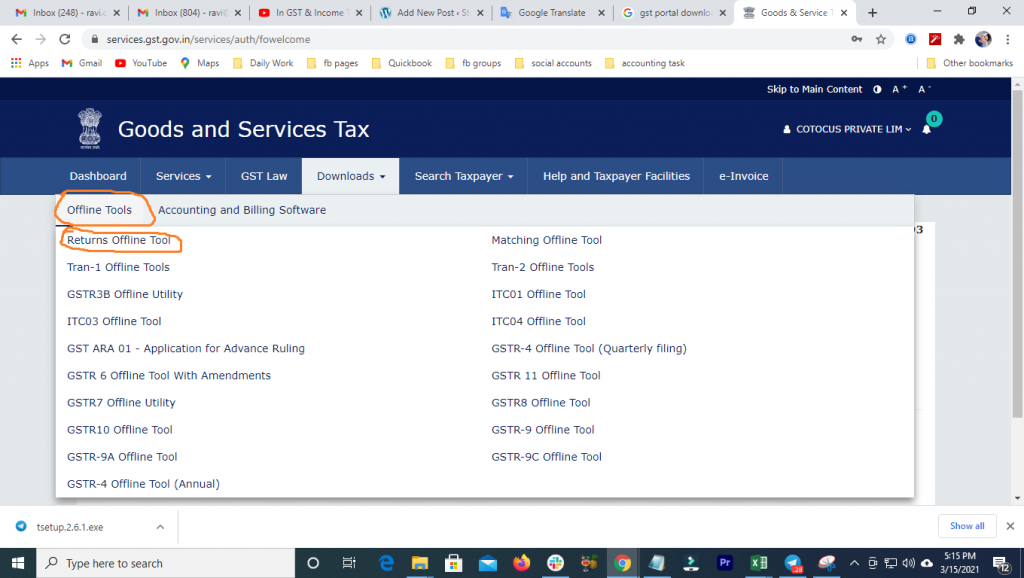

Step2 Click Offline Tools >>>> under this Choose returns offline Tools

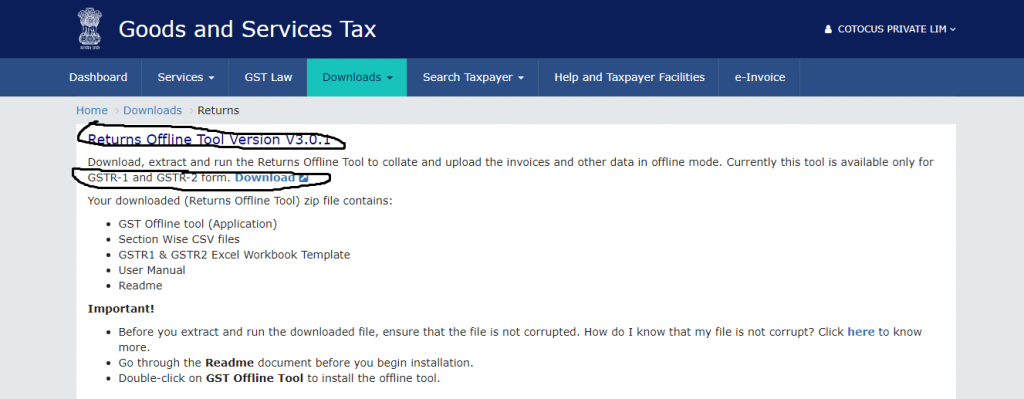

Step3:- you have to click the download option (return offline tool version v3.0.1)

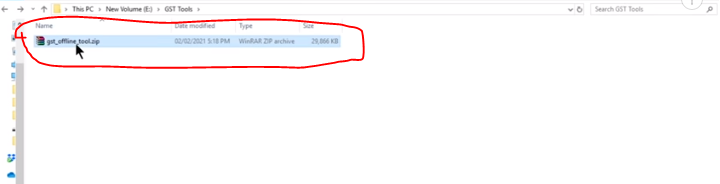

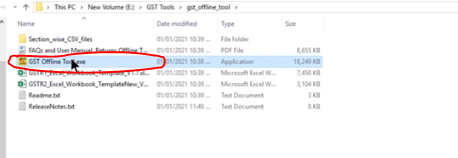

Step 4:- Extract to this file (Extract here)

Step 5 :- After extract you have a new file open it

Step 6:- Click and install this offline tools

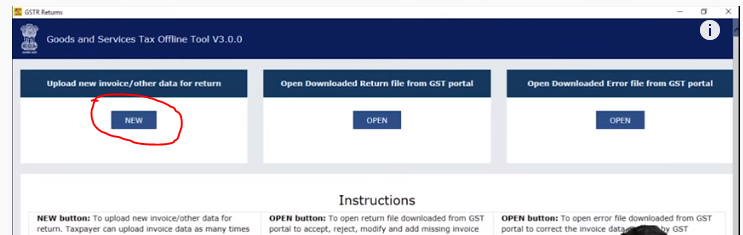

Step 7:- an open this tool click on the new button

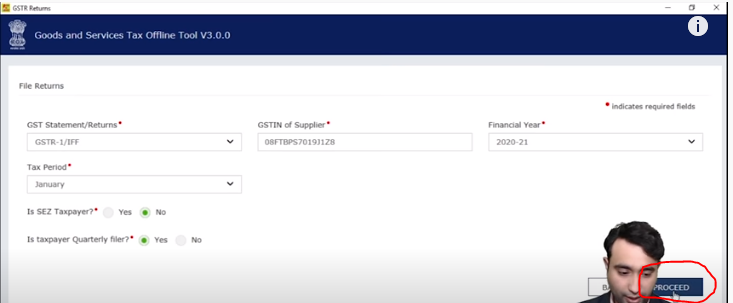

Step 8:- After that, We will fill all the columns given in this form and click proceed button.

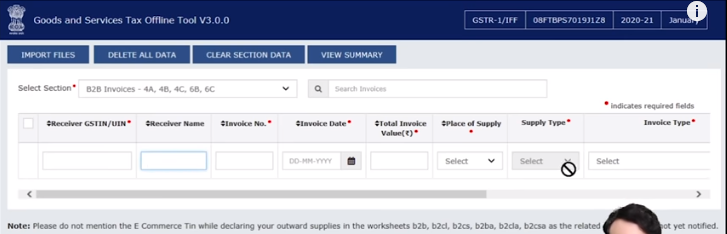

Step 8:- Fill in our invoice Details.

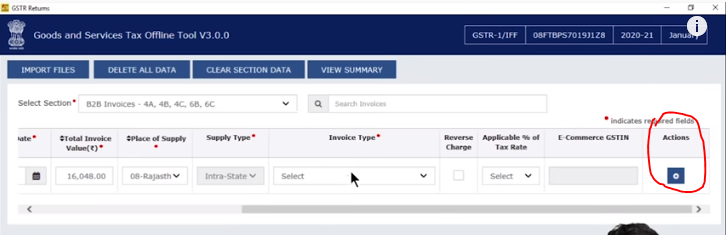

Step 9:- When we fill in the challan details, after that we have to click on the action button to enter the tax amount paid.

Step 10:- Enter our total taxable amount. (Enter the amount of GST goods)

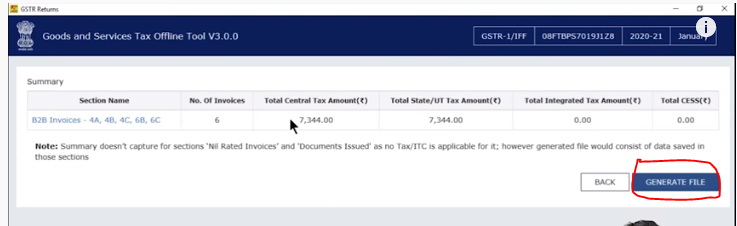

Step 11:- We enter all the B2B invoices then we click on the Generate File option. and This file name is JSON File

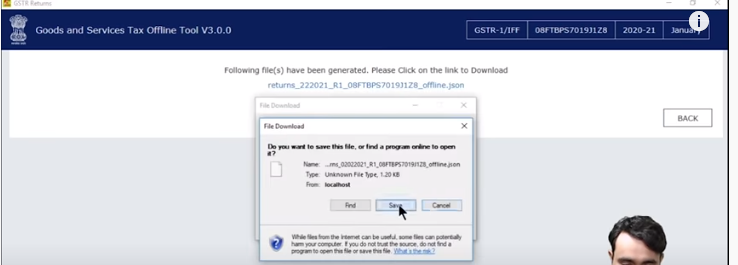

Step 12:- After This, my JSON file Is Downloaded and We browse it.

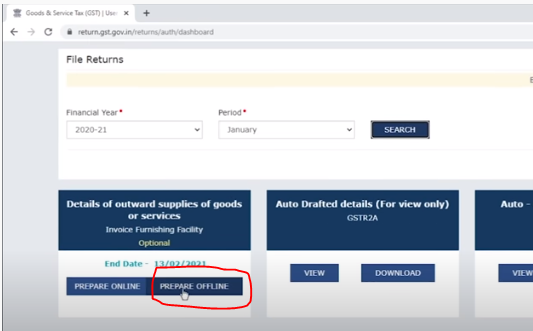

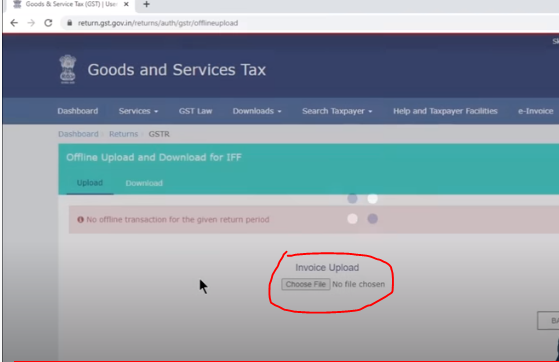

Step 12:- Log in to GST portal And Click IFF prepare offline.

Step 13:- Click on choose file option and upload our JSON file in the GST portal.

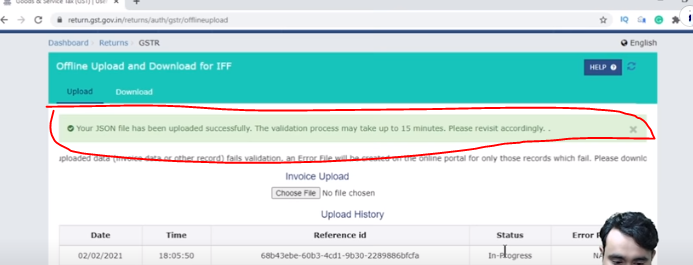

And The last is After that, when we upload our JSON file, we have to wait for 15 minutes for the GST file to be uploaded successfully, after that we will refresh our portal and check if my file has been successfully uploaded.

NOTE*********If we want to remove a bill, we can remove that bill by clicking on the delete option. The removal option is given below. We can remove the file before uploading the JSON format. Cannot be deleted after uploading