Steps to File the GSTR-3B QRMP Scheme Return

Step 1:- Log in to Your GST portal.

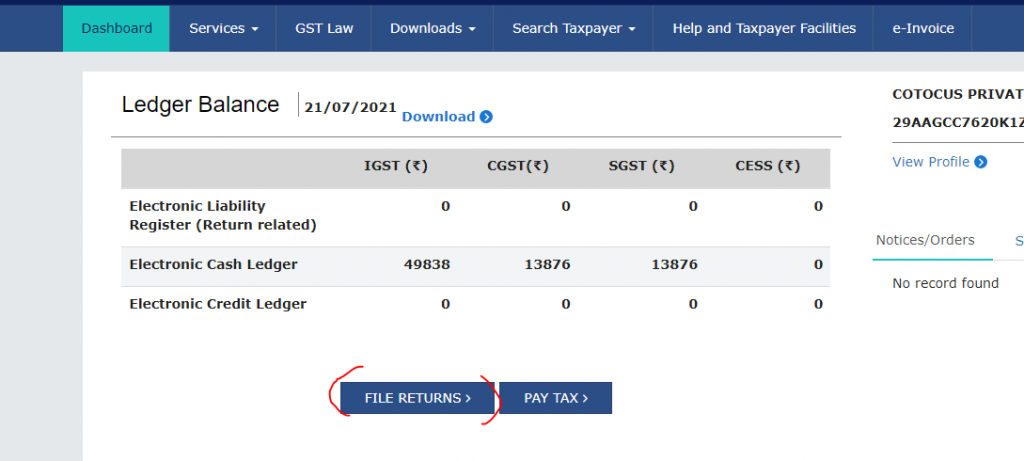

Step 2:- Click on the Dashboard with your login GSTR-3B portal.

Step 3:- Click on the file return option.

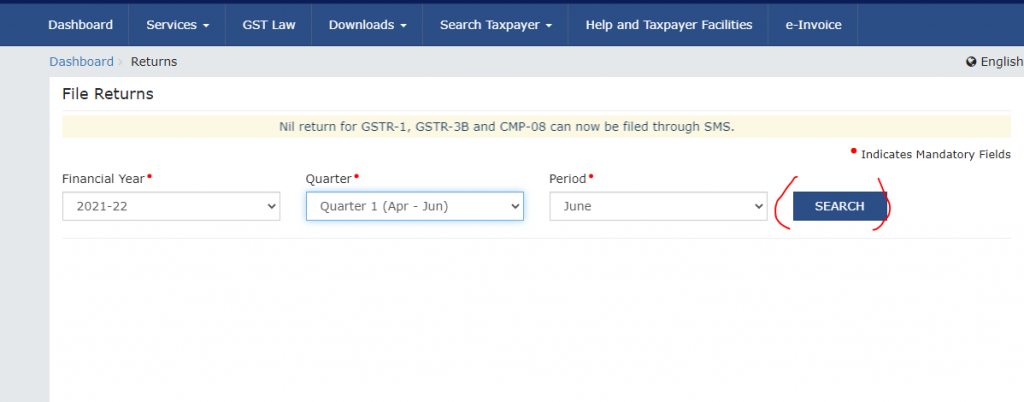

Step 4:- Select your Financial year, quarter, and the period after doing this click on the search button.

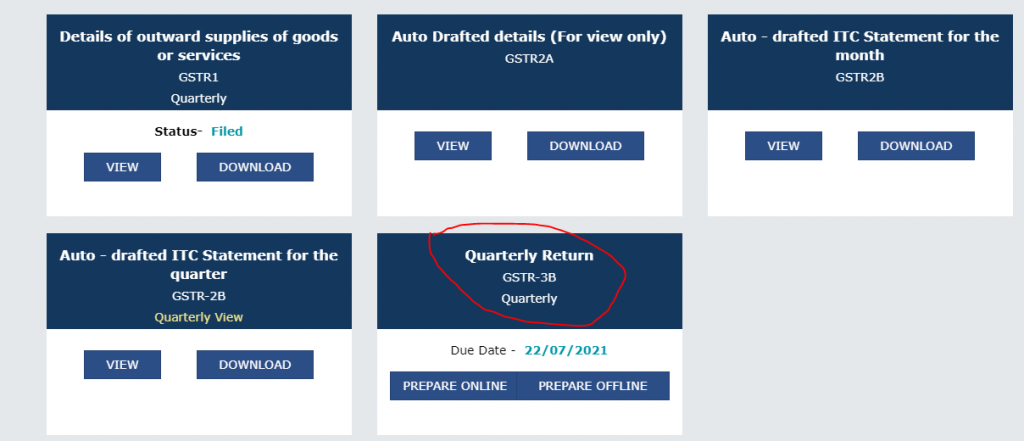

Step 5:- Click GSTR-3B Quarterly return monthly payment option

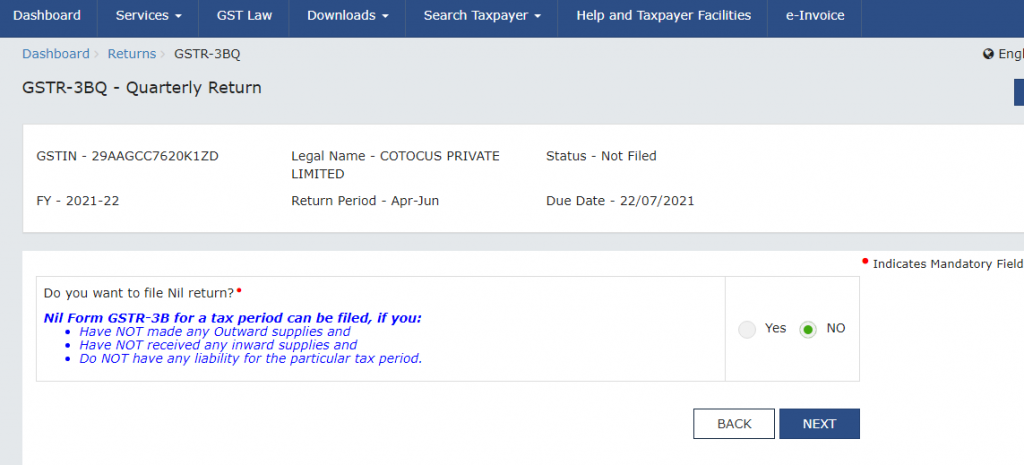

Step 6:- You have to receive a popup, which means if you are filling your NIL return click on yes and you have not filed a NIL return select the no option and click next.

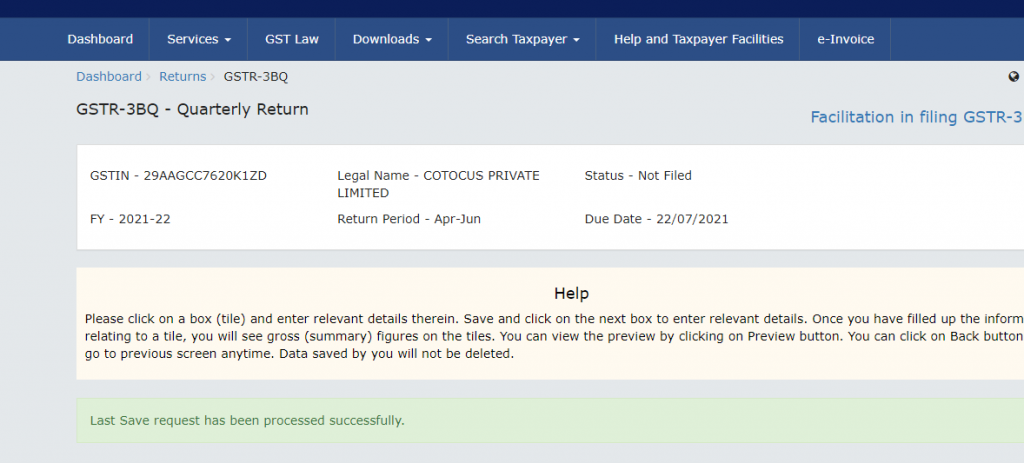

Step 7:- you are entering your GSTR-3B quarterly return dashboard,

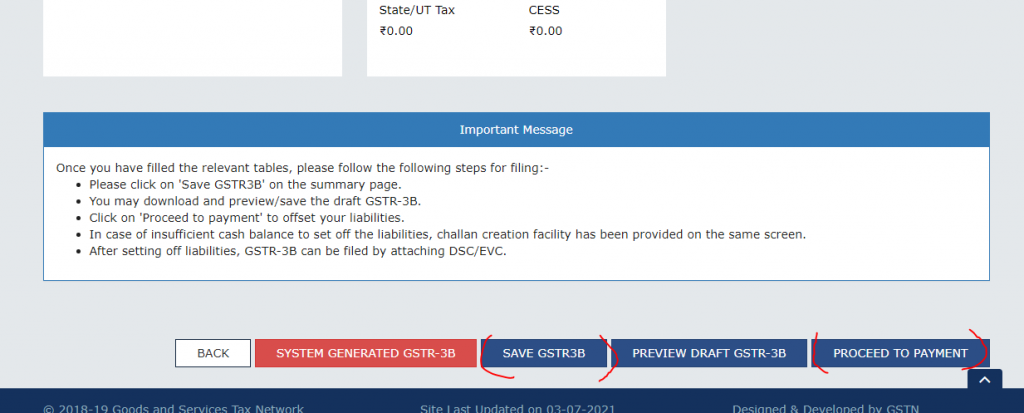

Step 8:- do scroll down and click save GSTR-3B after clicking this select proceed to payment option.

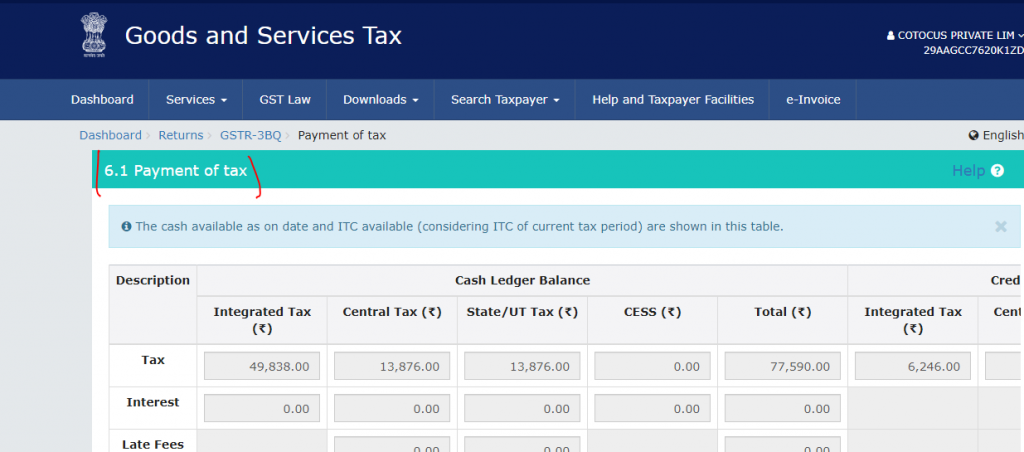

Step 9:- You Are entering your Tax payment column no.6.1

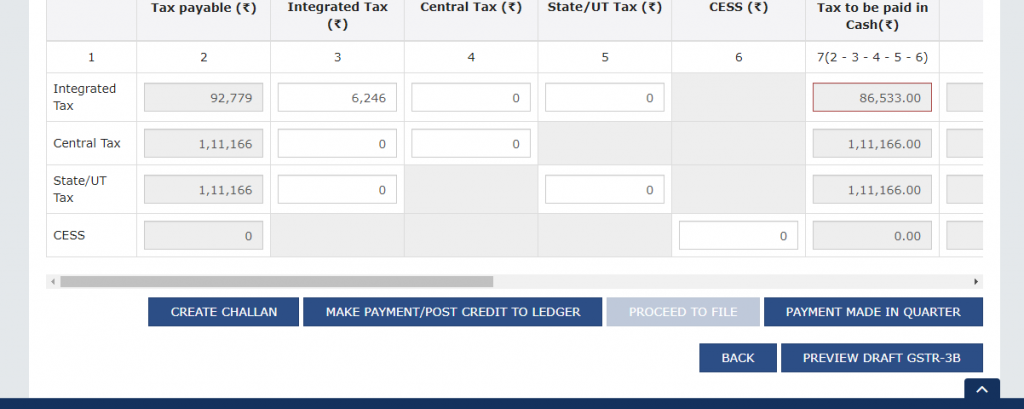

Step 10:- Do scroll Down and click create challan option.

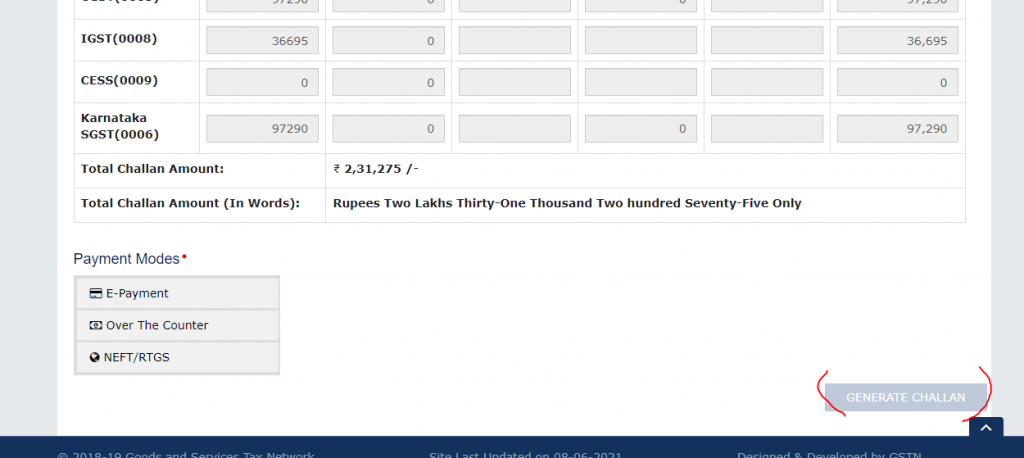

Step 11:- Select your payment mode and click generate challan.

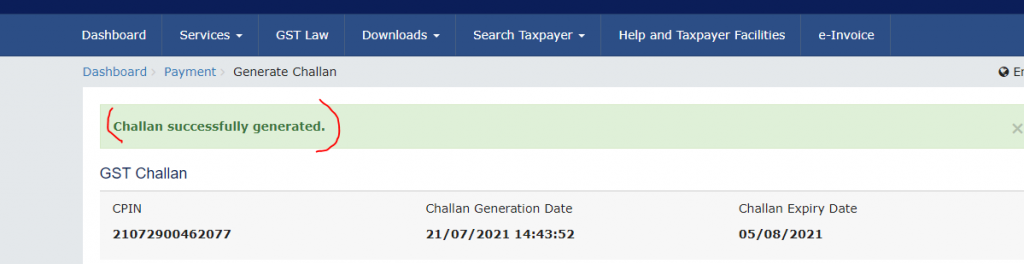

Step 11:- you have received a message your challan is successfully generated

Step 12:- Do scroll down and select your payment option after this selection clicks on the make payment option.

and finally, you attach your digital signature and enter the OTP this OTP is sent to your registered mobile number. and finally, click on the GSTR-3B file Return button after clicking this your GSTR-3B return is Filed.

Thanks”,