Hi Guys

This is Ravi Verma, in this article, I will tell you about the process of filing the NIL GSTR-1 return.

Let’s start,

When a company does not have any sales in a month, it will file a nil return in its GSTR-1 in that month.

- The process to file GSTR-1 NIL return.

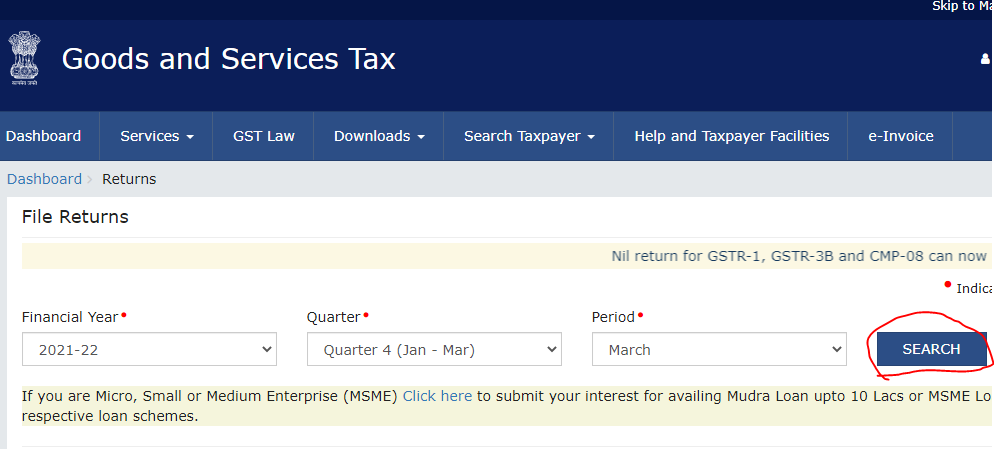

- Open your browser and search Gst.gov.in

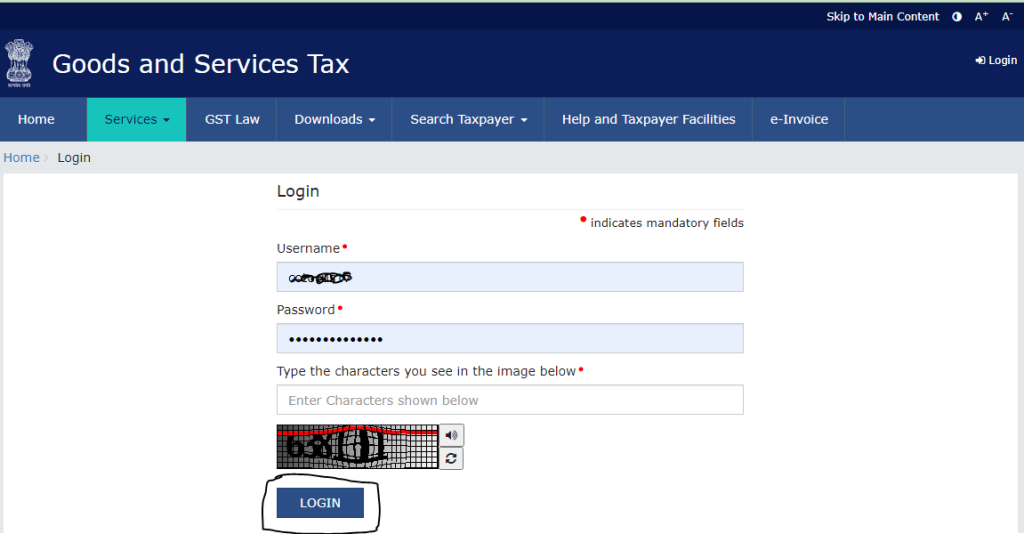

2. Click on the login option and enter your credentials as well as the captcha code.

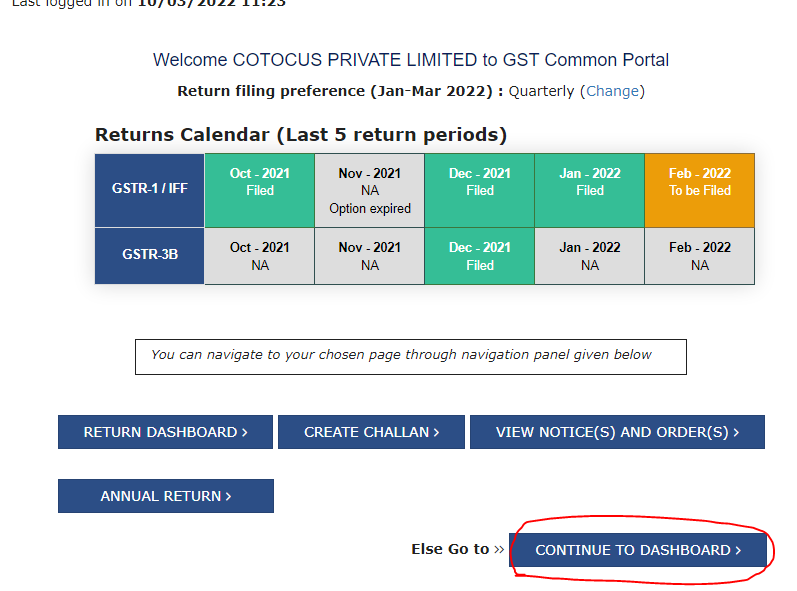

3. After clicking on the Login button, please scroll down and click on Continue to Dashboard option.

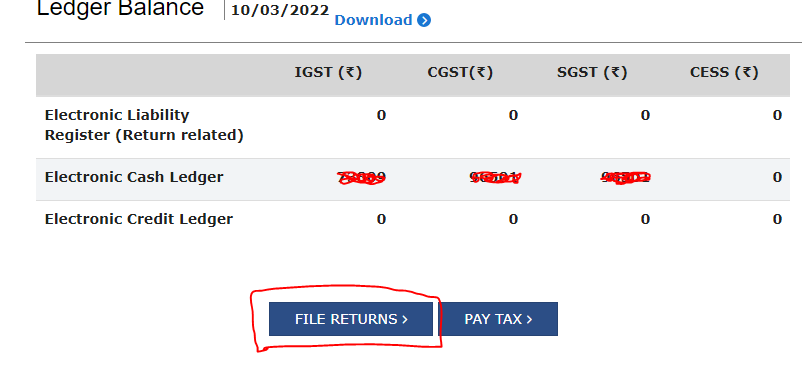

4. Then click on the File Return option.

5. If you want to file your GSTR-1 return then select your year, quarter, and period as well and then click on the search option.

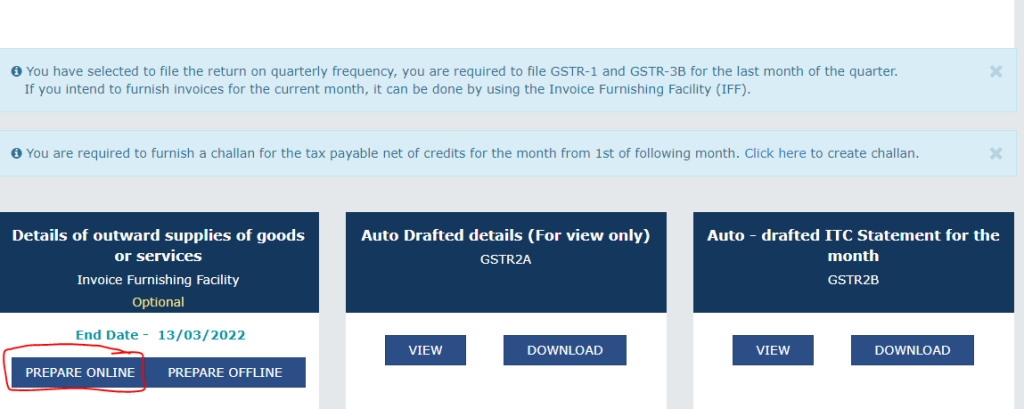

6. After that, you have to click on your GSTR-1/IFF option which you have selected

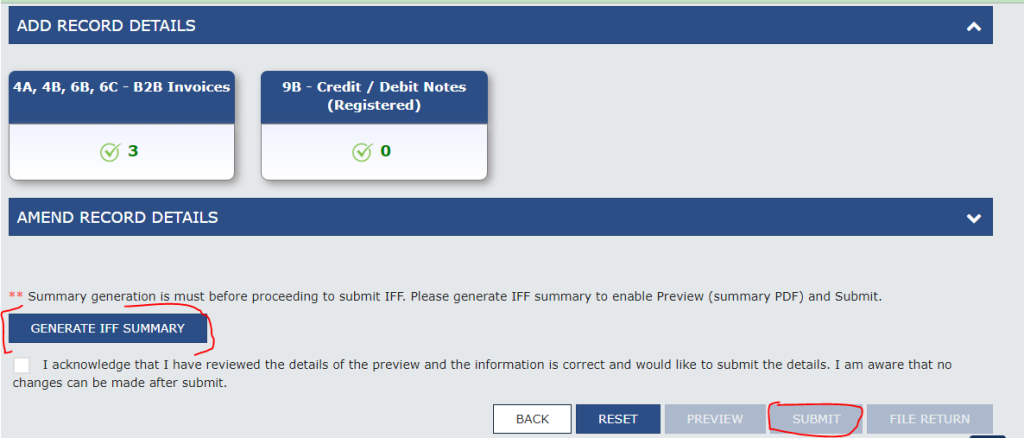

7. If your return is nil then there is no need to furnish your invoice details, just click on generate summary then tick the acknowledgment option and click on submit button.

8. And Then click on the file return option, it will enable you after clicking the submt option into your GST portal.

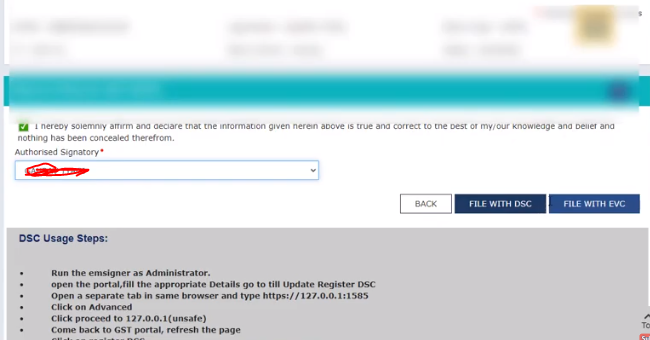

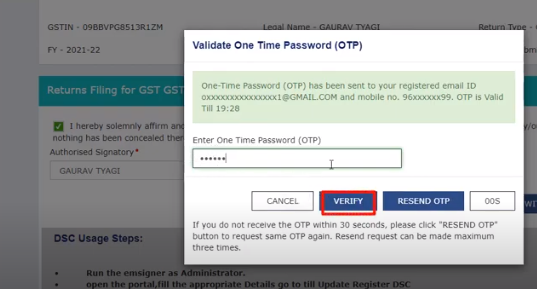

9. The last step is to tick the Acknowledgment option And choose your DSC/EVC which is available to you.

10. And finally you have to enter your OTP and click on Verify Option, after doing all this your return will be filed.

And you will get a message in your mail box that your return has been successfully filed.

Thanks,