Hi Guys,

This is Ravi Verma, in this Article I will tell you about the new method for filing the GSTR-1 NIL return.

Let’s start,

Why do we have to file the NIL GSTR-1 return?

If a business has no sale or purchase in a month, it must file its NIL GSTR-1 return for this month on the GST portal. but make a note for this, if you want to amend any invoice and if you will issue a credit note and Debit note to your client in that case you need to file your GSTR-1 return on the regular basis. you don’t need to file the NIL return in that case.

How to file my NIL GSTR-1 return in a new way?

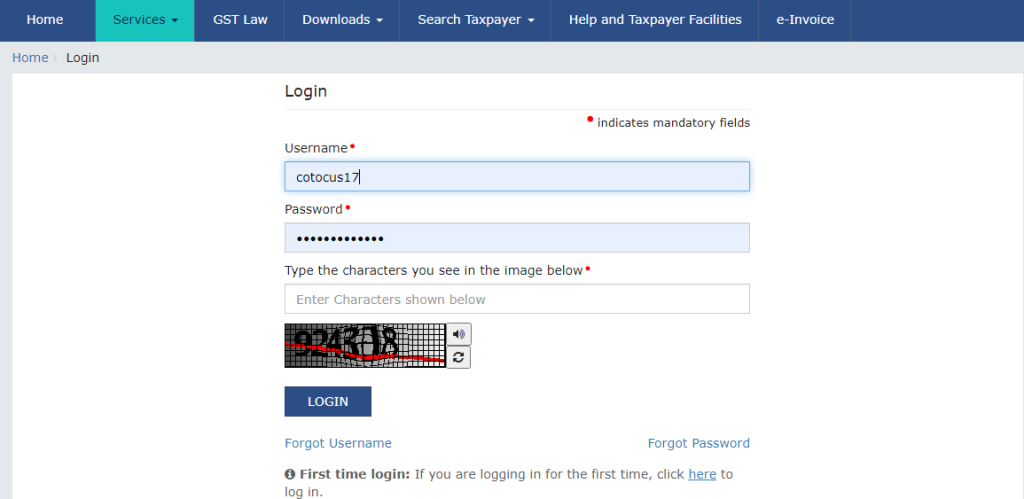

a. Open your GSTR portal with your credentials.

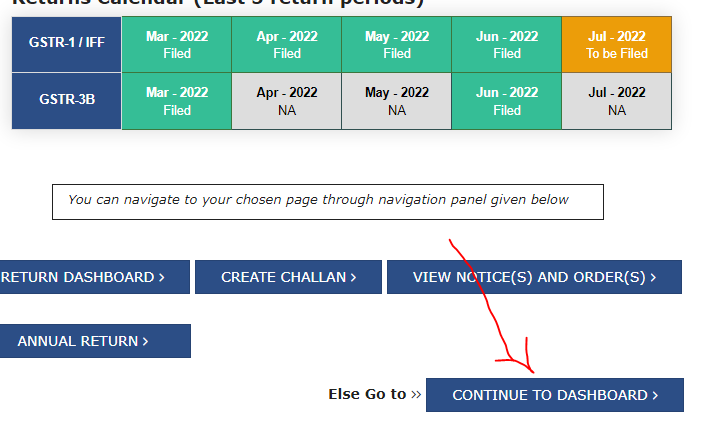

B. After logging into your GSTR portal click on the continue to dashboard button.

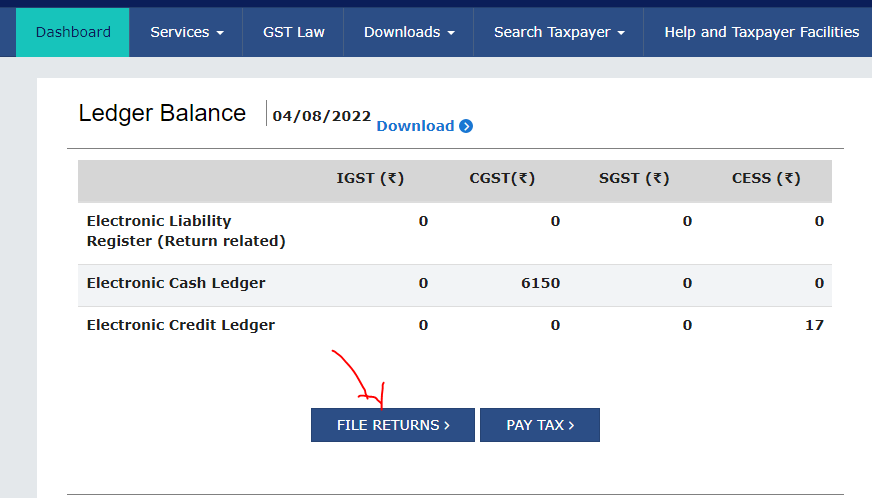

C. Click on the file return button.

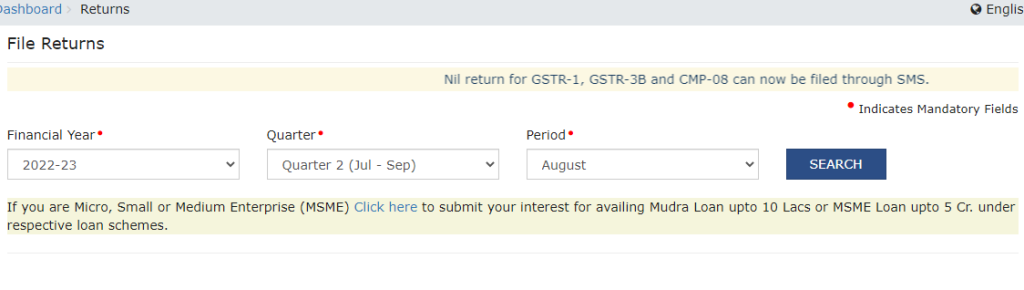

D. Select your GSTR-1 filing quarter, financial year, and the period after that click on the search button.

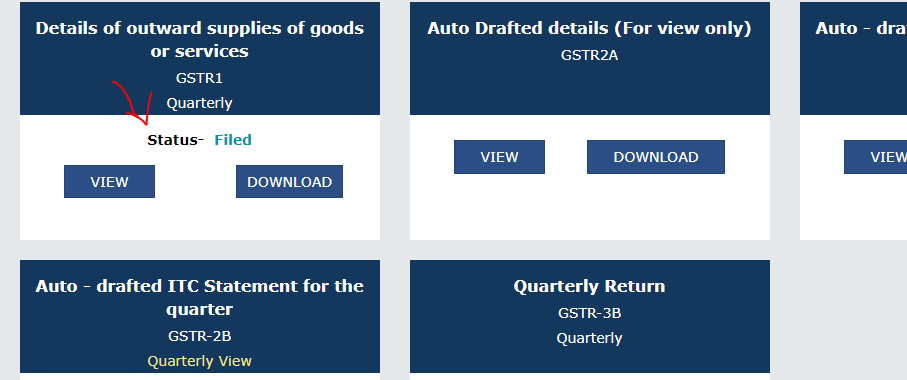

E. Click GSTR-1 Column.

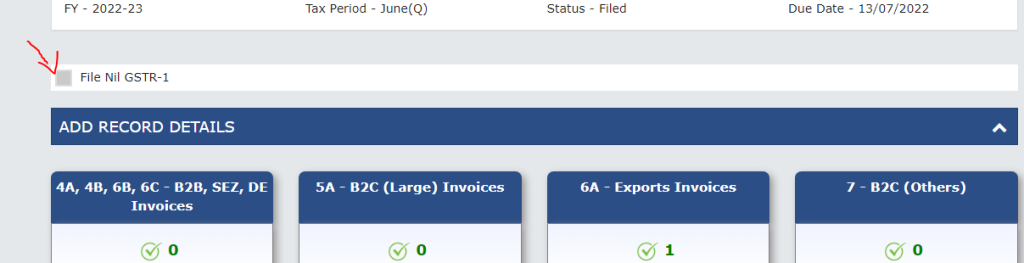

F. Click the button on the NIL GSTR-1 file.

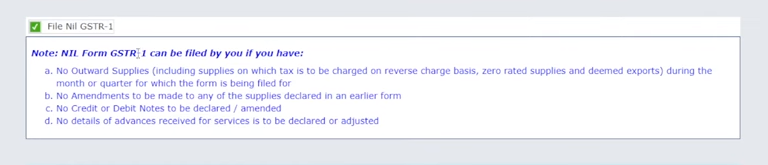

G. Please read this instruction that is for NIL GSTR-1 filing.

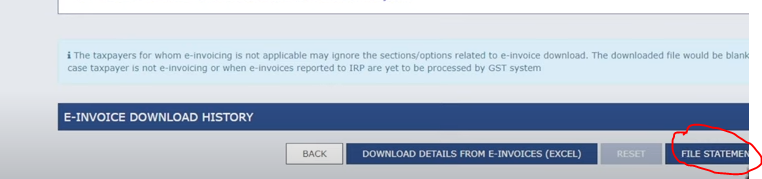

H. Do scroll down you will get a button of file statement then click on it.

I. After completing this process select your filing mode like EVC, DSC, or any which you have for filling. After that, you can file easily your NIL GSTR-1 return by yourself.

Thanks