Hi Guys

This is Ravi Verma, in this article I will tell you about how to file NIL GSTR-3B return in an online way.

Let’s start,

- What is GSTR-3B?

Goods and Services Tax was implemented in India on 1st July 2017, after which it becomes very important for individuals whose turnover exceeds 20 lakhs in a financial year, then it becomes very important for them to register in GST.

And if a person takes registration in GST, then from that day all the rules of GST apply to him.

Then that person has to file his GSTR-1 and GSTR-3B every month till his due date and if a person does not do so then interest is charged on him by the GST department

- What do you understand by NIL GSTR-3B Return?

When a company does not have any type of transaction in any month, then it becomes necessary for all the people to file nil GSTR-3B and if any person does not file his NIL GSTR-3B return then the government will charge a penalty on him.

- Steps to file NiL GSTR-3B returns.

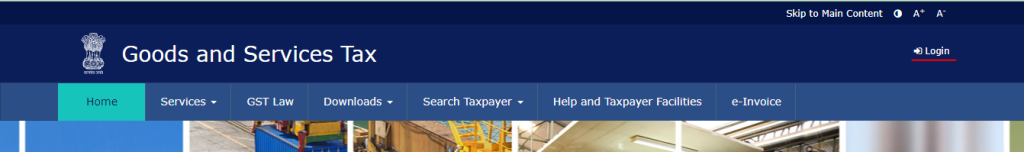

- GO to your browser and search gst.gov.in.

2. Click on the login button.

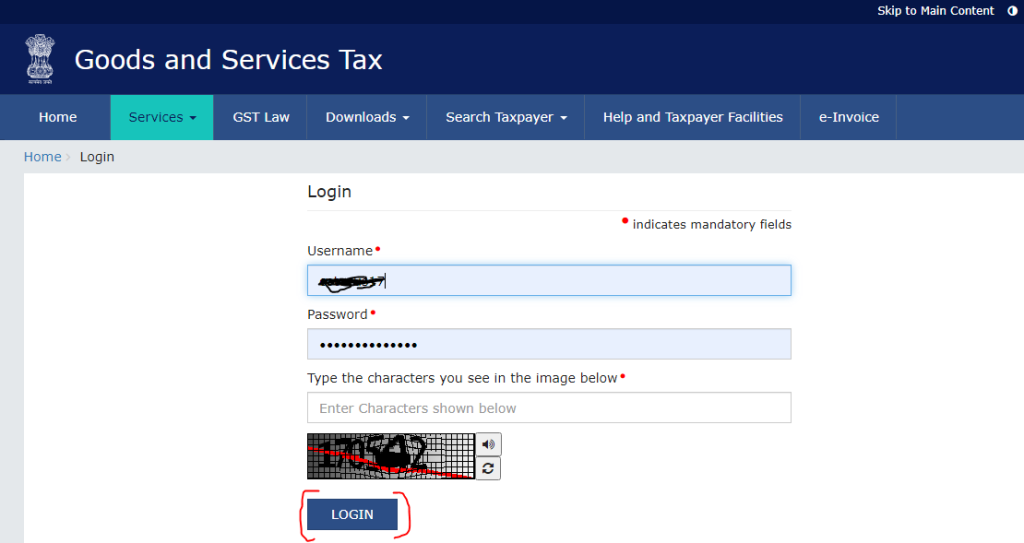

3. Enter your User ID & Password as well as captcha code, and click on the login button.

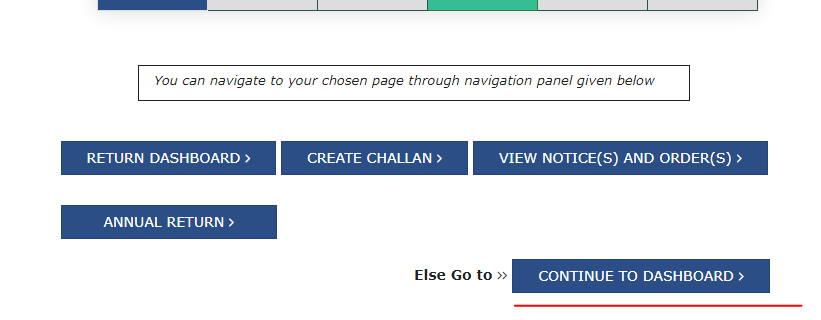

4. Now you are entering the GST portal, do scroll down and click on the continue to dashboard option.

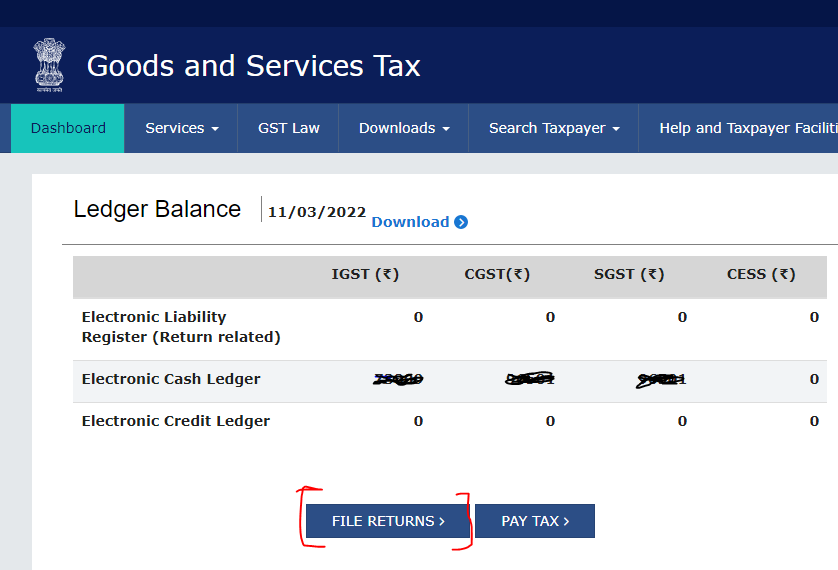

5. Click on the file returns option.

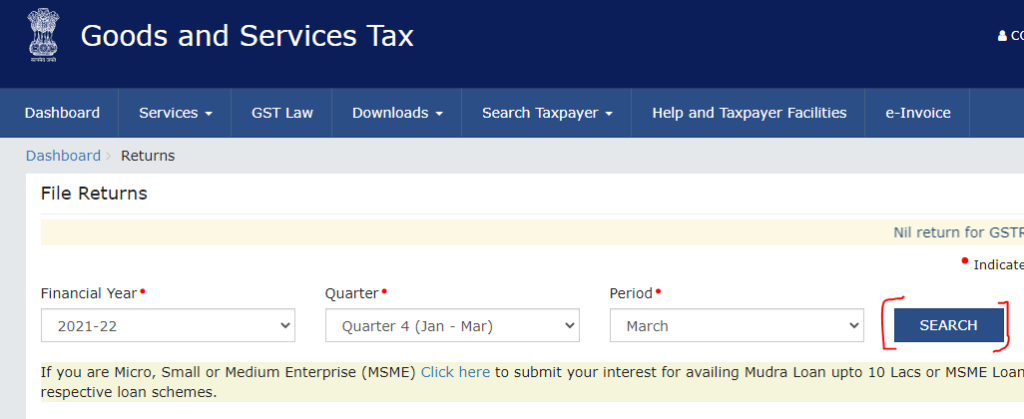

6. Now select your Financial year, quarter, and period and click on the search option.

7. Scroll down and click on the GSTR-3B Prepare Online option.

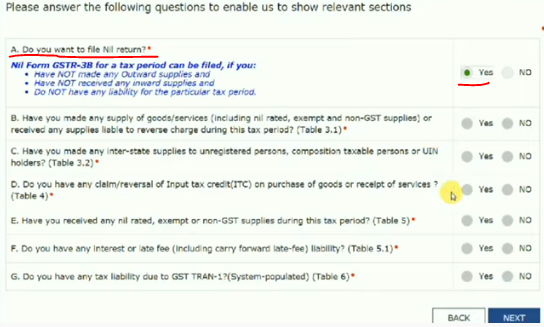

8. As soon as click on you the prepare online option then you will see the option to choose your returns type after this you have to choose the NIL return option and click on the Next button.

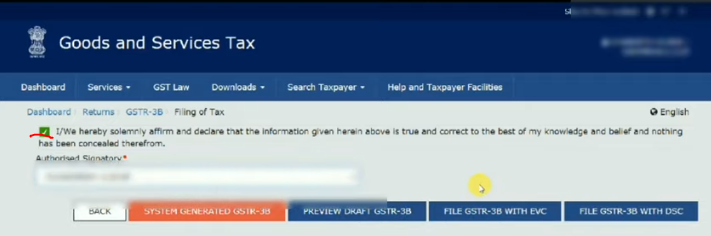

9. The last step is to tick the acknowledgment box and select your mode whether you want to file your return with the help of DSC or do you want to file your return through EVC mode, select any mode and successfully file your return Do it.

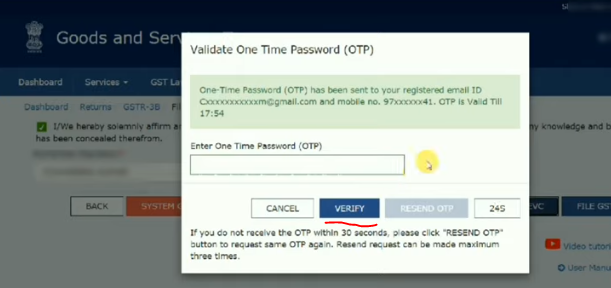

10. Enter your OTP to file your GSTR-3B NIL return.

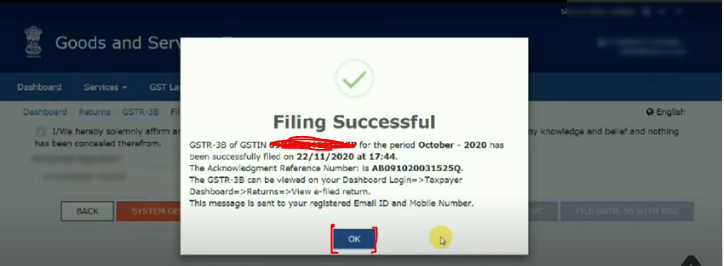

11. After entering the OTP you have received a message that your GSTR-3B return file is successful.

Thanks,