What is ITR?

When the turnover of a company or individual crosses the prescribed limit in a financial year, that person has to file his ITR so that he can inform the government that he has not evaded any kind of tax. And they have given their liability to the government so that the government never takes any penalty from them. Our Government of India has put a limit on all the people to keep the profit and as soon as a person crosses this limit, he has to pay the same tax to the government, as much as the tax liability becomes on him. When a person files his ITR, it means that he tells the government that he has not evaded any kind of tax and he pays all the liabilities to the government.

What are The Benefits of Filing ITR?

When a person files his income tax return, it means that he has freed himself from all penalties and interest. Because if a person fills his ITR then he gets many benefits.

(a) no black money

(b) No late fees

(c) No interest

(d) No penalty

(e) Bank loan

(f) House Loan

(g) car loan

(h) ITR refund

(i) carry forward of business loss

- Step by step guide to view your ITR file form.

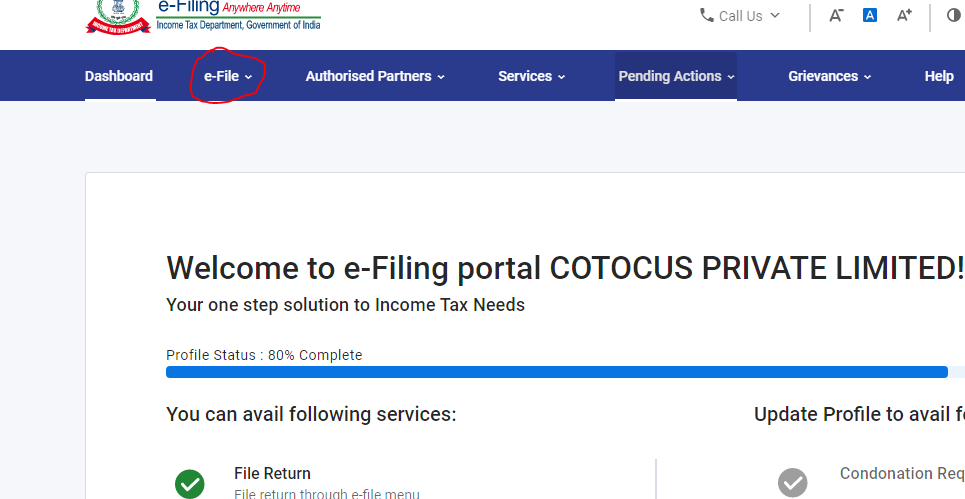

1st Open your ITR portal and Go to your Dashboard

2nd click e file option

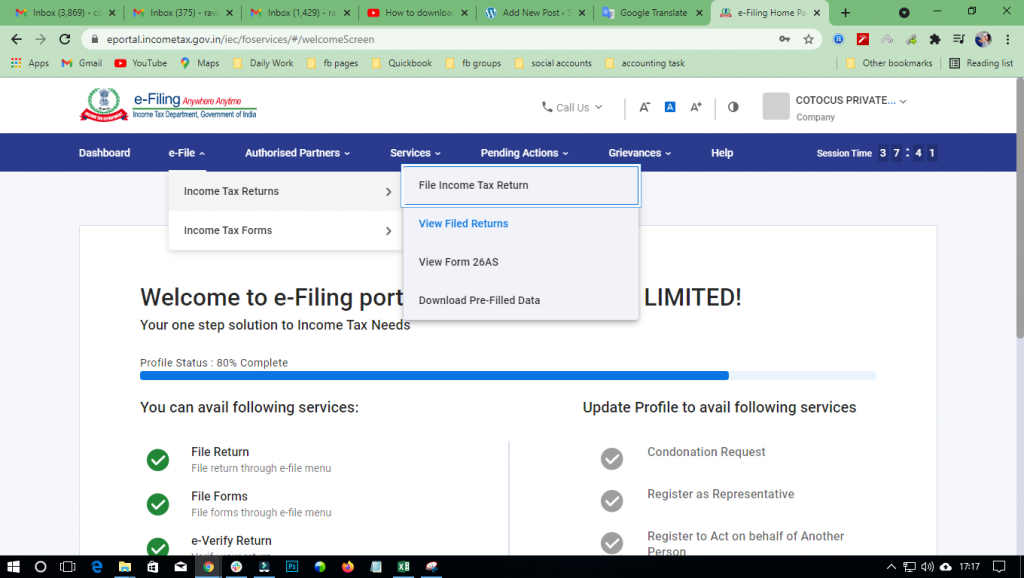

3rd click income tax return and under this, you will see view file return

After clicking on it, you can see the successfully filed Income Tax Return Form for your last financial year.