Hi guy’s

This is Ravi Varma, in this article I will tell you how to calculate TDS on salary.

Let’s start,

- How can we make TDS on salary structure?

| S.NO | Particular | AMT |

| 1 | Gross Total Income | XXXX |

| 2 | Less: Deduction allows u/s80cto80u | (XXXX) |

| 3 | Taxable income | XXXXX |

| 4 | income tax Amt(choose old/new regime) | XXXX |

| 5 | Less: rebate u/s87A | (XXXX) |

| 6 | Net income | XXXXX |

Some Basic points:-

- Gross total income:- No deduction is made in this income, whatever income you are getting, the report is given in this income (Salary = Basic + HRA + Transport Allowance + Other Allowance + Bonus – Provident Fund – Income Tax – Insurance.)

Benefits of deduction from 80C to 80U

- Section 80CCC:- Its full name is Deduction in respect of contribution in LIC pension fund, This section is applicable only for Individuals taxpayer, nothing other can use this section, under this section we can claim our LIC, Pension, and Funds amount to the government up to 150000.

- Section 80CCD:- Its full name is Deduction in respect of contribution to pension scheme of Central Government, This section is divided into 4 part.

(a) Section 80CCD(1):- Under this, a person who does not work inside anyone, if his income is from house property, then that person can take the benefit of this section.

Deduction:- Total 20% of gross salary and total provident fund deposit whichever is less.

(b) Section 80CCD(1B):- When an employee and an individual deposit his money in the Provident Fund, he is given exemption in that section as well as exemption of up to 50000 in section 80CCD(1B).

(C) Section 80CCD (2):- Under this section, when a person works in a private limited or government company, the company deducts some money from his salary and deposits it in the form of a provident fund and at the same time, the employer also deposits some money for his employee, Under which we also get discount inside it.

Deduction:- 10% of total salary and total provident fund amount whichever is less.

(D) Section 80CCD:- The government abolished the pension scheme after 2004 and a new scheme was brought in its place, under which the employee deposits some amount from his salary to the government, which we call provident fund and when that employee retires from the company, then all the money deposited by him is returned to him.

Deduction:- 10% of total salary and total provident fund amount whichever is less.

example:- Ram’s salary is Rs – 50000 and its provident fund amount is rupees 10000 then 50000*10/100 = 5000, so we get a deduction is rupees 5000.

The total limit of 80C = 150000 only.

- Deductions of Section 80D:- Its full name is Deduction in respect of medical insurance premium, This deduction is only for Individuals/HUF and this section tells us that if we take insurance premium, we have to deposit some amount every month to the insurance company so that it can be processed properly, and by using this section We can get tax exemption in our salary.

This section is divided into three types

Section 80DD (a) Spouse/children:- If your spouse’s/children’s age is less than 60, then they will get an exemption up to 25000.

(b) And If your spouse’s/children’s age is more than 60, then they will get an exemption up to 50000.

Section 80DDB (a) Parents:- If your parent’s age is less than 60, then they will get an exemption up to 25000.

(b) And If your parent’s age is more than 60, then they will get an exemption up to 50000.

(3) Preventive health check-ups:- We do health checkups every month for any member of our family, which we call preventive health checkups and in this, we can get only 5000 discounts from the government for our spouse and parents.

- Deductions of Section 80E:- Its full name is Deduction in respect of Interest on loan is taken for higher education With the help of this section, if we take a loan for our higher education, then we get a deduction up to 20000 in it and this deduction is for the individual and his spouse.

- Deductions of Section 80EE:- Its full name is Deduction in respect of Interest on the loan is taken for residential house property, With the help of this section, if we take a loan for our residential house property, then we get a deduction of up to 50000 in it and this deduction is for the individuals only.

Some basic points about this section

- You do not have to take a loan of more than 35 lakhs, if you take a loan of more than this then this section will not apply to you

- If you have taken a loan for your residency property then the value of that house should not exceed 50 lakhs

- When taking out a loan, make sure you don’t have any other residents.

- Deductions of Section 80G:- Its full name is Deduction in respect of donation to certion funds, charitable, instution etc, In this, we have been given deduction in donation

- Deductions of Section 80 GG:- Its full name is Deduction in respect of rent paid, Only an individual can take advantage of this deduction and if that person is getting the benefit of HRA on behalf of his organization then that person cannot take advantage of it, subject to a maximum deduction equivalent to 25% of their total income or Rs 2,000 a month, The lower of these options can be claimed as a deduction.

- Deductions of Section 80GGA:- Its full name is Deduction in respect of certain Donation, Any person who wants to take advantage of this category should not have income from business and profession, otherwise, everyone can take advantage of it.

Under this section, if we are donating 10000 rupees to any organization, then the government makes our entire 10000 tax-free, but we are donating more than 10000 to any organization and that donation will be in cash, then we will not benefit from it.

And also we should donate to an organization that has got approval from the central government, then whatever we donate to that organization becomes tax-free, but keep in mind that the mode of donation should be online.

- Deductions of Section 80GGB:- Its full name is Deduction in respect of contribution given by an indian company to political parties, If an Indian company gives money to a political party in the form of a fund, then all that amount gets tax-free from the government.

- Deductions of Section 80GGC:- Its full name is Deduction in respect of contribution given by any person to political parties, If any assessees gives money to a political party in the form of a fund, then all that amount gets tax-free from the government.

- Deductions of Section 80IA:- When any indian company builds an infrastructure with the permission of the government, then all the investment made in it becomes tax free and you can take advantage of it to avoid your tax, but to do all these things it is necessary to have an agreement. (eg – airport, telecommunication service, a highway ETC.)

- Deductions of Section 80IB:- Provisions of section 80-IB can be used by all assessees who have profits from hotels, ships, multiplex theatres, cold storage plants, housing projects, scientific research and development, convention centres, etc.

- Deductions of Section 80IAB:- If we do any kind of business in a particular economy zone, then he can take advantage of this section by making his profit tax free for any 10 years in 15 years

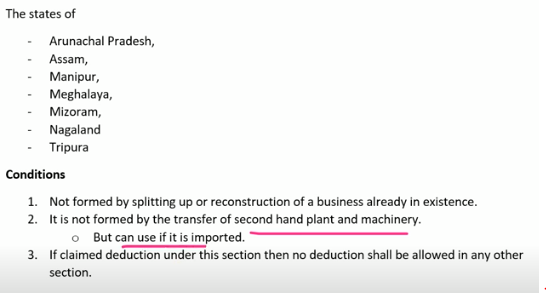

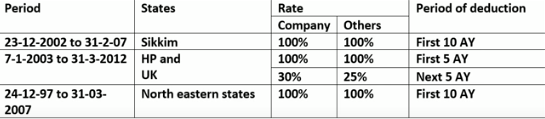

- Deductions of Section 80IC:- If an assessee starts his company in a particular category of state, the governor does not charge any tax on his profits for 10 years, And if any other person also does manufacturing on that state, then the government applies the same rule for him too, but keep in mind that we have to do the manufacturing according to schedule number XIV only then we can get its benefit.

- Deductions of Section 80ID:- All assessees who have profits or gain from hotels and convention centres are eligible for deduction under this section, subject to their establishments being located in certain specified areas.

- Deductions of Section 80IE:-

In this section, if an assessee manufactures qualifying articles and things in the North Eastern State, as specified by the Government,

So if we manufacture those things then we will not get any kind of tax on profit for 10 years.

- Deductions of Section 80JJA:- When an assessee does the business of such an item which is not used by anyone and that assessee manufactures an item of use from that article, then the government does not collect tax on his profit for 5 years to such assessee.

- Deductions of Section 80JJAA:- In a business where the employer increases the number of its employees but does not increase their wages, in this section, the focus is only on increasing the employment, then the government gives them an employment exemption of 30%. And that business should also be covered under section 44AB, then the government gives 30% employment exemption to such business for 3 years.

- Deductions of Section 80LA:-

Such bank units, which are mentioned by RBI in its act 1934 in the second schedule list by the name of the bank, are called offshore banking units and these banks should be in the special economic zone, then only we can avail.

And if an international bank starts its branch in a particular economic zone, then it will also get its benefit.

And lastly, if an International Financial Services Center starts its branch in a Special Economic Zone, it also gets the deduction of this section.

Condition of availing this section.

(1) All papers are attested by CA

(2) And all the papers of CA should also be signed.

(3) Under Section 1949, you have to take permission to open a bank and also have permission papers.

Deduction

No tax will be collected by the government in the first 5 years.

And then after 5 years tax will be collected by the government on that banking at the rate of 50%.

- Deductions of Section 80PA:- The benefit of this section can be availed by only those assessees who have agricultural income and their company should be a corporate company and the turnover of that company should not exceed 100 crores, then that company can take the benefit of this section for 5 years, The government does not collect any tax from it in 5 years.

- Deductions of Section 80RRB:- The government gives us 2 types of exemptions on the income we get from our patents in the form of royalty (This deduction is applicable only resident individuals)

- 100% deduction on royalty income.

- Royalty income should not exceed Rs30000.

whichever is lower

- Deductions of Section 80QQB:- Section 80QQB permits tax deductions on royalty earned from sale of books. Only resident Indian authors are eligible to claim deductions under this section, with the maximum limit set at Rs 3 lakhs. Royalty on literary, artistic and scientific books are tax deductible, whereas royalties from textbooks, journals, diaries, etc. do not qualify for tax benefits. In case of an author getting royalties from abroad, the said amount should be brought into the country within a specified time period in order to avail tax benefits.

- Deductions of Section 80TTA:- Under this section, any person who will be resident in India can take advantage of this, under this, if an assessee deposits some of his deposit in a savings bank, then he is given a rebate of up to 10000 by the government.

- Deductions of Section 80TTB:- Under this section, any senior citizen who is a resident of India can take advantage of this, under this, if an assessee deposits some of his deposits in a savings bank and any other bank then he is given an exemption of up to 50000 is by the Government of India.

- Deductions of Section 80U:-

The type of person covered under this section, who has been certified by health care that the person has more than 40 percent disability, shall be exempted by the Government up to Rs.75,000,

And if there is a person who is said to have more than 80% disability from health care, then such person is given a deduction of up to 125000 from the government.

Thanks,