Hi guy’s

This Ravi Verma, in this blog I am writing on how to activate our canceled GSTIN number

What is the GSTIN number?

The full name of GSTIN is the goods and service tax identification number. All India GST number is total of 15 digits which consists of alphanumeric words, when a person wants to start a business in India, he must first get his business registered in GST as per the rules of the Government of India. After which the government gives them a number to identify their business, which we call the GSTIN number. When any business gets this number, then it has to follow its rules to run its business properly. If a business does not comply with the terms and conditions of GST, the GST department cancels its GST number. And to activate that number back, the GST department issue a notice to comply with all the rules of GST, this notice has to be replied to within 7 days, if we don’t do this then our GST registration will be canceled Is.

How to activate our canceled GSTIN number?

If the GST department has canceled your GSTIN number, there can be many reasons for this.

- You must not have filed your return for the last 6 months.

- You may not have linked your bank details with the GST portal

- If you have opted for QRMP plan and you are providing service more than 10%

- You must be taking GST but not depositing it to the government.

- You have deposited less GST amount to the government

If for any of these reasons the department has sent you a notice to cancel your GST number, then within the next 7 days you will have to file all your pending returns. And you have to send a copy of the same to the GST department so that the GST department knows that you have filed all your returns and for this reason, your GST number will not be considered for cancellation.

note point***** But keep in mind that at the time of filing the return, you will have to deposit all the late fees and penalties as well.

Steps to Activate GSTN Number

- login to the GST portal.

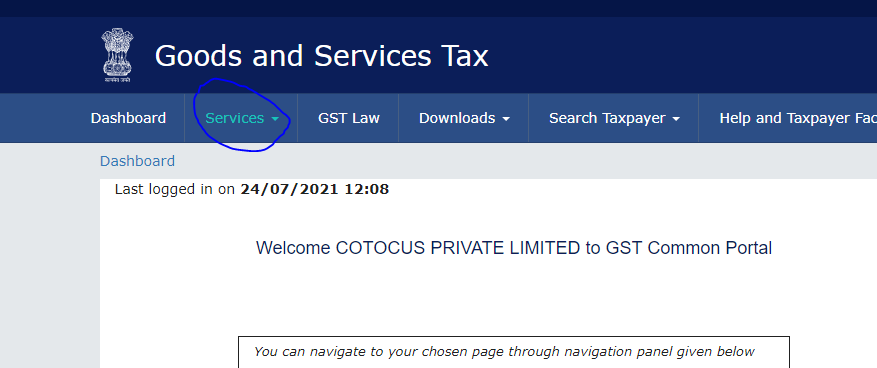

- Go to the Services tab

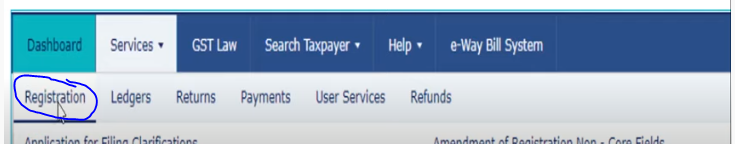

- under the services tab click on registration option

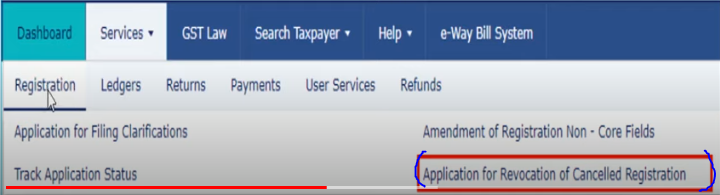

- Go to the application for revocation of cancelled registration option.

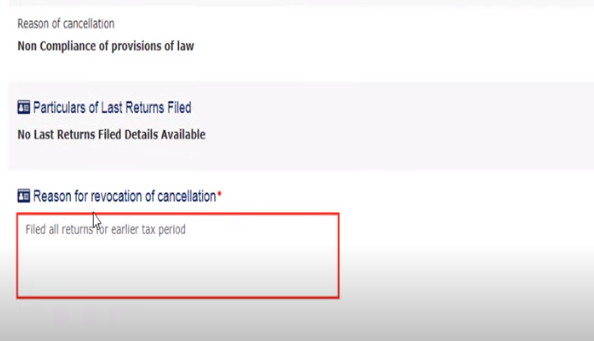

- after that your revocation form is opened do scroll down and write reasion for revocation of canclation.

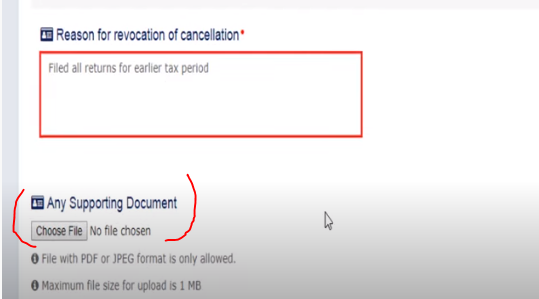

- Attached are your supporting documents if you file all pending returns.

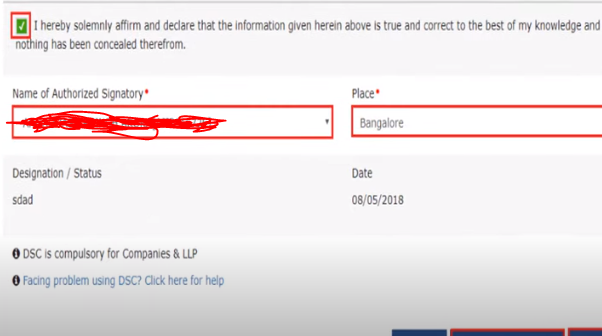

- verification your details

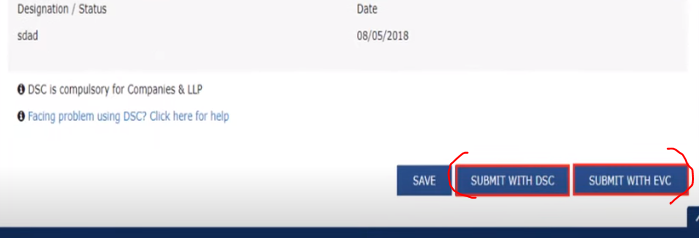

- and the last step is submmit to your form with your DSC/EVC

note pointe****** After doing all the process, if the department is satisfied with your attachment, then after 15 minutes you will get the acknowledgment from the GST department.