Hi Guys

This is Ravi Verma, In this article, we will discuss the 26AS Details.

Let’s started,

What is 26AS?

If any person will deduct a TDS then he can see that amount with the help of the government IT portal i.e income tax portal.

When suddenly our TDS will be deducted for any reason then we can easily check that reason in a very simple way we go to the income tax portal and we will show anything which is related to the TDS.

Steps to see our form 26AS

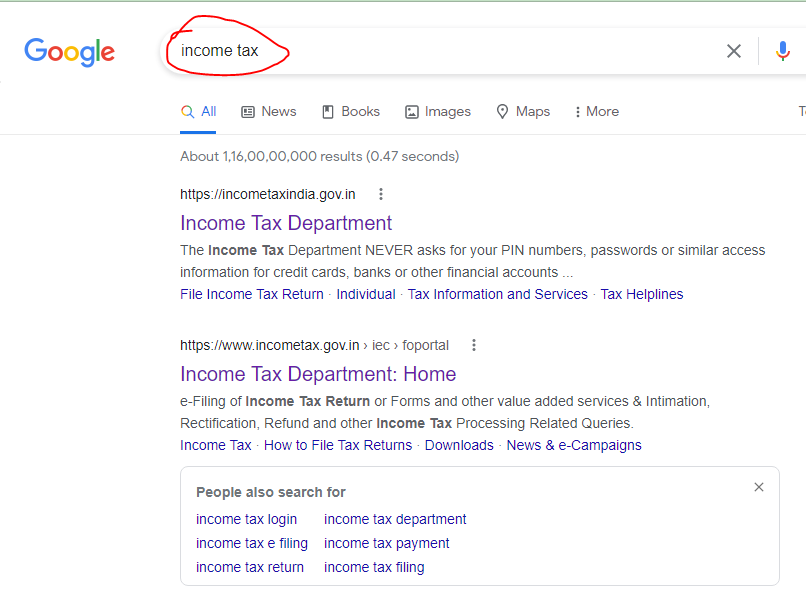

a. Open your browser and search income tax portal

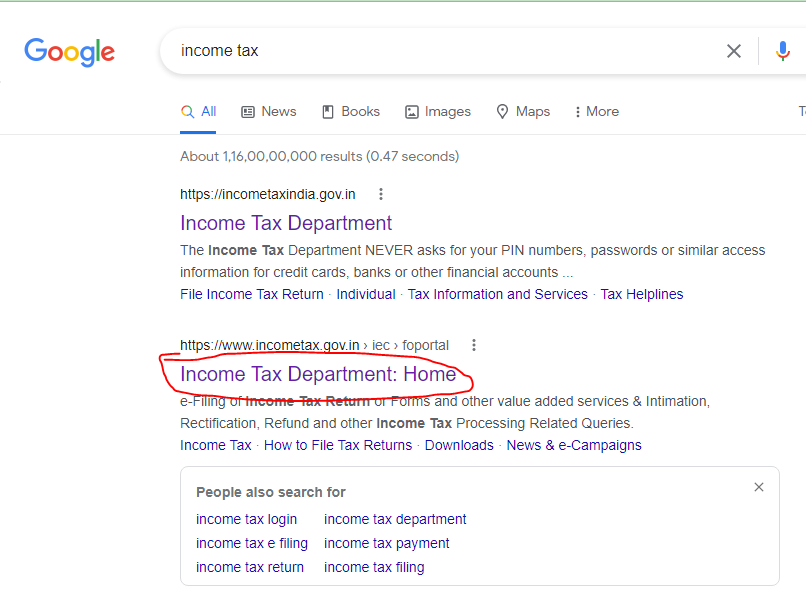

b. After that click on the income tax department: Home button.

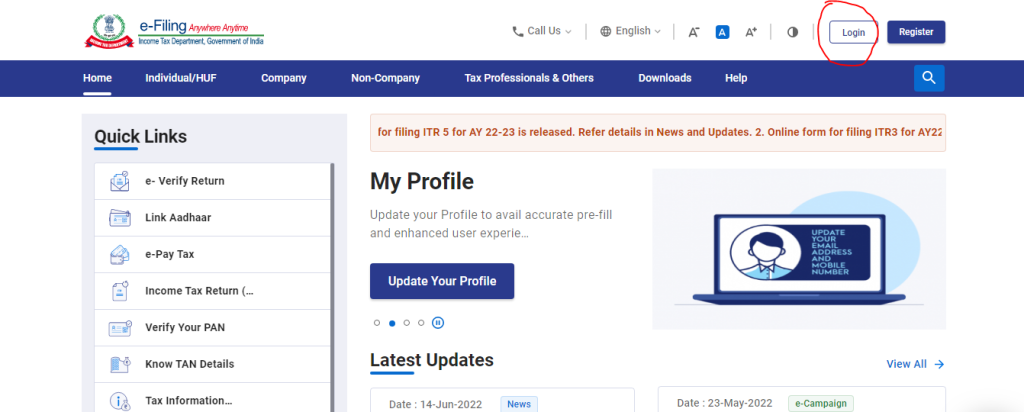

c. After that, you will see the dashboard of the income tax portal then click on the login button this button will show on your right-hand side.

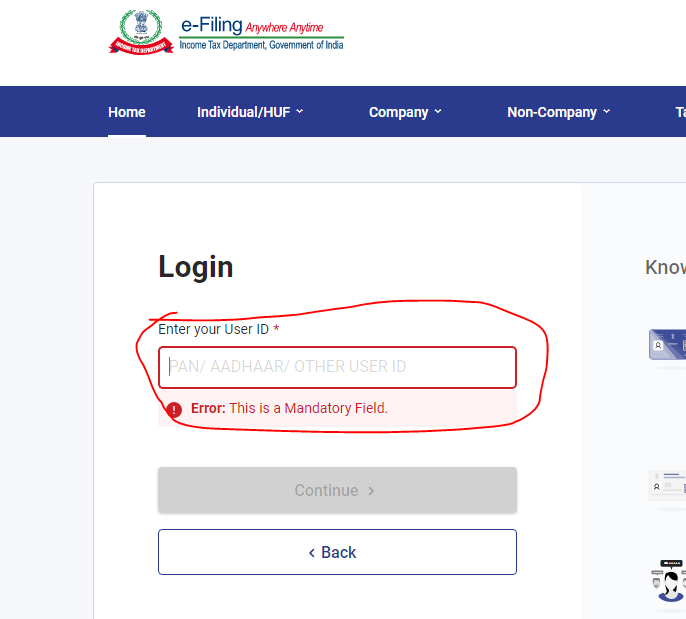

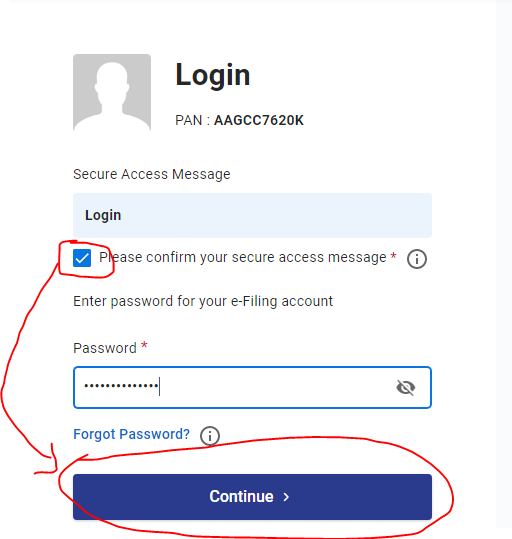

d. Then enter your login ID and Password, the login ID is your PAN card number please make a note of it. and then click on the continue option.

e. After that tick out the confirmation message button option after that enter your password and then click on the continue button.

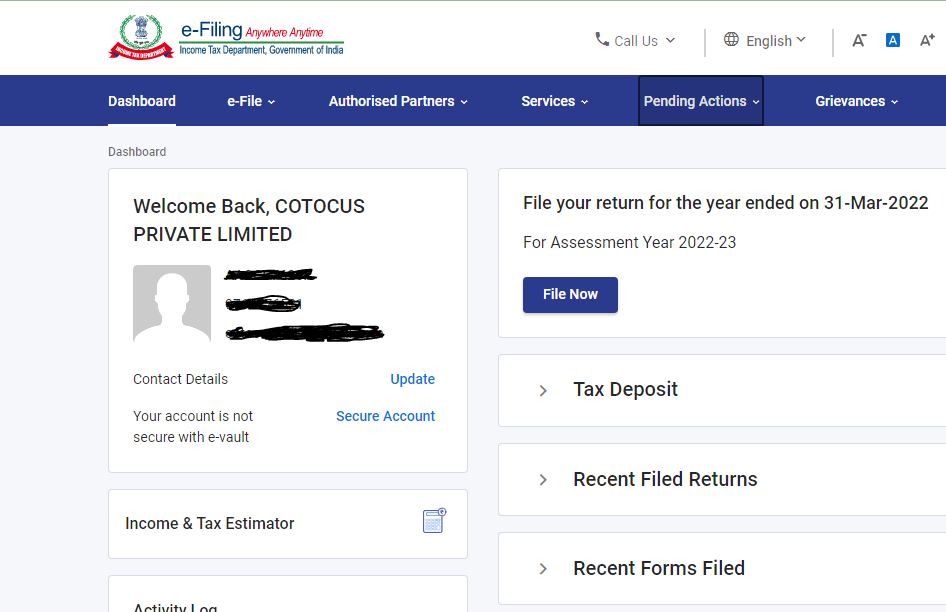

f. And you will be entering the income tax dashboard portal.

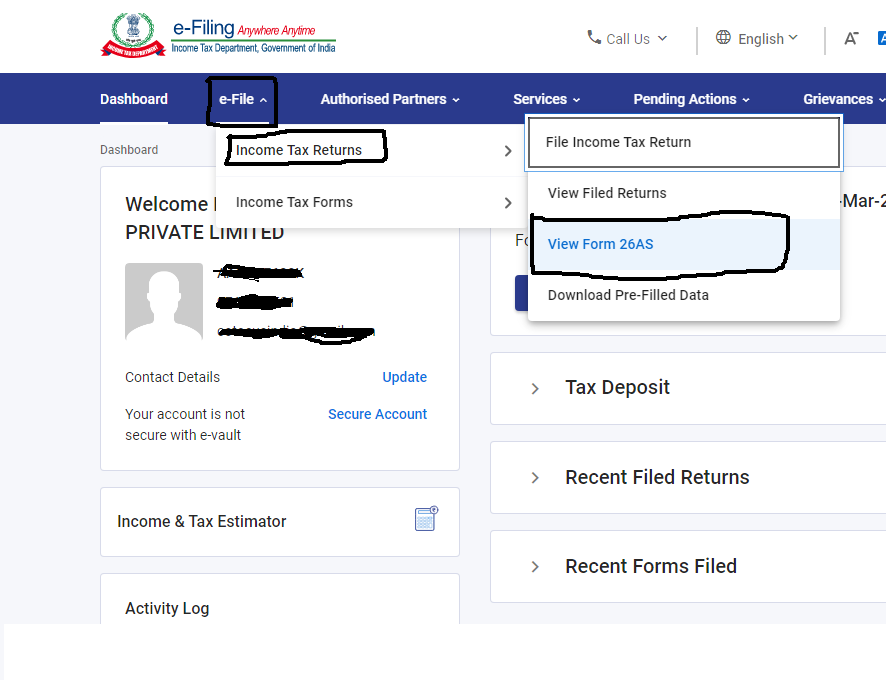

g. Go to the e-file option under this option you will see the view 26AS option then click on it.

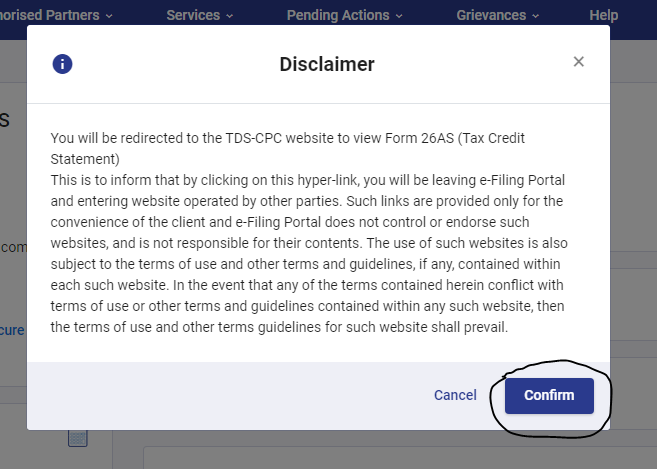

h. After clicking the form 26AS button you will appear a disclaimer then click on the confirm option

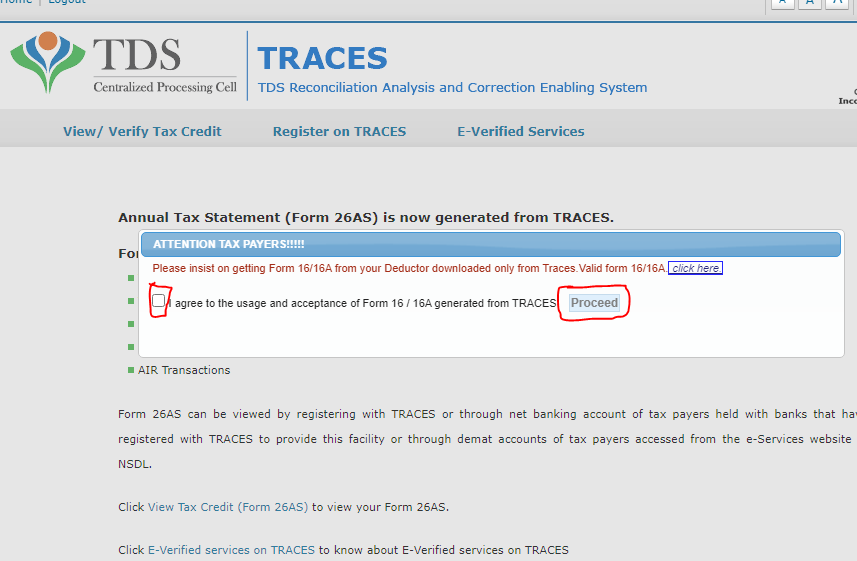

I. After clicking the confirm option you will get the new window in your dashboard and that is called TRACES Portal after that you will tick the given column and then click on the proceed button.

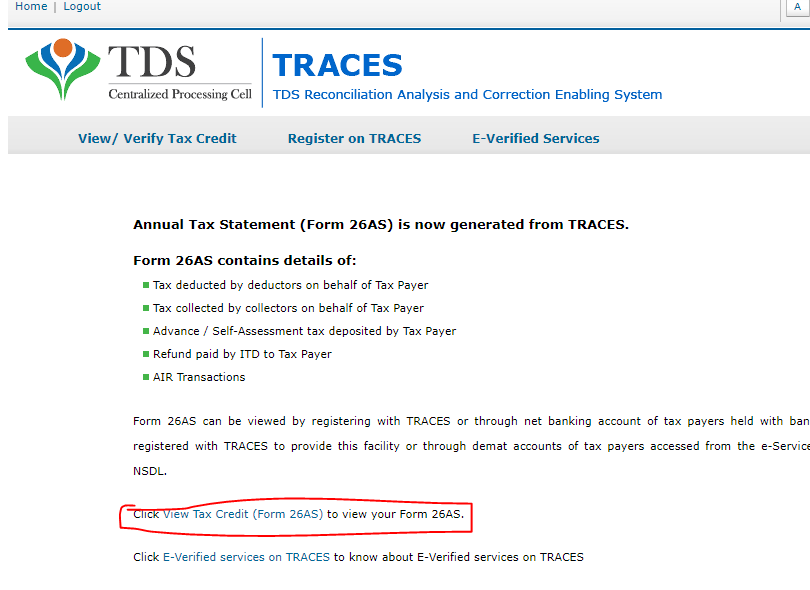

J. After that click on the view your form 26AS option.

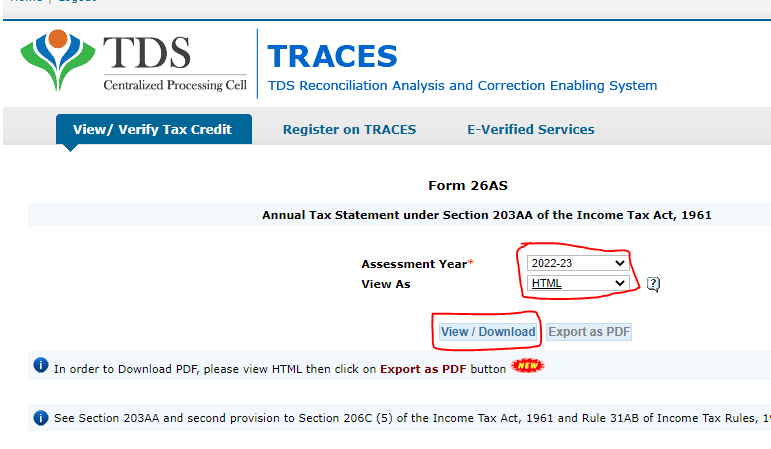

k. After that select your assessment year and select the view as HTML option then click on the View/Download button

L. After completing all these steps you will see your TDS report who has deducted your TDS and what is the deduction section of your TDS.

Thanks