Hey All

In This tutorial, We will discuss about the Exemption and new late fees for FY 2022-23 in GSTR-9 (Annual Return Filing).

What is GSTR-9 (GST Annual Return)?

GSTR-9 is an Annual Return Filing of the Goods and Services Tax (GST) system in India, serving as the GST Annual return form. This form consolidates all the monthly or quarterly GST returns (such as GSTR-1, GSTR-3B, etc.) submitted by a registered taxpayer throughout the financial year.

Registered taxpayers are required to file GSTR-9 annually, providing a comprehensive overview of their GST transactions for the entire financial year. This return offers a summary of the various GST activities, ensuring transparency and compliance with the GST regulations in India.

Key Points to Understand the GSTR-9

- What is GSTR-9? GSTR-9 is an annual return that must be filed by all registered taxpayers under GST, except for those who are exempt. It is a summary of all the outward and inward supplies, taxes paid, refunds claimed, demand raised, and input tax credits availed during the financial year.

- Who needs to file GSTR-9? All registered taxpayers under GST are required to file GSTR-9, except for the following:

- Casual taxpayers

- Input Service Distributors (ISDs)

- Non-resident taxpayers

- Taxpayers deducting/collecting tax at source under Section 51 or Section 52

- When is GSTR-9 due? GSTR-9 is due to be filed by December 31st of the year following the financial year for which it is being filed. For example, the GSTR-9 for FY 2022-23 is due to be filed by December 31, 2023.

- What information does GSTR-9 contain? GSTR-9 contains a summary of all the following information for the financial year:

- Outward supplies

- Inward supplies

- Taxes paid

- Refund claimed

- Demand raised

- Input tax credit availed

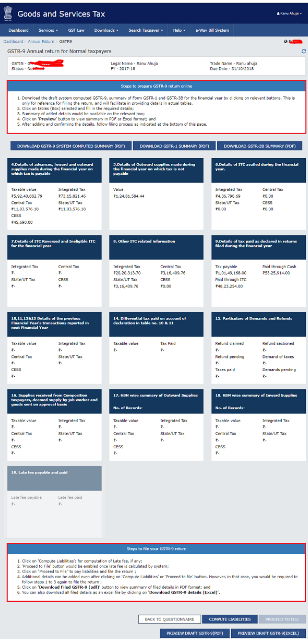

- How to file GSTR-9? GSTR-9 can be filed online on the GST portal. The taxpayer must have a valid GSTIN and password to file GSTR-9.

Here are some additional important points about GSTR-9:

- Taxpayers who are liable to get their annual reports audited must also file GSTR-9C, which is a reconciliation statement between the annual GSTR-9 and the audited financial statements.

- Taxpayers who file GSTR-9 after the due date may also be liable to pay interest on the late tax liability.

- The late fee is Rs. 100 per day per act, subject to a maximum of 0.25% of the taxpayer’s turnover in the state or union territory till FY 2021-22

Exemption to file GSTR-9

The following categories of taxpayers are exempt from filing GSTR-9 for FY 2022-23:

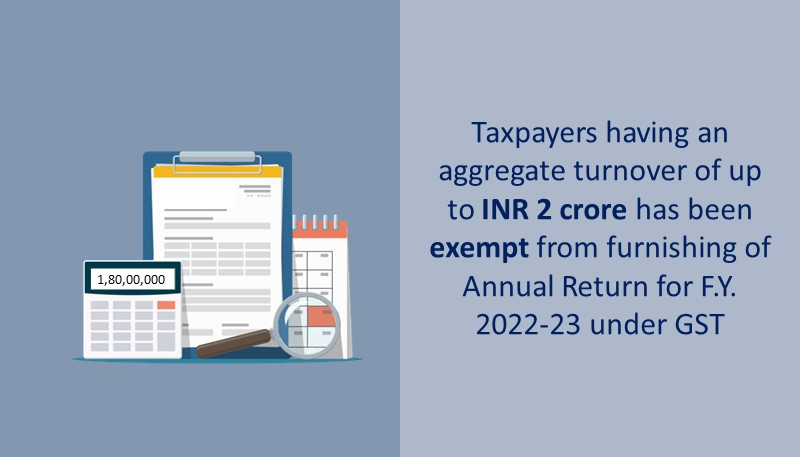

- Taxpayers with aggregate turnover up to Rs. 2 crore

- Input Service Distributors (ISDs)

- Taxpayers registered under the Composition Scheme

- Non-resident taxpayers

- Taxpayers who have filed for cancellation of GST registration

If you fall into one of these categories, you are not required to file GSTR-9 for FY 2022-23. However, it is always a good idea to check with your tax advisor to make sure that you are in compliance with all applicable GST requirements.

Even if you are exempt from filing GSTR-9, you may still be required to file other GST returns, such as GSTR-1 and GSTR-3B.

Annually, the Central Board of Indirect Taxes and Customs (CBIC) issues notifications specifying categories of taxpayers exempt from filing GSTR-9. For FY 2022-23, Notification Number 32/2023 has been released. According to this notification, taxpayers with an aggregate turnover not exceeding 2 Crore in the financial year 2022-23 are exempt from filing GSTR-9.

If your aggregate turnover does not exceed 2 Crore, you are not obligated to file GSTR-9. However, it is advisable to file the GST Annual Return if there are discrepancies between your Books, GSTR-1, and GSTR-3B. Filing the return allows you to rectify errors and address mistakes made throughout the financial year. Failure to do so might result in notices regarding mismatches and related issues.

Thanks,

[…] https://www.stocksmantra.in/gstr-9-annual-return-filing-exemption-and-late-fee-for-fy-2022-23/ […]