Hi Guys

This is Ravi Verma, In this article, I will tell you about new changes of GSTR-1

Let’s start,

The government has implemented new changes in GSTR-1.

- When we file our GSTR-1, we see a submit option, this option is used to submit our GSTR-1 report.

Now the government has removed this option from our GST portal.

Since there are many useless options available in the GST Portal, the government is planning that no additional options appear under the GST Portal.

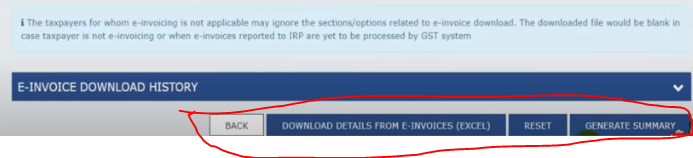

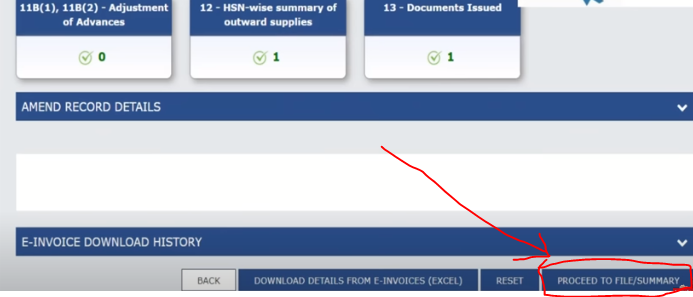

- As soon as we click on the Generate summary button then we will see the new button that is proceed to the File/Summary button,

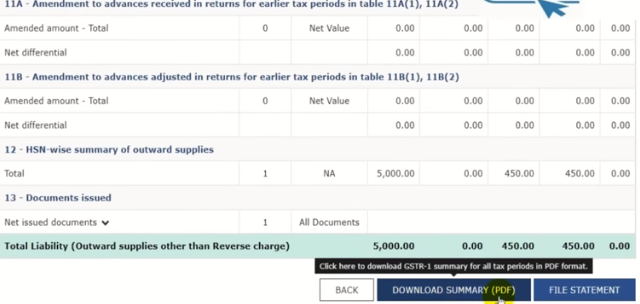

After clicking on this button we will see all the columns of GSTR-1 by the GST Portal, under this option we will see the data of all our columns as per the GST table and we can also see the total amount under this column, which will appear the consolidated summary in front of me of my all transactions.

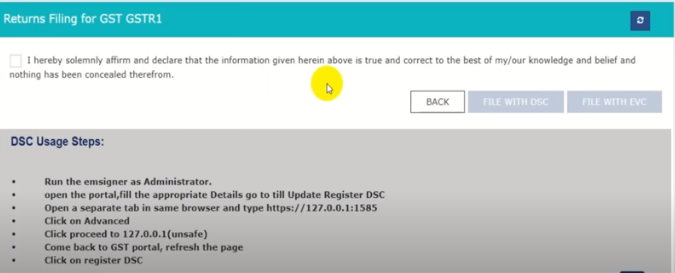

- After clicking the file statement you can file your GSTR-1 return by your DSC and EVC