What is QRMP scheme?

QRMP’s full form is “Quarterly Returns with Monthly Payment”. As this name is indicating it’s a scheme newly introduced under GST filing, where taxpayers can file their GSTR 1 and GSTR 3B both returns quarterly instead of monthly.

Who can opt for QRMP scheme?

All taxpayers whose aggregate turnover is up to Rs. 5 Crore in the current and preceding financial year are eligible for this scheme.

How to opt for QRMP scheme?

Self-opt option is not available now for this quarter (JAN 2021 – MAR 2021). Self-opt option was valid till date 31st Jan 2021. If you did not choose the scheme before the due date then GST portal will put you in any scheme based on your previous returns.

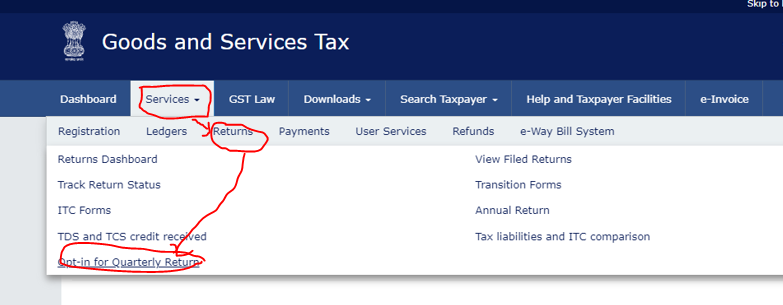

You can follow these STEPS for OPT IN – OPT OUT:-

Step 1 . Login to GST portal

Step 2. Go to “Services” => now select “Returns” => Select “Opt-in for Quarterly Return”

Can I opt in or opt out from the scheme in future?

Yes, you can opt in and opt out if you don’t want to continue your quarterly filing. But, once you opt for the quarterly return (QRMP scheme) you cannot opt out from the scheme for that quarter period.

You can opt in or opt out from the scheme as follows:-

| Quarter | Between |

| Q1 (April –May – June) | 1st February to 30th April |

| Q2 (July – August – September) | 1st May to 31st July |

| Q3 (October – November – December) | 1st August to 31st October |

| Q4 (January – February – March) | 1st November to 31st January |

Do I need to enter the scheme every quarter to avail its benefit?

No, once opted in, the scheme will continue for you, unless you decide to exit or opt out.

How to file GST returns under “QRMP” scheme?

Under this scheme you have to file GSTR 1 and GSTR 3B quarterly but you have to pay the tax liabilities by 25th of every next month using “GST PMT 06” Challan for the first and second months of the quarter. For example, for the month of January challan has to be generated by 25th of February.

There are two ways to make the monthly tax payments through “GST PMT 06” Challan, Fixed Sum Method (FSM) or Self Assessment Method (SAM).

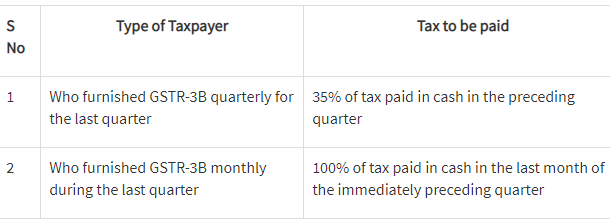

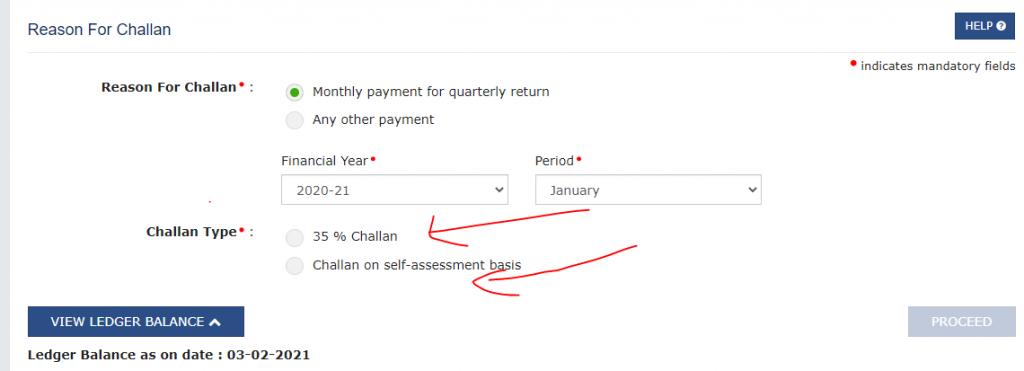

- Fixed Sum Method (FSM):-

Here you can simply deposit 35% of net cash paid by you in your last quarterly GSTR-3B filed or 100% of the net cash paid in your last monthly FORM GSTR- 3B (whichever is applicable).

This will be an auto-calculated system generated challan and no calculation / assessment has to be done by you. Taxpayers may note that no interest would be payable in case the tax due is paid in the first two months of the quarter by way of depositing auto-calculated system generated challan as detailed in by the 25 th of the succeeding month.

The taxpayer must pay an amount of tax mentioned in a pre-filled challan in the form GST PMT-06 for an amount equal to 35% of the tax paid in cash.

- Self Assessment Method (SAM):- This is a similar way where we use to pay our taxes on monthly basis under GSTR3B monthly returns like a taxpayer can pay the tax liability by considering the tax liability on inward and outward supplies and the input tax credit available.

The taxpayer needs to manually asses the the tax liability for the month and needs to pay the same by creating GST PMT-06 challan. (Actual tax due – after adjusting ITC)

NOTE:- To avail ITC for the month – get it from GSTR-2B.

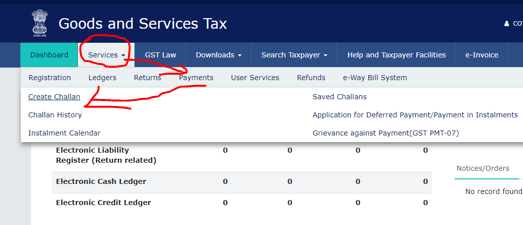

How to create “GST PMT-06 challan” under QRMP scheme?

Step 1.

Go to “Services” => select on “Payments” =>> select “Create challan”

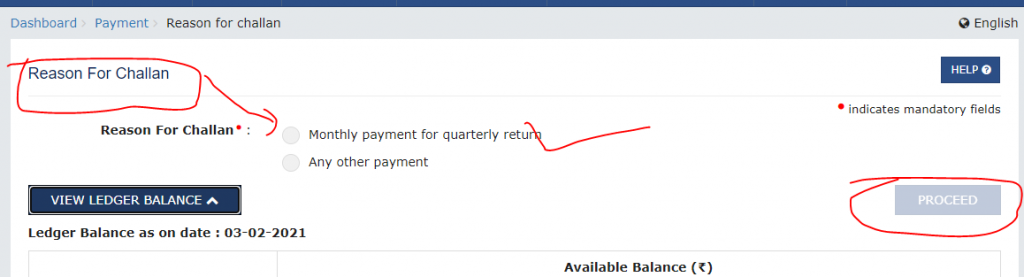

Step 2.

Select “Monthly payment for quarterly return” => Then “Proceed”

Step 3.

Select your Challan type based on your preference

Note:- Taxpayers are advised to check updated notifications etc. for change in dates.

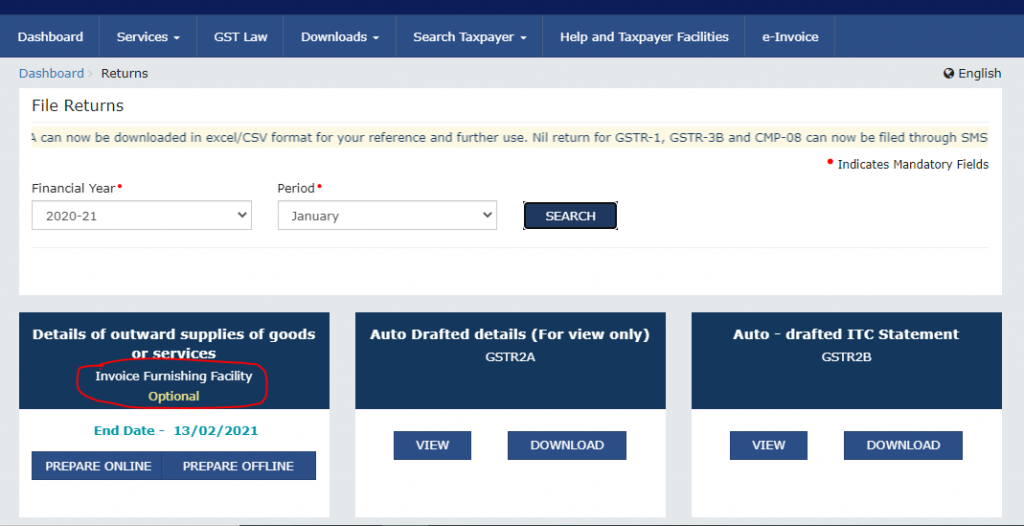

Under QRMP scheme you will get return filing dashboard in this way

Here we have one very important option which needs to be consider “Invoice Furnishing Facility (IFF)”

So, what is “Invoice Furnishing Facility (IFF)”?

Invoice furnishing facility (IFF) is an option which allows a taxpayers to update their outward supplies details of supply made to registered persons for the first two months of the quarter. This option works similarly like general GSTR-1 filling but it will allow filing for B2B invoices, Amended B2B Invoices, credit notes, debit notes and Amended Credit/Debit Notes only.

NOTE:- IFF facility is optional (Not mandatory). The details of invoices furnished under this facility in the first two months are not required to be furnished again in Form GSTR-1.

What is the benefit of “Invoice Furnishing Facility (IFF)”?

Once we will upload the invoice using IFF, it will be displayed in GSTR-2A and GSTR2B of the recipient. Which means received can claim the ITC while filling their monthly returns instead of waiting for 3 months.

What are the due dates of filling under QRMP scheme?

GSTR 1 Due Dates

| GSTR – 1/ IFF | Due Dates |

| Month 1 | 13/02/2021 |

| Month 2 | 13/03/2021 |

| Month 3 | 13/04/2021 |

GSTR 3B Due Dates

| Class of registered persons | Due Date |

| Registered persons whose principal place of business is in the States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep | 22nd of the month succeeding such quarter |

| Registered persons whose principal place of business is in the States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi | 24th of the month succeeding such quarter. |

Video Reference:-