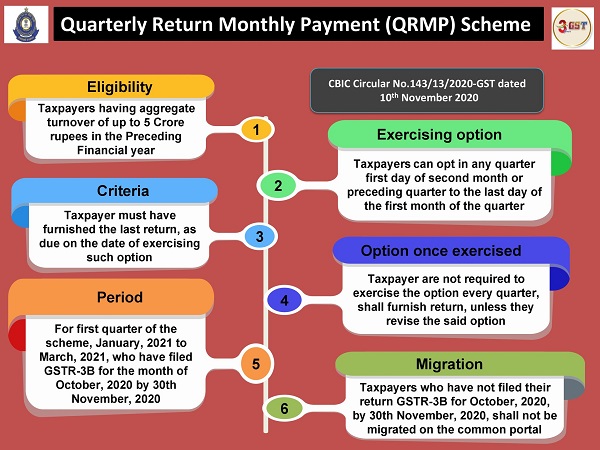

- What is Quarterly Returns with Monthly Payment (QRMP) Scheme?

Quarterly Return Monthly Payments have to follow very few compliances in which small businesses with a turnover of less than 50 million can benefit from this scheme by opting for it. These are very good schemes brought by the Indian Government, in which businessmen can bring their business on a good platform. And you can get your business run by following fewer compliances. In this, we have to make a monthly payment of taxes and do a Return quarterly.

(Note ****This is an optional method, if we want to opt out of quarterly Return monthly payment then we can also opt it out)

- Who all are eligible for the QRMP scheme?

A business that has a preceding financial turnover of up to 5 crores and a current financial turnover of up to 5 crores, then that business can opt for this scheme and take advantage of it.

- What are the pre-conditions for opting for QRMP scheme for a taxpayer?

(a) The business must have a PAN number as well as goods and service tax number.

(b) Business must be a registered person.

(c) Its annual turnover should be up to 5 crores.

(d) Taxpayer must be registered as a regular taxpayer or opted out of composition scheme.

(e) It has filed its (GSTR-3B).

(F) Business must have a correct user ID and password.

(g) And it should not be within the Business Composition Scheme.

- From where can I opt in or opt out from the QRMP scheme?

The Indian government had issued notice till 31st January that those who have to come out of quarterly return monthly payment and go in the monthly payment, they can opt out before 31st January. And if this date is over, now we can opt out in After 31st April.

That’s how we come out of it

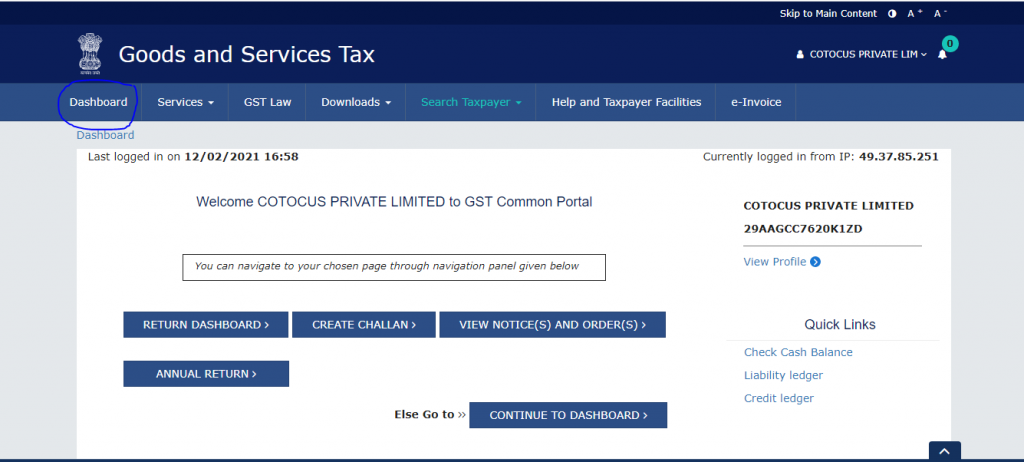

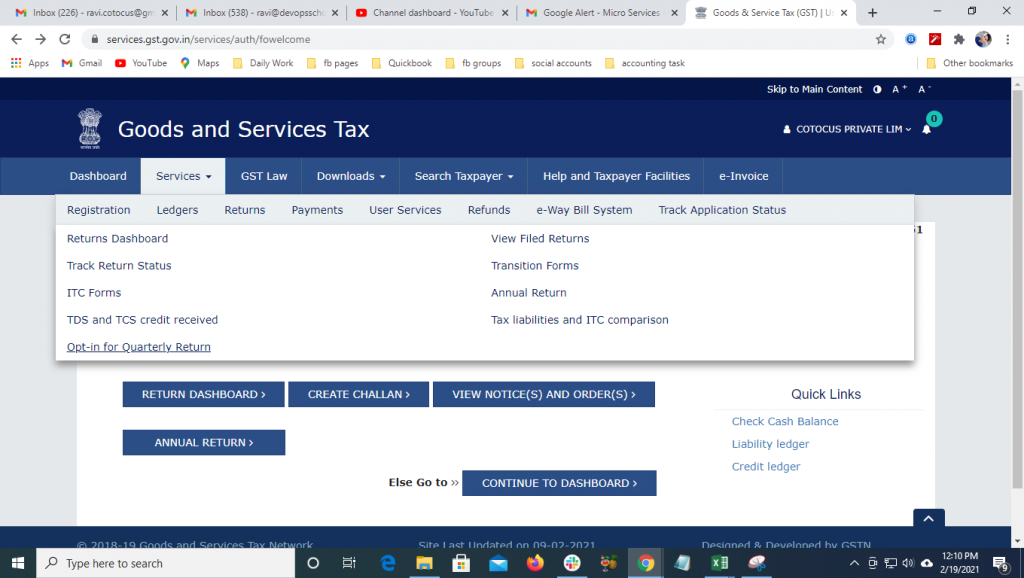

1st step>> Login Your GST Portal >>> Go to Your dashboard

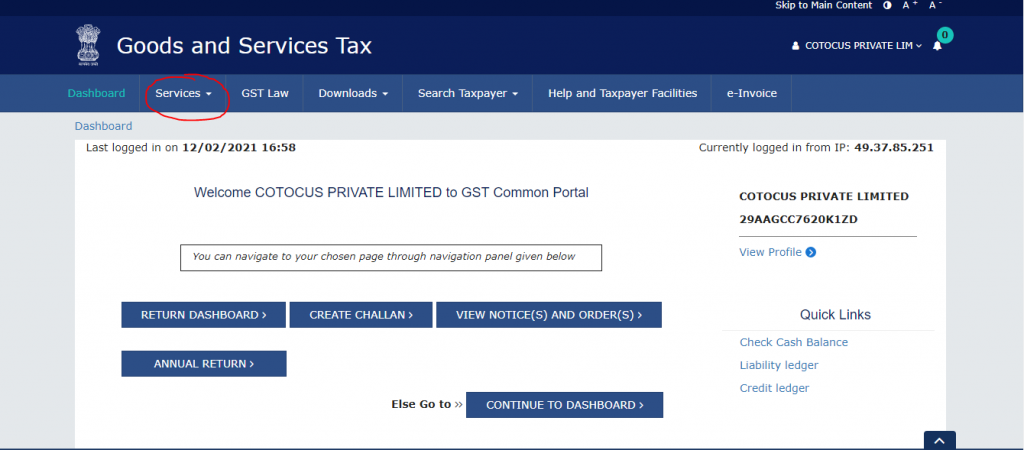

Step 2 >>> Click Services Option

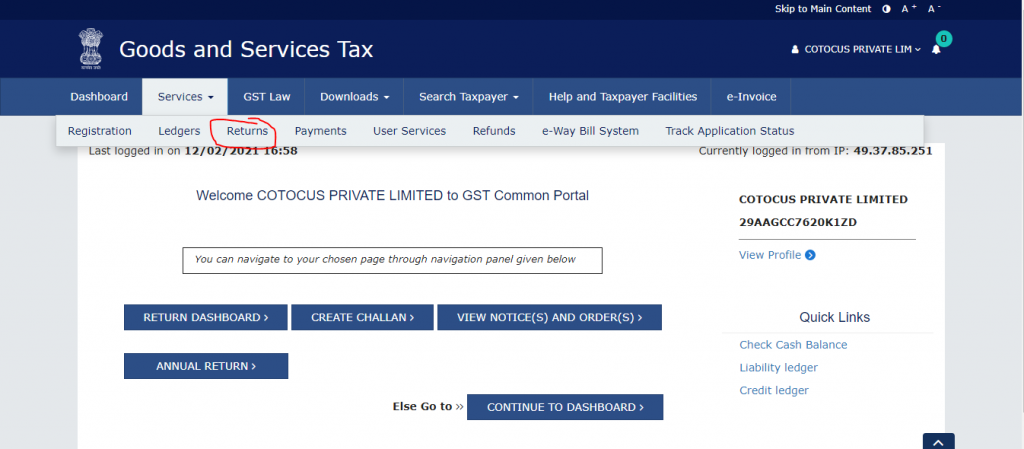

Step 3 >>> Go to the Return option

Step 4 >>> Select opt in for quarterly return

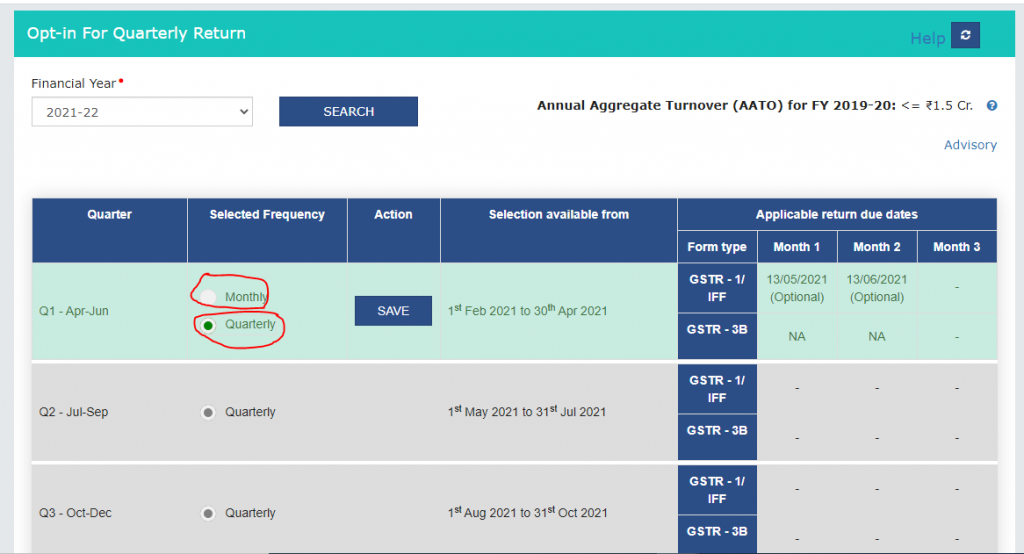

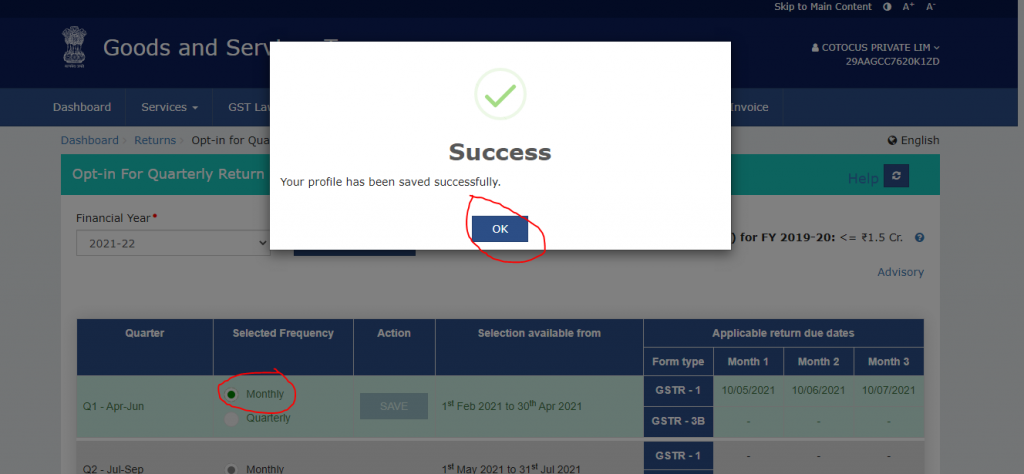

Step 5 >>> Within this, we will get the option to opt in and opt out, if we want to stay in the monthly then select and save the monthly and if you want to stay in the quarterly, then select the quarterly and save it.

Final Step Click on save option

- Whether after opting for QRMP Scheme, can I later opt out?

If the financial turnover of any company is up to 5 crores, then they can opt for this scheme. But we can never be opt out of this scheme suddenly, for this, the government has given time that if we make our payment (quarterly return monthly payment) then we opt out after the end of the quarter. And any company whose financial turnover is more than 5 crores, then they cannot opt for this scheme.