What is GST-PMT09 Form?

When the balance in our cache ledger accidentally moves to different columns, we use GST PMT-09 to bring it into the correct column. If the tax amount has gone to the wrong column, with the help of GST-PMT09 we can bring it to the right column, and that too easily. The government has provided this very good facility to us so that we can now easily transfer the amount of any wrong tax to the right column.

Who is this important for?

If a person is looking at the tax amount in the wrong tax column in the Cash Ledger in the GST portal, then that person can transfer the amount of his electronic cash ledger to the correct column with the help of the GST PMT 09 form. like If the amount of our IGST is visible in CGST, then we can correct it with the help of the PMT09 form.

GST-PMT09 Filling Step

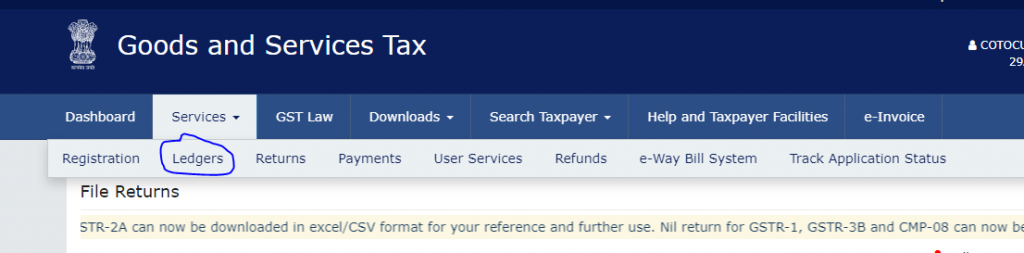

First>>>>> Open your GST portal And go to the Dashboard

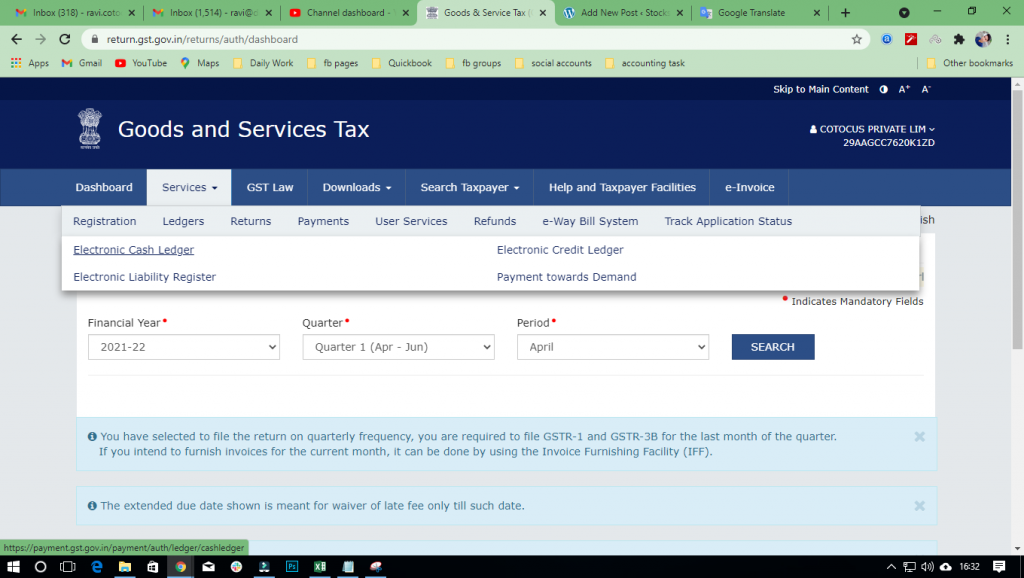

Second>>>>> Go to the Services option and click to the ledger option

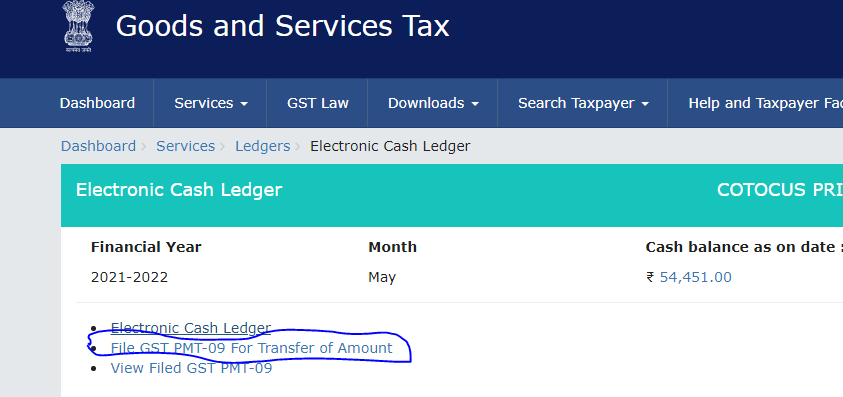

Third>>>>> Click to the Electronic Cash Ledger

Fourth Step>>>>>>>> Go to the File GST PMT-09 for transfer of amount

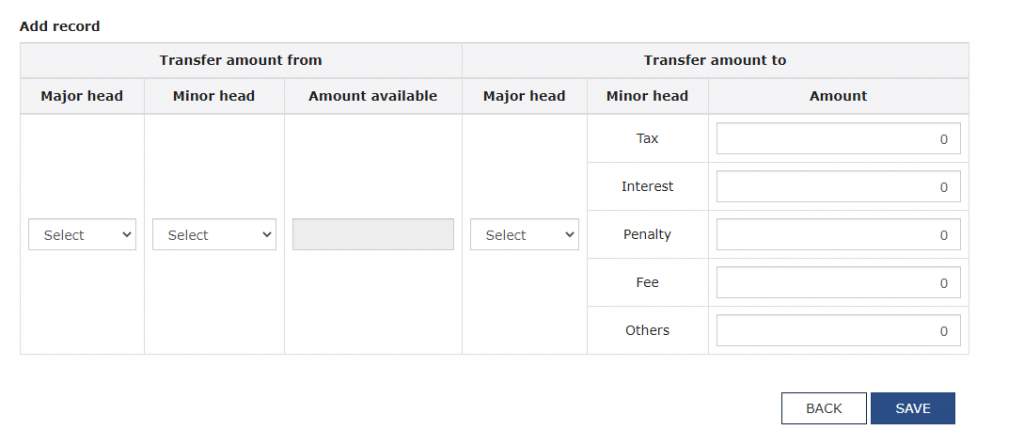

The fifth Step>>>>> Set up your Amount in your correct tax column and save. (Note****** In it, you will have two types of Cash ladder shows.) 1st Cash ledger balance-available for transfer:- In this, it will show how much balance you have in your cash ledger. 2nd Cash ledger balance-preview of updated balance:- When you change something in your cache ledger, it will appear in this column. 3rd Add record:- Whatever your amount appears in the wrong column, you can correct it in the column containing (add record).

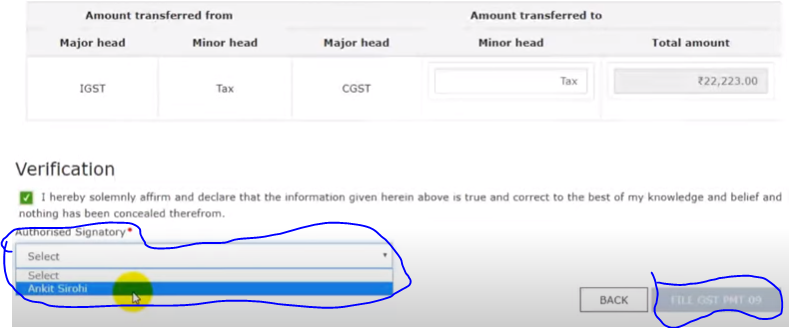

Sixth Step>>>>>> After clicking on save, you have to tick the knowledge and select the author signature and click on the file GST PMT-09.

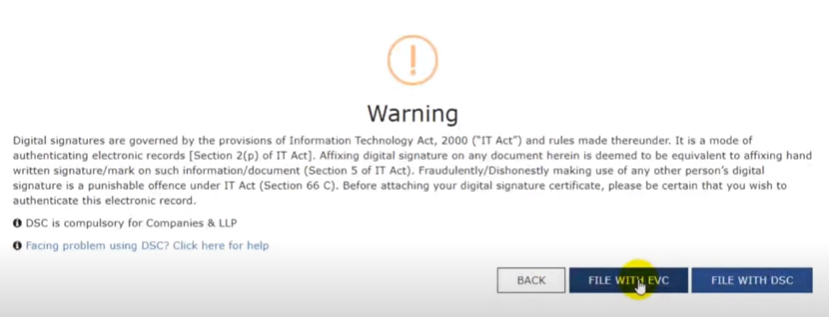

Seven Step>>>>After this, in whatever way you have to file, you can select it and file it. FILE WITH EVC/FILE WITH DSC

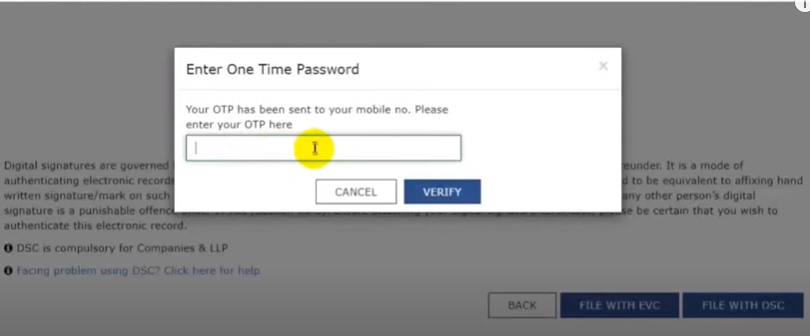

Eight Step>>>> After this, an OTP will come on our registered mobile phone and on our email, which we have to put the OTP option on the portal, after that, we have to click on Verify option and file.

The government has given us a very good option, with the help of which we can rectify the mistakes in the tax column.