Hi Guys,

This is Ravi Verma, In this article, I will tell you about the questions under the GST

let’s begin

- What is GST?

GST is called the Goods and Services Tax. it is an oblique tax that has changed many oblique taxes in India which include the excise responsibility, VAT, offerings tax, and so on. the products and carrier Tax Act became handed in the Parliament on 29th March 2017 and came into impact on 1st July 2017.

In different words, items and service Tax (GST) is levied on the supply of products and services. items and offerings Tax law in India is a complete, multi-level, vacation spot-based tax that is levied on every fee addition. GST is a single domestic indirect tax law for the whole USA.

- What are Inter-state supply and Intra-state supply?

In GST, the terms interstate and intrastate have brilliant significance inside the willpower of IGST, CGST, or SGST. Interstate supply draws IGST, while intrastate delivery draws CGST and SGST. In this text, we take a look at the definition of interstate supply and intrastate delivery in keeping with the GST Act.

Interstate Supply?

underneath GST, the supply of products or offerings from one nation to some other would be called interstate supply. The GST Act defines interstate supply as while the place of the supplier and the region of supply for the patron is in:

Two different States; or

Two special Union territories; or

Nation and a Union territory.

similarly to the above, the delivery of products imported into India, until they cross the customs station is likewise categorized as interstate delivery. also, the supply of products or services to or with the aid of a unique financial region developer or a special financial zone unit is classed as interstate delivery.

Intrastate Supply?

beneath GST, the delivery of goods or offerings inside the identical state or Union territory is called an intrastate supply. however, the delivery of goods or offerings to a special monetary sector developer or unique monetary zone unit located in the equal country would now not be intrastate supply. Any delivery of products or offerings to a special financial region developer or special monetary region unit is assessed as interstate delivery.

- What is RCM?

commonly, the dealer of goods or services will pay the tax on supply. below the opposite fee mechanism, the recipient of goods or services turns into liable to pay the tax, i.e., the price ability gets reversed.

The objective of transferring the weight of GST payments to the recipient is to widen the scope of levy of tax on diverse unorganized sectors, to exempt specific classes of providers, and to tax the import of offerings (for the reason that provider is based outdoor India).

- What is input Tax credit?

Input Tax Credit score approach at the time of paying tax on output, you could reduce the tax you’ve got already paid on inputs. Say, you are a Company – tax payable on output (final) is Rs 500 tax paid on entering (PURCHASES) is Rs 250 you can claim to Input Tax credit score of Rs 250 and you handiest want to deposit Rs 250 in taxes.

- What is the due date for filing GSTR-1?

The due date for filing GSTR-1 is the 11th.

- What is the due date for filing GSTR-3B?

The due date for filing state-wise GSTR-3B is 20th and 22nd.

- What is GSTR-2B?

GSTR-2B is a vehicle-drafted ITC statement this is generated for each everyday taxpayer on the basis

of the records supplied with the aid of his suppliers in their respective GSTR-1/IFF, GSTR-five (non-resident

taxable person) and GSTR-6 (input carrier distributor). The assertion suggests the supply and non-availability of input tax credit to the taxpayer towards each file filed through his suppliers.

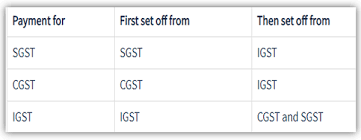

- How GST is set of?

- When E-Way bill is required to be generated?

E-way bill technology is a digital way invoice required to be generated at the time of the delivery of goods by each registered man or woman if the fee of the consignment exceeds INR 50,000.

It means if the cost of one consignment (invoice/ bill/ delivery challan) exceeds Rupees Fifty Thousand, then an E-way bill is needed to be E-way bill generated.

An e-way bill is needed to be carried by means of a person who’s in the price of the conveyance sporting any consignment of goods for which values exceed as prescribed above

- What is the Time Limit to cancel the E-Way bill?

In case wrong facts are entered while generating an E-Way bill, such an E-Way bill can be canceled within 24 hours of generation. a brand new e-way bill shall be created with accurate information.

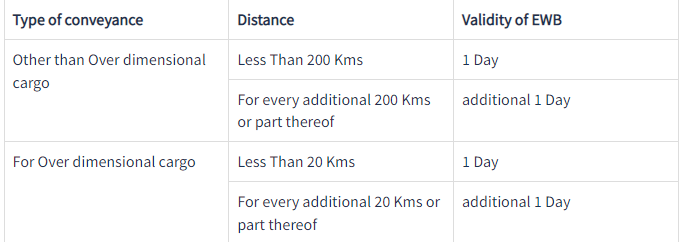

- What is the validity of the E-Way Bill?

An e-way bill is valid for intervals as indexed underneath, which is based on the gap traveled with the aid of the goods. Validity is calculated from the date and time of era of the e-manner bill-

- What is the detail required in the E-Way bill?

- Invoice/ Bill of Supply/ Challan related to the consignment of goods

- Transport by road – Transporter ID or Vehicle number

- Transport by rail, air, or ship – Transporter ID, Transport document number, and date on the document

- What is IFF?

An invoice Furnishing Facility (IFF) facility has been provided to taxpayers below QRMP Scheme (Quarterly filers of shape GSTR-1 and also of shape GSTR-3B returns), as in step with sub-rule (2) of Rule-fifty nine of the CGST guidelines, 2017.

- How much interest rate is in GST?

There are two types of rates under the GST (1) 18%- Tax paid after the due date and, (2) is 24%- If we claimed excess ITC then we will pay a 24% GST interest rate.

- How much the late fee is in GST?

the number of overdue expenses to be paid might be Rs.one hundred fifty, The late fee could be Rs.75 below CGST and Rs.75 underneath SGST. If the above return changed into a return with ‘Nil’ tax legal responsibility then late fees would be Rs. 60, The past charge could be Rs.30 under CGST and Rs.30 underneath SGST.

- What are the time limits for claiming ITC?

The time limit for claiming ITC is 180 days.

- GST implication in case of the sale of fixed assets?

The use time of any property is for 5 years after that this property is removed, so if we sell any immovable property then we claim ITC till the age of 5 years, and if he completes 5 years, then we cannot claim his ITC.