Hey all,

Welcome to my blog! Here, I’ll guide you on the process of a GSTR-1 filling error solution Stay tuned for step-by-step instructions and helpful tips to make your GSTR-1 filling seamlessly. Let’s make the GST process smoother together!

Now, when you fill out GSTR-1, a new popup message appears. This is because many taxpayers are claiming extra credit when filling out GSTR-3B. The GST department has sent a message to all taxpayers, instructing them to pay the extra credit amount before filing GSTR-1. To do this, you can use DRC-01C to make the payment.

Why DRC-01C message is showing on the Dashboard?

This is a form of grievance and by using this form you can able to pay your extra credit amount, So would you pay the extra credit amount? because You took an extra credit amount when you furnished your GSTR-3B form the GSTR-2B.

How to see the mismatch for this error?

If you want to see why this message is showing on your dashboard you just do some small steps.

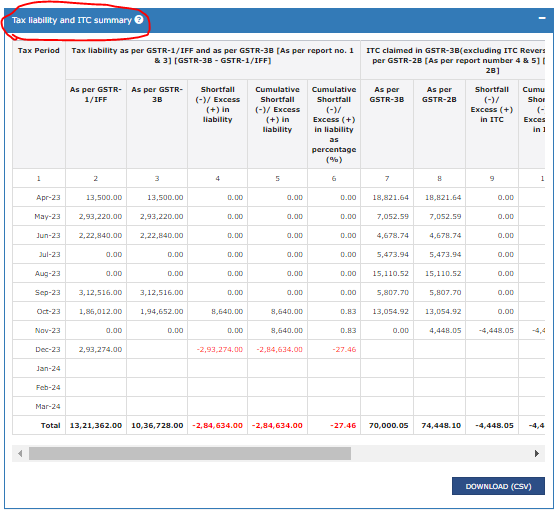

Click on the “services button” -> After that, go to the “Return section”, and in the Return section you can see the “Tax liabilities and ITC comparison” button then click on it after that you can see your GSTR-1, 3B, and GSTR-2B mismatch and also you can see the ITC details here.

Here I am explaining how to send the grievance through the DRC-01C.

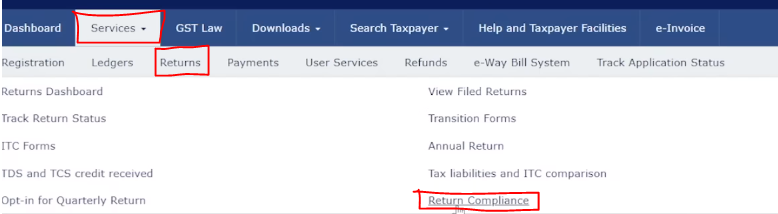

A. After logging into the GST portal, please click on the “Services button” and go to the “Returns button” Under the return section you can see the “Return compliance button” then click on it.

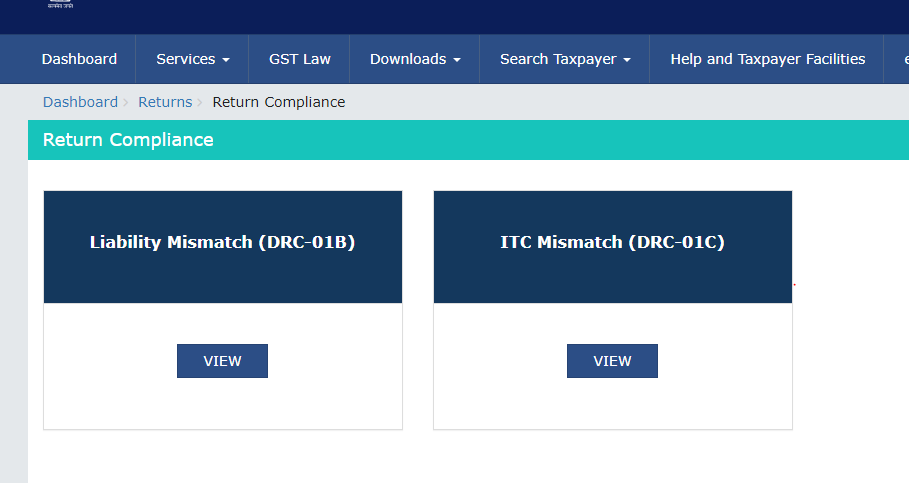

B. After clicking on this button you will be moved to the DRC-01C tab and in this section, you can able to send your request letter to the GST department. Also, there are two columns

1 . Liabilities Mismatch DRC-01B – When your GSTR-1 and GSTR-3 data will not match then the Government will send you a DRC-01B notice for the solution

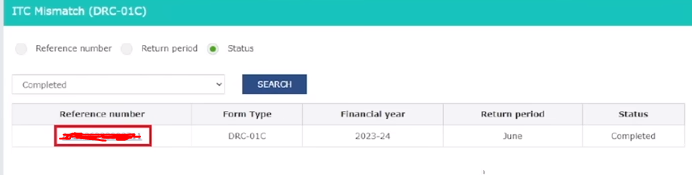

2. ITC Mismatch DRC-01C – When you are taking extra credit during the filing of GSTR-3B from the GSTR-2B then you need to pay the extra credit amount through the DRC-01C form.

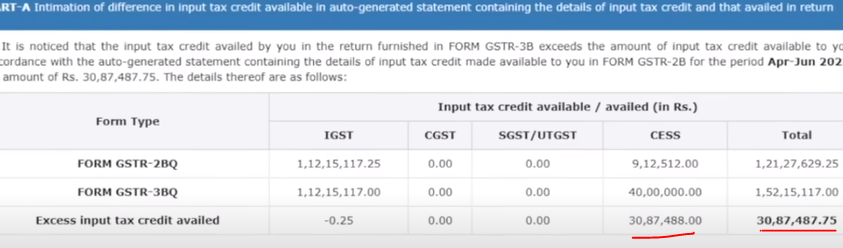

C. After that, you have to click on the “DRC-01C tab” and you can see the latter then click on it.

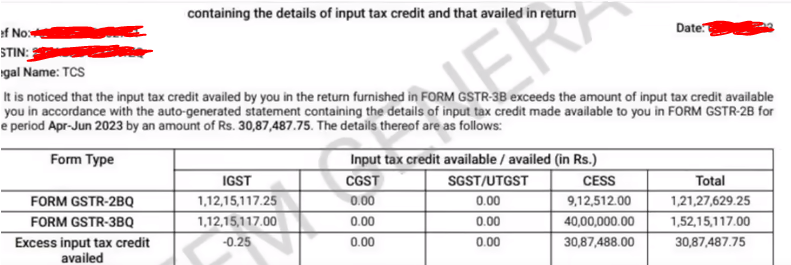

D. After clicking on it, you can see the different structures between the GSTR-2B and GSTR-3B.

E. If, you would have to pay the extra credit amount you can use the DRC-03 form to pay your Liabilities.

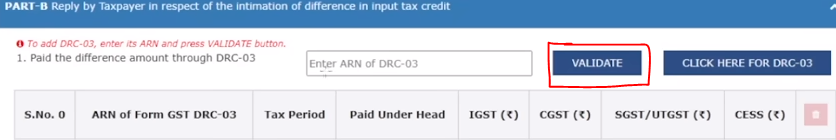

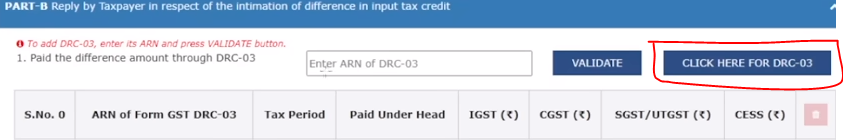

F. After the payment of your liabilities, please go to the DRC-01C tab enter the ARN number and click on the validate button.

G. After clicking on the Validate button all the details will show on the Dashboard on the downside, So after seeing your details please click on the DRC-03 button and validate your transaction.

H. If there is an adjustment issue for this notice then, please select the adjustment reason, attach your supporting documents, tick on the declaration option then click on the save button. After clicking on the save button, the DRC-01C button will be enabled to use then click on this button and submit your request to the GST department so that, the department will notify you shortly.

I. After that, your preview will be showing on your Dashboard so you can check the details from the preview draft.

J. After that you will receive the payment completed message on your DRC-01C dashboard.

Thanks,

[…] https://www.stocksmantra.in/drc-01c-error-on-gstr-1/ […]