Zerodha – 14 Nov 2023

What do you do if everyone equates your brand image with that of a boring, old company that caters primarily to Gen-X or the boomers? What do you do to change that narrative?

Well, if you’re Dabur, you announce that you have a war chest of ₹7,000 crores that’s waiting to snap up new-age startups! You say that you’re eyeing digital-first brands. You say that you’ll market directly to customers (D2C).

It looks like Dabur realised that investors have been ignoring it of late — in the past 5 years, Dabur’s stock price has risen only by 40% while the Nifty FMCG index has soared by over 80%. So Dabur needed to fire a warning shot; tell everyone that it might be down but it’s not out.

But wait…what ails Dabur in the first place, you ask?

As with most stories, we first have to trace its 140-year evolution. You see, back in 1884 , Dr S K Burman started a company selling Ayurvedic medicine in the streets of Kolkata (then Calcutta). He wanted to use natural remedies to battle malaria and cholera. And the idea clicked. People trusted these concoctions whose recipes were passed down from generation to generation. And when he saw the success of the business in Kolkata, Dr Burman felt the need to expand. So he began sending these medicines by mail to people in smaller towns and villages who needed them too.

Dabur, the company, was born. And its image as a purveyor of Ayurvedic remedies especially for the rural masses took root. Cut to today, as per a report by Emkay Research, Dabur has a 53% category share in Ayurveda-based products (such as hair oil, toothpaste, supplements) and 45% of its revenues come from the rural segment.

But here’s the thing. This legacy seems to have become a bit of a roadblock for Dabur.

You see, younger customers don’t seem to be enamoured by Dabur’s products. And the rural segment has been going through tough times economically. The end result is that its sales has grown at just 8% annually in the past 5 years.

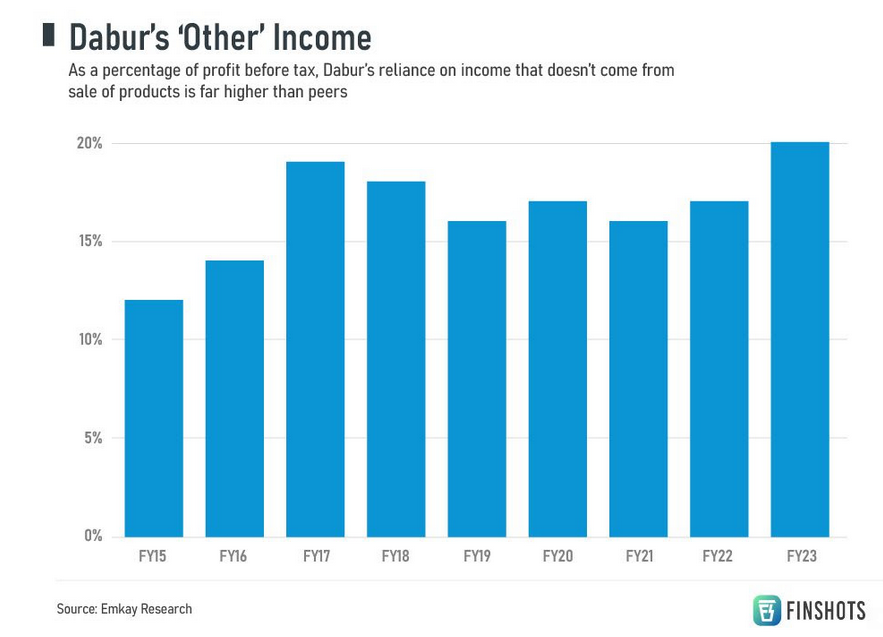

And maybe Dabur was quite comfortable staying in its existing lane before. Because it doesn’t seem to have done much to revamp itself and innovate either. Just look at how much the ‘Other income’ category contributes to their Profits Before Tax (PBT). Emkay Research’s report puts it at a whopping 20%. It’s one of the highest in the sector. Basically this means that the company has built up its cash over time, maybe it invested it into some bank deposits or mutual funds, and then eked out an income from it. Okay, so it’s not really idle, but you get what we meant.

To put things in perspective, ITC earns 10% of its PBT from such income, HUL squeezes out 5%, Marico gets 8%, and Emami earns 4.5%.

Now you be the judge of whether Dabur earning a fifth of its PBT from other sources is a good thing or not. But it’s no wonder Dabur’s war chest has ballooned to ₹7,000 crores, eh?

And it has finally decided to change the narrative around its stock and put this cash to use.

So, how’s it going about its business now, you ask?

Well, one use of this cash is to go the inorganic route. Dabur wants to make some acquisitions and snap up smaller companies that operate in a similar space. We’re talking about the Direct-to-Consumer brands that have built a loyal fanbase among the younger audiences. This way, Dabur doesn’t need to work hard at building a new brand and splash the cash on marketing it. The existing revenues get added into its own coffers and it just needs to expand what’s already there.

Now some might say that Dabur missed the D2c bus. That while rivals were snapping up brands — like ITC buying Yoga Bar or Tata Consumer Products buying Soulfull or Marico taking a stake in Beardo — Dabur didn’t really make these kinds of acquisitions. But here’s the thing. Sitting on the sidelines might turn out to be quite a prudent decision.

Why’s that you wonder?

Well, the funding tap has kind of dried up for D2C brands. In the first 8 months of this year, D2C startups have seen an 82% fall in funding compared to the same period last year. The growth capital has gone missing. And if companies are burning a lot of cash, they may end up on the chopping block soon. And Dabur, with its war chest, could be waiting to pick up the pieces at a much lower valuation. We’ll have to see if it pans out this way.

And since Dabur’s already a rural distribution giant, it could tke the D2C brand to all parts of the country though offline channels. It could be quite a revenue boost.

The other thing is that Dabur’s trying to tap into the digital-first nature of the younger generation. As per The Ken , Dabur has been launching new products exclusively on its e-commerce channel with brand new packaging. Packaging that appeals to say Gen-Z.

And maybe this is working already. Dabur says that 9% of the business comes from its e-commerce channel already and claims it’s the best in the industry. Now we do have to say this might be just one of those hot air claims because Emkay Research’s report reveals that rival ITC earns 10% and Marico gets 11% of revenue from e-commerce to.

But at least, Dabur is showing intent.

Then there’s the matter of premiumisation.

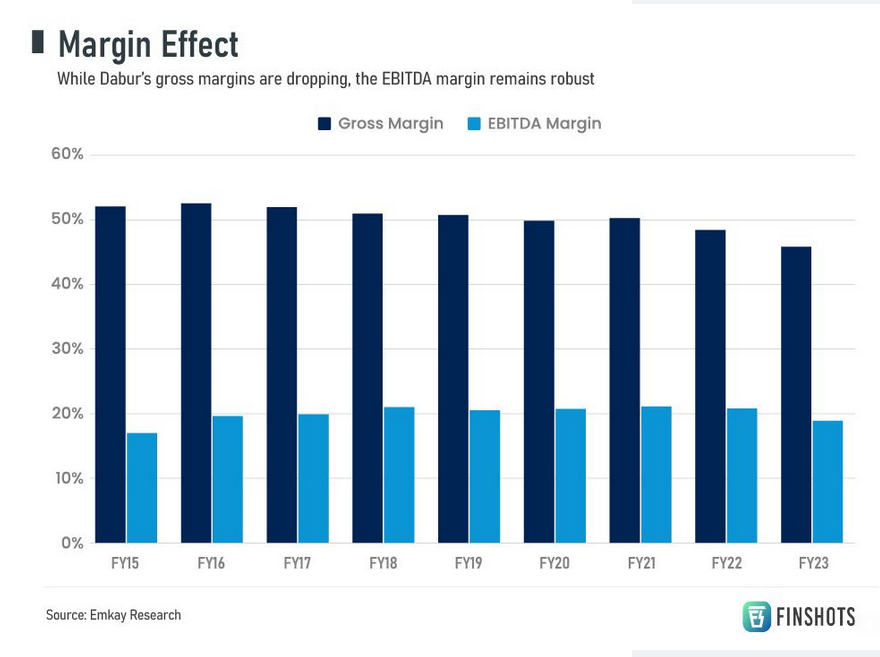

See, the gross margins for Dabur has been a bit of a concern lately. It hit a high of 52% in FY15 and it’s been on downward trajectory since then. In FY23, it was just 45%. Now think of gross margin as the percentage difference between the revenue earned by the company over the cost of the products it is selling. If the company faces higher raw material cost due to inflation but can’t charge higher prices from customers, it starts to pinch. And that’s the position Dabur is in right now.

So why isn’t Dabur able to raise prices then, you ask?

One theory is the dependence on its rural segment which contributes a bug chunk of its revenues. And let’s just say that this part of the economy has been going through some weakness.

But hold on…despite this, Dabur’s EBITDA (earnings before interest, tax, depreciation, amortisation) margins remain robust. How’s that possible?

Well, it looks like Dabur’s been aggressively cutting costs to keep its profitability margins intact. And that cost cutting is primarily happening in its advertising efforts — this has fallen from 14% of revenue to a mere 6% in the past decade. On the other hand, its rivals have picked up pace in their advertising.

So Dabur can’t keep relying on this strategy forever. It needs to find a way to sell higher priced products. And that’s where premiumisation comes in. The simplest example is in the form of Odomos . Earlier this mosquito repellant was sold only as a cream, but then Dabur premiumised it with a spray, a roll-on and even extended it to liquid vaporisers through its e-commerce channel.

At the moment, these premium products make up less than 10% of its portfolio, and Dabur’s pretty keen to improve on this figure.

So yeah, put all this together and Dabur seems to believe that it has unlocked the holy grail to growth. And over the next 5 years, it has quite an ambitious target — grow the home & personal care, healthcare, and food & beverage business by 14% annually.

But remember, Dabur’s only grown sales by 8% annually in the past 5 years. So it’s not going to be easy. Now we’ll just have to wait and see if Dabur can really rewrite its script as an FMCG company or whether it’ll find that its ‘boring’ brand image isn’t that easy to shake off.