Hi Guy’s

This is Ravi Verma, In this article, I will tell you about how to file CMP-08 under the composition scheme,

Let’s start,

- What is composition scheme?

A small number of compliances have been brought under this scheme by removing many compliances, due to low compliance small businesses focus on their business and their business grows.

In this scheme, the turnover of any person is 1.5 Crore can opt for this scheme and in this scheme, the taxpayers have to file only a limited number of returns.

- GSTR-4

- CMP-08

- GSTR-9A

- Filing process of CMP-08

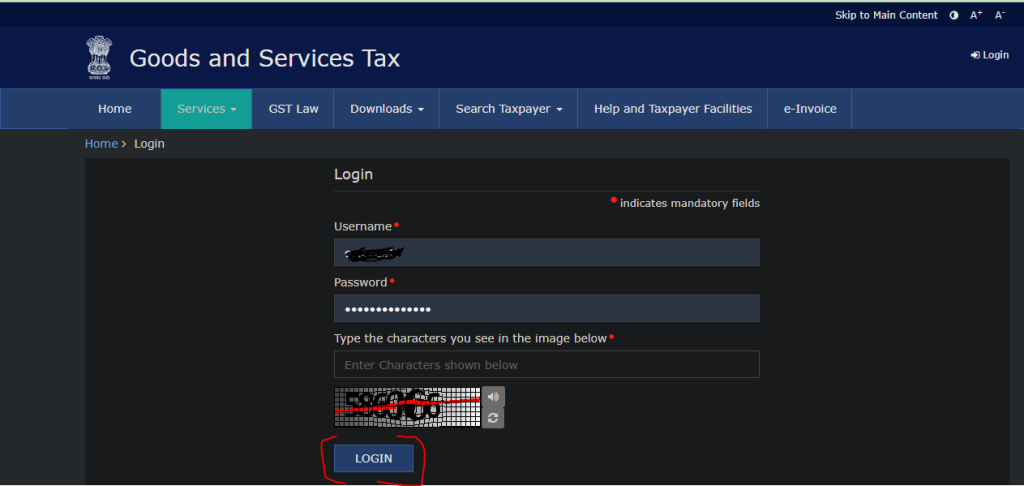

- Log in to your GST portal with your User ID and Password and also enter the captcha code.

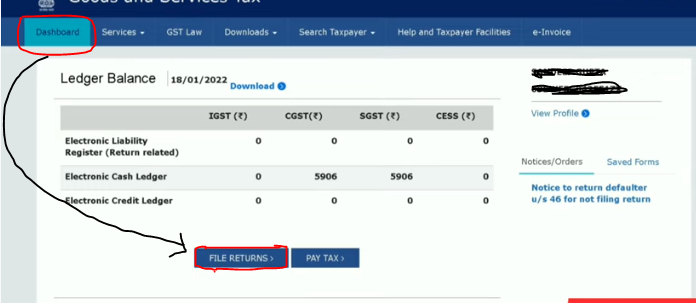

2. Go to the Dashboard and click on the FILE RETURN button.

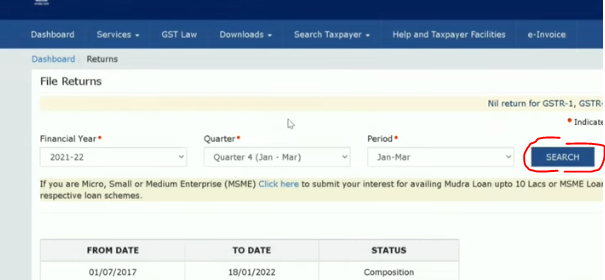

3. Select your financial year, quarter, and your period, and click on the search option.

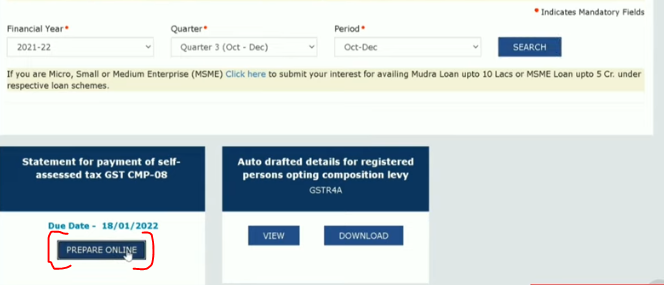

4. After clicking on the search button you will see the option of CMP-08 then click on Preparation Online

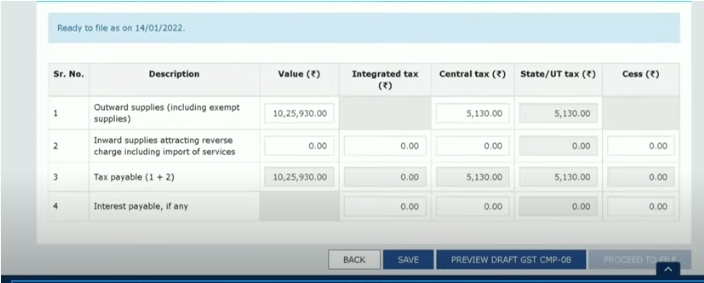

5. Inside this, you will see 4 columns which you have to fill.

. Outward supplies (including exempt supplies):- In this column, you’ll need to report all your sales types. And according to the nature of your business, you have to calculate the tax on your sales and submit it to the government.

. Inward supplies attracting reverse charge including import of services:- Whatever you have imported in this and if the tax is to be paid through reverse charge mechanism, then you will also have to put it.

. Tax payable (1+2):- Any taxes you paid in columns 1 and 2 will appear in this column.

. Interest payable, if any:-If you have not filed your return on the due date then the penalty will be applicable to you.

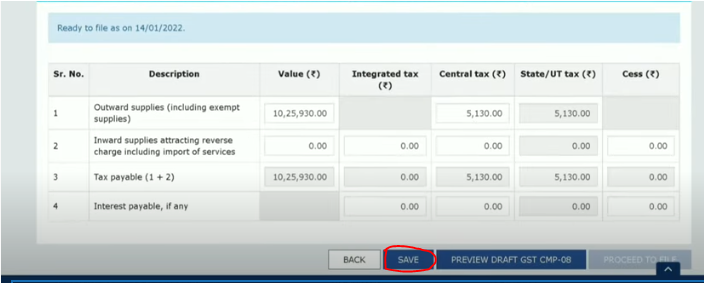

6. After doing all these things, please click on the save button.

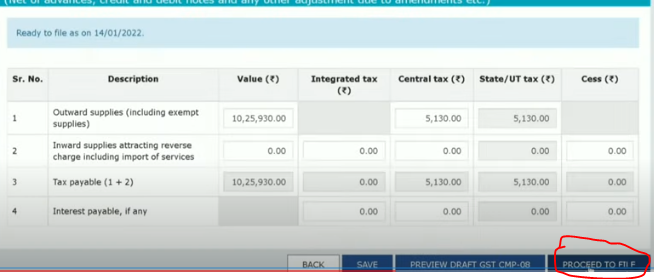

7. Once you click on the save button you will be able to go to the proceed to file button and then click on it.

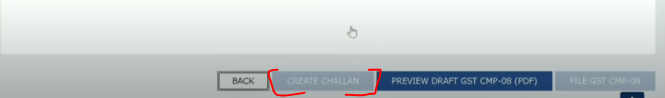

8. Click on CREATE challan bottom and enter your tax amount under this challan.

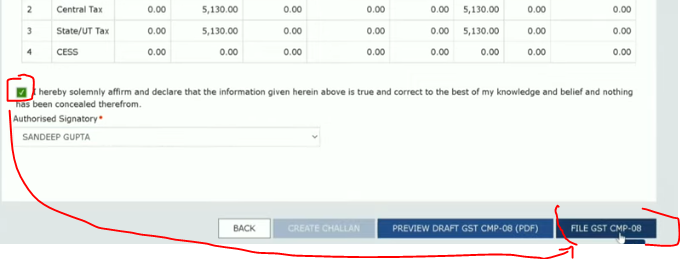

8. After that, tick the notification option and select your authorized signatory, finally click on the FILE GST CMP-08 button.

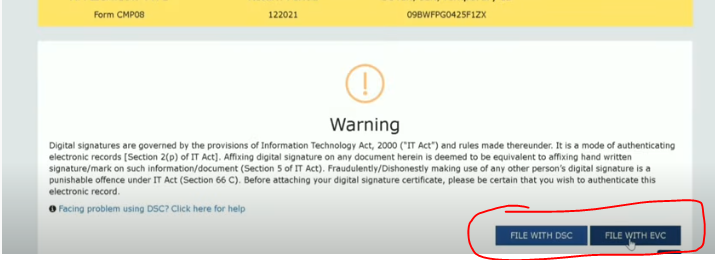

9. Now you have to file your return with the help of your digital signature / electronic verification code

The late fee of CMP-08 is Rs 200 per day i.e. 100 CGST and 100 SGST. This late fee does not exceed Rs.5000.

in addition to late fees, the taxpayer is also required to pay interest @ 18% per annum in the event of failure to make payment within the prescribed due date. Such interest is to be calculated on the amount of tax payable.

Thanks,