Analysis from Zerodha 28 Nov 2023

India’s only listed depository hit a massive milestone of 10 crore demat accounts. The number of demat accounts has jumped by nearly 5x since 2020. So in today’s Finshots, we have to talk about the business of the Central Depository Services Limited (CDSL).

The Story

Imagine the Indian stock market is on a bull run. Or at least, on the cusp of it. How would you play the story?

You could simply buy an index. Something like the Sensex 30. This way, you can ride the rally without worrying about which stock to pick. Or you might bet on a beneficiary of a bull market. We’re talking about brokerage firms. You figure that if people are excited about investing, they’ll first need brokers. So these entities will make more money. Or maybe you bet on a mutual fund company. You see those ads saying ‘Mutual Funds Sahi Hai’ (Mutual Funds Are Great) frequently popping up on the TV. And believe that it could nudge people into investing through mutual fund schemes.

But what if we told you there’s another proxy play for a stock market boom?

It’s a business-to-business (B2B) company that simply does the grunt work in the background. We’re talking about Depositaries. Or more specifically CDSL. And this stock has been beating the others hands down. In the past 3.5 years, CDSL has soared by nearly 700%. In comparison, brokerage firms 5Paisa Capital and Aditya Birla Capital, financial services companies that sell mutual funds, insurance, and even loans, have only risen by 300%.

But wait…what exactly is a depository’s role?

Well, to understand that, let’s rewind a bit. See, the 90s was the Wild West of stock market investing in India. Scams were aplenty and big investors were always trying to rig certain stocks in their favour. We’re talking about the infamous Harshad Mehta scam, of course. Transactions were conducted offline. If you wanted to buy a share, you’d have to call and place an order with your broker. Their representative would be on the stock market floor shouting out the order. And once people shook hands, the share certificates would get sent from one corner of the country to another. This was the only proof of ownership. But many times these certificates never showed up at the buyer’s doorstep and when it did, it turned out to be fake.

It was a massive problem.

Apparently, the first solution proposed was to store all the share certificates deep inside a mountain in the Western Ghats. But you can imagine that this was a costly proposition. That’s when another idea popped up — ‘dematerialisation’ of shares. This would eliminate the need for the physical certification altogether and just keep the details on a computer. An investor would open a ‘demat’ account and everything would be done online.

Now the ones in charge of making this happen would be a Depository. They would be the safekeepers. And whenever an investor bought a stock, the depository would just mark them as the beneficial owner. A simple digital entry.

And this changed the face of investing in India. In 1996, NSDL, the first depository emerged in India. They were promoted by the National Stock Exchange of India. And because monopolies are never a good idea, a rival promoted by the Bombay Stock Exchange emerged in 1999 — the protagonist of this story, CDSL.

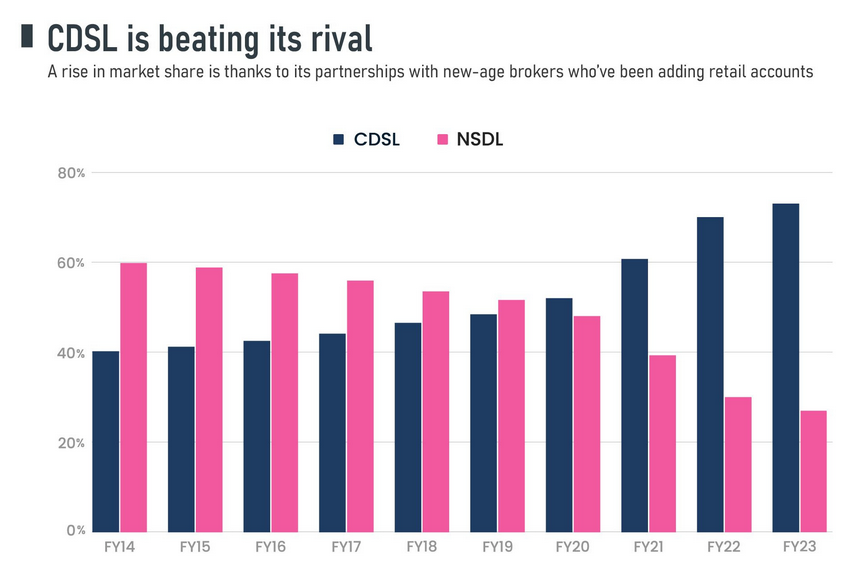

Slowly but steadily, CDSL began to snatch market share from its rival. And over the next 14 years, it managed to control a 40% share of demat accounts. But in the past decade, the growth has been even swifter. It now commands a whopping 73% share of demat accounts and it’s rising everyday.

How did CDSL make this happen?

If you remember, the mid-2010s was when new-age discount brokers began to pop up. The ones like Zerodha* which primarily cater to retail investors like you and me. And somehow, CDSL struck up quite a solid relationship with these entities. So when the retail investors began to flock to the stock market, a majority of the new demat accounts opened went to CDSL. Meanwhile, NSDL had focused on institutional demat accounts in the past and that didn’t grow quite as quickly.

But it’s trying to do more. Slowly, CDSL has been diversifying its core business.

In 2006, it set up a subsidiary called CDSL Venture Ltd (CVL) whose core job is to run KYC (Know Your Customer) checks. So if an investor is opening a new account and the broker or the mutual fund company wants to check if the person’s Aadhaar and PAN are verified, that’s where CVL comes in. It authenticates the investor. At the moment, this subsidiary contributes 18% of CDSL’s profits.

Then in 2011, it extended a service to the insurance industry. So if you buy a bunch of insurance policies (maybe through our parent company Ditto Insurance) and you want them all to be stored in a single electronic folder, CDSL helps with that too. But this business doesn’t contribute to CDSL’s top line yet.

Now the thing is, providing all these services does not require truckloads of capital either. It’s a low-cost IT business of sorts. As Ambit Capital puts it in the report, all CDSL needs are computers and a bunch of employees. These two bits make up 60% of the company’s costs. But, CDSL has been able to keep these costs in check too — these costs are lower than NSDL. So the end result is that CDSL’s EBITDA (earnings before interest, taxes, depreciation and amortization) has grown at a faster rate than the growth in revenues itself. That’s quite a nice green tick for the company.

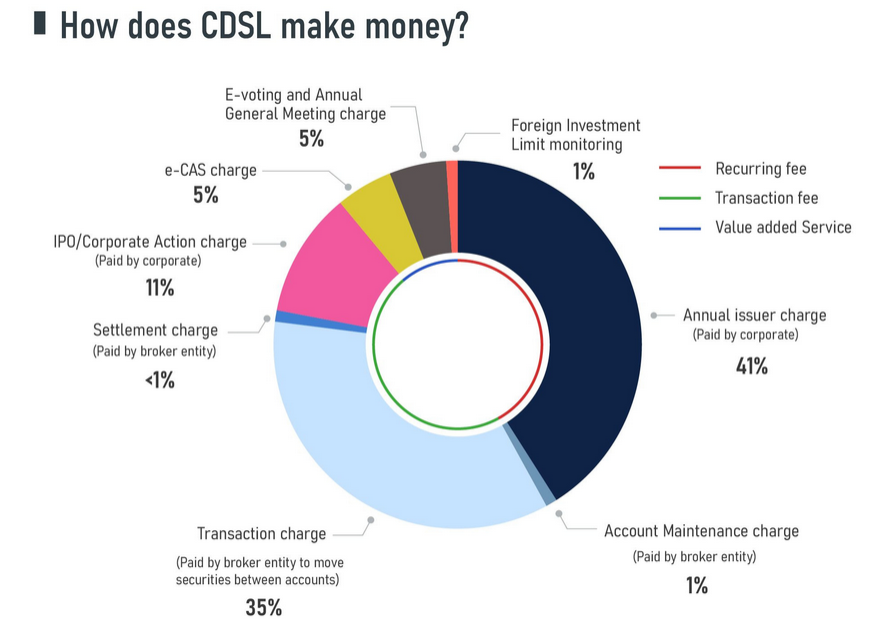

So imagine this business in the midst of a bull run. People want to invest so they open demat accounts. CDSL earns. People trade more often. So for every sell order, CDSL pockets a fee. And as more startup unicorns decide that it’s time to stop raising money from VCs (venture capital firms) and look to retail investors instead, CDSL gets to charge them a few bucks for issuing securities too.

And with demat penetration in the country at just 8% compared to 15% in peers like China, you can see why people are excited about its prospects.

But before you rush to hit the ‘buy’ button, we do have to tell you about the risks too.

For starters, everything’s hunky dory in a bull market, but, when the tide changes, people won’t touch stocks with a barge pole. They’ll stop trading. Even IPOs will be put on the back burner. And these revenue sources will dry up for the company. It has happened each time there’s been a bear market during the past 15 years. And the thing is, nearly 60% of CDSL’s revenues are linked to these market cycles.

Also, there’s the matter of the depository business being highly regulated. See, if depositories need to tweak prices, they need the regulator to sign off on it. And as per Ambit Capital’s report, Transaction Charges have remained the same since 2004 while Issuer Charges haven’t been tweaked since 2015. Despite that, CDSL has been raking in the money and operates with a nearly 60% EBITDA margin. So you might even get a situation where the regulator says, “Look, you’re making a lot of money. So we recommend that you cut your charges. We think it’s in the best interest of investors.” If that were to happen, it could impact the profitability quite a bit.

So yeah, while CDSL is cashing in on the current stock market boom, don’t forget to take the success with a pinch of salt too.