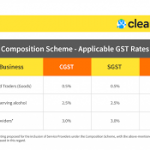

The first question that comes in this is that the eligibility for the composition scheme is individual, the first of which we have to check 2 points to check its Scheme. Which is the most important. Whoever can become a competition dealer has to follow certain rules and regulations only […]

Continue readingCategory: GST – Tax – TDS – MCA

Limited Time Offer!

For Less Than the Cost of a Starbucks Coffee, Access All DevOpsSchool Videos on YouTube Unlimitedly.

Master DevOps, SRE, DevSecOps Skills!

What is GST Composition Scheme?

The purpose of this GST scheme in IndiaThose small companies used to get a lot of problems in running their company.His most important problem was that to run his business, he had to take a lot of complexes, due to which he used to come to problems in running his […]

Continue readingwhat is GST (goods and service tax)

GST is a kind of indirect tax, its full form is Goods and Service Tax.This bill was passed in India on July 1, 2017, so that any goods or services will be taxed only.Because before this all were taxed separately and more.Whose amount was too much. And now due to […]

Continue readingCONCEPT OF GST

In this way, we can expand this in our Language. Before coming to GST India, we used to have total 14 types of tax due to which different tax was paid on each place. Every state used to keep its own tax rate that if any sale or purchase of […]

Continue readingGENESIS OF GST IN INDIA

THE genesis of ideas in India was the Gelcoat task force in 2004 who recommended the fully integrated GST idea in India on a national basis. Central budget (2007-2008):-those inseminates and the government and its central budget are wise just due to being implemented. In India with the effort from […]

Continue readingFEATURES OF INDIRECT TAXES

If we take India in the taxes one of the important sources of revenue and only in the world wide indirect tax is the major source of tax revenue and it continues to grow because many countries are actually shifting to the consumption tax regime, (a)In India more than 50 […]

Continue readingINTRODUCTION TO GST IN INDIA

(A)GST IN INDIA AN INTRODUCTION *background of taxes:-if you take any country it is actually the responsibility of the government to fulfill the increasing devolvement needs of its people and how the government can fulfill them by getting all public expenditure.If you take in India:-India is still a developing economy […]

Continue readingSTATEMENT OF CASH FLOWS & OTHER COMMON REPORTS

The net cash increase for the period is XXXX amount indicated in item number five it is a total of three activities operating activities investing activities and the financial activities cash at the end of the period this is going to be the total of cash of the beginning of […]

Continue readingSTATEMENT OF CASH FLOWS & OTHER COMMON REPORTS- 2

Statement of cash flow The statement of cash flows shows the flow of cash within the business, including where it came from and how it was spent during a specific time period. Cash flows is categorized into 3 types of activities 1 operating activities:- shown how much cash was generate […]

Continue readingADD CUSTOMER AND VENDOR. ENTER AR- AP BEGINNING BALANCE SHEET

Set up customer &beginning balance Quickbooks will open an online dashboard. Then click on the option of the cell. We will open the customer inside it. And whoever is the customer will add them with the signaling balance. Scroll to the bottom and open the import process. And if the […]

Continue readingmonth-1 RECEIVE PAYMENT FORMS

Receive payment We will open the Quickbooks online account, then go to the report section of the dashboard and open the balance sheet and duplicate it by right-clicking the mouse. Then will open the trail balance and P&L account. After checking the transaction, I will come back to the dashboard […]

Continue readingMONTH 1 SALES RECEIPT &DEPOSIT

Sales receipt part-1 We will open the dashboard and go to the balance sheet in the report and open the date and look at the sales to see what stage are the sales in the report and then we will also open the profit and loss account and trail balance […]

Continue readingMONTH 1 RECEIVED INVENTORY AND LINK EXPENSE FROM TO

Inventory payment link to p.o Open the Quickbooks online, click on the plus icon in the country board. Go to the Money option and click on Add Expense. So its interface will open and from that, we have to select the inventory. Then a column will come in it, it […]

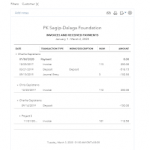

Continue readingMONTH-1 PURCHASE ORDER AND INVOICE:

Purchase order Open the QUICKBOOKS, click on the tool plus icon in the dashboard and open the send purchase order in the money out, then its interface will open in that we will email the vendor name and also fill all the columns. And there are also important order dates […]

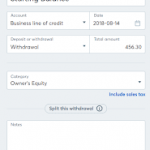

Continue readingADD ACCOUNT & BEGINNING BALANCE,CHECKING,CREDIT CARD,NOTES PAYABLE,EQUIP.

Add Bank Account First We will open the dashboard of QuickBooks Online and click on the Chart of Accounts option in Accounting to add a new bank account, then it will show us physical type accounts such as current assets, current liabilities, inventories. We will click on the new button […]

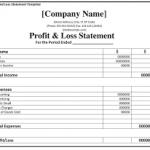

Continue readingPROFIT AND LOSS OR INCOME STATEMENT REPORT

Profit & loss Click the option of Report in the Dashboard of Quickbooks Online and go to the standard report, after that we will open Profit and Loss by clicking and the date for which the balance sheet is to be checked. In this, we can also check the entire […]

Continue readingBALANCE SHEET REPORT

Balance Sheet format report option In the 1st dashboard, you will click on the report option and open the date in the balance sheets. After that, we will click on the upper-cost option, we will fill all the options in it and we can also change the header and footer […]

Continue readingENTRY FOR THE SECOND MONTH OF OPERATION

Short term investment deposit In this, we will open the dashboard and go to the balance sheet and look at the short term investment in it, how my short term investment happened, we will then click the plus icon provided in it, and in that area, I will open the […]

Continue readingENTER DATA FOR THE FIRST MONTH OF OPERATION

Journal report and financial statement 1st we want to check the month for which we want to check the report, click on the report option and go to date and run and report the run, after that we will check the total liabilities and then check the total assets both […]

Continue readingENTER DATA FOR THE FIRST MONTH OF OPERATION

Job or sub-customer sales receipt Now we are going to the dashboard and go to the sales item .now we click into the plus icon and choose the customer on the left-hand side and within the customer section, we are looking for the sales receipt. we are going to select […]

Continue reading