What is Quarterly Returns with Monthly Payment (QRMP) Scheme? Quarterly Return Monthly Payments have to follow very few compliances in which small businesses with a turnover of less than 50 million can benefit from this scheme by opting for it. These are very good schemes brought by the Indian Government, […]

Continue readingCategory: GST – Tax – TDS – MCA

Limited Time Offer!

For Less Than the Cost of a Starbucks Coffee, Access All DevOpsSchool Videos on YouTube Unlimitedly.

Master DevOps, SRE, DevSecOps Skills!

How Many Compliance Any Company Has To Complete After Starting the Business

COMPLIANCE:- Compliance means that in order to do any work properly, we have to follow all the rules and laws made by them so as not to bear any loss beyond. While starting any business in India, all the rules made by the Indian Government should be followed. Everything a […]

Continue readingGST FULL DETAILS AND ITS FILING DATES

TAX PAYING DIVIDED INTO TWO CATEGORY ‘X’ AND ‘Y’ X CATEGORY:- Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union Territories of Daman, Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands, and Lakshadweep. Y CATEGORY:-Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar […]

Continue readingImportant Dates

TDS is deducted from the income of all persons in India as per the rule of the Indian Government. But whoever deducts TDS has to submit it to the government. Which we do every three months DUE DATE FOR FILLING TDS RETUN FINANCIAL YEAR 2020-2021 OUARTER QUARTER PERIOD QUARTER ENDING […]

Continue readingUSEFUL ACCOUNTING RESOURCES FOR MONTHLY AND YEARLY COMPLIANCES

TDS (Tax Deducted At Source) These are the rules made by the government, in which the government is monitored by any of your income and as soon as you get any profit which falls under the rule of tax deducted At source, then the government is first paid tax. The […]

Continue readingINCOME TAX RATE SLAB FOR PRIVATE LIMITED COMPANIES

Income Tax Rate Private Limited Companies FY 2020-21 There are two types of investments in India company, one is of Normal India, which we called as Domestic Company and another forging company invests in it. All the companies have to file their returns on 30 September whether it is domestic […]

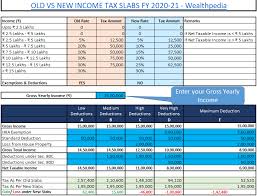

Continue readingINCOME TAX RATE SLABE FOR INDIVIDUALS IN INDIA

Slab Rate Financial Year 2020-21 Direct tax to be paid on the income of any person is called income tax. In India, the tax levied on all persons is levied according to age, in which all are category wise divided. Individual (Resident or Resident but not Ordinarily Resident or non-resident), […]

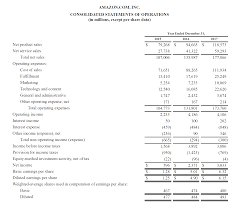

Continue readingSTATEMENT OF PROFIT AND LOSS ACCOUNT FOR PRIVATE LIMITED COMPANY

What is Profit And Loss Account? To know about the profit of the business, we have to look at the profit and loss account of that company, then it tells us that my company has earned profit or loss in that financial year. So for this, we have to create […]

Continue readingGST Update – How to file returns in QRMP scheme?

What is QRMP scheme? QRMP’s full form is “Quarterly Returns with Monthly Payment”. As this name is indicating it’s a scheme newly introduced under GST filing, where taxpayers can file their GSTR 1 and GSTR 3B both returns quarterly instead of monthly. Who can opt for QRMP scheme? All taxpayers […]

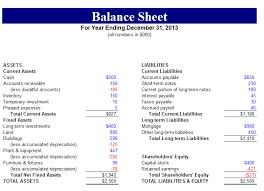

Continue readingCompany Balance Sheets Details Step by Step

What is company balance Sheets? In The Balance Sheets, all the assets and all the liabilities of any company are fully accounted for. This shows us how much loan we have taken. How many debaters do we have? How many are Creditors? How many shareholders are holding our shares? What […]

Continue readingAmazon GST Issues – You are shipping certain item(s) to a state for which you have not entered GSTIN in your business account

Amazon GST Issues You are shipping certain item(s) to a state for which you have not entered GSTIN in your business account. Please note that for such item(s) you will not get GST Invoice. Your business account admin(s) can go to Manage Your GST page and add GSTIN. Solution Form […]

Continue readingStarting in GSTR-3B

When we open (3B), a report opens in front of us, in which we file all the details of that, only then we can file our returns, in which we are asked about our turnover, which we can tick by the entire column. After that, our Return Dashboard opens. *First […]

Continue readingAmended Invoices in GSTR 1

9A – Amended B2B Invoices If we have made any mistake in this (B2B ), then we can change it by going to 9(A) business to business return file. In this, we Can change the cut-off to less than 2.5 lakh. 6A – Exports Invoices These tables are part of […]

Continue readingWhat is 4A, 4B, 4C, 6B, 6C – B2B Invoices, Under GSTR-1 All Details?

In this, we add our output supply which is sold to a registered person and it is an output supply. Whichever business 1.5 More than ten million transactions take place, in which they file monthly returns. And of any business Transactions of less than 1.5 crores can file it both […]

Continue readingWhat is an input tax credit?

The input tax credit is the first input which means that when we bring any raw material in our business, then it is called our input of business. The input of three types of any business is 1 Raw Material 2 Service 3 Capital Goods, these are what we call […]

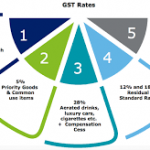

Continue readingWhat are GST rate slabs?

GST means goods and services tax .there are 7 types of tax slab rate 0 % 0.25% 3% 5% 12% 18% 28% In India there are 7 tax slabs, so how will this tax slab rate be charged, how much will be charged, and which will not be taxed on […]

Continue readingHow would you differentiate between CGST, SGST, and IGST?

Meanning SGST:- State goods and service tax When we sell goods in our own state, it is called SGSTCGST:- In this, when we supply the goods at one place like we are in Delhi, we are selling the goods inside it, then whatever tax will be there will be tax […]

Continue readingWhat are CGST, SGST, and IGST?

The full name of GST is Goods and Service Tax, in this, GST has been dived into 3 parts. CGST-Central Goods & Service Tax SGST-State Goods & Service Tax IGST-Integrated Goods & Service Tax First of all, we know about SGST – the full form of SGST is State Goods […]

Continue readingWhat are the benefits of GST?

There are 8 benefits of GST 0% tax on the essential commodity:- Within this, we have to pay 0% tax, which means that whatever our regular products are like (Fresh Vegetables, Books, Honey, News Paper, and Wheat Toothpaste, Soap),there are a lot of groceries. We have to pay 0% tax […]

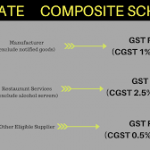

Continue readingRate of tax under the composition scheme?

These are the most points of composition scheme because any company accepts this scheme. Because the rates of tax in this are levied at a special rate pay tax. Whatever rates are inside it are special rates. The rate of tax at the favorable rate is the percentage of turnover, […]

Continue reading