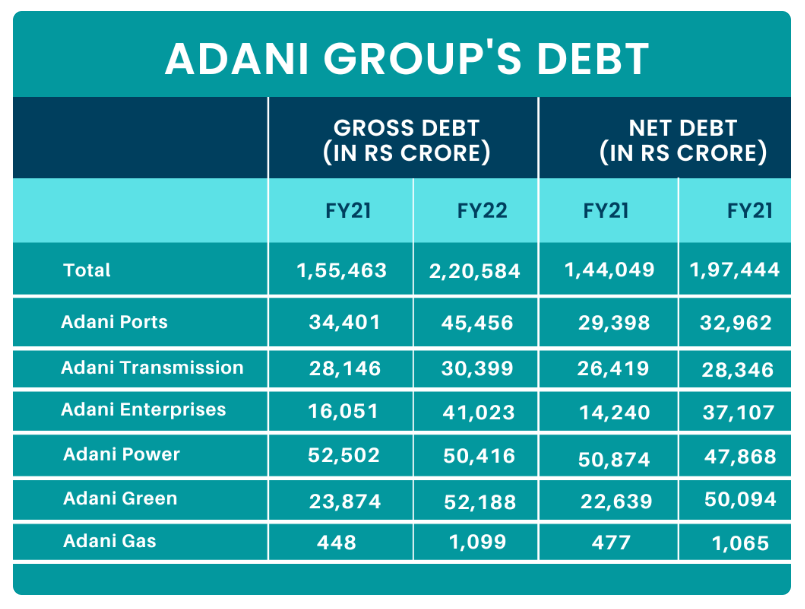

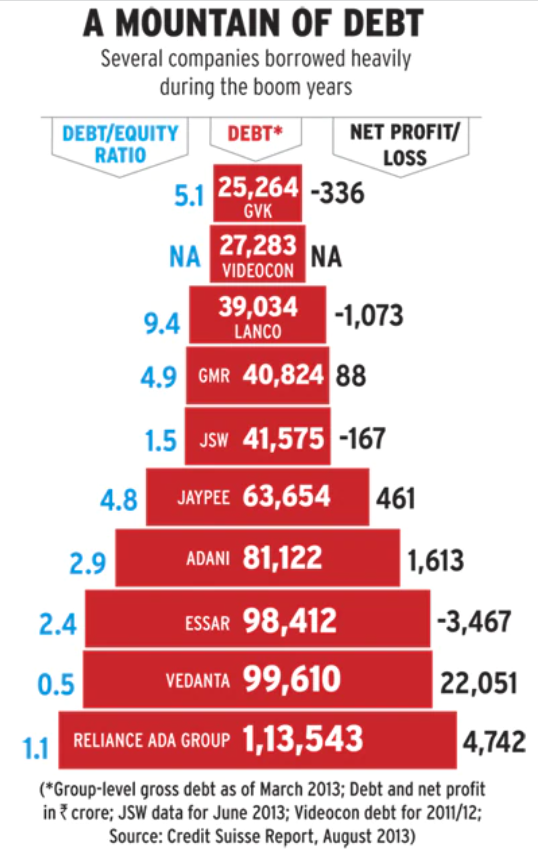

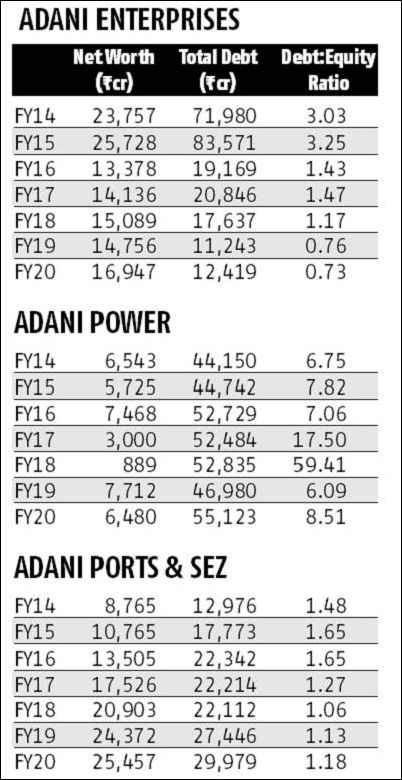

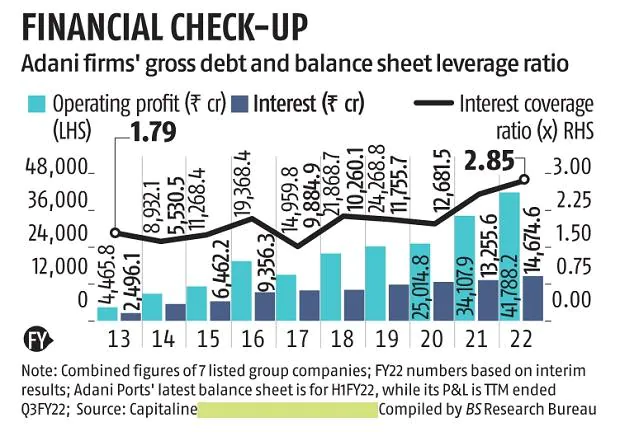

- The group had a gross debt of Rs 1.88 lakh crore in March 2022

- Net debt of Rs 1.61 lakh crore after considering the cash balance.

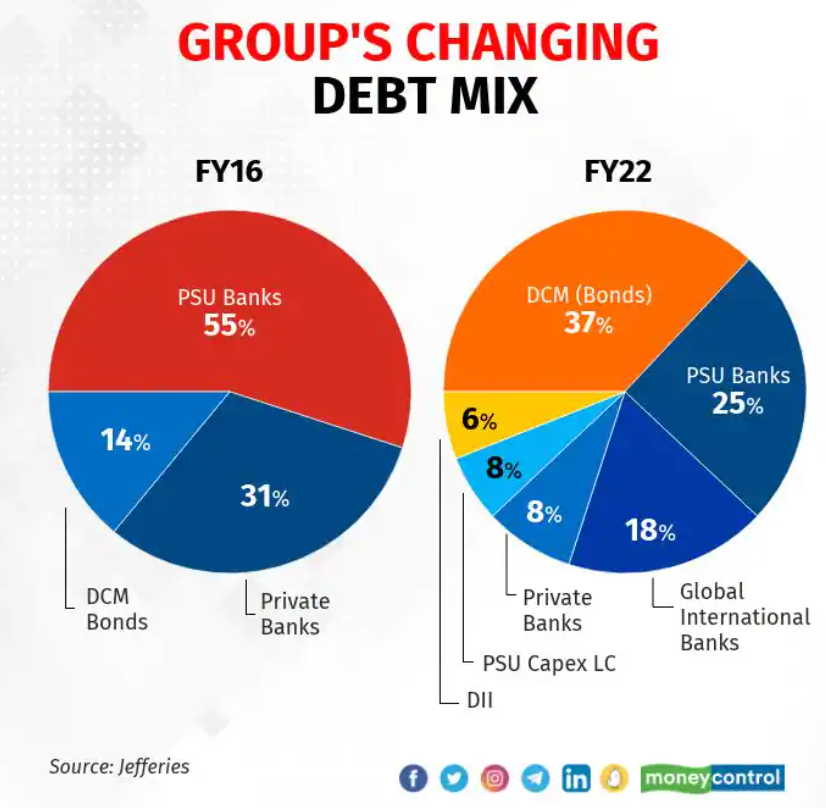

- In 2021-22, borrowing from PSBs made up for 21 per cent of all debt

Risk Company

1. LIC

In September 2020, the insurer owned less than 1% of the conglomerate’s flagship Adani Enterprises; by September 2022, that ownership had grown to 4.02%.

Adani Total Gas saw the largest increase in LIC’s holdings among the Adani Group companies, going from a stake of less than 1% in month September 2020 to 5.77% in September 2022.

Its stakes in Adani Green Energy increased from less than 1% to 1.15%, and those in Adani Transmission increased from 2.42% to 3.46%.

Adani Group Acquistions

Adani Enterprises Loan Exposure with Banks

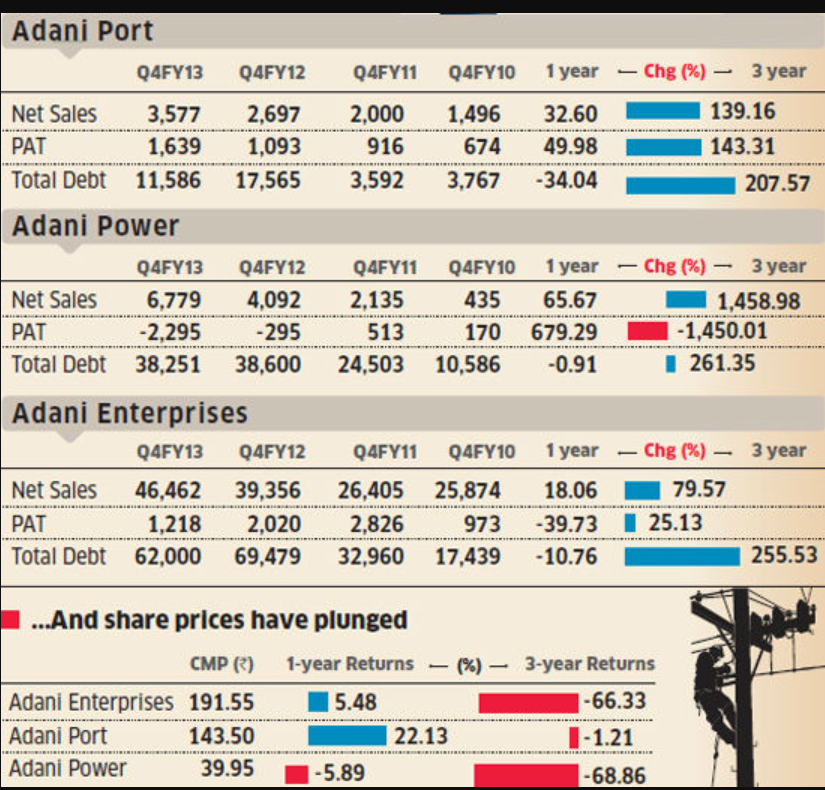

Adani Enterprises Prior annual Reports and other documents list 13 banks as their partners, for their business needs. By 31 March 2021, the company had total borrowings of Rs.15,293 crore.

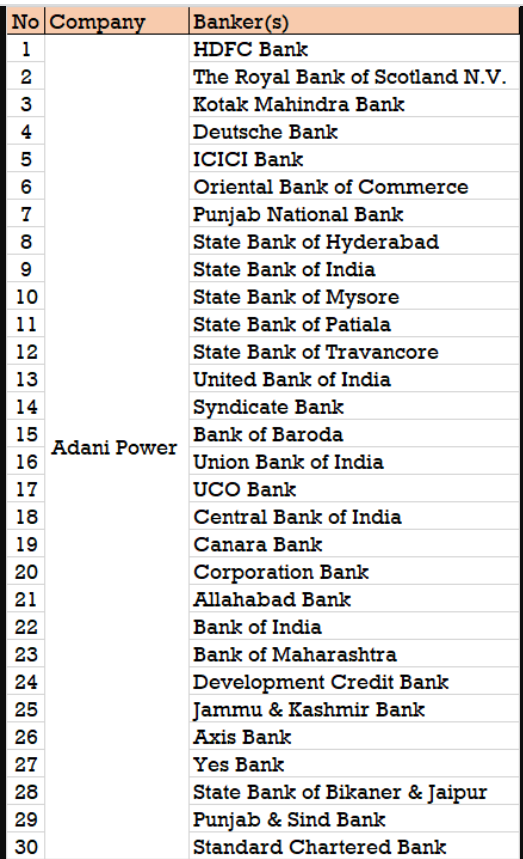

Adani Power Loan Exposure with Banks

Adani Power: Probably the most indebted of all Adani group Companies, lists 30 banks as its partners. By 31 March 2021, the company had total borrowings of Rs.49,640 crore.

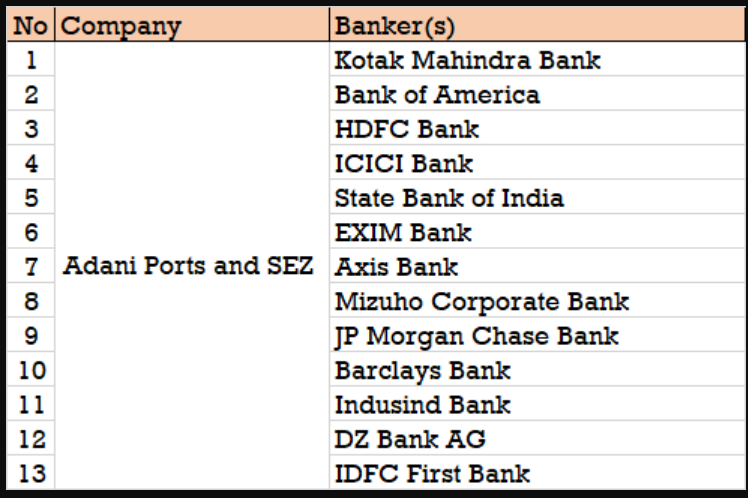

Adani Ports and SEZ Loan Exposure with Banks

Adani Ports and SEZ: Lists 13 banks as their partners, with many international banks supporting their needs. The total borrowings of the company by 31 March 2021 were Rs.33,336 crore.

Adani Total Gas Loan Exposure with Banks

Adani Total Gas: Lists a total of 11 bankers for their financial needs. The company had borrowings of Rs.472 crore by end of the previous financial year (FY21). The stake sale to Total S.A. helped the company to keep its borrowings and debt burden lower.

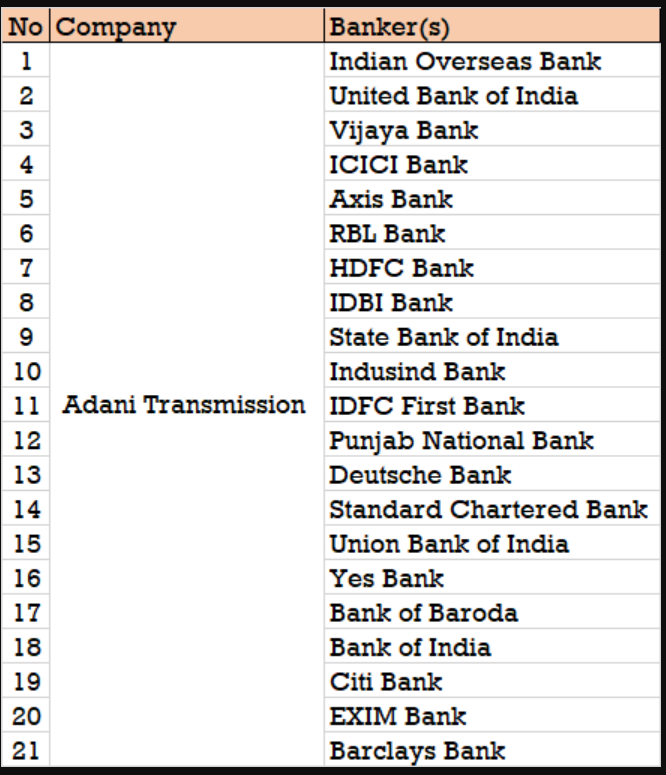

Adani Transmission Loan Exposure with Banks

Adani Transmission: Lists 21 bankers as their partners for financial support. The company had total borrowings of Rs.25,775 crore by the end of March 2021.

Adani Green Enegry Loan Exposure with Banks

Adani Green Energy: Lists only 2 banks as their partners, namely Bank of Baroda and YES Bank. This would be extremely surprising considering the fact that this business needs a lot of money and the management continues to raise a lot of money through debt for expansion. By 31 March 2021, the company had total borrowings of Rs.23,774 crore. It would be impossible to believe that only 2 banks have provided that amount.